Foreign investors are staging a comeback for government securities following a hike in benchmark interest rates and reforms led by Nigeria’s Central Bank.

Many of these investors have shown interest in Open Market Operations (OMO) and treasury bills auctions.

[ad]

Sources in the Nigerian Exchange Limited (NGX) said there was an uptick of foreign portfolio investors in the market which domestic investors dominated for the past seven years. Foreign Portfolio Investments on the NGX in February 2024 rose by 23% from ₦53.11billion ($39.13 million) to ₦65.81 billion ($42.61 million) compared to January 2024.

This uptick reflects investor confidence in the market, according to analysts.

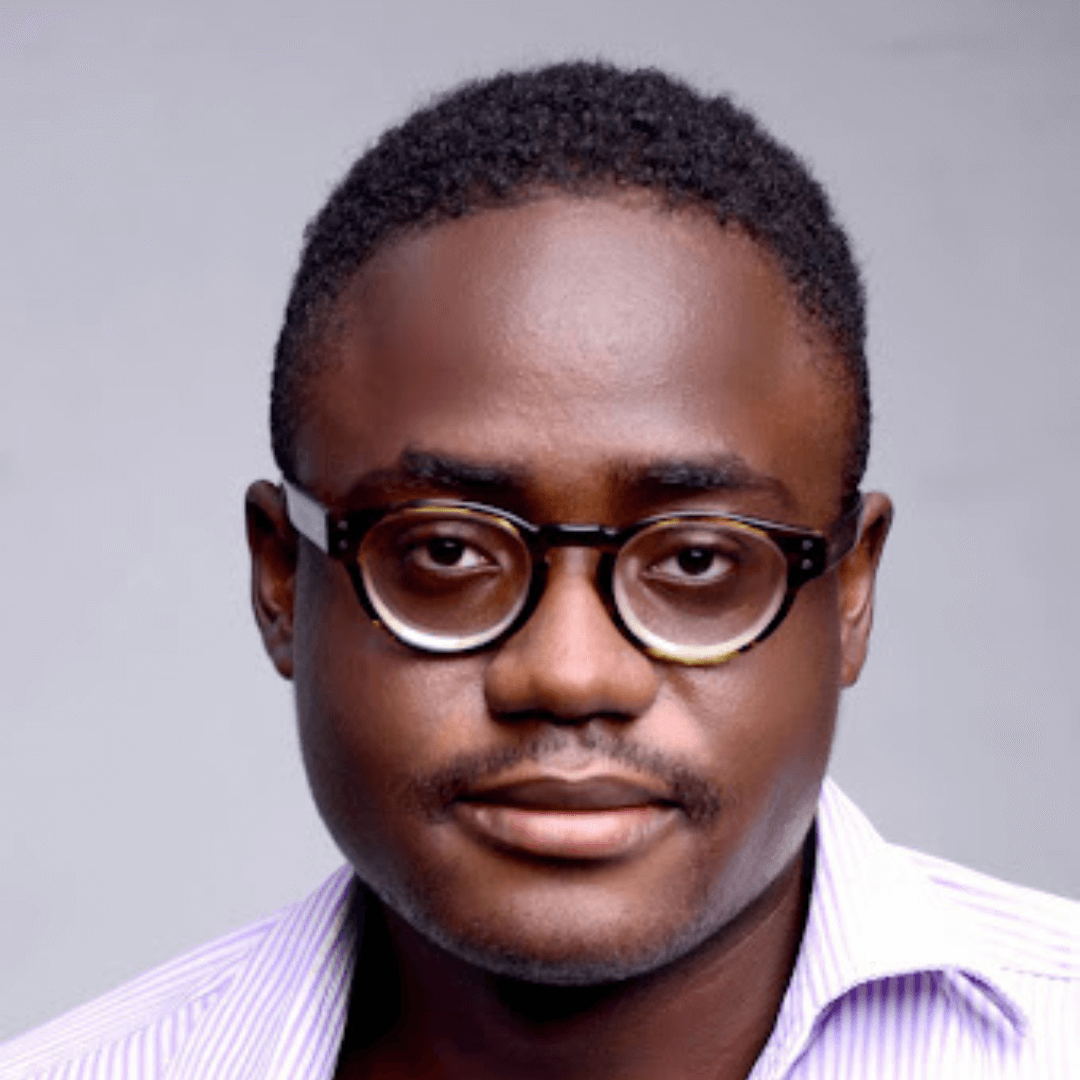

“High-interest rates attract foreign investor participation, which could stabilise the currency woes,” Ayodeji Ebo, Chief Business Officer, Optimus by Afrinvest told TechCabal over the telephone.

