According to World Wide Worx and Mastercard’s online retail study, South Africa’s online retail industry reached R55 billion in 2022, a 30% growth from 2021 mainly driven by an ongoing boom in demand for home deliveries.

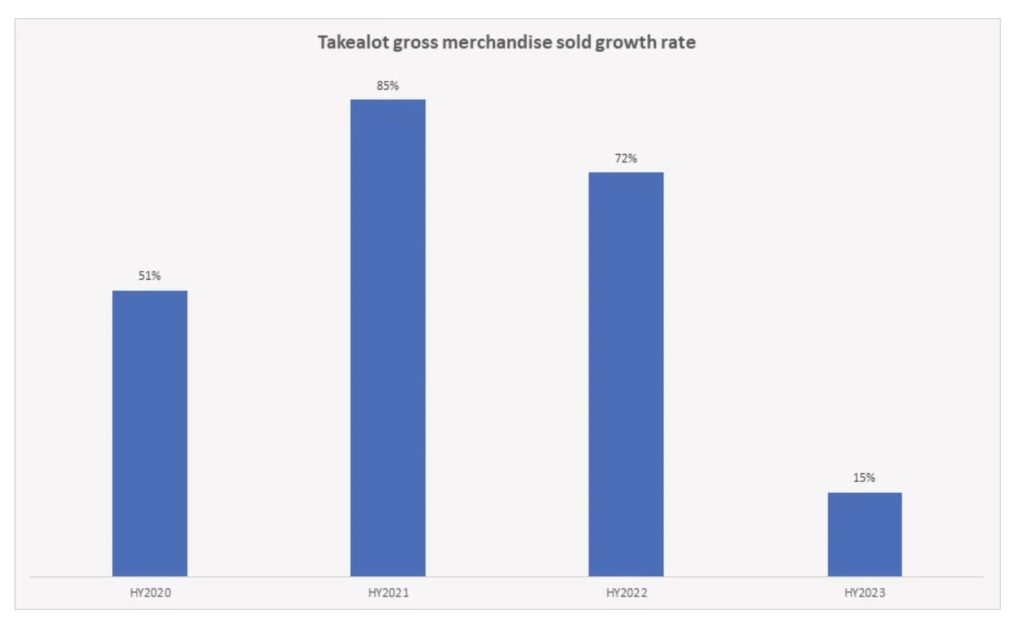

Despite its continuing dominance of the South African online retail market, according to the study, Naspers-owned Takealot has seen its Growth Merchandise Value (GMV) growth plummet from 72% in 2021 to 15% in 2022.

For the incumbent SA retail giant, the slowing down growth rate could not have come at a worse time. Apart from increasing competition from local players, Takealot’s other headache is the imminent arrival of Amazon, the biggest online retailer in the world, and American retail giant Walmart’s acquisition of Massmart which owns Makro, the country’s second largest online retailer.

Despite still accounting for over half of all online retail sales in the country, the explosive growth of competing platforms like Checkers Sixty60, Mr Price, and Makro, is a cause for concern for Takealot.

According to the study, Checkers Sixty60 grew its turnover by 150% from July 2021 to July 2022, Mr Price reported a 48.2% jump in sales for the year to April 2022 while Massmart’s eCommerce sales rose by 50%.

Exploring other growth avenues

Amazon and Walmart’s looming ecommerce proxy battle in South Africa coupled with an increasingly competitive local ecommerce front seems to be forcing Takealot to get aggressive with its growth initiatives. This week, the platform announced that through a partnership with retailer Pick n Pay, it was piloting a “pick-up counter” initiative which, if successful, would be rolled out across Pick n Pay’s 2,000-plus stores across the country.

“We aim to run the pilot for three months to gauge the value it provides customers, but the results after two weeks are already very promising,” said Pick nPay’s head of general merchandise in omnichannel operations, Ansgar Pabst.

The partnership will allow Takealot to take advantage of Pick n Pay’s extensive geographical presence to tap into South Africa’s booming online home deliveries boom and help it carve a significant market share on that front before Amazon, with its esteemed Amazon prime delivery service, hits the shores of South Africa.

