IN PARTNERSHIP WITH

Happy pre-Friday!

If there’s one tech job that’s underrated, it’s social media management.

About 59% of the world’s 7 billion+ population is on social media; that’s 4.70 billion people watching videos on TikTok or connecting with friends on Facebook or joining 7 PM moaning Spaces on Twitter.

Social media managers present brands to these people using content creation to endear you to different products. They are the digital voices and community builders that amplify the work of businesses and people.

In this week’s edition of #EnteringTech🚀, TechCabal’s social media manager, Bright Azuh, tells newbies how they too can become the voices of brands. Why should you listen to Bright? Well, she tripled TechCabal’s following within 18 months!

CRYPTO MARKET

|

|

|

|---|---|---|

|

Bitcoin

|

$18,708 |

– 1.56% |

|

Ether

|

$1,264 |

– 5.57% |

|

BNB

|

$265 |

– 0.89% |

|

Solana

|

$31.21 |

– 2.33% |

|

Cardano

|

$0.44 |

– 2.46% |

|

|

Source: CoinMarketCap

|

|

* Data as of 06:00 AM WAT, September 22, 2022.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

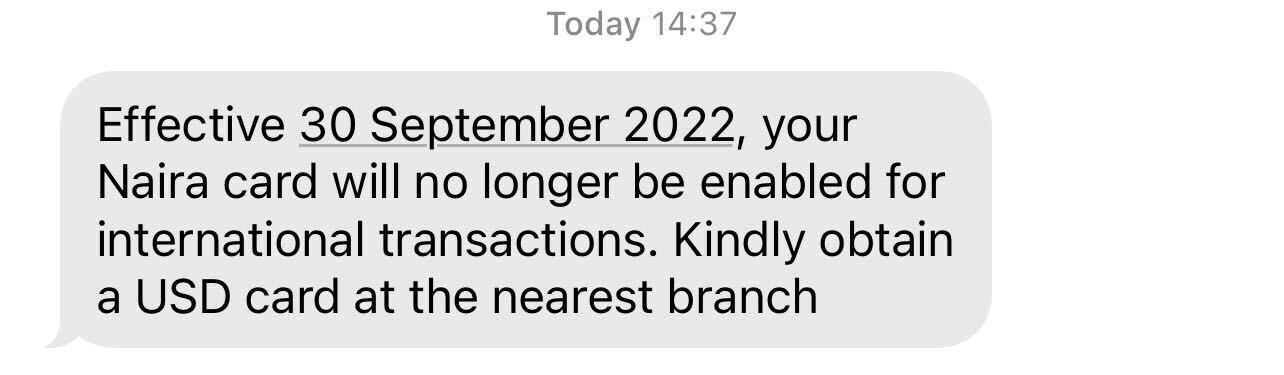

NO MORE DOLLAR SPENDING ON NAIRA CARDS FOR FBN CUSTOMERS

We are back to square one zero.

Around March, several Nigerian banks reduced the monthly card international spending limit from ₦42,900 ($100) to ₦8,580 ($20).

Now, the First Bank of Nigeria (FBN) has announced that its naira cards will not be able to make any international transactions by September 30. Its naira cards—naira credit card, virtual card, and visa prepaid naira card—will now be restricted to transactions in the local currency.

If you are a First Bank customer, you must get a USD card from your bank to make international payments.

Why is this happening?

The bank has told its customers that this change is due to the current market realities on foreign exchange. The country is seeing a major plummet in its forex revenue, and it is trying to fix that. This move from First Bank seems to be another response to the measure that the Central Bank of Nigeria is taking to turn the tides.

First Bank is not the first to do this. In August, Standard Chartered Bank suspended international transactions on its naira card. Other banks may make similar announcements in the near future.

ZERO TRANSFER FEES FOR TANZANIANS

Money is moving around freely in Tanzania.

By October 1, 2022, Tanzanians will wave goodbye to transfer fees on withdrawal of cash through bank agents and ATMs for Tsh30,000 ($12.81) and below. This is thanks to its government.

Why is the government doing this?

The government is waiving transfer fees to encourage more people to use mobile money services. This is not to say that Tanzanians were never interested in mobile transactions—they were. The Tanzania MOMO market reached a value of $54.5 billion in 2021. They began to shun the technology after the government introduced transaction levies to provide basic services for its citizens in the financial year 2021/2022.

