The short answer is to fix the political leadership. The long answer (for African/Africa-facing entrepreneurs) is what we’re more concerned about. It is a conversation we should all be having, that is, if you are not already.

As the population and youth unemployment grow side by side and disposable incomes fall, Africa’s need for stable, visionary and effective political leadership at all levels has never been more acute. But Next Wave is not a very political economy newsletter. We’ll leave that for others. Instead, let’s focus on what the broad technical features of what building a business despite the dreariness might look like.

Why is this important? If you’re reading this you are very likely interested in Africa’s technology and venture capital ecosystem. You have likely also read a few of the rosy projections of a soon-coming $180 billion or so digital economy. By the same token, if you’ve had your finger on the pulse of African streets, you will likely also have felt the dreary chill in household consumer expenditure as household incomes come under pressure across middle-class and low-income market segments in Africa.

Not too long ago, if you mentioned emerging markets as an investment destination, some African countries would feature prominently. Today, not so much. A few African countries still make emerging market lists, but only politely. Some of the then-exciting economies in Africa have reversed growth trends and fallen (or are on the road to) frontier market status or less. Today, Southeast Asian countries like Indonesia, and Bangladesh, and emerging markets in Eastern Europe and Latin America command more attention. Occasionally even more than even South Africa (when it is not sacrificing trade agreements on the altar of foreign policy).

There is a lot the governments can do. Unfortunately, the political theatre we see across the continent does not inspire much hope. Africa’s political elite do not seem capable of consistently linking their policies (in practice and posture) to economic improvement.

On the other hand, if you run any form of enterprise you can choose to do one of three things.

- Resign yourself to the flow like dead fish.

- Align yourself with the political wind. Arm yourself with the knowledge that seats here are limited and the competition do not make any claims to innocence or gentlemanly dealing.

- Fight to maintain your “clean hands” AND embrace cold pragmatism.

If you choose options 1 and 2, you can close this email and move on with your life. If you however pick option 3, you will have to add a few tools to your armoury. A lot of what follows is probably familiar to you. But it bears repeating.

Partner Content:

Infinix brings all-round fast charge technology to the NOTE 30 Pro

The face in the mirror is not the fairest of all. Or even rated in the “Fairests of All”

Let’s start with the latest McKinsey report “Reimagining economic growth in Africa: Turning diversity into opportunity”. One point it makes abundantly clear is that we have to acknowledge our economic and social underperformance if it will make any meaningful step forward and away from it. Compare this most recent report with this hopeful one (also from McKinsey) in 2010 and this in 2017, and the reality of how much we have failed just hits you in the face.

One of the most unfortunate truisms today is that: Africa is still very poor. And Africans (collectively) are doing little to get out of the status quo. Individually, a lot of the people are brilliant. But collectively, the African destiny seems resigned to the ebbs and flows of global events. Like rising or falling commodity prices, a war in Ukraine, overhyped neo-colonial enemies that are useful for domestic political deflection or directly attacking countrymen or residents who have more or less melanin (depending on what part of the continent you are on).

In the few occasional pockets of brilliance, it appears that prosperity for African economies may develop along regional or intercontinental corridors. Some of the investment inflows and inter-country relationships we see appear to be toeing this line. If you’ve been paying attention, you will notice that a Gulf-to-North-African-to-Indian-Ocean corridor is developing, increasingly driven by investment from Gulf countries like the UAE and Dubai-headquartered business concerns. The UAE, for example, is the fourth-largest investor globally into Africa—after China, Europe and the United States. Some of that investment even finds its way into stable but smaller economies like Rwanda who may not be on the coast, but are hitting some of the notes GCC investors want to hear.

China is often the focus in conversations about non-Western investment (and business relationships) in Africa, but the eastern flank of Africa has always had its unique connections with Asia. These age-old relationships are being refined as Asian firms and investors from Singapore, for example, test Africa’s commercial waters. Even the Japanese are shaking off some of the decades-old reticence and looking beyond Tokyo into Africa.

