OPay says it is having its best yet ever. It claims it now has 5 million users and processes over 60% of mobile money transactions in Nigeria

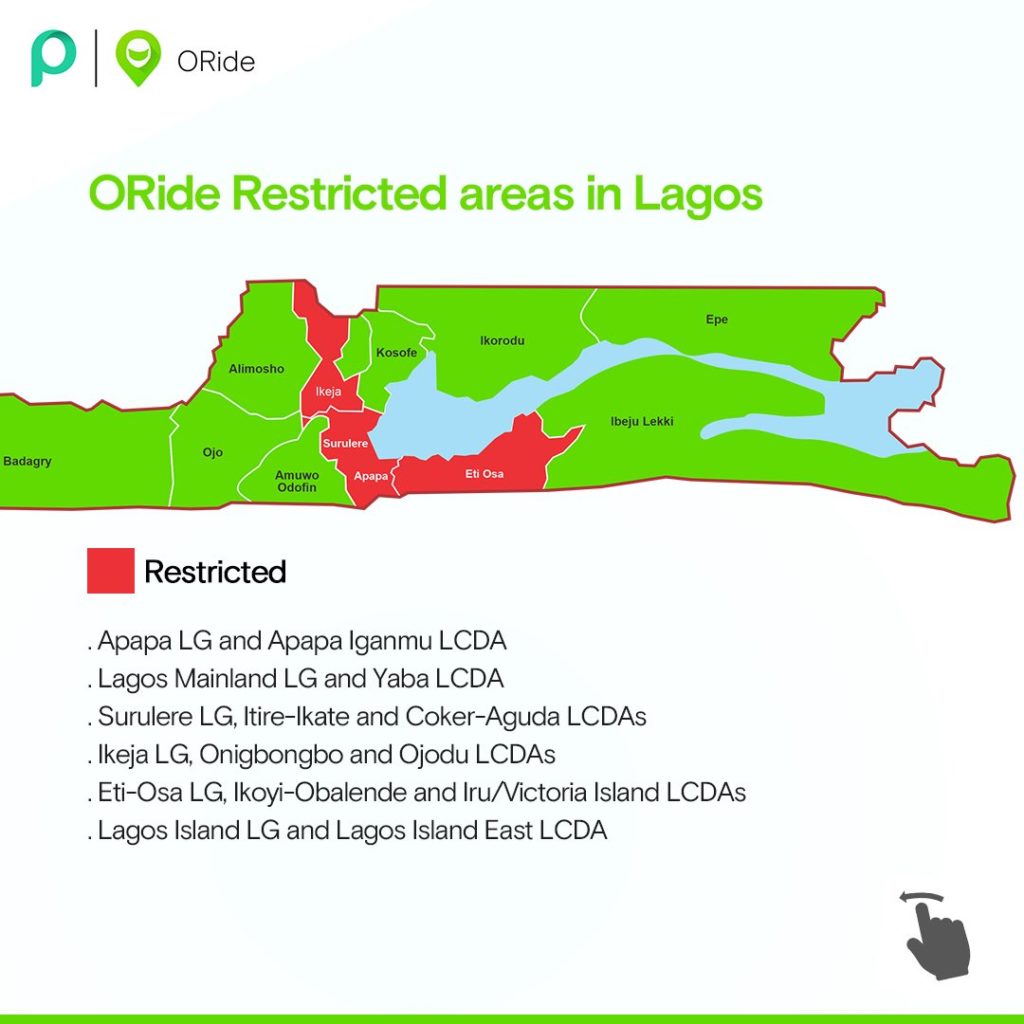

Outside its core payment business, OPay’s 2020 had been rough. The Lagos ban on motorcycles for passenger transport threatened the future of its bike hailing service. The ban affected OPay’s visibility in the mass market. The pandemic also disrupted the marketing of new products while affecting existing offerings like OCar and gambling payments.

In May, TechCabal reported that “[a]s a consumer-facing company, [these] issues are reducing [OPay’s] visibility to customers.”

However, despite these challenges, OPay says it is having its best year ever. In an exclusive interview with TechCabal, OPay’s Nigeria Country Manager, Iniabasi Akpan, explained that while the different verticals attracted users to the app, more customers now use the app for other things especially payments.

