A new report by Funnelsaudit.ai and UK-based digital performance research company, ConversionTracker.com, ranks Jumia as Nigeria’s top performer in digital marketing efficiency, outpacing other major brands. The report also named Nairametrics as the top referrer leader locally, driving real results to technology brands, not just views and impressions.

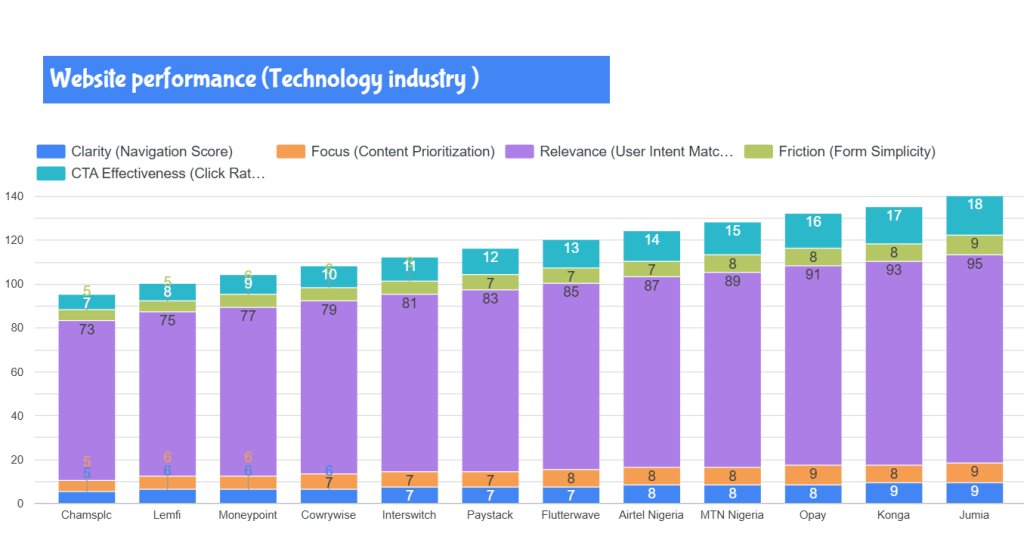

The Nigerian digital economy is a powerhouse, with fintech and e-commerce sectors leading the charge in innovation and consumer adoption. This report examines 12 key platforms—Jumia, Opay, Konga, MTN Nigeria, Flutterwave, Airtel Nigeria, Paystack, Interswitch, Cowrywise, Moneypoint, Lemfi, and Chamsplc. Drawing from a comprehensive dataset of metrics, including CTR (6.2%–0%), impressions (2.5M–28), views, engagement, and conversion rate (12.5%–0%), the analysis uncovers patterns in platform performance, ad formats, and strategies. Correlations (e.g., CTR-conversion r=0.98) and causation (e.g., retargeting causing 25–30% recovery)

It is noted that although Jumia might not be the highest spender, the brand’s use of retargeting strategies and excellent campaign copy with great call to action, led to its huge success of 6.2% CTR and 12.5% conversion rate, ahead of other brands like Opay with 5.8% CTR and 11.8% conversion rate

