Good morning☀️

It’s another Friday where we break away from our traditional format to let a guest writer take over TC Daily. In today’s edition we have two guest writers: Derin Adebayo and Osarumen Osamuyi.

Derin Adebayo is an Associate at Endeavor. Through his newsletter, Unevenly Distributed, he explores the diffusion of technology, entrepreneurship, and venture capital in emerging markets.

Osarumen Osamuyi thinks in public about technology in frontier markets. He writes business/strategy publication, The Subtext, and works as Head of Venture Growth at early stage VC firm, DFS Lab.

The African Obsession with Exits

Emerging technology ecosystems face a chicken and egg problem. In order to attract investments, an ecosystem needs to have exits (the profitable sale of investments) but in order to have exits, an ecosystem needs to attract investments.

Over the past few years, there has been a lot of hand wringing in the African tech ecosystem over a a perceived lack of exits, and what it means for the viability of the ecosystem. We think this concern is premature.

View Tweet here

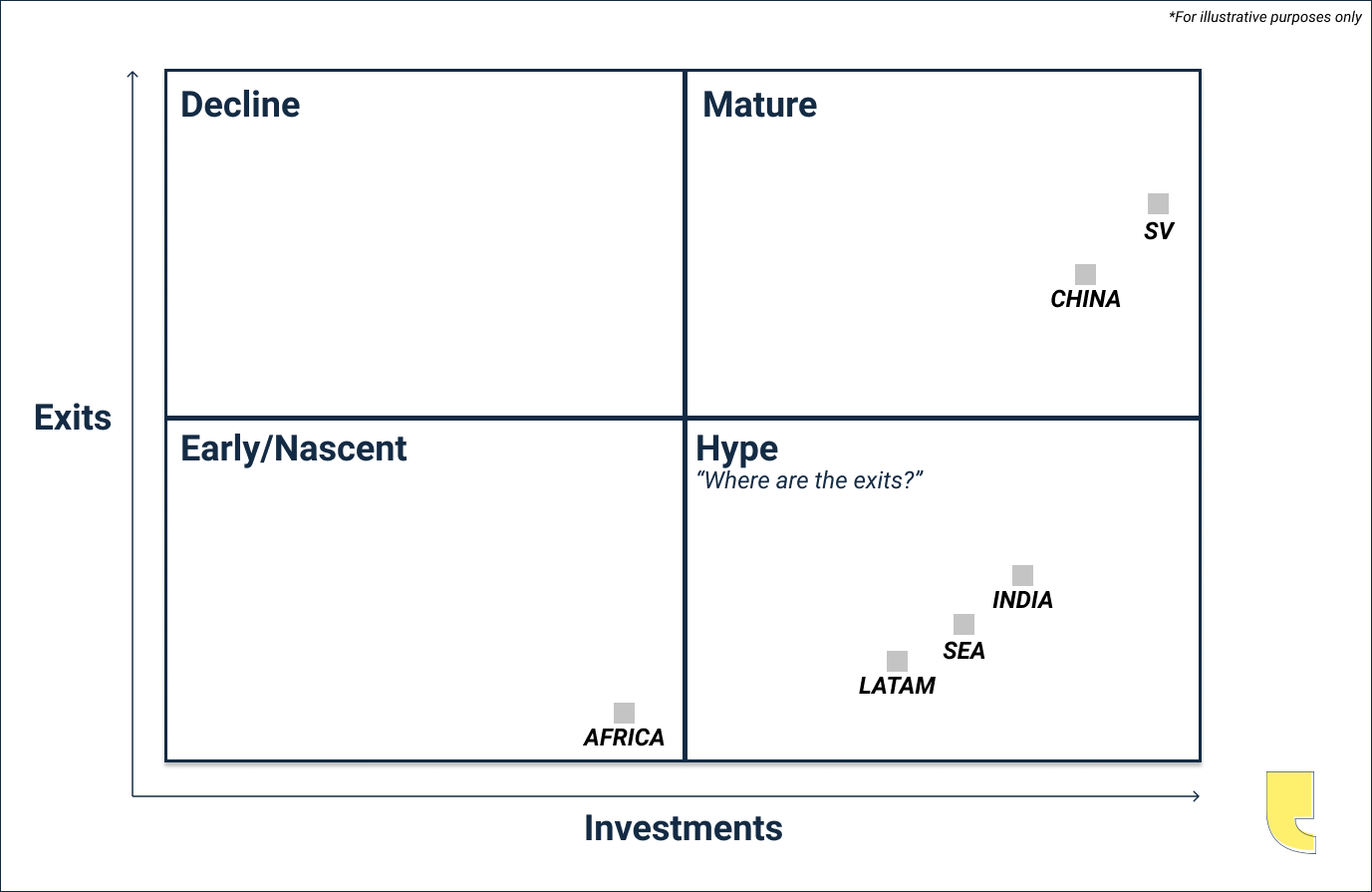

The venture capital driven tech ecosystem in Africa is barely a decade old. Given that the median time it takes a company to go from seed stage to exit is about 8 years, we shouldn’t expect to see many exits just yet. Besides, every emerging ecosystem goes through this phase. Entrepreneurs and investors in India, Latin America, and South-East Asia, ecosystems with significantly more investment than ours, are only just starting to see regular exits. Thankfully, the African technology sector has started seeing the early signs of increasing exit activity.

