OPay is having a difficult 2020

OPay became a household name in Lagos, Nigeria last year. At the start of 2019, the company was just one of many upstarts trying to disrupt the Nigerian financial system. But six months into the year, the startup gained traction and began to move way up on the fintech food chain. Hinged on the development of new non-finance services, OPay gained massive visibility that attracted people to use its service.

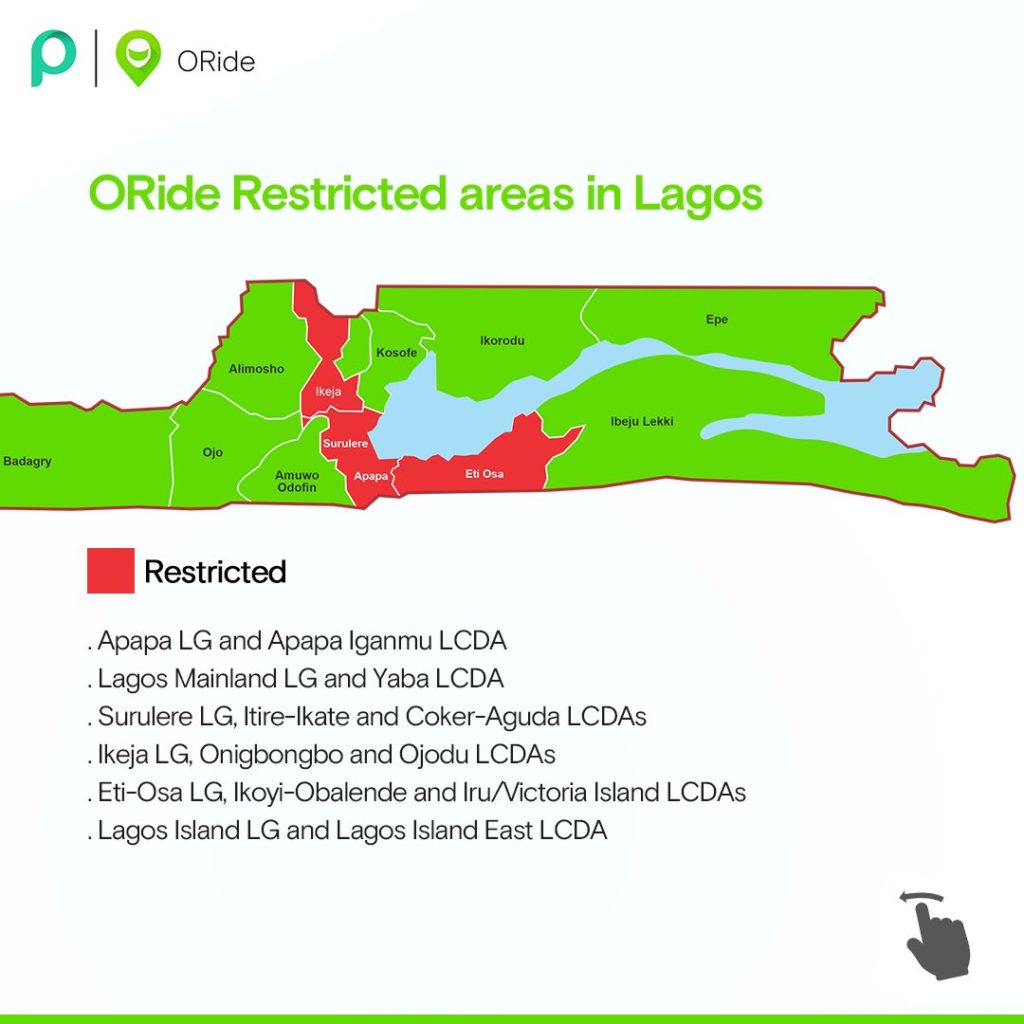

The traction started with the launch of ORide, a bike hailing service that grew quickly thanks to huge discounts. ORide’s growth attracted people to use the app. By offering discounts, people used their OPay wallets to pay for rides and make other payments.

Within a few months after it launched, ORide signed up thousands of bikers in Lagos and expanded to other cities including Ibadan, a city 130km away from Lagos.

OPay’s $50 million round in July 2019 paved the way for the app to roll out more verticals including food deliveries (OFood), wealth management (OWealth), and more ride-hailing services like OTrike and OCar.

It became a superapp, and a massive $120 million funding round signalled the company’s future ambitions. It was going to keep burning cash to keep growing its services and acquiring new customers.

But over the last few months, the buzz around the company has hit a snag. As a consumer-facing company, two issues are reducing its visibility to customers and making it less important in people’s lives.

OPay loses its visibility in Lagos

On February 1, the Lagos state government implemented its threat to ban passenger motorcycles in certain areas of the state. Sources at rival ride-hailing companies blame OPay for the ban. They claim OPay didn’t do enough safety checks on its bikers, nor did it fully comply with the 200cc bike regulation.