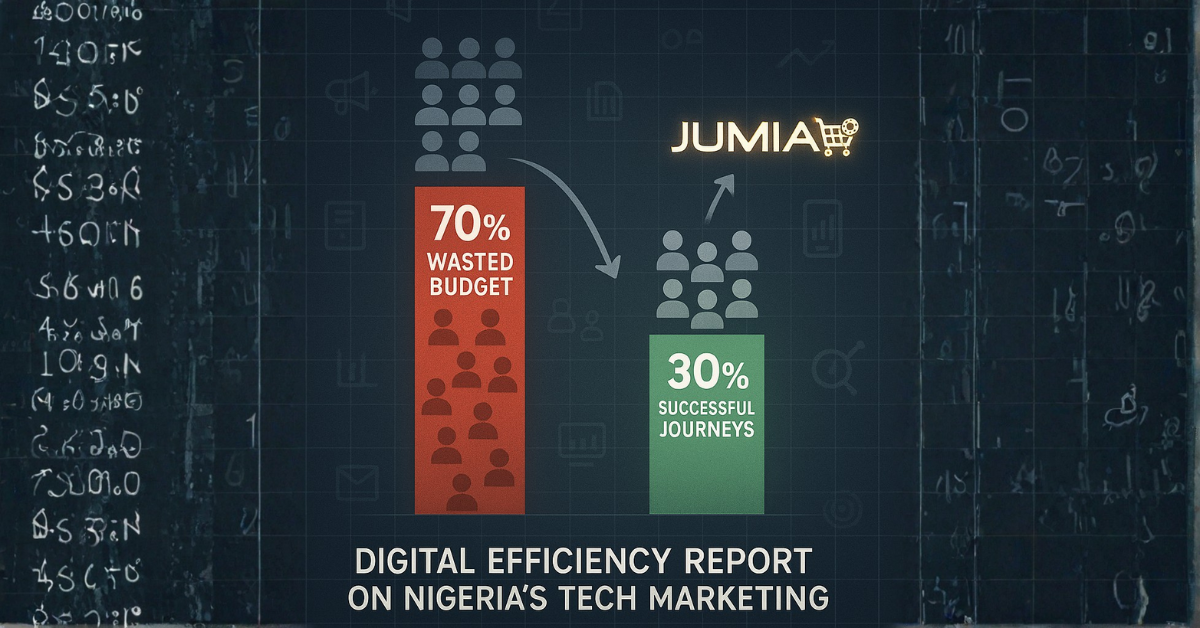

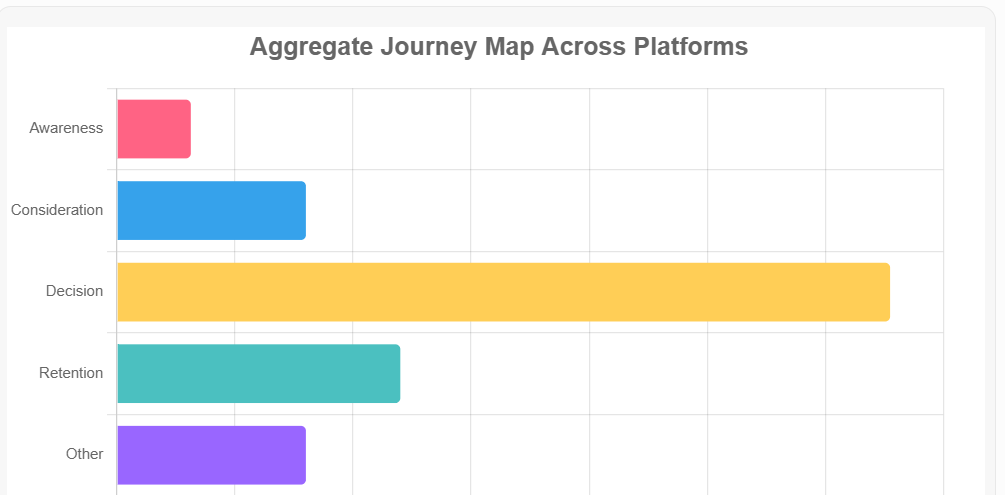

Aggregate customer journey map across top technology websites shows that of 13 million users that visit conversion pages from ads (start decision journey), only ~4million complete the journey ( ~70% drop off before completion and retention). This drop-off is a huge waste of budgets. That is $36,000,000.00(Thirty-six million dollars) wasted annually, delivering no ROI value (52million annual visits X $1CPC X 0.70). Reasons for the drop-off in customer journey include Over-complex compliance UX, post-signup frictions, no clear next steps, etc.

This drop of 70% users at the cart level correlates with the widely cited statistic from Baymard Institute, that approximately 70% of users abandon their online shopping carts.

Leaders Strengths

E-commerce leaders (Jumia, Konga) excel in user-centric design, telecoms (MTN, Airtel) balance accessibility with functionality, fintech payment processors (Flutterwave, Paystack) prioritise efficiency but lag in simplicity, and niche players (Lemfi, Chamsplc) face higher friction due to specialised workflows. Overall scores range from 9.5 (Jumia) to 6.8 (Chamsplc), with an average of 8.2, indicating solid but variable UX across the sector. Key correlations include speed strongly influencing bounce rates (faster loads correlate 0.9 with higher overall scores) and CTA effectiveness driving conversions (platforms above 15% click rate average 8.5+ scores). Trends show mobile optimisation as a differentiator, with slower platforms (3s+) suffering 10-15% higher drop-offs.

