IN PARTNERSHIP WITH

Good morning 🌄

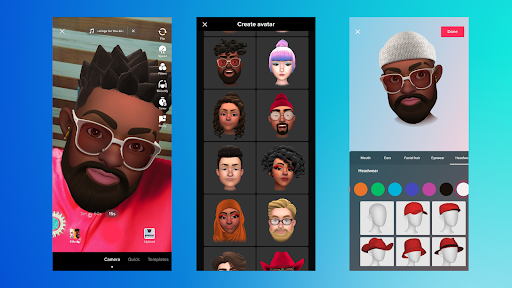

TikTok now has customisable avatars!

A few years ago, when Apple launched memojis—animated emojis that look like you—iPhone users paraded their avatars around because their phones finally had the one thing Androids did not. Their joy turned to ruins in 2020 when Snapchat launched Bitmojis for Androids and iOS. 🌚

Earlier this year, Meta also launched avatars on Facebook.

And now, the proliferation of AR avatars continues as TikTok also launches its own customisable avatar feature.

To use TikTok’s customisable avatars, search for “TikTok avatars” in Effects. Then, you can then either use a preset look or hit “new” to create a custom avatar.

In today’s edition

- MFS Africa acquires GTP

- Kenya wants crypto miners to use clean energy

- Rentoza raises $1.3 million

- Opportunities

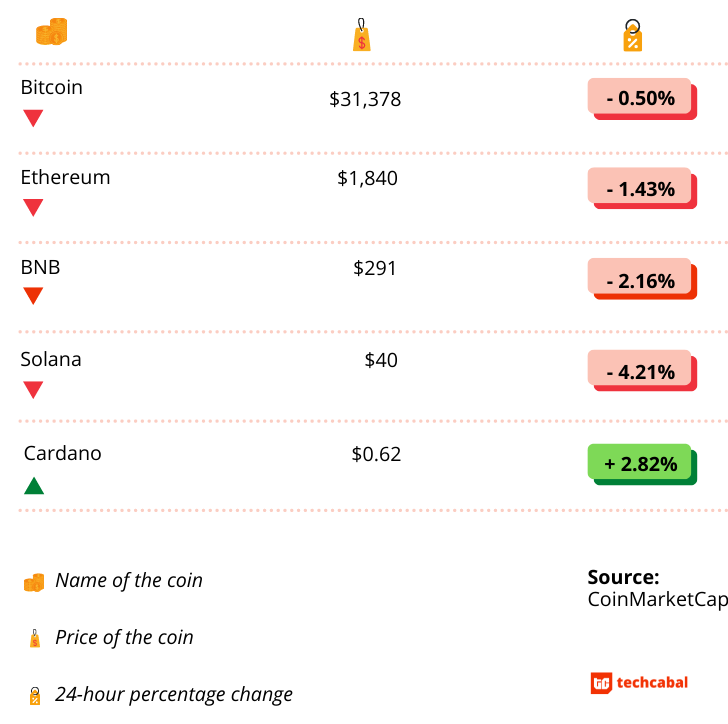

CRYPTO MARKET

* Data as of 10:35 PM WAT, June 7, 2022.

Is this column helpful to you? Please take our survey.

MFS AFRICA ACQUIRES GTP

We frequently hear of African companies acquiring other African companies, or of foreign companies acquiring African companies.

We, however, rarely hear of African companies acquiring foreign companies.

Well, just like Egypt-born Swvl’s acquisition of Volt Lines and Zeelo, another African company is crossing continental borders for acquisition.

This week, MFS Africa, a pan-African digital payments company, has announced that it will be acquiring US-based payments software company, Global Technology Partners (GTP), in a $34 million deal.

What MFS achieves with this deal

MFS Africa is the largest fintech interoperability hub in Africa. With over 320 million customers, it connects banks, telcos, and money transfer operators across over 35 countries via a single integration point.

GTP, on the other hand, is a prepaid and mobile payment platform that integrates several prepaid cards with a single bank account, and allows users to shop online. Over 500,000 users across 30 countries use GTP’s platform.

MFS Africa’s acquisition of GTP will offer MFS Africa 2 things: the fintech will be able to offer its users prepaid cards which they can credit using their mobile money wallets, and the deal will see the fintech expand into the US.

While this will be the fintech’s first off-continent acquisition, it has acquired 3 other African startups in its bid to expand its digital payments network. Previous acquisitions include Sochitel in 2016, Beyonic in 2020, and more recently Baxi in 2021.

All these acquisitions have helped push MFS Africa closer to its vision of having a presence in all 54 African countries, serving 500 million people and millions of MSMEs.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

KENYA WANTS CRYPTO MINERS TO USE CLEAN ENERGY

Remember when Elon Musk approved BTC as a payment option at Tesla and later changed his mind due to environmental concerns? Well, we can’t say if Elon’s concerns were as altruistic as he claims.