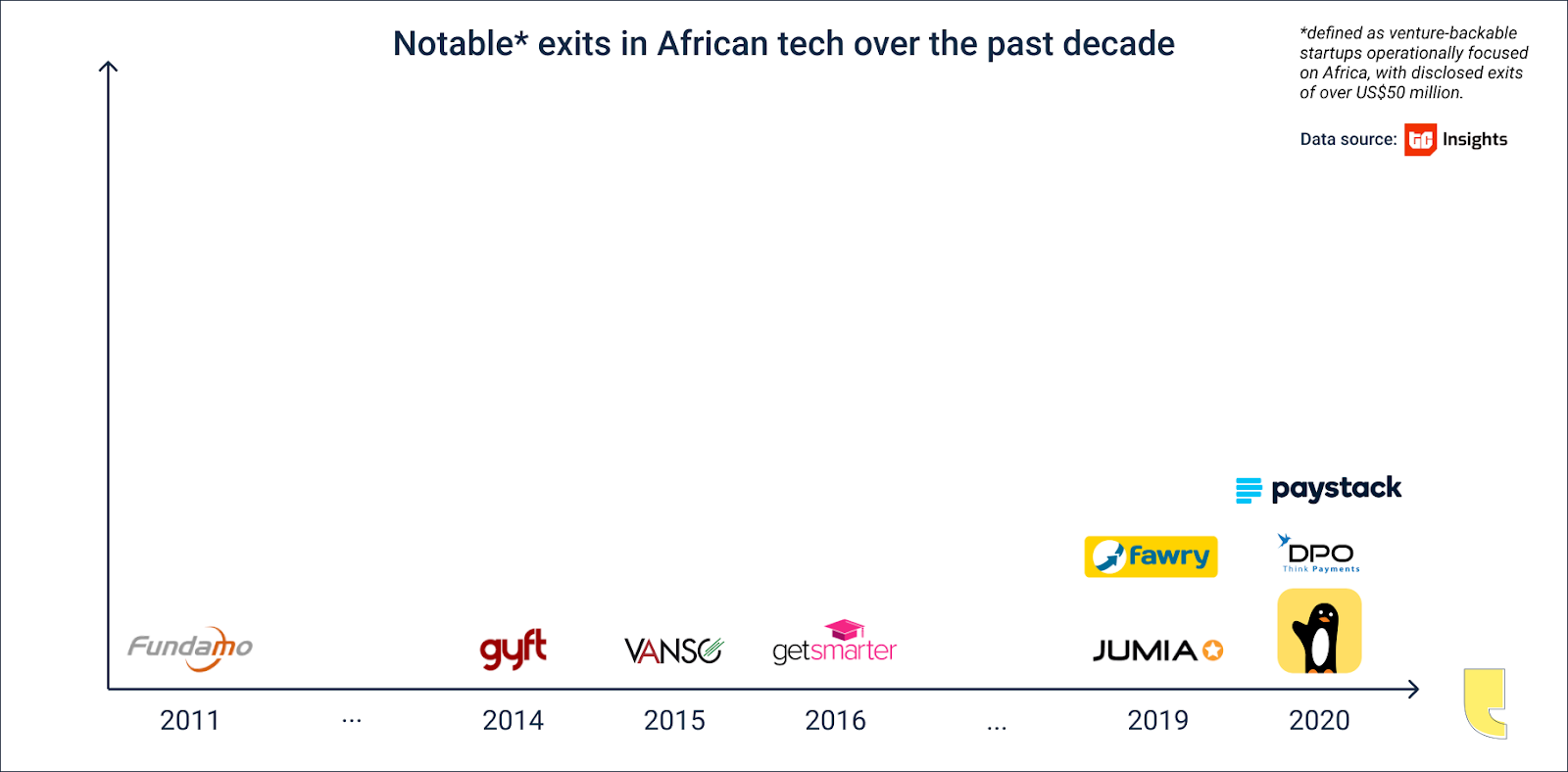

Notable exits in the African technology ecosystem over the past decade

In 2020, Paystack, DPO, and Sendwave were all acquired by larger fintech companies. Asides from Apis Partners’ investment into DPO and the angel investors that backed Paystack, the capital into all three companies came from funds not primarily focused on the continent. Over the next few years, as our ecosystem matures, we expect the pace of exit activity to increase. It is important that funds focused on the continent play an important role in backing the companies that will eventually generate these returns.

In a new essay titled The Chicken or The Exit?, we attempt to place the African technology ecosystem in the right context given its maturity, and predict what happens next.

Ecosystem maturity framework

We draw from the history of venture capital, covering its progenitor – the whaling industry, its origins in Silicon Valley, and its spread into emerging markets.

By placing the African ecosystem in it’s appropriate context, we aim to provide clarity on how to think about the question. Once we accept the premise that exits will follow large, successful companies, then a more interesting conversation emerges around what Africa focused funds must do to ensure that they profit when the exits eventually arrive.

Read more: The Chicken or The Exit?