More and more Tanzanians stopped using mobile money services after the government introduced taxes on mobile money transfer and withdrawal transactions on July 15, 2021. People even took a step further and withdrew their assets from their mobile money accounts, and began paying directly with cash instead. The plummet continued until September 2021 when the government slashed the taxes it introduced by 30%. Seeing that the reduction of charges improved the situation in the mobile money scene, the government took off another 43% from its mobile money (MOMO) transaction levy three months ago. Now it has scraped the whole thing off.

How will the government meet its needs now?

To get the money it is now foregoing in the annulment of bank charges, the government plans to reduce the expenses it makes on things like conferences, training, refreshments, and trips. Hopefully, its citizens go back to using mobile money services again and the country can grow its mobile money market to $120.4 billion by 2027, as experts predict.

Mobile money taxes such as the one being scrapped in Tanzania have been implemented in countries like Uganda, Cameroon, and Zimbabwe. They have particularly been met with public criticism by the Cameroonian people.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront.

This is partner content.

AWIF LAUNCHES WITH $60 MILLION FOR FEMALE FUND MANAGERS

Earlier this week, as world leaders gathered in New York to discuss collective global growth, the UN’s Secretary General, Antonio Guterres, joined other stakeholders to launch the inaugural Global Africa Business Initiative.

The impact of this event was a $60 million fund dubbed the African Women Impact Fund (AWIF), which will be deployed into various sectors in Africa, and more importantly, will be managed by women.

Much ado about gender?

No. At least not in this case. Records show that of the $69.1 trillion of financial assets under management globally, less than 1.3% are managed by women. Also, only 7% of private equity and venture capital funding is allocated to women-led businesses in emerging markets like Africa.

The consequences of this gap in today’s world are many, leading to prejudices that trickle down to affect funding for women-led businesses and appointments of women into key leadership roles.

AWIF is a breath of fresh air in the world of investments, a step in the inclusivity direction.

How will AWIF benefit Africa?

AWIF will place more African women in control of mega funds, setting the ball rolling for a balanced investment ecosystem on the continent. Also, it will follow a profit-led approach and invest in businesses that can generate returns.

AWIF will also be deployed to score some of the goals outlined by the UN. The SDGs 5 and 8, which target gender equality, decent work, and economic growth are central to the fund’s thesis.

EVENT: T-MINUS 1 DAY UNTIL #FOC2022

If you haven’t signed up to attend #FOC2022, what are you waiting for?

At this year’s Future of Commerce 2022, our conversations will centre around ‘money on the streets.’

More than 30 business leaders and experts will discuss how innovation in payments, social media, and logistics are powering Africa’s commerce. We will discuss the current state, challenges, and solutions, from the key players in the commerce ecosystem.

#FOC2022 is a conference you don’t want to miss, so click here to sign up now.

Start cashing out your bitcoin for naira today. With Cashout, you can own a bitcoin exchange and start receiving payments with bitcoin. Cashout makes it easy to exchange bitcoin for naira.

Get started today! Cash out with Cashout.

This is partner content.

IN OTHER NEWS FROM TECHCABAL

Who will win the race for 5G dominance in South Africa?

Quidax’s website briefly crashes after BBN QR Code advert.

Nedbank enters the metaverse through a partnership with Africarare.

OPPORTUNITIES

- Applications are open for the UK Research and Innovation African Research Leaders’ Programme. Talented researchers in sub-Saharan Africa who are leading quality health research in the region can apply to get up to £750,000 in funding. Apply by December 1.

- The USADF Accelerate Africa Entrepreneurship Challenge 2022 is now open to applications from MSMEs in Africa who are prioritising job creation and job and youth productivity on the continent. Winning applications will receive grants of up to $250,000. Apply by Sepetember 30.

- Applications are now open for Meta’s AR/VR Africa Metathon. XR developers, programmers, UI/UX designers, artists, animators, storytellers, and professionals resident in Africa can sign up to get curated learning resources from XR experts who will provide mentorship, and facilitate masterclasses and workshops. Apply here.

What else is happening in tech?

- How Nigeria’s Edusko connects parents with funding for their children’s education.

- Ivorian fintech startup, Julaya, raises an extra $5 million pre-Series A round.

- Gas-powered Ubers to be phased out by 2030.