For more than a decade, Job Konadu, a 33-year-old electrical technician in Kumasi, Ghana’s second-largest city, relied on the country’s National Health Insurance Scheme (NHIS) for his medical care. For him, however, routine hospital visits often became a test of patience.

“Sometimes you go to the hospital and stay in a queue for hours,” Konadu said. “And even then, you might not get the treatment or medication you need. They tell you to buy the quality drugs outside and give you just painkillers. I used to spend the whole day in the hospital, which was very stressful.”

The NHIS, established in 2003, was designed to provide universal health coverage and reduce out-of-pocket medical expenses for Ghanaians. In its early years, it covered a wide range of treatments and medications at minimal cost. Over time, delayed reimbursements, resource shortages, and gaps in coverage have made access increasingly unpredictable for many users.

As these challenges persist, employers increasingly turn to ad hoc reimbursement schemes, paying staff back for medical expenses rather than offering structured healthcare coverage.

For employees, this often meant paying out of pocket first and waiting weeks or even months for reimbursement.

That experience is now beginning to shift for some Ghanaians through Rivia, a healthtech startup co-founded by Isidore Kpotufe in 2024. The platform aims to reimagine healthcare access for employees of small and medium enterprises (SMEs) and individual users through a free virtual care plan.

Rather than operating as a traditional insurer, Rivia offers what it calls “Health Access,” a subscription-based system designed to guarantee access to care through both virtual and in-person consultations, with payments and prescriptions managed digitally.

Healthcare via WhatsApp

For Rivia users, healthcare begins and unfolds on WhatsApp, from booking appointments to virtual consultations and prescription fulfilment. The platform relies on WhatsApp because patients already use it daily, eliminating the need to download or learn a new application and making care instantly accessible, even for low-income users.

Konadu first used Rivia in November 2025. After registering, he reached out via WhatsApp when he fell ill.

“I introduced myself, told them which company I was coming from, and they responded immediately,” he said. “They asked what the problem was, I explained by typing or sending a voice note, and then they sent me a link to book a doctor’s appointment.”

The system automatically confirms appointments, sends reminders 30 and five minutes before the scheduled time, and manages follow-ups.

After consultations, patients receive their diagnosis and prescription through WhatsApp. Medications are coordinated with nearby partner pharmacies, and patients can submit receipts directly through the same channel for reimbursement.

“Virtual care programs often fail because they force people into a new app,” Kpotufe said. “WhatsApp allows us to meet patients where they already are, providing instant, familiar access and increasing adoption of virtual consultations across our network.”

Inside RiviaOS

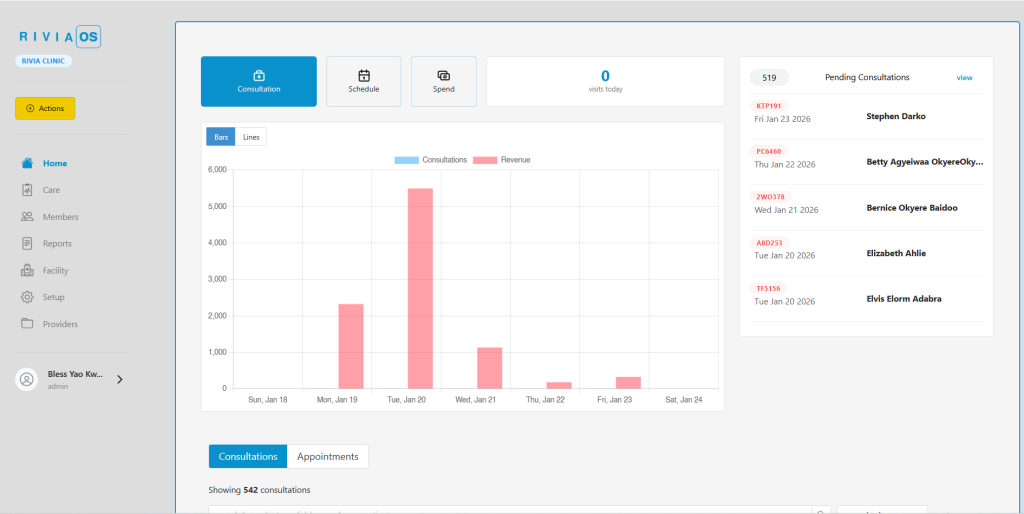

While WhatsApp simplifies access for patients, the technical backbone of Rivia is a proprietary platform called RiviaOS. The system grew out of the acquisition of Waffle, a Ghanaian SaaS company focused on hospital and inventory management, shortly after Rivia’s launch in April 2024. Waffle’s tools were rebranded as RiviaOS and now unify patient records, clinic workflows, scheduling, billing, and operational management across the network.

According to Kpotufe, this integration allows care to move seamlessly between virtual and physical settings.

“Virtual consultations are documented in RiviaOS,” he said. “When a provider refers a patient for an in-person visit, the patient authorises record access through a one-time password. The receiving provider can instantly view the patient’s records and continue care.”

At Teresa Hospital in Accra, one of the first clinics to join Rivia, those changes are already visible in day-to-day operations. Dr Samuel Nai, a prescriber at the primary healthcare centre, said the hospital joined Rivia during its pilot phase.

“At the time, we were transitioning from paper records and expanding beyond maternity care, but we didn’t have the infrastructure to support that,” Nai said. “ Rivia provided the systems, technology, and training that made the shift possible.

