BBNaija Lockdown edition was a big success. It reminds us how valuable Nigerian content is for the future of SVOD platforms like Netflix and Showmax.

I was scrolling through my WhatsApp Status in early September when I saw an interesting post about the Big Brother Naija (BBNaija) show from an unlikely contact, Grace. “Our votes didn’t go to waste, #Lay-Lay of Lagos,” the post read, with a star face emoji. She had been rooting for Laycon, one of the housemates who would eventually become the winner.

But Grace is not a Nigerian. She is originally Congolese but now lives in South Africa. However, like many people, the appeal of MultiChoice’s BBNaija show was strong. “So you’ve been watching the show too,” I asked her. “All day every day,” she responded with a laughing emoji.

When the show’s 2020 edition was first announced, many anticipated its success like similar editions. But as millions of people across Africa retreated to their homes to avoid the spread of COVID-19, the show received excellent reception and the already content-hungry audience on social media found a new thing to consume.

Themed “The Lockdown House”, the show’s organisers would not disclose actual viewing numbers. But they did share that the show recorded around 900 million votes from viewers. That’s roughly four times the population of Nigeria. Voting isn’t always free, it costs ₦30 naira to vote via SMS. (Note that DStv subscribers also did receive free votes depending on their subscription plan.)

While the show only had one winner, there were other types of winners. Advertisers possibly saw great value for their money as the show became a critical success. Tech companies including Flutterwave, Kuda Bank and Patricia were all advertisers on the show.

Overnight these tech companies became popular and would trend on social media every night they sponsored a task on the show.

But the biggest winner is Multichoice.

BBNaija Lockdown, a gift to Showmax and Multichoice‘s SVOD ambitions

The company’s pay-TV business product holds exclusive viewing rights to the show. But this year, viewing went beyond decoders as online streaming became popular. Multichoice was well prepared.

Just weeks before BBNaija started airing, Multichoice announced a major upgrade to Showmax, its on-demand video streaming platform. A member of the Multichoice team hinted to TechCabal that this was the single most important upgrade on the service.

Showmax has previously broadcast the 2019 edition of the BBNaija show. But it never live-streamed the entire show. In 2019, users could only live stream the eviction shows and watch two spin-off BBNaija shows.

For the 2020 edition, Showmax was revamped and was technologically developed to handle the streaming demands from millions of users. In early July, Showmax announced Showmax Pro and Showmax Mobile Pro, two new bundles that offered live TV in addition to video-on-demand.

BBNaija started a few weeks after. Thanks to serious advertising, Showmax became the go-to service for live streaming, alongside DStv Now.

This visibility and success are important as competition with Netflix enters a higher gear. The California-based Netflix has continued to ramp up focus on Africa despite intense competition in its home market. In the US, the service faces new threats from Disney+, Amazon Prime, Apple TV, WarnerMedia’s HBO, Hulu and NBC Universal.

With heightened competition in Africa and beyond, access and ownership of popular content are crucial. Disney has stopped renewing a licence to many of its popular movies and series, meaning they’re now only available on Disney+.

In 2019, Showmax told TechCabal it had deepened its local content library. In July 2019, the streaming platform claimed it had 35,000 movies and series in its library including famous series like Game of Thrones. Now a hugely successful BBNaija season has gifted Showmax a chance to attract and keep users on its streaming platform.