OPay’s core payment business has continued to grow despite the steep decline of ORide. Payments grew over 400% in April 2020 compared to a year ago, according to Akpan.

“I understand from an outside point of view that people believe things are bad,” he told TechCabal, “but what people believe is not actually the fact.”

“Our business has been growing from that point [January]. Transaction volume has grown over 40% from January to May, both offline and online.”

For the rest of 2020, the company has its sights on more growth in different services, Akpan told TechCabal. The mobile money company is banking on the aggressive growth and visibility it has built over the last one year.

How OPay blitzscaled into 5 million users

“How would I describe the growth of OPay?” Akpan pondered during the interview. “I would say the growth has been phenomenal. Our growth has been unprecedented,” he said

Indeed, the company has grown at an impressive pace over the last two years.

In 2018, after it was incubated by Chinese-owned Opera, OPay focused on building its agent banking business; developing its network of mobile money agents across the country. Its number of agents reportedly grew from less than 5,000 in December 2018 to 40,000 in July 2019. This growth paralleled growth in transaction value.

“When we started in August 2018, we were doing maybe ₦20 million ($51,544) a month,” Akpan told TechCabal. “But by the end of December 2018, we had done ₦11 billion ($28.4 million), which was quite significant.”

The company set ambitious growth plans for the next year.

Very few in the financial sector believed in the viability of agency banking, Akpan explained. Data gathered by TechCabal showed that a number of Nigerian banks have mobile money agents. They include Access Bank, Union Bank, FCMB, Zenith Bank, Ecobank and GT Bank.

But collectively, these five banks have 14,600 agents, far lower than OPay’s reach. Only a few companies like FirstBank (45,000 agents), Paga (24,143 agents) and, possibly, MTN have deep agent banking reach, according to publicly available information.

OPay aimed to process around $50 million worth of payments monthly by April 2019. It was a significant objective, Akpan explained. “[But] we achieved and surpassed that target,” he shared.

This kicked off a new growth frenzy. After growing its agent business across the country, Akpan said OPay’s focus switched to the consumer side of the business.

Since mid-2019, the Chinese-backed company has transformed from an unknown brand to becoming one of the most talked about companies in mobile payments. This transformation is thanks to an innovative distribution model: the superapp model.

“In June 2019 we decided to launch the superapp. It was unique to itself. Nobody had ever offered a unique value proposition like that.

The superapp plan was glaring with the launch of each new service. But for months, OPay declined TechCabal’s request for comments on its superapp plans.

The company went on to raise $50 million in July 2019, its first publicly announced round of funding. The goal was to raise capital to scale at a very aggressive level, Akpan shared.

“In offering financial services, you need enablers to bring in the type of customers that you need and you need to have the capacity to do that,” Akpan told TechCabal.

“There’s no way around it, you need to find a path to engage the market,” he added.

OPay developed new business verticals focused on services that people needed. With huge discounts, these services became popular in the mass market which in turn increased transaction volume for its core payment business.

“That was when we launched the consumer side of the business and began to scale things,”

The first vertical was ORide, followed by OFood, OCar, OBus, and a number of other ventures including investment product, OWealth.

Launching new products was probably faster as OPay gradually reduced its technology dependence on parent company, Opera. Between April 2019 and March 2020, Opera reported declining technology licencing revenue of $20.7 million. “[This was] largely driven by temporary support to our investee, OPay,” Opera told investors each quarter for the last four. Licencing revenue was expected to end by Q1 2020.

By November 2019, OPay raised $120 million from a group of Chinese investors. That round was significant and is the single largest fundraise by a Nigerian startup. OPay success with raising money is thanks to Chinese billionaire and Opera CEO, Yahui Zhou.

“Only a darling of the Chinese tech world like Zhou Yahui could bring in heavyweights like Meituan Dianping, IDG Capital and Sequoia China,” wrote the South China Morning Post (SCMP) in December 2019. His interest in OPay is significant, and he reportedly has key expansion plans across the African continent.

But with each fundraise and as OPay’s verticals grew, more people mistook its identity, thinking it was simply a transportation company.

“There was so much noise and hype around ORide that it was difficult for people to comprehend,” Akpan shared, “they actually thought that we were just okada riders in the market.”

