2023 was a remarkable year for Nigeria’s tech ecosystem. Despite the decline in venture funding, layoffs, and shutdown of some startups, the ecosystem scored some major wins from the policy side. We saw the introduction of policies aimed at supporting startups and innovation. The appointment of a member of the tech ecosystem into the federal cabinet also created a new level of validation. This leaves a trail of both opportunities and unforeseen challenges for next year.

In March, Nigeria became the first country in Africa to adopt open banking regulations that allow banks to share customer data with third-party service providers—fintechs and mobile money operators. This move promised increased data sharing and innovation, empowering consumers with control over their data. However, the initial excitement was dampened by a proposed plan by Nigeria’s Central Bank to centralise open banking operations through the National Inter-Bank Settlement System (NIBSS). The apex bank would later rescind the decision following pushback from industry stakeholders.

Also in March, Osun state made headlines after cancelling right-of-way fees, allowing telecom companies and internet providers to lay fibre optic cables for free. The move was aimed at attracting startups to set up shop in the state. Osun also unveiled plans to domesticate the Nigerian Startup Act. The Nigerian government also launched a $618 million fund under the Investment in Digital and Creative Enterprises (iDICE) initiative to promote innovation and entrepreneurship in the digital, technology, and creative industries. [ad]

May came with a twist as Nigeria’s Central Bank revoked the operating licences of more than a hundred financial institutions across the country for non-compliance. One of the affected banks is the Softcom-owned digital bank Eyowo. Another remarkable event in May was the last-minute attempt by former Nigeria’s minister of communications and digital economy, Isa Ali Pantami, to amend the already passed Nigeria Startup Act, just days before ex-president Muhammadu Buhari’s tenure ended. Similarly, a controversial bill that seeks to ascribe new powers to the National Information Technology Development Agency (NITDA), Nigeria’s governing body for information and technology, passed a public hearing at the Senate, despite pushback from stakeholders.

In June, President Bola Tinubu signed the Nigeria Data Protection Bill 2023 into law. The new law provides a legal framework for protecting and regulating personal information in the country. In another development, following the unification of the exchange rate, the central bank announced new rules that allow beneficiaries of diaspora remittances to receive payments in naira. The move birthed new opportunities for fintechs and traditional banks. But on the flip side, the new FX regime affected how Nigerian startups report revenue to their foreign investors.

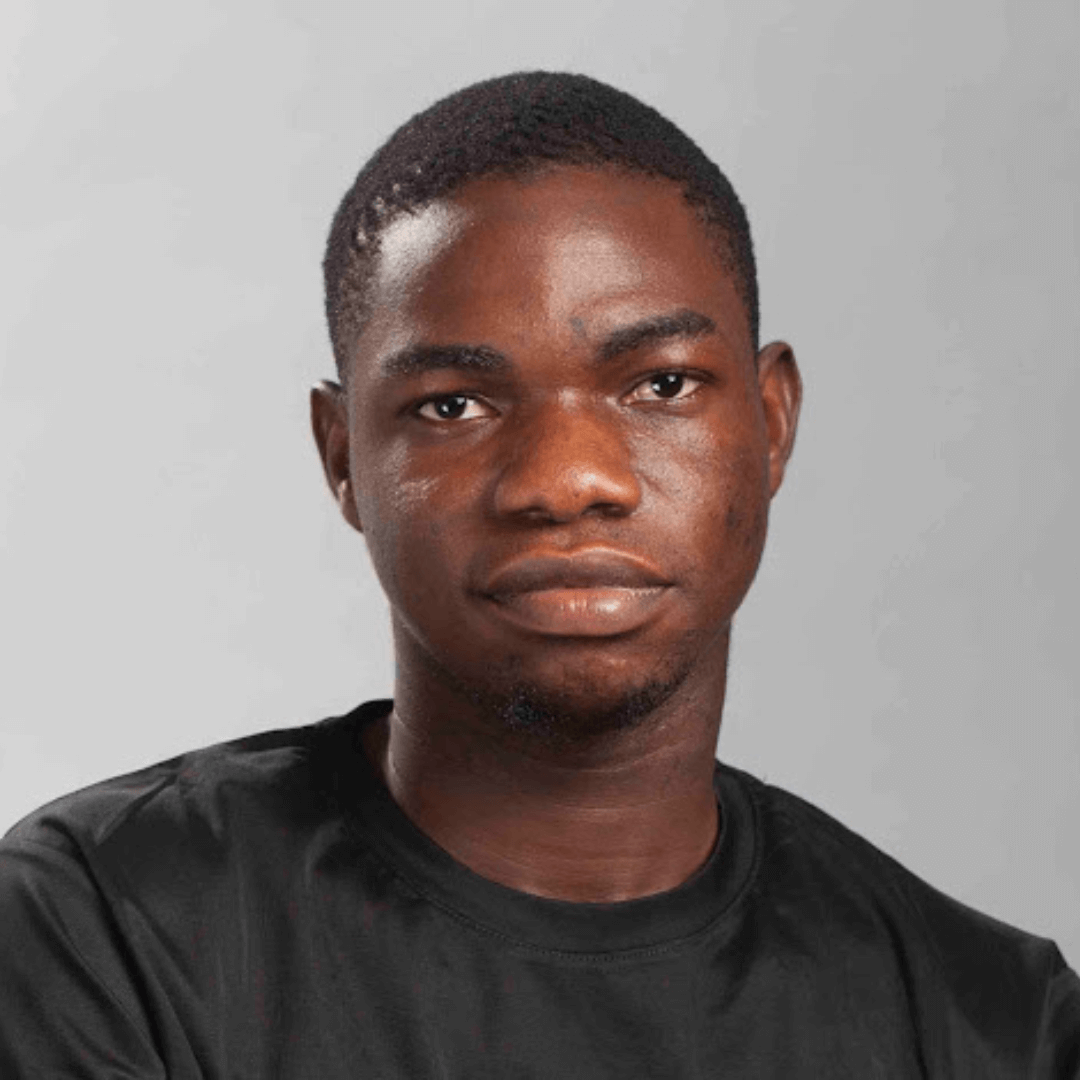

In August, Bosun Tijani, co-founder of CCHub—adjudged to be one of the most influential tech incubators on the continent—was named Nigeria’s minister of communications, innovation, and digital economy. His appointment brought a new wave of optimism for Nigeria’s growing tech ecosystem which now has a seat at the table. In October, the minister formally unveiled his plans to train 3 million technical talents in four years. In the same month, OPay, Meta, and DHL were investigated by Nigeria’s Data Protection Commission (NDPC), for alleged data privacy violations—claims that the companies denied.

In November, the minister flagged off the pilot phase of the ambitious plan to train 3 million technical talents. A total of 30,000 will be trained in three months. The same month, the Nigerian government launched its Startup Support and Engagement Portal thirteen months after its Startup Act was signed into law. The portal will facilitate the labelling of Nigerian Startups and the registration of venture capitalists, angel investors, accelerators, incubators, and innovation hubs. Other benefits include tax incentives, access to financial resources, and fund management as well as collaboration with relevant government agencies. In December, Nigeria’s Central Bank removed a two-year restriction on cryptocurrency transactions but introduced stringent guidelines for financial institutions.

Ultimately, 2023 was a year of regulatory highs and lows for Nigeria’s tech ecosystem. One thing is clear: the ecosystem will be counting on one of its own to push policies and programs to spur its growth. More importantly, collaboration and engagement with the government are a no-brainer.