Flutterwave, Africa’s most valuable startup, has been named ‘Fintech of the Year’ at the African Banker Awards in recognition of its contributions to the financial technology sector in Africa. The award celebrates Flutterwave and other companies and individuals setting new standards of innovation and contributing to the growth and development of Africa’s banking sector over the past year.

The award is Flutterwave’s third international recognition in 2024 after the fintech giant was included in CNBC’s Disruptor 50 list and Fast Company’s Most Innovative Companies.

Although it remains unclear when Flutterwave will IPO, the awards might lend credence to Flutterwave’s ambitions to go public. The fintech company has been linked to an initial public offering since August 2023, when Olugbenga Agboola, its CEO, disclosed that the fintech would forge ahead with its 2022 IPO plans. The fintech has also recently changed up its executive team after several high-profile exits in recent months.

“We are incredibly honoured to receive this prestigious award,” said Agboola, in a statement seen by TechCabal.

The award ceremony took place last night at the JW Marriott Hotel in Nairobi, Kenya, where over 300 of Africa’s leading figures in banking and finance were attending the African Banker Awards gala.

“This recognition is a testament to the hard work, dedication, and creativity of the entire team at Flutterwave. It also reaffirms our mission to simplify payments for endless possibilities, and we remain committed to building solutions that enable multinationals to expand in and within Africa, and also supporting African companies to compete globally,” an excerpt from the statement read.

Flutterwave also received approval in principle for a payment aggregator licence from the Central Bank of Mozambique today as it looks to expand into the southeastern African region. The licence, if approved, will allow Flutterwave to support businesses expanding into Mozambique and global enterprises expanding into Africa.

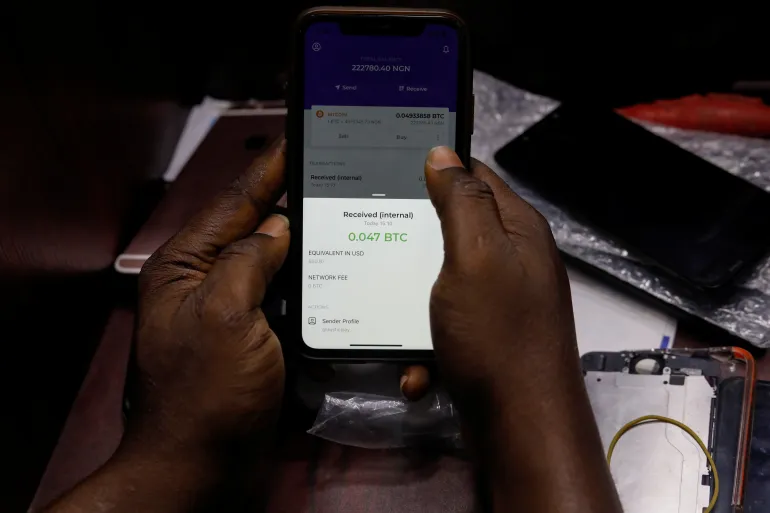

Flutterwave’s key business is processing online payments, enabling international businesses like Uber to accept payments from African businesses and customers. The fintech allows these businesses and multinationals to accept various forms of payments, like mobile money, card payments, and bank transfers.