“ORide was just one of the enablers,” he emphasized a few times during the interview. “[The enablers] onboarded users who were typically informal and excluded,” he said.

“There are quite a lot of products and services that are enablers, and they helped us to scale in certain areas,” Akpan told TechCabal. “But the core foundation and the key business of OPay is payments.”

Growth challenges in 2020

2020 has been a challenging year for some of OPay’s verticals, especially ORide which gave the company high visibility in the mass market. Akpan admitted that the dual challenges caused by the okada ban and the pandemic did have some effects on OPay’s consumer business over the last six months.

“There are risks and there are certain things people are careful about especially in a pandemic situation,” Akpan explained. “So we may not be doing as much in terms of ridesharing business [ORide and OCar].”

Despite these challenges, OPay says growth hasn’t stalled. These challenges were not “significant because many of our users were converted users who found other things to use the platform for,” Akpan explained.

In May, sources at the company shared that its agent business was still growing. Now, the company says it has over 300,000 agents and 5 million users. “In about a year, we went from around 100,000 users to over 5 million. That’s significant,” said Akpan.

OPay’s transaction volume has surged by 40% since January, he told TechCabal and some of this recent growth has been fuelled by the pandemic.

The lockdown in Nigeria between late March and May restricted banks and forced many customers to use mobile money agents for bank transfers and cash withdrawal.

With its latest growth, OPay claims it now accounts for over 60% of mobile money transaction value and volume in Nigeria. The company declined to give actual figures on these. Since much of Nigeria’s mobile money industry data is not publicly available, TechCabal could not independently verify OPay’s claims.

However, industry insiders say it may not be impossible that OPay is leading the mobile money market. A partner at a Big Four consultancy firm explained to TechCabal that OPay has successfully penetrated the market with serious visibility offline.

Without disclosing figures, another source at the Central Bank of Nigeria (CBN) said it is possible OPay is doing this volume of transactions. “[I] will not be too surprised because of their approach,” the source told TechCabal.

“OPay bought a licence holder (Paycom) and sort of revolutionized how people used the payment service by going after a popular niche (motorcycle transport) in Lagos,” the source explained.

Despite the ban, the source shared, “if you have achieved some level of stickiness with the people using motorcycles in Lagos, that is a huge number of people. All you need to do is convince those people that they can do much with it [the app]. If those people are already used to using the app to pay for rides, they will use the app for other services you offer.”

Based on the interview with Iniabasi Akpan, OPay’s Country Manager, the mobile money company shares the same thought.

“We are actively exploring other things that we feel may be relevant to people every day; because we want it to be a lifestyle app,” he told TechCabal.

Over the next few, the company is looking for more growth. Its new obsession is Nigeria’s eCommerce market.

OPay’s new ecommerce ambitions

On March 31, OPay quietly released two ecommerce services, OMall and OTrade, on its app. OMall is a pure ecommerce marketplace, like Jumia. Meanwhile, OTrade is a business-to-business trading platform, allowing merchants to buy directly from wholesalers.

“We have a plan to transform the B2B and B2C market space in Nigeria,” Akpan told TechCabal, “[and] we have very serious interest in that space because it is underdeveloped.”

One notable feat about OPay is its willingness to enter other businesses that already have significant players. This time around, it is entering Jumia’s turf.

“Ecommerce is going to happen,” Akpan said. “And we want to be a big player if not the biggest player for both businesses and consumers.”

This is a blitzscaling attempt, and it could be a significant one. In the last two years, Jumia has understood the interchange between ecommerce and payments. Following the playbook of companies like eBay and Alibaba, Jumia has integrated JumiaPay into its marketplace.

“Our job is to make sure that because we have this huge marketplace ecosystem a great product; a base of consumers, we want to make sure JumiaPay is in a position to become the next Alipay, the next PayPal,” Jumia’s Co-CEO, Jeremy Hodara said in January.

OPay has latched on this understanding too and is looking to run with it to market, leveraging on its 5 million customers. In comparison, Jumia operates in 11 countries but has 6.4 million customers.

Order fulfilment could also be cheaper since it already operates a delivery service, OExpress. This new ecommerce competition could further open up the market to new growth and opportunities.