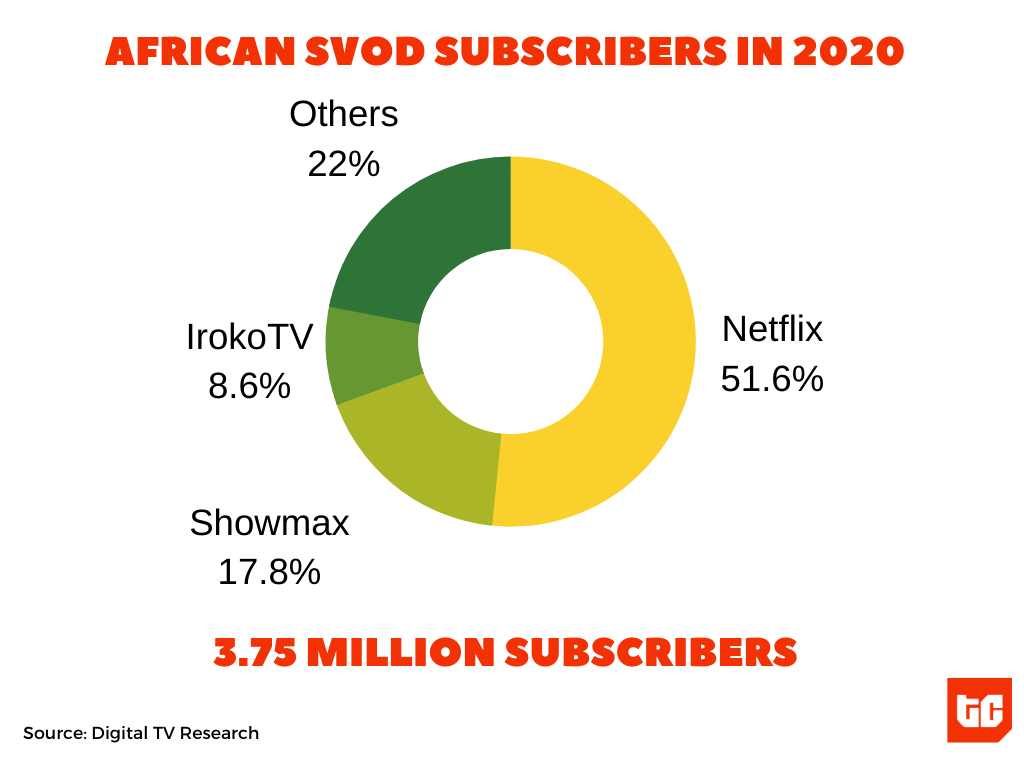

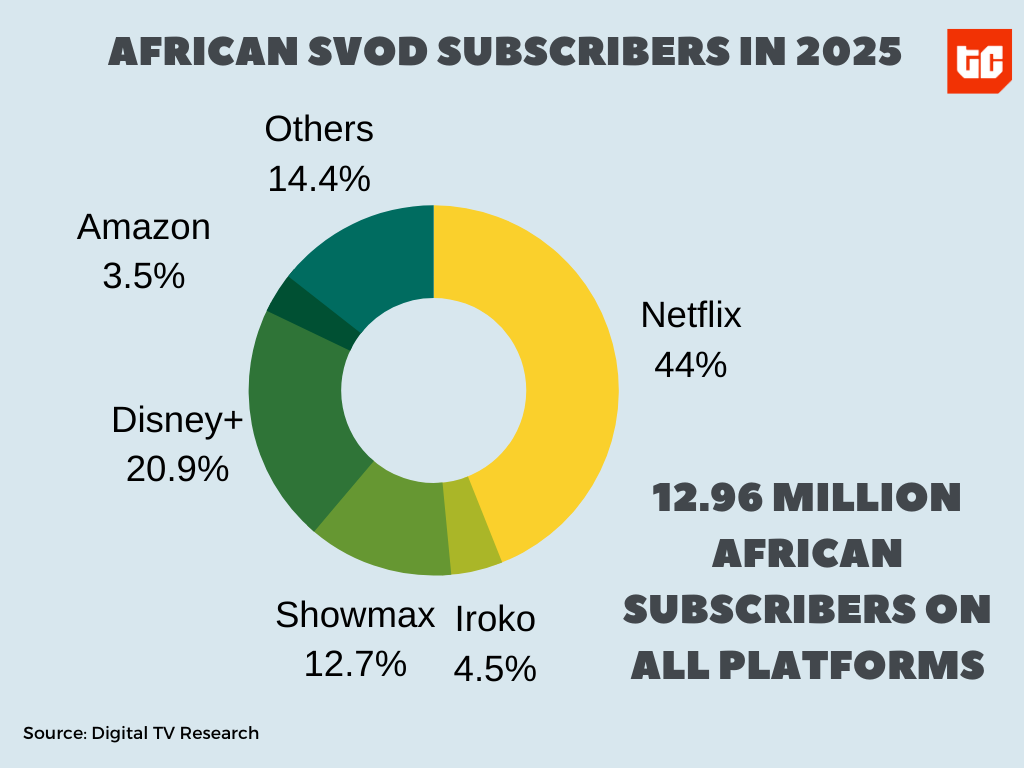

According to Digital TV Research, Africa’s streaming market will to 12.96 million subscriptions by 2025. In 2020, the research puts Showmax’s total subscribers at 688,000; but predicts that it will increase to 1.65 million by 2025.

But this only intensifies competition with Netflix and other streaming companies locally.

Netflix’s rising Africa ambitions and the focus on content

Netflix has increased focus on international markets. In February, the company created the Netflix Naija account on Twitter, to signal its focus on Nollywood, Nigeria movie industry.

Since 2018, it has snagged the rights to some important content from the continent. With its $8 billion annual budget for original content, Netflix has secured rights to Nollywood box office hits including October 1, The Wedding Party, Lion Heart, Up North, among many others.

The company’s Africa ambitions are huge. It currently has around 1.9 million subscribers on the continent just four years after first expanding to South Africa. Digital TV Research expects this to rise to 5.7 million by 2025. And Netflix appears to be working towards this.

In early 2020, Variety reported that a team of high-level Netflix executives, led by Ted Serandos, the company’s Chief Content Officer, spent a week “crisscrossing the African continent wooing local creators.”

In September, it announced four new original content (one series and three movies) from Nigeria. The three movies will debut on Netflix in October and November and they were each produced by three of Nigeria’s best-known directors: Mo Abudu, Kunle Afolayan and Kemi Adetiba.

Showmax has also been on the block shopping for original content and producing its own. In September, its parent company, Multichoice announced two new original movies: Rogue, an action drama starring Hollywood actress Megan Fox, which premiered on Showmax on September 11. The second is Blood Psalms which was co-produced with the French company, Canal+.

But unlike Netflix, Showmax’s content budget seems tilted away from Nollywood, the world’s second-biggest movie industry. It has focused more on South African series and international content. Research estimates that South Africa will continue to lead the continent by subscriber count with 4.3 million subscribers by 2025.

In July, it announced four originals: Life With Kelly Khumalo; Tali’s Wedding Diary Season 2; Skemerdans; and Dam. They are all set for release in 2021. Previous Showmax originals including Tali’s Wedding Diary Season 1, The Girl From St. Agnes, and Somizi & Mohale: The Union, each set first-day viewing records on the platform.

However, the focus on Nigeria might play a huge role in the success of Showmax and Netflix not just in Africa but internationally.

