For good reason, startups are excited when they announce the close of a funding round. While not a guarantee of future success, navigating the process signals some validation for founders.

But because this process can be cumbersome for both founders and investors, one Nairobi-based startup has created a solution to facilitate simplicity.

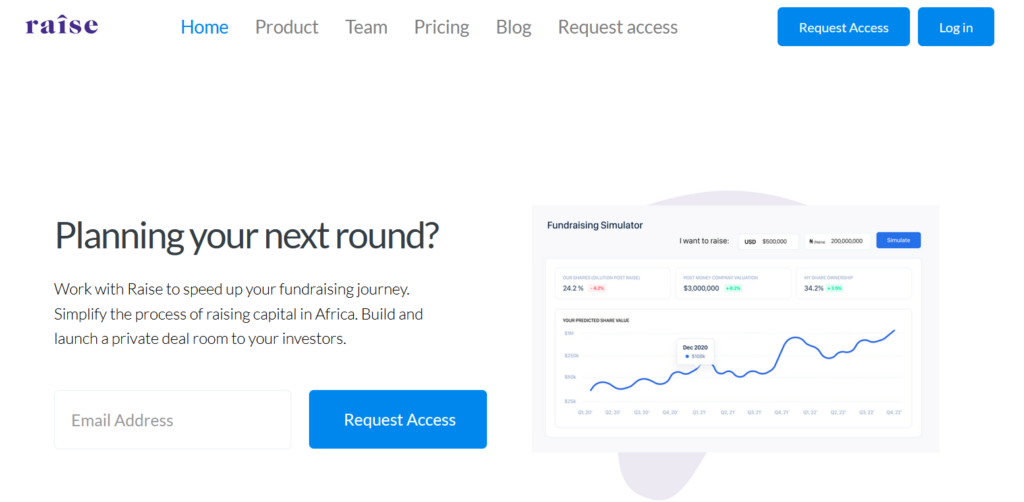

The result is Raise, a digital equity management platform. It is built as a meeting point for founders and investors to activate and finalise fundraising activities.

The company wants to “bring security, transparency and simplicity to the African venture capital space,” according to Marvin Coleby, Raise co-founder and CEO.

Fundraising has always been arduous in Africa, with some deals taking up to a year. Raise sees the mobility restrictions of the present moment as an opportunity to speed up growth in the VC space by simplifying the investment process.

How Raise works

Raise is a web-based equity exchange platform for companies to receive private investment as seamlessly as possible.

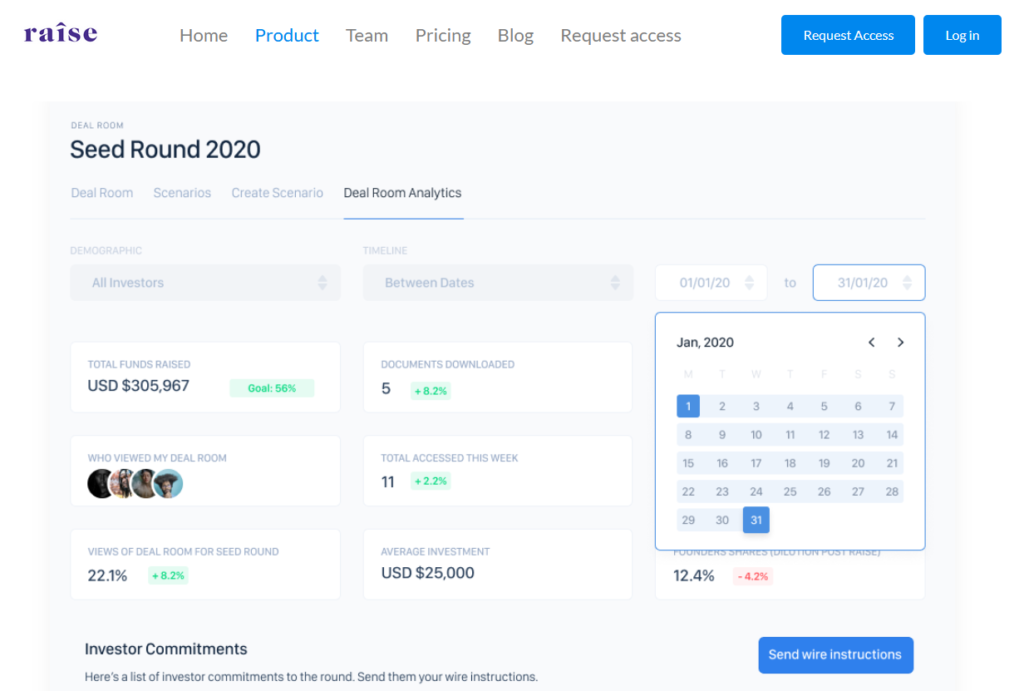

A founder whose company is currently raising funds sets up their company’s profile with all relevant due diligence information. After setting up a private virtual deal room, they send an investment invitation to prospective investors with whom they are already in active talks.