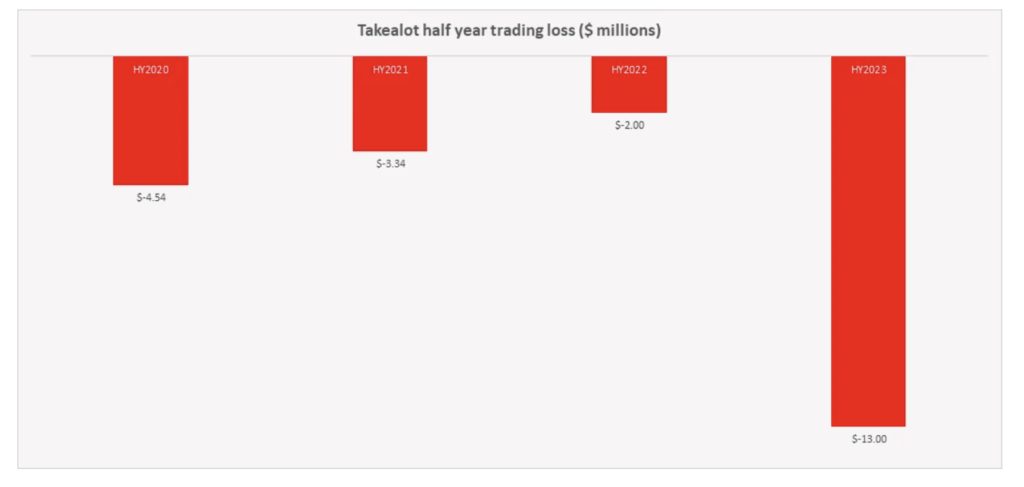

What also makes Takealot’s quest for growth a bit complex is the fact that the platform has been bleeding cash for the last four years. According to its latest financial results released in November 2022, the retailer incurred a $13 million (R223 million) trading loss.

However, if your parent company is Africa’s largest company by market capitalisation, you do not have to worry much about availability of capital to fund your growth ambitions. Takealot owner Naspers does not seem to be worried a lot about Takealot’s unprofitability streak, and for good reason.

As the numbers below reflect, there is still a lot of value to be unlocked in South Africa’s online retail industry and Naspers realises that Takealot, with its current dominance, is primed to be the biggest benefactor of this growth, should it play its cards right.

A lot of pie to go around

According to the World Wide Worx and Mastercard study, in 2022, total retail sales in South Africa reached R1,16 trillion, with online retail making up 4.7% of that total. This figure shows the amount of value that stands to be unlocked in South Africa’s online retail.

Another factor from the study that shows the huge potential in South Africa’s online retail is the fact that the rise of ecommerce is occurring at the same time as total retail stagnates. This phenomenon means that growth in online retail comes not from increasing demand for retail goods but rather from South African consumers shifting existing purchase behaviour from physical shops to online stores and apps.

Because online channels have not yet been able to offer some elements of physical shopping on an online experience, total retail is stagnating, showing the amount of value that would be unlocked by online platforms who will be able to plug this gap.

Some of these elements that are yet to be perfected by the incumbent South African online retailers, according to the study, include fast delivery, security, and an omnichannel shopping experience.

“Since physical shopping was limited during the hard lockdown, it was during this time that we first saw a rise in consumers resorting to online shopping. Due to this, consumers got comfortable – but with comfort of use we are seeing emerging consumer needs and expectations that go beyond being able to shop online,” says Gabriel Swanepoel, country manager of Mastercard South Africa.

All hope is not lost for Takealot

Amazon’s arrival and Walmart-owned Massmart’s ramping up of its ecommerce arm does not mean it’s all doom and gloom for local online retail incumbents. Takealot and others have what it takes to bring the fight to the global giants, but it won’t be easy.

The retailer’s continued investment into ramping up growth shows owner Naspers’ commitment to standing shoulder to shoulder with Amazon and Walmart. Of course, only time will tell the effectiveness of these investments. Also, the fact that Amazon and Walmart have not fared well in other markets, like India, presents a glimmer of hope for Takealot and other local players.

Declining growth and intensifying competition paint a gloomy picture for Takealot’s SA online retail dominance ambitions post the arrival of Amazon and Walmart. However, a growing total addressable market coupled with a more than capable financier in the form of parent company Naspers and vast knowledge of the local market puts a lot of gas into Naspers’ tank and allows it to at least attempt to race the global giants.