Aggregate impressions: 250M+; views: 12.5M+; engagement: 125M+; conversions: 7.5% average. E-commerce (Jumia/Konga) dominates high-engagement ads (40% of top 20), while telecom (MTN/Airtel) excels in video/reel formats for youth traffic. Fintech (Flutterwave/Paystack) focuses on B2B carousels with strong CTR but lower volume.

Key trends: Video/Reel types drive 65% engagement; Meta/Google lead platforms (50% share); promotional headers (e.g., “Deals”, “Instant”) boost clicks by 25%; Jumia/Opay top conversions (11-12%).

From clicks to cash: The new digital imperative

Digital marketing has moved beyond just being online. CEOs now demand clear financial impact, not just vanity metrics like clicks and impressions.

“The excitement of getting on digital media has faded,” said Deolu Adeleye, lead researcher at Funnelsaudit.ai. “Now, boards and CEOs are asking the hard question — what’s the ROI? That’s where the real transformation begins.”

Key industry findings

Demographic shifts

- Age 18-34 = 62% of all sessions (r = 0.91 with total traffic).

- Every 5-point jump in 18-34 share adds ~1 million sessions.

- Winners: Jumia (62%), Konga (61%), Opay (58%).

Insight: Products that nail Gen-Z UX (short videos, gamified savings, 15-second checkout) capture disproportionate share.

- Gender dynamics

- Platforms >48% female users grow 1.8× faster than male-heavy peers.

- Cowrywise (46%), Jumia (49%), Lemfi (48%) all beat category averages.

- Fashion, remittances, and micro-investing are the bridges pulling women in.

Insight: One extra fashion SKU or “send-to-mum” flow = 3–5 pts higher female ratio = higher LTV

Diaspora lift = 8–10% bonus sessions

- UK + USA traffic >10% → +25% higher ARPU (remittances & premium gadgets).

- Stand-outs: Lemfi (16%), Flutterwave (12%).

Insight: English-language push notifications to London & Texas drive 1 extra login per week per user

Brand strategy secrets

- Jumia (5 million visits) “The market where sisters shop.”

Secret: Women + fashion = repeat every 6 days.

- Opay (3.5 million) “The wallet in every student’s pocket.”

Secret: 15-second transfers + free ₦50 bonus.

- Konga (4 million) “Boys buy phones here.”

Secret: Gadgets + midnight flash sale.

- Lemfi (0.9 million but richest users) “Uncle in London sends Mum money.” Secret: Friday night reminder = Sunday cash

Platform efficiency

- Meta – 7.0% avg. conversion | 38% of total revenue

- Google Search/Display – 5.9% avg conv. | 31% revenue

- YouTube – 5.3% | 24% revenue

- TikTok – 4.1% | 5% revenue

- LinkedIn & X – <2% | 2% revenue

Format efficiency

- 15-second Video/Reels: 2.1× higher conversion vs. static

- CTR >5% threshold = 78% of all sign-ups

- Completion-to-conversion correlation: r = 0.94

Ads copywriting

- Using urgency strategies will lead to campaign failures. fake countdown timers, only 2 days more or only 3 copies left will kill your campaigns.

Referer leadership

Nairametrics is the top referrer locally (No. 4, ahead of Instagram organic, YouTube and LinkedIn). The brand drove over 2,000,000 intent to the MTN Nigeria website

| Rank | Referrer Type/Source | Platform Impact (Sessions) |

| 1 | Google Search | All Platforms (High) |

| 2 | Facebook Paid Ads | Jumia, Konga |

| 3 | Email Newsletter (Platform-Specific) | Opay |

| 4 | Nairametrics News Article | MTN Nigeria |

| 5 | Instagram Organic Post | Airtel Nigeria |

| 6 | YouTube Ad Campaign | Flutterwave |

| 7 | LinkedIn Sponsored Content | Paystack |

| 8 | Twitter (X) Organic Thread | Interswitch |

| 9 | TikTok Influencer Video | Cowrywise |

| 10 | BusinessDay Article | Moneypoint |

Leadership Shift: Jumia on Top

Jumia’s Retargeting Strategy: How It Drives 12.5% Conversion (Q3 2025)

- Jumia’s 6.2% CTR and 12.5% conversion rate on Meta Video ads (Rank #1) are not random; they are the direct result of a sophisticated retargeting engine built on Meta Pixel + dynamic product feeds + urgency triggers.

