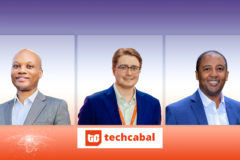

Noel K. Tshiani, the founder of Congo Business Network, discusses with Ibrahima Kourouma, co-founder of Paylia, about his entry into the fintech sector in the African continent in this exclusive interview conducted for TechCabal.

Please tell our readers about yourself.

My name is Ibrahima Kourouma. I am the co-founder and Chief Operating Officer of Paylia, an African fintech startup building an all-in-one payment platform for merchants and consumers. I was a Senior Program and Change Manager at Cisco Global CX Centers in the CX Programs, Change and Governance Business Unit.

While at Cisco, I led the design and execution of the overall program as well as change management initiatives and strategy for Cisco Systems’ Managed Services, a $14 million Virtual Engineers innovation program. I also developed its long-term organizational program and changed the roadmap and plans, resulting in a 90% adoption.

As an avid Digital Transformation and Change Management Consultant, I have addressed many questions related to digital transformation adoption in both the public and private sectors, especially in the financial services sector in French-speaking countries in Africa. I was instrumental in the elaboration of the Guinean government’s first Digital Transformation and Innovation Strategy, now in its second phase of implementation.

I have a Master of Business Administration and a Master of Science in Organizational Leadership from Nichols College in the United States with a focus on e-Government and Digital Transformation.

What does Paylia do and what inspired you to start it?

Paylia is a mobile app that allows businesses to accept payments from any payment provider. Traveling around Africa, we noticed that merchants had to open separate accounts for each mobile money network and buy separate devices to accept payments from customers on different networks.

The whole process was very inefficient and made no sense as merchants had to memorize codes and go through different payment flows just to accept payment from a customer. We figured we had the technical talent to quickly iterate and build a solution that simplifies the end-to-end customer-to-merchant payment experience.

Besides fintech, is there another sector in Africa that has a potential for business?

Africa is the new land of startups and entrepreneurship. With economic development and the birth of a real middle-class, business opportunities are multiplying.

Many trained and creative Africans want to undertake and are looking for profitable business ideas to create, make a fortune, or simply live passionately and comfortably.

There is no shortage of promising sectors: tourism, energy, mining, construction and building, and training services, but also traditional sectors such as agri-food or the agro-industry are among those with the most potential for investment and yet are under-explored.

What has surprised you about entrepreneurship so far?

Doing business in Africa is like an obstacle course. The obstacles are of different kinds: an unfavorable business environment, cumbersome administrative formalities, a difficult political context, as well as the weight of culture and society.

The main barriers to the development of entrepreneurship in Africa, as we have noticed, are the regulations in force in some countries, which do not help to develop this niche. Also, there are traditional banking systems that are not open to the world.

We also quickly come to understand that Africa is primarily a cash-based society. About 95% of all transactions are cash-based, making it difficult for merchants to track their sales and manage their finances. The other side to this is that mobile penetration is around 75%, so there is a lot of opportunity for businesses to switch to reliable digital payment solutions.

Another challenge we faced was how to build a solution that addresses core customer pain points while gradually changing customer behaviour because it’s very easy for businesses and consumers in Africa to hold on to cash.

For sure, there are also challenges with corruption too. I think most people are inherently good but there is a lot of friction between people wanting to hold on to their hard-earned money and paying their fair share of taxes for instance.

What can be done to strengthen the economic relationship between the United States and Africa?

Advancing trade, investment, and technology in Africa offers enormous economic growth and increased prosperity for both regions and is best realized through value-based foreign policy and a market-based model of development, education, and accountability. There is no better time to accelerate U.S. trade and investment in Africa than now. Despite Africa’s tremendous economic potential, the U.S. has lost substantial opportunities to traditional and other emerging partners.

I believe that to strengthen economic relationships between the U.S. and Africa, a value-based foreign policy is necessary with a focus on building a modern, inclusive economy. The focus should be on economic transformation, moving workers from low-productivity sectors like agriculture to higher-productivity areas like industry and the service sector, as well as increasing productivity within sectors.

In the same context, and as an African living in the diaspora and a founder, we have a potent force for development, through remittances, but more importantly, through the promotion of trade, investment, knowledge, and technology transfers. It was estimated by the International Monetary Fund that entrepreneurship has an investment potential of over $2 billion by 2023.

My hope is that over time, leaders in both countries will have no choice but to examine and advocate for the untapped potential in Africa and African entrepreneurship.