For investors, Opera’s Q4 results are a step in the right direction as the company continues with expansion plans

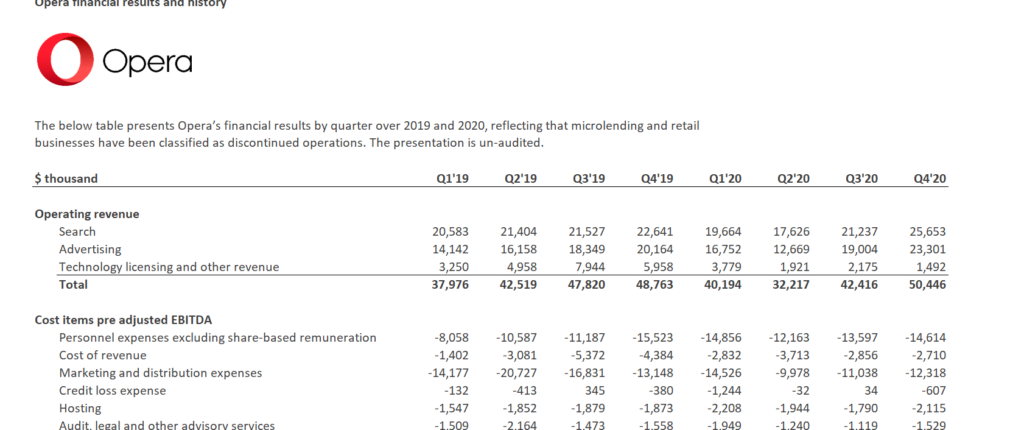

Opera, the software company that owns the widely-used Opera browser and content platform, Opera News, has released its results for the fourth quarter of 2020. The company posted strong results for the quarter with $50.4 million in revenue.

That’s an increase of 19% from Q3 when its revenue was $42.4 million. Most of this growth was driven by its search and advertising business which brought in a revenue of $48.9m.

It has been able to monetize its platform even more because it is growing its users at a breakneck pace – Opera says it added 29 million users in 2020.

It launched Opera GX, a browser which it says it built specifically with gaming in mind. It has proved popular with gamers with over 7 million users. This sort of reach means it can charge advertisers more, as that revenue stream is up from $19m in Q3 to $23m in Q4.

While its existing income streams are impressive, the company will be adding new revenue streams with interesting new products and features. One of those is a digital wallet called Dify.

Opera’s Dify is an integrated digital wallet

According to Ling Son, Opera’s Co-CEO, “We’ve just announced the launch of Dify. It’s a new digital wallet that will fully integrate into our browser.” “What this means is that online shopping is about to become a lot more convenient for Opera browser users”

Opera will push adoption for this product by providing cash back incentives to users who shop from the 300 merchants that are already part of the program. Online payments can sometimes have a layer of complexity due to required security measures, but an integrated wallet could, in theory, be easier to use.

Opera believes Dify is a “significant” product; and according to the numbers it reports for Opera news, Dify already has a large pool of users.

Opera News expansion plans

Opera News is huge in Africa and the company says that the continent contributes a huge chunk to its estimated 200 million users in emerging markets. At the end of 2020, Opera news expanded to more “developed” markets.

While the company has not shared the numbers, it says that “the early results have been promising.” According to Lin Song, “we’re getting right now well-positioned to scale. While there will be meaningful upfront and marketing costs and in our user acquisition, we will broaden our ecosystem in developed markets with a larger and profitable content business and with a major potential impact on our revenue growth this year.”

While we can only speculate on how many users Opera can get with this expansion, one thing we know for sure is that its investment in the fintech startup, OPay, is looking promising. The company’s Chief Financial Officer, Frode Jacobsen, said in the earnings call: “OPay’s revenue is increasing quite rapidly while the company is able to achieve profits right around breakeven despite the growth. We expect this growth to continue as OPay continues to scale in Nigeria and expands to an additional country in Africa.”

Opera’s Q4 results and OPay’s transaction volume

Opera owns 13.1% of the fintech startup, OPay and as such, it reports on that investment in its earnings report. According to that report, “Other items of note include…$8 million increase in the book value of our preference shares in Starmaker and OPay.”

It also says that OPay continues to grow at a massive scale. In Q3 2020, we reported Opera’s claim that OPay processed a gross transaction value of $1.4 billion in the month of October. As we stated in that report, there is no independent way to verify those numbers.

However, according to market share reports TechCabal saw from NIBSS, OPay’s market share is around 70%. It is important to say that those NIBSS figures are also not a way to verify OPay’s transaction value.

If the figures from October raised some eyebrows, then the December figures are even more incredible. OPay says it processed a gross transaction value of $2 billion in December alone, a 43% jump in two months.

With its expansion to another African country and the prospect of more customers, it will be more interesting to see what its reported numbers will be by the end of Q1 2021.