Under a sub-service called OStreet, ORide signed up okada riders and allowed them to use their regular bikes. It provided them with a smartphone and ORide branding. OStreet was later discontinued in Lagos, but not before inviting trouble from transport unions like the NURTW and RTEAN.

Both transport unions concluded that bike hailing services were going to “steal” their members. For months, the unions tried to force these companies under their umbrella. The government acted as an intermediary and a deal was struck in November 2019.

Nevertheless, the Lagos government went on to ban passenger motorcycles less than three months later.

With the ban, OPay lost its main growth enabler in Nigeria’s richest state. While its Ibadan operations remain, its once ubiquitous presence in Lagos has disappeared.

ORide has since switched to delivery services. The company said the bike hailing service was planning to fully roll out its delivery arm to more operators.

However, unless the plan is to enable everyday people place delivery orders, ORide would cease to be relevant to many in Lagos. It would become a wholly business-to-business service, a significant deviation from OPay’s desire to become a consumer app.

At its peak, ORide claimed it had over 1,000 bikers using OPay-acquired motorcycles. Operating under a hire purchase model, bikers repaid a certain amount every day for a period of time. Before the ban, one ORide biker told me he paid N3,000 daily and had a 15-month repayment period. He was still in his seventh month when the ban occurred.

Following the ban, OPay suspended the daily payment while the logistics transition is in the works. The push to deliveries may be more about recouping investments on the bikes than it is about keeping the service going. The company did not respond to official requests for comments.

Coronavirus makes a dent

The COVID-19 pandemic is another major issue OPay is contending with. Like businesses globally, the pandemic has affected how a few OPay services and how people use the app.

Company insiders claim the core payment services are still growing.

With banks temporarily shut, people are defaulting to mobile money agents to do cash transactions. By July 2019, OPay said the number of agents on its platform was over 40,000. During the lockdown in Nigeria, they have become important for fund transfers, sources say.

However, OPay’s ultimate goal is to become a lifestyle app. In introduced other verticals like loans and investments services last year to achieve this. Beyond receiving and sending money, these verticals ensured users activity within the OPay ecosystem. By January 2020, the app was the seventh biggest player for interbank transfers, meaning it could possibly have more customers than some banks.

But the pandemic is affecting some of these services.

In November 2019, the company launched OCar, a ride-hailing service. On the surface, OCar will compete with Uber, but within the company, the service was designed to draw more people into the OPay ecosystem and initially used discounts like ORide. However, with the outbreak of the virus and the lockdown in Nigeria, fewer people will be on the roads. It is anticipated that usage of riding hailing services will decline. For example, Bolt was forced to pivot to deliveries.

So once again, OPay is temporarily losing steam from another important growth service.

Before the pandemic, the app had also partnered with sports betting companies to allow users to make payments. But sports activities across the world have been cancelled and gambling interest has disappeared.

In January, OPay launched a smartphone business, Olla. These made-in-Chinese devices hit the market at the worst possible time as smartphone sales in Nigeria declined. The pandemic struck Nigeria at a time when the company was still developing its marketing presence.

New features: OMall, OTrade and FlexiFixed

In the height of these misfortunes, on March 31, the company quietly released two ecommerce features: OMall and OTrade. OMall is a pure ecommerce platform like Jumia. But not much is known about OTrade.

But after three weeks, the service has not generated a buzz online. On the one hand, the fact that OPay users have not noticed the new updates reveal how much the app may have lost their attention. On the other hand, sources within the company say marketing efforts were reduced due to the pandemic. OMall was still onboarding merchants onto the service when the lockdown was announced.

The company also introduced a new savings product called FlexiFixed. OPay will pay users interest up to 18% per annum if they deposit funds for 7 days, 30 days and 90 days.

OPay is losing key staff

While these new services may play a role in the future of the company, some industry insiders doubt if the company has the right individuals to lead them. “There is the idea and there is the execution, most of the people who can execute have left the company,” said an industry source who requested to be anonymity.

At least four senior managers have exited the company in the last four months.

Moses Nmor, who formerly led sales and business development at OPay, was poached in December 2019. He now works at rival fintech company, Fairmoney as Head of Direct Sales. Chukwudi Enyi, OPay’s Senior Marketing Manager since 2018, left the company last month. He has since joined Fairmoney as Head of Marketing. Moriam Durosinmi-Etti joined OPay in June 2019 to lead the company’s Government Relations and Partnerships role. She left the job in January.

Another key executive who has played pivotal roles in the development of the company’s payment and bike hailing services over the last two years is set to resign.

These exits temporarily cast a shadow over the company which raised a record sum in 2019. Coupled with the operational challenges caused by the pandemic, OPay may have to struggle for the short term. But unlike others, it has the capital to make a resurgence.