The Central Bank has consecutively raised interest rates sharply to a 10-year high of 24.75%, in an aggressive move to contain stubborn inflation. At the last rate hike meeting, Cardoso hinted that the MPC would keep raising the rates in hopes that inflation moderates below 30%. The continuous rate hike has attracted more investors while hurting lending to smaller businesses.

[ad]

Analysts told TechCabal that they want the trend to continue. Last week, the CBN directed all banks on a recapitalisation drive, to increase their minimum capital requirements within 24 months, to ensure stability of the financial system. Ebo believes that the entrant of foreign investors will provide the needed capital for the banks’ recapitalisation. He explained that even if the entry of foreign investors is for a short while, their inflow is important for stabilising the economy.

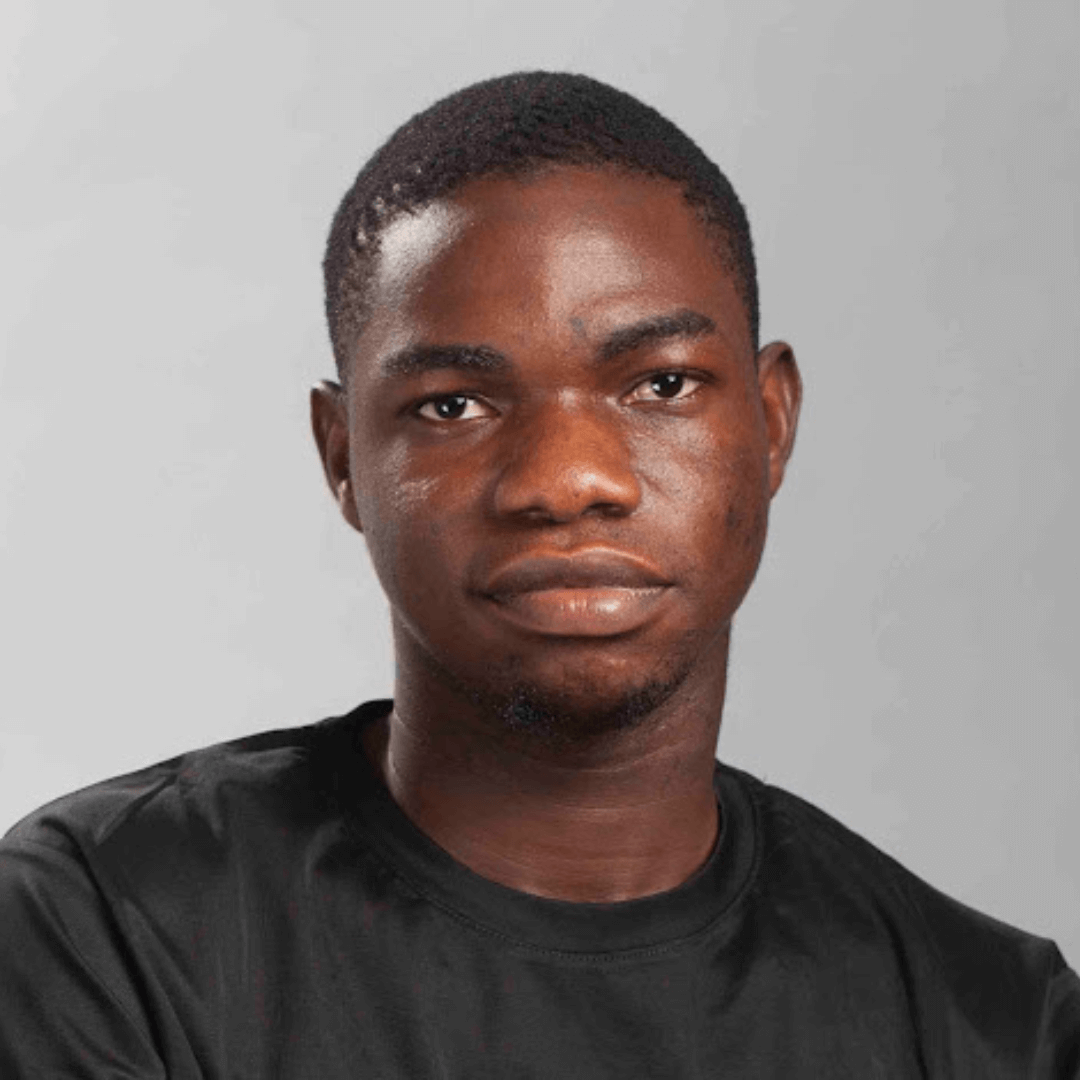

Foreign investors provide the liquidity needed in the market, said Ayooluwade Ogunwale, a portfolio manager. Therefore, making carry trade opportunities in Nigeria attractive again.