Granted, a lot of it is directed at finding and pocketing their slice of the African pie. But we already know that the world does not run on altruism, unfortunately. Irrespective of the ultimate motivation, the direction of interest of some of this investment also contains ingredients and signals investors and entrepreneurs who want to build a thriving business should pay attention to. To see and properly capture these opportunities, both governments and private sector players in Africa will need to…

Stop fantasising about GDP growth

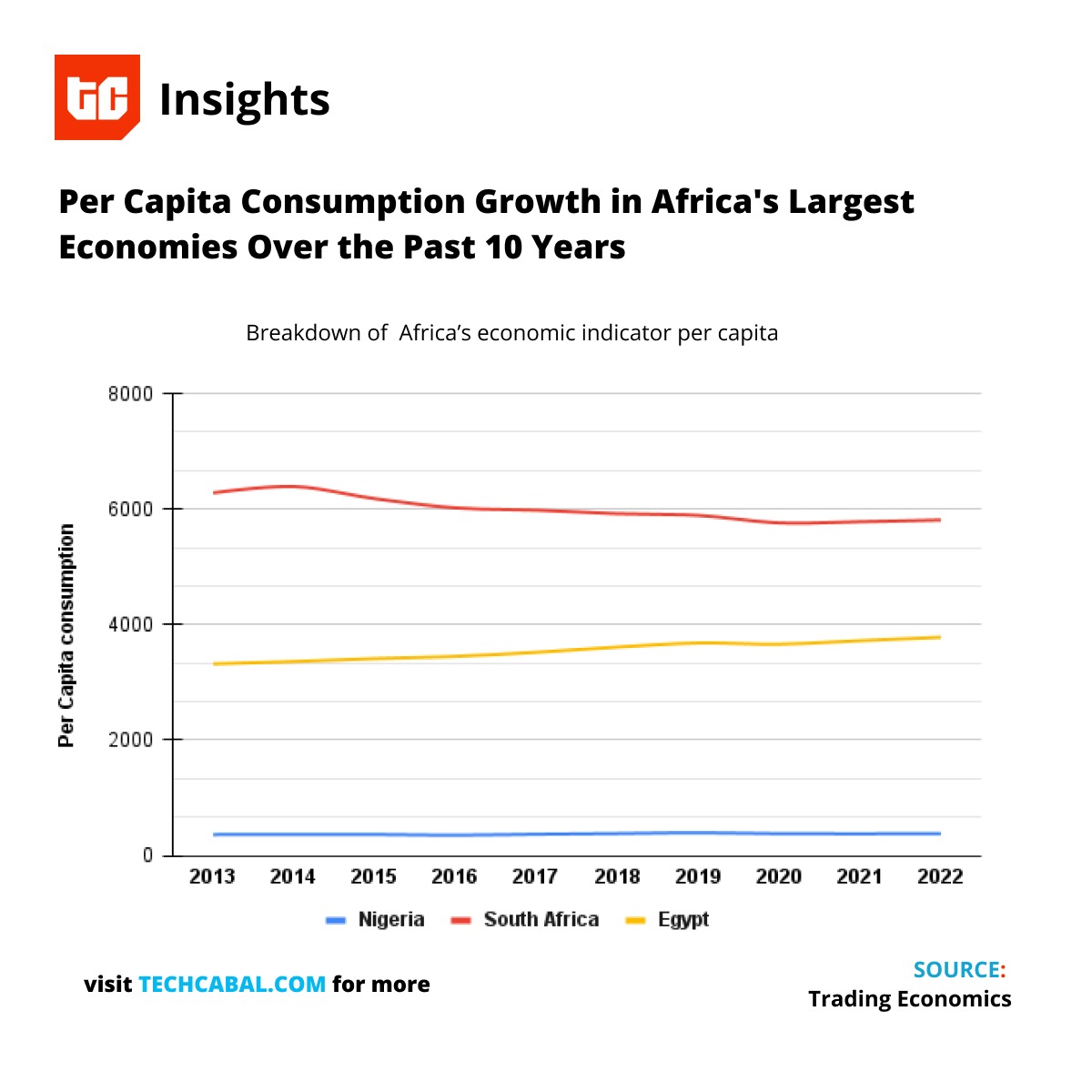

Looking back 10 years, per capita consumption in Africa’s largest 3 economies is mostly stagnant.

