- To reduce the financial-underserved, unserved population

- To provide 1,000 jobs to Nigerians

- As Royal fathers endorse Kayi’s financial solutions.

A week after its national launch in Abuja to unveil its brand, Kayi Bank (www.kayibank.com), Nigeria’s digital payment platform, has officially opened its Kano Headquarters under the brand ‘MKC-Kayi,’ to deepen seamless access to financial services by individual and businesses in the country.

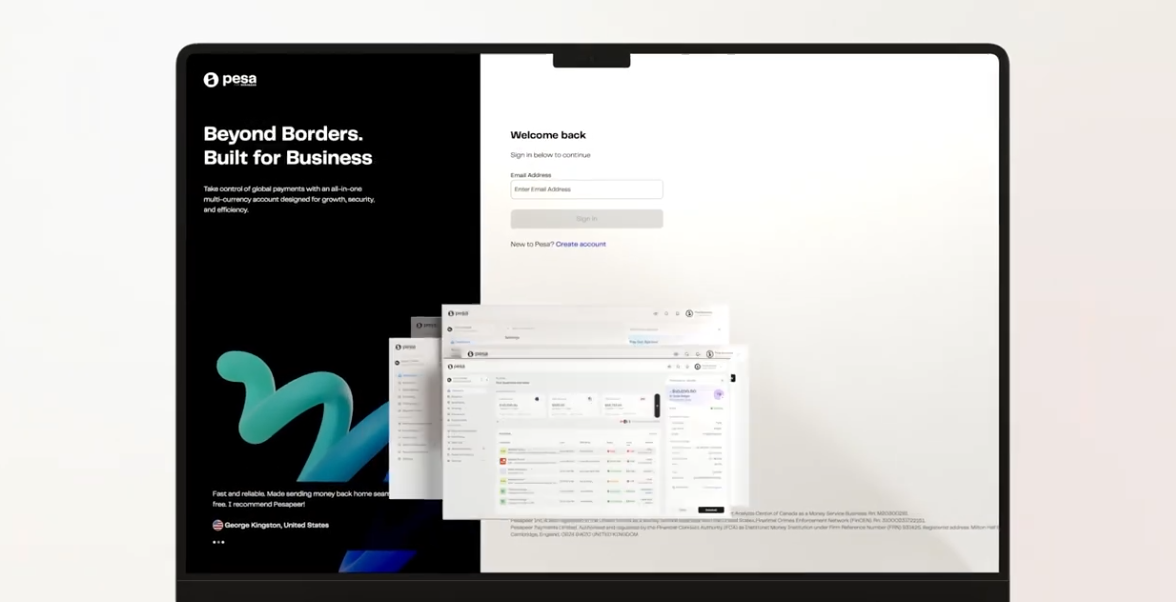

At the epoch-making event where the bank unveiled KMC Microfinance Bank as its signature institutional headquarters in the city of Kano, the bank also unveiled its innovative and cutting-edge KayiApp for smart digital banking and payments.

The newly-launched app is distinctively first of its kind in the state and more importantly in the country, with inbuilt capabilities to provide financial inclusion for Small and Medium Scale Enterprises (SMEs) and individuals.

Speaking at the Kayi Head Office and App launch, on Thursday which was well attended by dignitaries such as government officials, traditional rulers, financial experts and citizens in the state, the Managing Director of KMC-Kayi, Mr. Mark Williams, said the Kayi App is committed to enhancing financial inclusion through a customer-centric approach.

“Local agents are on-boarding customers, promoting transactions, and boosting financial literacy. Next up: the launch of our efficient web app, followed by the mobile app release for an enhanced customer experience,” he said.

Williams expressed his delight for being part of the vision that offers Kano the unique opportunity of KMC-Kayi headquarters in terms of provision of facilities that would be an empowering economic factor in the state.

He said: “KMC-Kayi Bank stands as a trailblazing financial institution headquartered in Kano, Nigeria, with a resolute mission to reshape the financial landscape through innovative and secure digital banking solutions. This visionary digital bank is deeply committed to augmenting financial accessibility, fortifying security, and embracing a customer-centric ethos.”

Williams also said the bank signifies more than just a financial entity; adding “It embodies a catalyst for change, a gateway to empowerment, and an emblem of security, agility, and customer contentment.”

Speaking on the unique features of KMC-Kayi Bank, the Product Lead of the financial institution, Dr. Abdulganiyu Rufai, said, “At KMC-KAYI Bank, we harness the formidable potentials of web3 technologies to fashion a seamlessly secure financial ecosystem. Our integration with top-tier cybersecurity solutions guarantees the safeguarding of financial transactions against potential threats.

“In the contemporary world characterized by relentless swiftness, speed is of paramount importance. Our cutting-edge ML server architecture empowers us to facilitate lightning-fast transactions, enabling you to send and receive money with unmatched speed and unwavering reliability.”

Also speaking, Chairman of KMC-KAYI Bank, Alhaji Saadina Dantata, said the bank was poised to re-define modern banking by offering a comprehensive array of services, ranging from stock investments and insurance to loan facilities and a savings structure with an exceptional return on investment (RoI), putting solutions to all financial requisites under one roof.

“Our journey commences with inclusivity, targeting the unbanked and underbanked segments of society, thereby ensuring access to financial services that were hitherto out of reach.”

Also speaking at the event, a businessman/industrialist, Alhaji Tajudeen Dantata, said Kayi should be viewed an institution ready to make the difference extending its financial services to the diaspora community, proffering cutting-edge cross-border payment solutions and supplying contemporary banking solutions for urban professionals.

Meanwhile, royal fathers, who graced the occasion, have commended the initiative of KMC-Kayi Bank to site its headquarters in the nation’s Centre of Commerce, saying the institution has shown its readiness to support the digital financial inclusion, first in the northern states of the country and across the country, in the long run.

Emir of Kano, His Highness, Alhaji Aminu Ado Bayero commended KMC YAYI Microfinance Bank for reducing the growing rate of unemployment in the North by offering over 1,000 youths in Kano and other northern states job opportunities. He said the Kayi Head Office and App launch deserve accolades.

The Emir, who spoke at the bank’s Kano headquarters situated on Maganda Road, Nassarawa GRA, rallied the business community in Kano and other northern states to patronize the bank.

Emir Ado Bayero, who officially inaugurated the bank said: “I am very optimistic that the establishment of KMC Kayi Microfinance Bank will contribute immensely to the economic and social wellbeing of our people.”

Similarly, the Emir of Bichi, His Highness, Alhaji Nasiru Ado Bayero, expressed his excitement about the KMC-Kayi Bank and the new banking App designed to reduce the financial-underserved and unserved population in the county.

According to him, “This platform will help the people in terms of running their business, receiving payments and also an avenue for creating job opportunities to the Kano population.”

About Kayi App

Kayi Bank is the proprietor of KMC-Kayi Microfinance Bank and KayiApp, both targeted at promoting financial inclusion in Nigeria by providing top-notch solutions that serve various financial demands in the country. As an operator duly licensed by the Central Bank of Nigeria (CBN), Kayi Bank is poised to empower individuals and businesses across Africa, offering seamless transactions in traditional and cryptocurrency. Our mission includes serving the unbanked, the diaspora community, and urban professionals. Powered by Web3 technology, we ensure stability and speed, redefining modern banking with comprehensive services. Kayi App: where innovation meets accessibility and security meets convenience. Join us in shaping the future of finance.