Early stage investment in Nigeria is a space that hasn’t been explored as much as it can be. It’s itself an early stage venture. Between skittish angel investors and venture capital funds looking for sky-high traction before jumping in, there just isn’t a lot of money available to startups early on from local investors, leaving them to bootstrap till they get attention from foreign interests.

More than a decade ago, Tomi Davies, ABAN president and leading angel investor in Nigeria, invested in Strika Entertainment, the company that produces SupaStrikas, the serialized football-themed comic that became popular in early 2000s. It was his first tech startup investment, he told me at the post-event mixer at the ABAN angel investors’ summit few days ago. The company has grown in the region of 70x to 100x from the time he invested and of course, Mr. Davies is getting good return on his money. And he’s also passionate about angel investing. You only need to hear him talk about it.

Another investor I spoke with, however, did not have a tale as inspirational as Mr Davies’. After he told me he hasn’t made any early-stage investment into tech startups, he caught himself and took on an expression, like one would after recalling a long-forgotten event; the saddening kind. He went on to tell me about an ERP startup he invested in 10 years earlier. The one that never achieved a positive cash-flow and has since sunk, along with his money. He didn’t strike with that one, and as I looked at him, I got the sense that he won’t be investing in any technology startup anytime soon. But then I also wondered why he was around.

This, I think, is indicative of the general angel investors sentiment in Nigeria. There are different people on different spots in the early stage investment spectrum. Those excited and willing to put money down on the right terms and those just waiting and watching on the side lines. Both groups influenced by previous experiences.

At present, there are not enough startup stories that have ended well for startups and investors. None has ended infact, and the few on the path to that destination, are not being retold well, often and in proper context. Mr. Davies’s bet on Strikas Entertainment that has grown exponentially, for instance. Startups have been known to hold back on the specifics of their investment rounds. Details on valuation, specific amount invested and equity takeout are often kept close to the vest.

Capital without mentorship

At the ABAN angel investors summit, a point that was echoed frequently among the panelists was how angel investors needed to provide, not just money for their portfolios, but also a support framework that allows them mentor these portfolios as well as provide industry connects.

Candace Johnson, president of the European Business Angel Network (EBAN), summarized it when she said “capital without mentorship is lost capital.”

The sense I am getting, however, is that the reality is much different. The number of Nigerian angel investors who are willing to invest in the first place is modest. This, before we speak of those willing to invest and “stay at the table” to nurture.

Where is the nationality?

“Where is the nationality?” Mr. Davies asked as he talked about angel investors who are looking to cut cheques for ROI on the short term. His thinking was that angels should not put money into startups because they are going to get money back – and quickly too – but because it’s a moral and patriotic thing to do. And money can come later, if it comes.

I doubt that’s the kind of pitch that gets investors excited about early stage startups. In the free market set up, investors are looking for returns, not simply looking to show up in solidarity with their smaller brothers in the struggle.

A new wave of angels

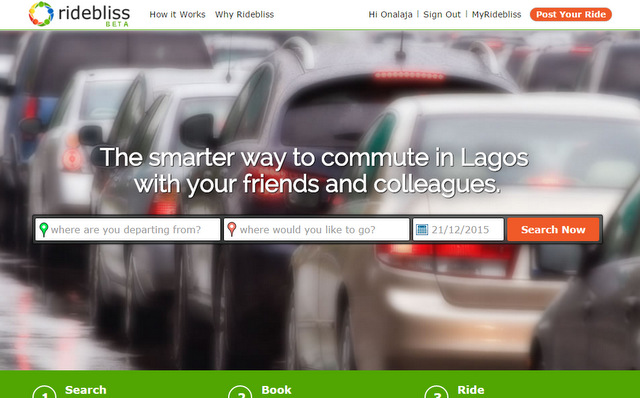

The trend that has been catching on for a while is technology entrepreneurs cutting early stage cheques. Jason Njoku with SPARK has invested in a little over half a dozen early stage companies, Tayo Oviosu invested in a game development studio back in 2014, Marek Zmyslowski of Jovago in SimplePay and more recently, Sim Shagaya invested in GoMyWay, a carpooling startup. More of these are expected to occur in the coming year, and among other influences, the reason this is so is because they have experienced success stories first-hand and also lived it in their own startups.

Mr. Davies is excited about startup investment because he has experienced first-hand how startup investments can balloon to 100 times their value. I also imagine that he has realized that there will be lost investments, but that the few who grow can make the loss on other portfolios worth it.

A few successes from Nigeria are Interswitch, whose initial investors received up to 1,400% return on investment after Helios Investments bought majority stake in the company in 2012; Jobberman which was acqui-hired by One Media Africa back in April and Hotel.ng $1.2 million raise from Omidyar’s and Echo VC that made the value of its first investor’s seed money increase five fold. But it’s obvious, these success stories are few and far between, only it won’t remain so for long. Stories such as these will become popular in the coming years, and the concern is that investors coming on board at that stage will be doing so at a higher valuation. It is presently the buyer’s market, and it will stay so for few years more before that table turns.