Letshego has reported a P14 million (~$1.04 million) loss caused by currency depreciation, mainly in Nigeria and Ghana. This translated to a 7% slump in its profit before tax for H1 2023.

Pan-African microfinance bank Letshego has said that the devaluation of the Nigerian naira and the Ghanaian cedi caused a 7% decline in the company’s profit before tax in H1 2023. Letshego said this equated to P14 million (~$1.04 million) in foreign exchange losses compared to a P23 million (~$1.7 million) gain in the same period last year. The company’s profit after tax was also down 12%.

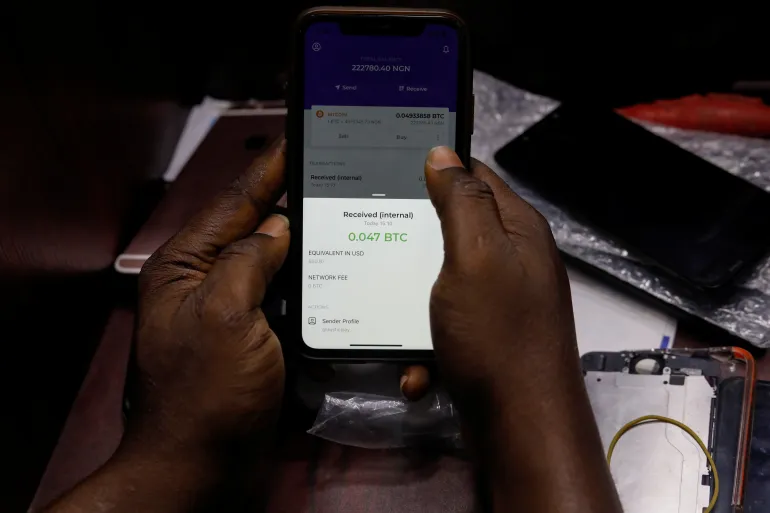

Letshego, founded in and headquartered in Botswana, operates in eleven markets on the continent and reports its earnings using the Botswana pula. Over the first six months of the year, the naira depreciated 69% against the pula due to Nigeria’s liberalisation of its foreign exchange rate. The cedi, on the other hand, depreciated 30% against the pula, spurred by Ghana’s runaway inflation.

Despite stating that the macroeconomic conditions causing the FX losses were beyond the company’s control, chief financial officer Gwen Muteiwa said Letshego would proactively address the losses. Responding to a question from TechCabal about how the company plans to hedge against the losses, Mutaiwa shared that the holding company would extend borrowing to its Nigerian and Ghanaian subsidiaries, who might not be able to borrow from the local market.

“One of the things that we do is that instead of giving that money to them in pula, we give it to them in naira, for example, so that if there are any exchange movements between the pula and the naira, it doesn’t hit the numbers directly,” Mutaiwa said. “Because at a country level, [the subsidiaries] can’t necessarily hedge some of these positions. But we can. So what we do is having given them local currency funding in Naira, we then go to the bank and then ask them for a hedge of the dollar against the naira.”

Letshego, which is listed on the Botswana Stock Exchange, commenced operations in Nigeria in August 2016 and Ghana in January 2017. Over the years, it has doubled down on its East and West Africa operations, even appointing a regional CFO for the West Africa markets. According to CEO Oupa Monyatsi, when taking away the FX losses, the company’s profit growth was 4% year-on-year, driven by the well-performing East and West Africa markets.

“Our East and West markets, which are the markets with scale, are doing well. The double-digit growth in most of these markets demonstrates that actually, the underlying businesses are performing optimally. It is when you translate them to pula, that you then lose the benefit of these double-digit and profitable growth because of the depreciating local currencies,” Monyatsi said.

Have you got your tickets to TechCabal’s Moonshot Conference? Click here to do so now!