According to Nai, patient records, billing, and care coordination are now managed through RiviaOS, replacing manual processes and reducing administrative friction.

“Everything runs on the operating system now,” he said. “It has made our work more structured, more predictable, and easier to manage.”

A different model of insurance

Rivia differentiates itself from traditional insurance by focusing on access rather than risk underwriting.

“Insurance is built on exclusion,” Kpotufe said. “Health Access flips that. Everyone deserves a front door to care, and the system should make that door easy to open.”

That positioning places Rivia in competition with both traditional health insurers and digital-first healthcare platforms. Conventional insurers such as Nationwide and Acacia primarily act as financial intermediaries, collecting premiums and reimbursing care delivered by third-party providers.

Rivia also overlaps with healthtech startups like MPharma and MinoHealth AI Labs, offering virtual consultations and care coordination. But Kpotufe argued most stop at digital access.

“Apps alone don’t deliver healthcare,” he said. “Our advantage is the physical infrastructure behind the technology. We can move a patient from a WhatsApp chat to a clinic, laboratories, and prescriptions without breaking the care journey.”

That combination of physical clinics and digital access also shapes how Rivia makes money.

For employers, Rivia operates a business-to-business model tied directly to service delivery. Companies pay a fixed annual membership fee of $40 per employee, which covers access to Rivia’s technology and virtual care services.

Employers can also opt into an additional cashless care arrangement designed to make health spending predictable. Payments are made to partner clinics, which then deliver care to employees through the Rivia system. As the primary organiser of care and acquirer of members, Rivia earns a margin from this arrangement, Kpotufe said.

For individuals outside formal employment, the company operates a parallel model. What was previously a free offering has now been converted into a low-cost virtual care card priced at $9 per year and designed specifically for mass-market use.

The card is sold through an expanding network of agents operating in communities and pharmacies, using a distribution approach similar to mobile money services. While the virtual care component is offered at minimal cost, Kpotufe said it functions as an acquisition channel that drives patient volume into Rivia clinics.

At the facility level, users pay for physical diagnostics and medications, allowing the company to capture value across the entire patient journey, from the first WhatsApp consultation to in-person treatment and prescription fulfilment.

At clinics, providers continue to operate alongside NHIS rather than replacing it entirely.

“We still run NHIS alongside Rivia,” Nai said. “People come in with NHIS, and we attend to them. Others come in with Rivia. The difference is predictability and quality.”

Rivia at the clinic level

Since launch, Rivia says it has partnered with 52 clinics and impacted over 50,000 patients. About 70% of consultations begin virtually, with AI-enabled triage collecting symptoms via WhatsApp and routing patients appropriately.

For clinics like Teresa Hospital, patient volume has increased, though not always in a uniform way.

“Before, we used to get three or four patients a day, mostly walk-ins,” Nai said. “With Rivia, we now average between eight and 15 patients. Sometimes it triples, sometimes it doesn’t, but it is far better than before.”

More importantly, appointments have replaced uncertainty. “Before, you came to work hoping someone would come in,” Nai said. “Now, you already know who you will see because people have booked appointments.”

Still, challenges remain. Nai pointed to gaps in how pharmacy inventories sync with the system and the need for better internal communication tools within RiviaOS, such as real-time notifications between laboratories and prescribers. For now, some updates are handled manually, and staff still rely on phone calls for internal coordination.

Scaling and expansion

Scaling the platform presents operational and technical pressure.

“Every time we add a new company or clinic, the whole machine has to level up so quality doesn’t slip,” Kpotufe said. “The demand for simple healthcare access is massive. The real test is scaling our infrastructure fast enough.”

In 2024, Rivia raised a pre-seed round of $200,000 from Kaleo Ventures, Fast Forward Ventures, Chanzo Capital, and Taurus Venture Capital to build RiviaOS, upgrade clinics, and expand its network. The company is now raising a seed round to scale employee health access in Ghana and support regional expansion.

Rivia is preparing to expand into Nigeria, Côte d’Ivoire, and Kenya, adapting its model to local regulations, pricing structures, and clinic partnerships. Regulatory classification remains a key consideration as the company navigates whether it is viewed as a provider, insurer, or a new category altogether.

In Ghana, healthcare financing models are primarily regulated through the National Health Insurance Authority, which oversees insurance-based schemes, while physical facilities fall under the Health Facilities Regulatory Agency. Rivia does not operate as an insurer, nor does it provide care directly as a standalone health facility. Instead, it functions as an access and payment platform that sits between employers, patients, and licensed clinics.

According to Kpotufe, this has required ongoing engagement with regulators to clarify how the model should be treated within existing frameworks. The company has proposed the creation of a distinct regulatory approach for health access platforms, separate from traditional insurance oversight, while continuing to comply with data protection and facility-level regulations.

For Kpotufe, the long-term ambition is broader than company growth.

“Five years from now, we want healthcare in Africa to be as easy as two clicks,” he said. “One membership, guaranteed care, and a system where clinics, employers, and patients are all connected.”

Rivia bets that embedding technology, clinic networks, and prepaid access into a single system can turn fragmented, out-of-pocket healthcare into something predictable and humane. Whether that model can scale across Africa remains to be seen, but for patients like Konadu and clinics like Teresa Hospital, it already represents a meaningful shift in how care is accessed and delivered.