Chart by Tomisin Bamidele, TC Insights. Source: Trading Economics

Depending on your market, you may need to pay attention to an entirely different set of economic indicators. While GDP indicators are useful macro snapshots, you will quickly realise that income and per-capita consumption spending habits are better indicators.

This is not to excuse lackluster economic growth of course. It is to emphasise that more than following GDP growth forecasts, knowing where the GDP is growing from and where the spending is happening is important, regardless of whether you are serving consumers or businesses. It is the difference between simply knowing that (hypothetically) Zambia’s GDP is growing by 10% versus knowing that Zambia’s GDP is on the high now because copper prices are absolutely crushing it on the London Metals Exchange.

In any case, Africa’s current GDP and even the most liberal GDP forecasts are not anything to jump in excitment about. Indonesia has a GDP of over $1 trillion with a population that is little more than half of that of the size of the entire East African Community (EAC) states. The EAC has a combined GDP of about US$163.4 billion (at purchasing power parity, about US$473 billion) and the average GDP per capita is about US$941 (at purchasing power parity, $2,722). That is little more than a tenth of Indonesia’s GDP in nominal terms. But closer to 50% in PPP terms. It shows how far the GDP has to go. But to me, it also shows why the focus for a business looking to build its market strategy, should be more on consumption capacity and income growth trends than vice versa. Not exclusively of course.

Investing time to understand the nuances associated with all of these indicators and the practical realities they represent will confer information advantages. Add this to invaluable local context and relationships and you may find the right commercial mix to bring home the bacon. Few businesses invest in discovering and putting information advantages to use. You might end up playing in largely uncontested waters. Knowing more doesn’t mean you will succeed. But it does give you a better chance at execution.

This is where technology comes in

Confronting the stark reality of Africa’s position does not mean drowning in the despair that “only 3 million Nigerians spend $10 a day”. Or that in Cairo, young men who speak polished English will compete to open car doors in the hopes of a $1 tip.

One of the biggest benefits of technology is the power it has to organise chaos at scale. Another term for this type of organisation is formalisation. It is not a silver bullet (especially in isolation), but it is a good way to execute the answers to questions like: How do you organise healthcare insurance and access? How do you formalise discovery between disjointed skilled workers and work opportunities with consumer and worker protection? How do you formalise food production and aggregate market access? And how do you do this in a way that balances out potential disruption to existing inefficiency?

We know 3 million people can afford to spend $10 a day, but we (at least I) don’t know how many can afford to spend $5, $6 or $8 a day. An even bigger question is what type of consumption can enable the millions more who are now spending $5 per day grow in disposable income in the next 3 years?

For brave entrepreneurs—and I mean really brave entrepreneurs—deploying digital technology as an agent of organisation represents the biggest tension point to resolve on the journey to making things work (as far as government permits, of course). There will be tension here, admittedly, but again, tension is often a part of the process of finding true balance.

Embracing cold pragmatism also permits you to not build a business under severe, unreasonable and unyielding government constraints. It may also mean pursuing growth along the regional and intercontinental corridors that are emerging. It is how Miami, for example, hosts hundreds of the leading businesses in Latin America, and it is why Dubai is becoming the hub of choice for a lot of African businesses.

Smart African governments can tap into this. And the ones that lack good sense will lose. Hopefully, there will be two or more African governments that have good sense—and the will to pursue this. But for you the entrepreneur, you don’t have to wait around. Sometimes you may need to vote with your feet. The smart economies will recognize and welcome this endorsement.

We’d love to hear from you

Psst! Down here!

Thanks for reading The Next Wave. Subscribe here for free to get fresh perspectives on the progress of digital innovation in Africa every Sunday.

Please share today’s edition with your network on WhatsApp, Telegram and other platforms, and feel free to send a reply to let us know if you enjoyed this essay

Subscribe to our TC Daily newsletter to receive all the technology and business stories you need each weekday at 7 AM (WAT).

Follow TechCabal on Twitter, Instagram, Facebook, and LinkedIn to stay engaged in our real-time conversations on tech and innovation in Africa.

Abraham Augustine,

Senior Reporter, Business and Insights

TechCabal.