From a fraudulent betting company in Nigeria to aggrieved customers, and a Nairobi High Court order, here’s how Flutterwave accounts were frozen in Kenya.

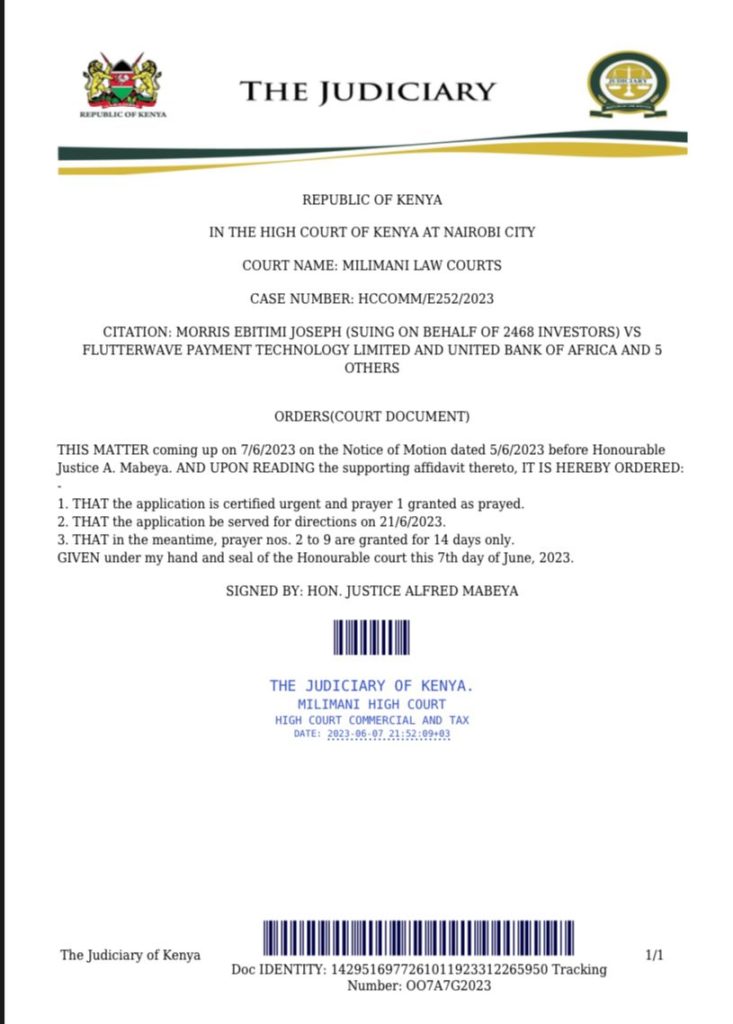

Last week, Justice A. Mabeya, a Nairobi High Court judge, placed a 14-day lien on 45 Flutterwave bank accounts at Access Bank, Equity Bank, Guaranty Trust Bank, United Bank of Africa, Ecobank, and 10 mobile money accounts at Safaricom PLC. The lien comes as a result of a petition by Morris Ebitimi Joseph, on behalf of 2,468 investors who were swindled by 86 Football Technology Ltd (86FB, 86W, and 86Z), a Ponzi scheme posing as a sports betting company. Joseph and the other investors claim that Flutterwave and 86FB colluded to defraud them of $12.04 million.

In a response to TechCabal, Flutterwave said, “Some accounts have been frozen, yes, but it is a matter of procedure in such civil cases. It is an unsubstantiated claim by the report because last year, during routine checks, we noted a few companies were using our platform to process payments for the company named 85FB/86Z. We proactively notified the merchants to cease processing and suspended their use of Flutterwave. We also reported the matter to the law enforcement bodies in Nigeria. We are following all due legal process in Kenya, including providing all necessary documentation as we work towards settling these matters”.

Accusations and clarifications

In 2022, 86FB accused Flutterwave of “maliciously freezing” its accounts. “This payment company [Flutterwave] maliciously froze our funds and intends to take the funds as their own and extort us by cooperating with the local police. 86FB has never yielded as we have been trying our best to protect the rights and interests of every user, but the other party has a strong background in Nigeria. We cannot fight against it, now 86FB cannot withdraw money normally,” the company said after it was exposed as a Ponzi scheme.

At the time, Flutterwave responded in a tweet, saying that 86FB was not “registered or approved by Flutterwave”. Flutterwave also revealed that during its investigation, it “identified direct merchants of Flutterwave who were processing transactions for 86FB without our approval or permission to do so on the Flutterwave platform”. It added that it had suspended the merchants’ use of the Flutterwave platform.

Payment processors and Ponzi schemes

This was not the first time that Flutterwave had intervened by suspending a Ponzi scheme from using its platform. In 2020, as Racksterly (another Ponzi scheme) was unravelling, Paystack and Flutterwave restricted Racksterly from using their platforms to process payments. Olugbenga Agboola, Flutterwave’s CEO, told TechCabal the restriction was done to protect customers from being defrauded.

“The business model of the merchant does not support this sort of transaction that they were doing,” Agboola explained. “And so we saw that customers were going to be defrauded on our platform.” Flutterwave also refunded all transactions by Racksterli’s subscribers done in January 2020.

Flutterwave also claimed that in May 2022, it suspended a merchant who had been using its platform to handle 86FB transactions without having the necessary authorisation. It also added that this was done after a routine audit of merchants, through which it was discovered that 86FB’s operations were a Ponzi scheme.

An initial trial and a success

This is also not the first time that the aggrieved investors in 86FB have tried to sue Flutterwave in Kenya for the loss of their invested funds. Although the fraud happened in Nigeria, the investors tried to join the Kenyan Asset Recovery Agency’s (ARA) application to prevent Flutterwave from transferring or withdrawing the funds in three bank accounts, including two in UBA and one in Access Bank, and 19 Safaricom M-Pesa pay bill numbers. Flutterwave was eventually cleared of any wrongdoing, and the investors lost their bid to get a share of the funds frozen by ARA.

However, with this new court case, the 86FB investors have finally been able to obtain a lien on Flutterwave’s accounts and might be able to recoup their losses. After the expiration of the 14-day lien on June 21, the parties will reconvene with Justice A. Mabeya for further directions on how to proceed with the case. The judge will also decide whether to extend the freezing orders.

This new court case comes as Flutterwave continues its bid for a payment license in Kenya. Flutterwave has responded by suing 86FB on criminal defamation charges.

What do you think about our stories? Tell us how you feel by taking this quick 3-minute survey.