Remember when Elon Musk approved BTC as a payment option at Tesla and later changed his mind due to environmental concerns? Well, we can’t say if Elon’s concerns were as altruistic as he claims.

What we can tell you is that there are worldwide concerns about the damaging effect that mining cryptocurrencies have on our climate, and Kenya’s energy production company KenGen is offering cryptocurrency miners a safer means of mining.

What is so concerning about cryptocurrency mining?

Mining bitcoin alone consumes 26.73 terawatt-hours of electricity per year and is estimated to generate between 22 and 22.9 million metric tons of carbon dioxide emissions a year. Carbon emissions are gases that cause global warming, and these numbers are worrisome.

Why does it create so much pollution?

The mining of bitcoin is done solely on computers (so if you thought that coins were literally mined from the ground, perish that thought).

This whole protocol for mining crypto is called “proof of work”, and it is indeed a lot of work, which is why it demands a lot of computing power and, consequently, a large amount of electrical energy, most of which is generated by burning fossil fuels.

Where does the Kenyan government come in?

The cryptocurrency industry is looking to reduce 100% of its carbon emissions by 2030.

One of the ways it is trying to achieve this is by generating energy for its computation using clean energy. Clean energy is energy that is produced without damaging the environment. Examples are hydro-powered energy, and the geothermal energy which the Kenyan government is now offering.

Kenya’s clean energy

Overall, 80% of KenGen’s power generation comes from renewable sources including hydro and wind. The company, however, has not revealed how much energy it generates.

Peketsa Mwangi, KenGen’s geothermal development director, said that they have been receiving requests from miners who want to purchase its energy. Some have requested to start with 20 MW and upscale later. Now, the plan is to have miners set up in an energy park at the company’s main geothermal power station in Olkaria, Naivasha, 123 km from the capital, Nairobi.

While maintaining its stance against crypto trading because of the scams that its citizens have suffered, the Kenyan government is looking to contribute to the reduction of carbon emissions caused by bitcoin mining by offering clean energy.

Europe’s biggest start-up and tech event is back! Viva Technology brings together start-ups, CEOs, investors, global tech actors, and well-pronounced speakers. It will take place on June 15-18, in Paris.

This is partner content.

RENTOZA RAISES $1.3 MILLION

South African on-demand subscription platform Rentoza has raised $1.3 million in funding from Khulisani Ventures. Khulisani Ventures is a $10 million early-stage investment arm of the Mineworkers Investment Company (MIC) that funds black-owned businesses in South Africa.

Of the 722 black-owned startups in South Africa that applied to MIC for funding, only 10 finalists made the cut. Rentoza was one of the first to close and did so with an investment of $1.3 million.

Rentoza’s winning factor

Rentoza is an online electronics and appliances retailer operating on a subscription-based model. The model allows qualified buyers to pay in instalments for goods like laptops and drones over a period of, at most, 24 months.

The South Africa-based startup sees itself as an economic inclusion technology company, and the investors do too. MIC’s Chief Investment Officer, Nchaupe Khaole, said the economic enablement associated with the Rentoza business model made it stand out during the selection process.

What the Rentoza will use the money for

Rentoza plans to use this investment to accelerate its growth, broaden its reach and deliver a new model in the market that it believes will evolve the way everyone relates to and interacts with products.

According to the startup’s Chief Marketing Officer, Mishaan Rata, Rentoza hopes to prove its worth and show its investors that their decision not only grew a successful business but shaped a country.

Payment collection just got easier on Fincra!

Receive payments from your customers via debit/credit cards or bank transfers and settle these payments to your Fincra wallet or your bank account.

Create an account in less than 2 mins and Try the Fincra checkout here.

This is partner content.

OPPORTUNITIES

- The Last Mile Money Startup Accelerator is now open to ventures working at the intersection of last-mile users and financial empowerment. Selected startups will receive design support, access to Last Mile Money’s network, and up to $50,000 in equity-free grants. Apply here.

- The Nigeria Youth Futures Fund (NYFF) Young Leaders Development Fund 2022 is open to applications from young changemakers with experience in media, health, environment, civic participation, education, security, and ICT. Apply for the chance to get up to $40,000 in grants. Check it out.

- The Future Rural Africa’s Female Researchers Grant 2022 is now open to applications to female African researchers who want to gain more visibility and expand their network. Up to €5,000 ($5,300) will be awarded to select participants. Apply here.

What else we’re reading

- Mara hires ex-Apple executive as Chief Marketing Officer.

- Nine African startups selected for Norrsken Impact Accelerator.

- Ex-MTN CEO Paul Edwards has secured pre-Series A funding for his new fintech venture called VantagePay.

- Nigerian fintech startup Klasha raises an additional $2.1 million in seed round.

- Egypt’s insurtech startup Nice Deer raises $1 million.

MOVE TC DAILY TO YOUR PRIMARY FOLDER