Nigeria has become the first country in Africa to adopt open banking regulations [pdf], which will encourage innovation in the country’s banking industry. The regulations and guidelines for open banking were approved by the Central Bank of Nigeria (CBN) in a circular dated March 7, 2023. The operational guidelines provide rules for how banks and third-party financial institutions interact with customer data.

The regulation also provides responsibilities and expectations for the various participants (the banks, third-party financial institutions, and customers) and ensures consistency and security across the open banking system. An outline of minimum requirements for participants is also provided, which stipulates safeguards for financial system stability under an open banking regime.

What open banking means

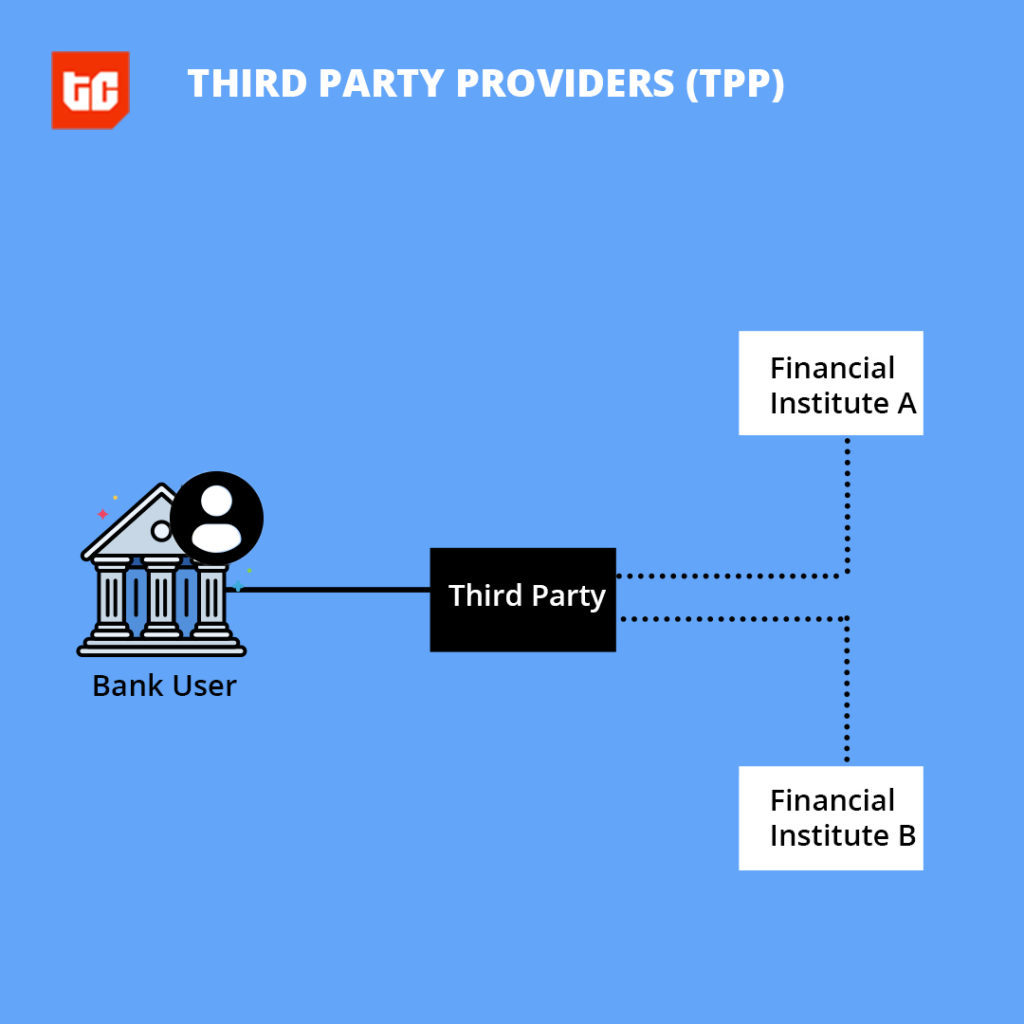

Open banking is the practice that allows banks to share customer data with third-party service providers—fintechs and mobile money operators—that will leverage the data to create solutions that boost financial inclusion and innovation in Nigeria. The data is shared via APIs and can only be shared with a customer’s consent.

Several fintechs like Mono, Stitch and Okra have all had to come up with innovative hacks to provide similar solutions to open banking. But with the new regulation, they can now provide a more robust set of data.

What it means for Nigeria

On a call with TechCabal, Adedeji Olowe, the CEO of Lendsqr, shared that although the regulation might take some time to bear fruits, it is the beginning of a journey towards increased partnerships between banks and fintechs in Nigeria. “ There are still some steps that need to happen before the regulations take effect but what it means is that if everyone speaks the same language, the friction of interoperability will reduce. That means people can build apps that have access to customer data and will do interesting things. Financial inclusion will explode, and custom loans can be built,” he said. According to the CBN, the regulation will allow for credit scoring and rating.

The clamour for open banking regulation in Nigeria began in 2017 when Adedeji Olowe led industry experts to form an open banking working group, which became known as Open Banking Nigeria. The CBN then released a regulatory framework for open banking in 2021, which led to an industry committee that created the draft of the open banking regulation in 2022. Now that the draft has become law, the next steps are for the CBN to build a registry and for the financial institutions to leverage the regulations to build new financial solutions.

The regulation will also be supported by the Nigeria Data Protection Regulation (NDPR), which was released in 2019, as data privacy is a foundational pillar for open banking. The open banking regulations will also benefit merchants by allowing them to use the solutions provided by financial institutions to better manage the flow of money and will allow customers to enjoy more tailor-made opportunities for credit and investments.