For all the progress Nigeria has made in adopting digital payments, one small but persistent inconvenience remains: typing bank account numbers. It’s a step every Nigerian knows too well – the slow, error-prone ritual that holds up supermarket queues, stalls purchases at market kiosks, and complicates quick online payments.

Consumers all over Nigeria find themselves slowly typing in bank numbers whilst glancing back and forth from printed signs, or asking cashiers to repeat the number until they’ve got it right, and even with all that care, typos slip through. Funds land in the wrong account, transfers bounce back, and simple payments turn into time-consuming disputes.

This friction hasn’t been solved by QR codes or alternative payment systems either – many of those require merchants to adopt new tools or customers to change how they already transact.

AidaPay decided to take a different approach.

Rethinking the transfer experience

Instead of redesigning Nigeria’s payment ecosystem, AidaPay’s founder and lead software engineer, Musefiu Agbeniga, focused on the smallest point of failure: entering the account number. If that one action could be removed, the entire experience – from speed to accuracy – would transform.

That thinking led to ScanPay, AidaPay’s new AI-powered scanning tool built directly inside the AidaPay app.

How ScanPay Works

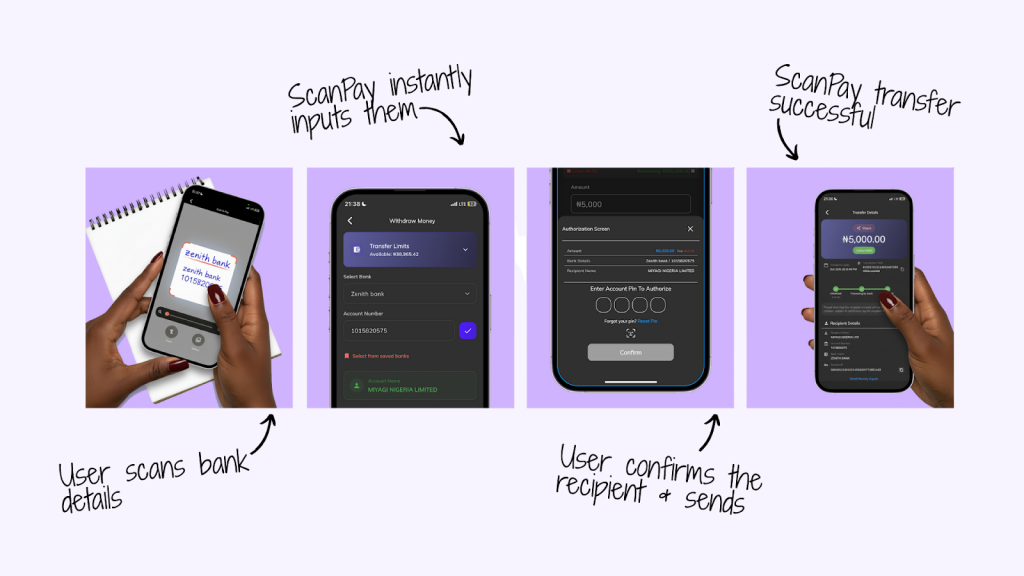

ScanPay lets users complete a transfer simply by pointing their phone camera at any bank details – whether printed on paper, typed on a screen, or handwritten. The system instantly recognises the numbers, identifies the bank, and fills out the transfer form for the user, and even verifies the details, filling in the account name.

There’s no typing – just scan, input the amount, confirm the recipient and send.

The feature works even in low lighting and handles the messy reality of real-world data: blurry photos, uneven handwriting, screenshots saved and resaved through social media compression.

That’s because ScanPay is built on a proprietary code model engineered specifically for Nigerian banking formats, with a highly-trained AI system as backup. Drawing on both, the tool can tell the difference between an account number, a phone number, and a random string of digits, and it understands how various banks format their details.

What normally takes 30 to 45 seconds of careful typing becomes a five-second scan. And with the risk of human error dramatically reduced, failed transfers and wrong-recipient mistakes drop, too.

Early Access Launches Nationwide

AidaPay has now opened EarlyBird Access to ScanPay – the beta phase allowing Nigerians to test the technology before full market rollout. Early users get free transfers and 1% cashback every time they send money, during this launch window.

To try the feature, download the AidaPay app and sign up for EarlyBird Access, or visit www.aidapay.ng/scanpay.

The response so far has been enthusiastic.

“People are realising just how much time they’ve been wasting typing account numbers,” Musefiu told TechCabal. “Seeing them experience that moment of relief – that’s been the best part. We built something simple that solves a real, everyday problem.”

AidaPay plans to bring ScanPay to the wider public in the coming weeks, aiming to make it a staple tool for everyday digital payments across the country.