The big focus: Nigeria and Nollywood

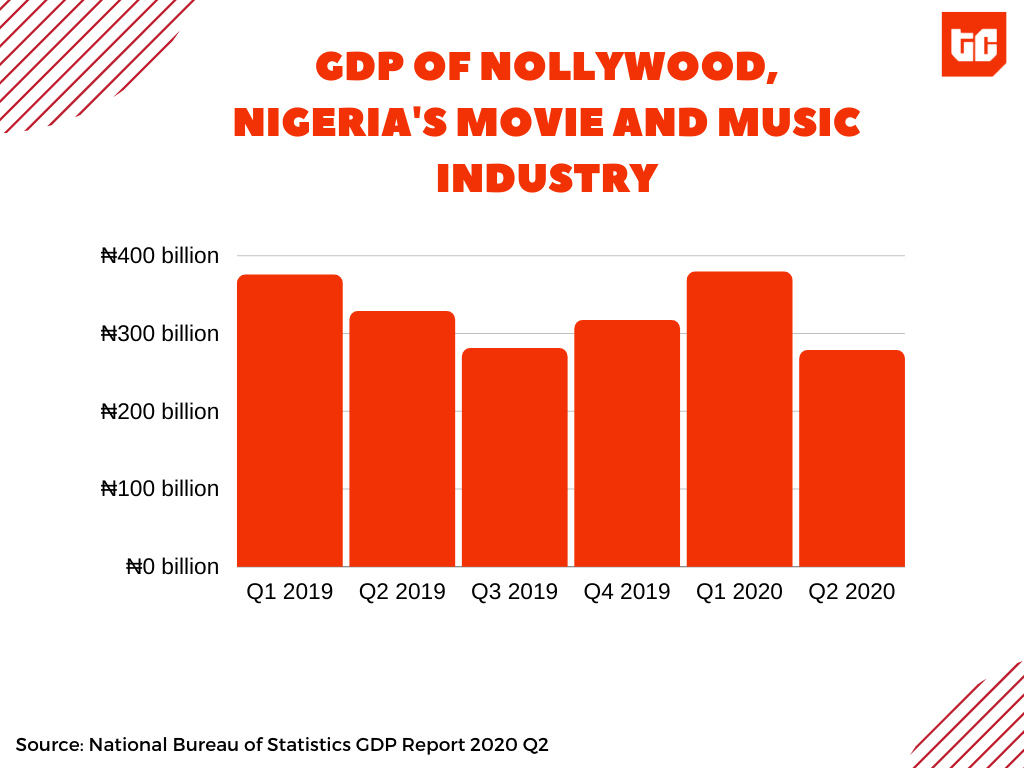

Nollywood is a $3.3 billion industry, according to 2014 Nigerian government data. In Q1 2019, Nollywood recorded revenue [PDF] of ₦375.3 billion ($984.3 million) according to the National Bureau of Statistics (NBS). Yet, research estimates that there will only be 2.73 million video-streaming subscribers in the country by 2025; albeit a 333.3% growth from 2020.

But the greater focus is on the Nigerian diaspora. According to The Economist, 375,000 Nigerian immigrants in the US represent the single largest group of immigrants from Sub-Saharan Africa which stood at 2 million in 2018. And the Nigerian-born population in the UK make up an important percentile of the 1.3 million African migrants.

This international demography has had a huge impact on transporting Nigerian and African culture abroad. In turn, this has had boosted the country’s entertainment industry with Nigerian artists becoming global sensations.

This is important because while macroeconomic realities continue to reduce consumer spending power in Nigeria, the spending by Nigerian migrants remain strong.

Recently, IrokoTV, the Nigerian streaming platform which has 331,000 subscribers in 2020, cut back its growth ambitions in the country. Its Nigeria-based subscribers represent a small of its customers, the rest are Africans based abroad.

But whether the focus is on in-country Nigerians or foreign-based Africans, local content is important.

Netflix’s corporate culture gives it an edge here. Under CEO Reed Hastings and an $8 billion original content budget, company executives are free to seal multimillion-dollar without much over from the higher-ups, The Economist wrote in a recent article.

In Africa, Netflix is more focused on high-value content, a significant departure from the low production value that’s typically found in Nollywood. The country’s movie industry is the world’s second-largest, not by box office revenue but by movie volume. Nollywood’s typical movie budgets range from $15,000 to $40,000.

In comparison, Netflix acquired the distribution rights to Beasts of No Nation starring Idris Elba, for $12 million in 2015. In 2020, it has also signed production deals with important local production companies like Mo Abudu’s EbonyLife.

While having this strong focus on quality content, Netflix is experimenting with a cheaper mobile-only subscription plan for the African market. Unsurprisingly, Nigeria is the test bed.

The service will cost ₦1,200 ($2.65) in Nigeria, more than half of the ₦2,900 standard price. It is also cheaper than Showmax Pro’s most affordable plan which retails for ₦3,200. This pricing strategy could help Netflix leapfrog the low spending power Nigerians struggle with.

Multichoice and Showmax will have to pay attention to these trends. Nigeria is the battleground and they may have to re-strategize.