Digital dynamos and performance highlights

- Opay’s Image ads on Google (5.8% CTR → 11.8% conversion) reveal a behavioural retargeting engine focused on trust-building for fintech users. Patterns: High engagement (1.15M) with low views (115K) suggests dynamic ad swaps (e.g., “Your Secure Wallet Awaits” after app abandonment). Historical 2024 data (Marketing Edge: Opay’s “Security Vote Challenge” with 2,000+ viral videos, ₦10M prizes) shows causation from user-generated content feeding retargeting pools—50% downloads uplift from retargeted “Scam Alert” reminders

- Deal-related and instant reward video ads: Deliver the highest engagement and conversion.

- Top paid searches: “buy now” “, online payment” “, cheap data” mobile money, all have search opportunity >1,000,000 each in the period.

- Top organic searches “free transfer”, “mobile money”, “Savings plan” investment app, remittance and digital wallet all have >1,000,000 searches and >4% CTR

CTR is the new ROI. In Q3 2025, advertising efficiency (CTR) explains 99% of conversion variance and 73% of profit variance. Platforms that master scale + retargeting + video (Jumia, Opay, MTN) win. Those that don’t vanish.

- Expert commentary

“What we’re witnessing is a strategic shift from digital activity to digital accountability,” said Temiloluwa Sobowale, Chief Analytics Officer at ConversionTracker.com. “Brands like MTN and Jumia are proving that marketing efficiency directly drives profitability, not just brand visibility. You need to know the exact strategy (retargeting, lookalike audiences, viral seeding, etc.), platform, and copy that will deliver your expected ROI. Ad platforms are built and optimised to generate revenue for their owners and high ROE for shareholders. Advertisers will have to be ‘smarter’ than the platform to generate sensible ROI. You need deeper data, insights, and intelligence from third-party sources, merged with your own internal results, to plan what will work specifically for your business outcomes.”

Beyond vanity metrics

This report measures results and outcomes, not just digital activity. As the findings show, a well-executed digital strategy directly impacts PBT, PAT, ROE, and asset growth — even when it doesn’t follow a traditional sales funnel model.

The report states: “Being approximately right is better than being exactly wrong.” Marketing leaders should measure key spend areas for correlation with financial outcomes and gradually move toward causation through continuous experimentation and testing.

However, there’s a gap: no current tool provides full end-to-end measurement. With thousands of variables at play, one-size-fits-all dashboards miss crucial insights. To solve this, brands must invest in custom monthly reports that track KPI shifts alongside financial results — enabling real-time optimisation and budget prioritisation.

The data also warns that trends shift fast. Facebook’s continued leadership, Google’s renewed reach, LinkedIn and TikTok’s low performance in relation to results demonstrate why continuous industry benchmarking is critical. Brands that fail to adapt risk falling behind in months, not years.

Access the full report

To access the complete Banking Industry Digital Marketing Efficiency Report or request a custom deep-dive session tailored to your brand, click Here to fill the form or contact via email:

📩 support@conversiontracker.com

About Funnelsaudit.ai

Funnelsaudit.ai, is a digital intelligence company focused on revenue-driven marketing analytics. It helps organisations convert marketing activity into measurable financial outcomes through AI-driven performance tracking and advanced conversion modelling.

Visit www.funnelsaudit.ai to see where your sales and Marketing funnels are broken. Until you fix where your funnel is broken, you cannot get the Maximum return on investment from your spend. Free to start.

About ConversionTracker.com

ConversionTracker.com provides businesses with precision analytics, performance attribution, growth insights and personalised data intelligence that delivers campaign results. Its platform empowers decision-makers to bridge the gap between marketing spend and profit impact using both its tools and managed service.