A subsidiary of MTN Nigeria, Yello Digital Financial Services (YDFS), has secured a licence from the Central Bank of Nigeria to operate financial services in the country.

Created in June 2018, YDFS is the company’s main pivot into the financial sector of Nigeria. The company was registered as a financial technology company in order to qualify for a CBN license.

MTN Nigeria CEO, Ferdi Moolman said YDFS has been granted a “full super agent” license by the CBN.

“Through the network established by YDFS, MTN is in a position to broaden the availability of financial services for the under-served across the country. This marks a very important first step in leveraging our infrastructure to scale our Fintech initiatives,” said Moolman.

Following the success of mPesa and similar services in Kenya, MTN launched its own mobile money service 10 years ago. Its financial services are operational in Benin Republic, Uganda and Ghana. Last year, when MTN Ghana listed on the Ghana Stock Exchange, it allowed over 100,000 mobile money users to buy its stock, helping the company raise $237 million.

However, in Nigeria, MTN Group’s biggest market, regulatory issues blocked telecom companies from fully operating financial services. With its 65.3 million subscribers, MTN is the biggest telecom company in Nigeria and wants to leverage this to gain a significant footing as a financial provider.

MTN operates mobile money in countries like Ghana, Benin and Uganda. It is counting on its success in these markets in order to offer financial services in Nigeria.

But last year, the CBN started making efforts to open up the market in order to bring financial services to the country’s unbanked population. According to Enhancing Financial Innovation & Access organisation (EFInA), Nigeria’s unbanked population stood at 60.1 million in 2018. In its report, EFInA disclosed that affordability, difficulty with banking procedures and locations of banks were major reasons why people are unable to use financial services.

To address this, the banking regulator announced two proposed licencing arrangements to accommodate new players like fintech startups and telecom companies.

First, in October 2018, the banking regulator issued a draft detailing new license regulatory measures for fintechs or payment system providers (PSPs) to follow. The draft re-categorised existing licences for financial technology providers and set new requirements for obtaining licences. Previous licence categories included Payment Terminal Service Providers (PTSPs), Mobile Money Operators (MMOs), Payment Solutions Service Provider (PSSP), switches, super agents among others.

Each of these categories accommodates specific financial services. For instance, a PSSP licence allows holders operate payment gateways and other payment applications, while an MMO licence supports e-money operations, wallets and financial management. A PTSP licence allows operators deploy point-of-sale (POS) systems. Another licence allows operators deploy agents.

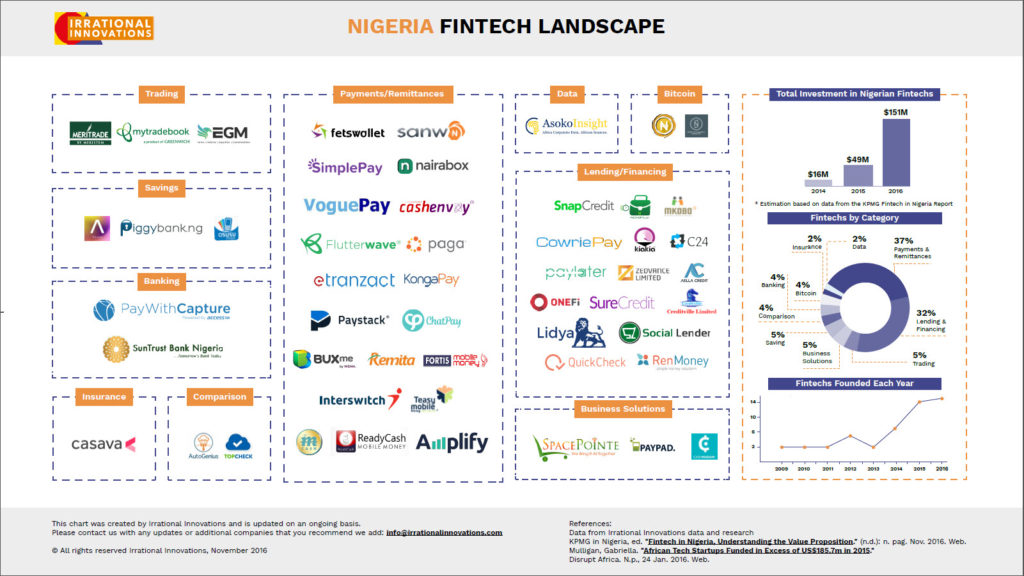

Nigeria has many fintechs, with many planning to launch multiple financial services including deposits, loans, payment processing and funds transfer. To do these, existing CBN regulation requires startups to secure multiple licences. Image source: Irrational Innovation

The new CBN draft regrouped all these into three: PSP Super Licence, PSP Standard Licence and the PSP Basic Licence. This means fintechs will only require one of these licences in order to operate multiple services that required their own individual licences. For example, the basic licence covers POS deployment, payment processing, and agent recruitment. The standard licence supports mobile money operations and agent networks. Meanwhile, the super licence supports all the above.

The second licence proposal drafted by the federal government is the Payment Service Bank (PSB) (PDF). The PSB is a limited banking license that wants to bring basic financial services to the unbanked population of Nigeria. It allows operators to issue bank accounts, debit cards, deploy ATMs, allows people to make payments, among a few other functions. However, operators will not be able to give loans or engage in foreign exchange operations.

Neither of the licenses has been formalised, but the draft is enough for companies to pursue different initiatives. MTN Nigeria says it will also apply for a PSB license. A PSB licence “will enable us in time to offer a broader and deeper range of financial services to those communities and we remain hopeful we will receive approval shortly,” Moolman said.

This is an important feat for a company which has had challenges with the Nigerian government in recent years. In the last four years, MTN has battled fines worth over $10 billion from the Nigerian Communications Commission (NCC), the CBN and the Nigerian Attorney General. It reached an agreement with the NCC in 2016, which resulted in the company’s ₦2 trillion stock market listing in May. MTN also settled its dispute with the CBN through a $52.6 million agreement reached earlier this year. Its dispute with the Nigeria’s Attorney General is still in court.

MTN has shrugged off all these on its course into the financial services sector. But it is not the only telecom company making this push. Airtel disclosed last year that it wants to launch mobile money services in Nigeria. The telco already offers the same service in Ghana, where it competes with MTN for market leadership.