The investor receives an email notification, logs in and is taken to the company’s dashboard. Both parties are able to simulate the fundraising procedure in the deal room with the possibility of issuing electronic share certificates after agreements are reached.

Founders can send such invitations to multiple investors and will see how each investor interacts with the information on their profile. For each potential investment amount in play, the Raise platform generates the equity implications for the parties.

It has been launched this week in public beta. At the moment, investors are not able to make direct payments on the platform. Payment integration will come in the product’s later stages, Coleby says.

For now, focus is on engineering efficient and remote negotiation that eliminates many of the traditional hassles that elongate the fundraising process, from the back-and-forth of email chains to unnecessary hours spent on travel.

Simplifying fundraising for startups

Nichole Yembra, managing partner at Chrysalis Capital, an investment management firm whose portfolio includes Helium Health, says most of their companies and advisory business clients use Raise for different purposes.

She is a pre-seed investor in the platform and has served as an advisor after first meeting Coleby and his co-founder, Eugene Mutai, in December 2018.

“With Raise, companies can proactively load all the data investors usually want to see,” Yembra says to TechCabal.

Such data include capitalisation tables – which shows the equity ownership for a company, formation documents, and performance metrics. These help inspire more confidence in the investor to invest, she says.

That was part of the attraction for Yele Bademosi, the founder of Nigeria-based firm Microtraction and Bundle, a new payments app.

He discovered Raise on social media early 2019 while at Binance, the cryptocurrency exchange. He was familiar with the lack of digital infrastructure for securities in Africa and the inefficiencies of preparing cap tables on paper.

“What I loved about Raise was that they were not just trying to solve the problem but also wanted to do it with elements of the blockchain as well,” Bademosi says to TechCabal.

Captable.io and Carta are two of the more popular tools in use for managing cap tables. But Bademosi thinks the former has a lot of room for improvement and the latter very expensive for Africa.

As with Chrysalis, Microtraction now recommends Raise to its founders for equity management, Bademosi says. The VC firm itself uses elements of the platform to calculate dilution – how future rounds affect their ownership in businesses.

Raising more Series A companies

Raise is not a matchmaking platform. It’s not a place for making first contact with investors or for crowdfunding investment.

The objective is to help founders formalize the fundraising process, especially startups transitioning from offering convertible notes at seed stage to offering preferred shares (which give investors more privileges) as Series A companies.

“Our job is to create more Series A African companies. There’s a lot of convertible instruments floating around but many aren’t converting,” Coleby says to TechCabal.

This is where Raise plans to add the most value “because that’s where diligence is most painful on both sides,” he says.

Lots of documentation and emailing goes into that process. Investors place a higher premium on clearly understanding what they are going to get for their financial outlay. For founders, going from seed to Series A is a graduation process that opens them up to heightened scrutiny.

Raise curates a checklist of necessary data points for the due diligence process which each founder is required to add to their profile.

It’s a system of fundraising that will present African companies as trustworthy and ready for transparent interaction with global players in the tech ecosystem, Yembra says.

Raise received funding from Binance as one of 13 startups to join Binance Labs (the crypto platform’s venture arm) in 2019. Afterwards, they launched in private beta in January 2020 and claim to have enabled transactions worth over $20 million.

Coleby hopes to launch a fully public version around September. Besides Chrysalis Capital and Microtraction, Raise counts Nigerian fintech Wallets.africa and Kenyan law firm Anjarwhalla and Khanna among its partners and clients.

It’s still very early days and the main users at the moment are investors with an advisory or financial interest in it. But Coleby, who is from the Bahamas, describes his company’s ambitions as a “300 to 400 year vision” for Africans.

“We are definitely looking to help the company scale across Africa and we are excited to continue working with the team,” Bademosi says.