Eden Life, the home service platform that provides laundry, cleaning, and meal-delivery services for Nigeria’s working class, is testing a push into the larger retail market. Since its launch in 2019, Eden Life has used a subscription model with prices ranging from N23,000 ($63.6) to N76,000 ($210). Because of the need to pay upfront for its services, Eden Life gained a perception as a service for the upper middle class. Since 2019, its subscription prices have risen sharply—to about ₦150,000 for two meals daily—in response to Nigeria’s food inflation.

The startup justifies its pricing by pointing out that it serves high-quality meals made by chefs. For home cleaning, it argues that its vetted and trained cleaning staff called “gardeners,” are conscientious, professional, and consistent, more than you could say for many hired helps. But subscription pricing remained a significant barrier to entry for many customers. Eden Life tried to solve that problem by unbundling its services; its more affordable cleaning and laundry services became standalone. But the company was always up against the realities of an economy that has suffered a recession twice in the last seven years.

With inflation at a 17-year-high of 22.79%, one of the company’s key customer segments, young and upwardly mobile workers, began to leave the country in droves in a ‘japa wave.’ With purchasing power dwindling, Eden Life, like every business in the Nigerian economy, has been forced to restrategize to keep revenues up.

Eden Life’s Quick service delivery experiment

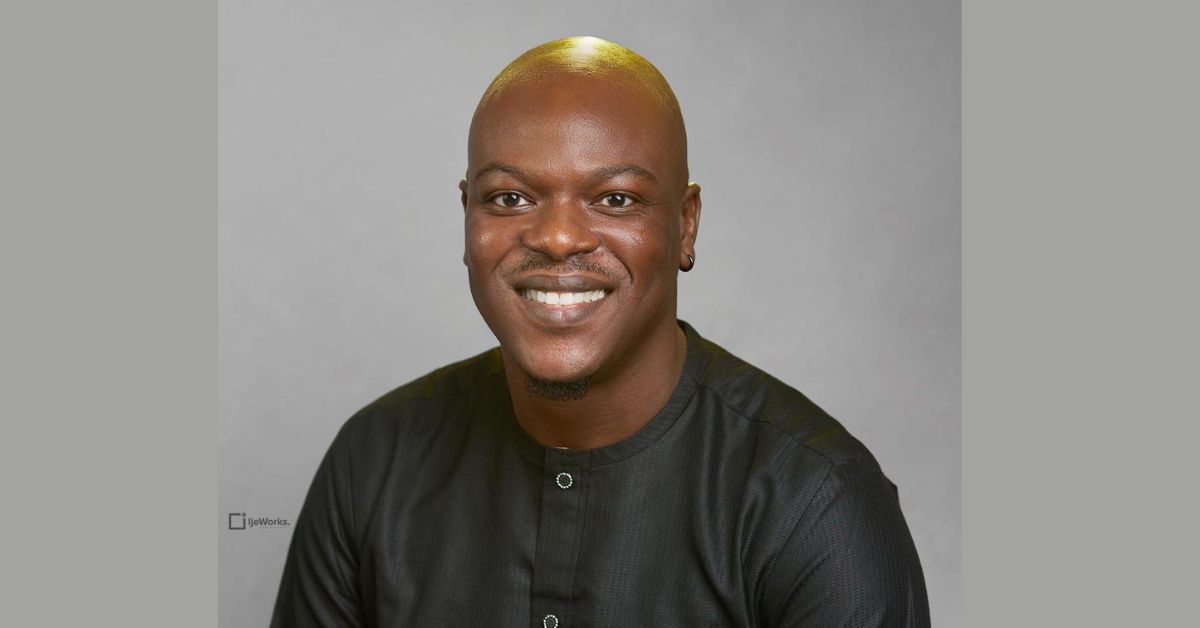

This week, Eden Life began promoting “Homemade by Eden,” a quick service restaurant (QSR). Eden’s Homemade offers a plate of special fried rice with grilled peppered beef for N3,340, similar to middle/mass market offerings like Chicken Republic or Sweet Sensation. One theory with Eden Life’s push into QSR is that it is a way for the company to acquire new users and build trust. If people buy food from Eden every other day and come to trust them, it may become easier to sell subscriptions. Nadayar Enegesi, the Co-founder and CEO of Eden Life, told TechCabal that the company’s recent experiment is about access. “In Nigeria, food is an essential commodity. It’s about how we can take this essential commodity and level it up. We’ve shown that we have figured out quality, so the priority is to ensure this is as accessible to everyone as possible.”

For an hour this Friday, Eden Life is offering customers the opportunity to buy any meal from its QSR for N1,000, a push to get into the faces of more people and drum up the needed publicity for its experiment. It’s an experiment worth pursuing when you consider that the organised fast-food industry in Nigeria is valued at $602 million with an estimated annual growth rate of 10%.

With over 300 stores, Food Concepts (the brand behind Chicken Republic) is the biggest QSR brand in Nigeria. Despite its dominance, Chicken Republic leans on companies like Glovo and Jumia for food delivery. The online food delivery market is also huge and is valued at $834 million in 2022.

Food delivery’s competitive landscape

Eden Life’s existing logistics backbone means it will compete against QSR brands like Chicken Republic and food delivery services like Jumia Food, Glovo and Chowdeck. While Jumia Food is the market leader in the food delivery space, newcomers like Chowdeck are giving the company a run for their money.

Chowdeck, for instance, has begun doubling down on its push into grocery delivery, offering free delivery to its customers till the end of July. While it only recently started pushing the offering, people close to the situation say it began onboarding grocery stores in February. It’s a nod to how businesses within the food and QSR space are constantly innovating to increase revenues.

Eden Life hopes that its QSR experiment brings more customers into the door and changes the perception that it is an ‘expensive’ service. It will also be looking to cross-sell and show them the value of being long-term customers. The final stage will then show customers that subscription pricing is not always a trap.