IN PARTNERSHIP WITH

Good morning ☀️ ️

This year has the highest number of African start-ups participating in Y Combinator’s Accelerator programme: fifteen.

Last month, I wrote about the thirteen startups from Nigeria, Ghana, Zambia, Egypt, South Africa and Morocco, who were part of the summer batch of 2021.

Two startups, Kenya’s Fingo and Egypt’s Pylon, joined the list at Demo Day, which took place on August 31 and September 1.

In today’s edition:

- Is Nigeria’s CBN going a Bitt too far in designing the eNaira?

- Facebook is tuning down political posts and content

- Fintech Focus: Can open banking aid financial inclusion?

- Events: NSB Regional Town Hall Meetings

IS NIGERIA’S CBN GOING A BITT TOO FAR IN DESIGNING THE ENAIRA?

On Tuesday, we reported about eNaira and how Nigeria’s apex bank is designing the state-backed digital currency. Well, it appears that Nigeria is looking outside the nation for tech companies that will design the eNaira.

And the search extended outside the country, and even the continent.

On Monday, the Central Bank of Nigeria (CBN) announced that global fintech company, Bitt Inc. will be its technical partner for the launch of eNaira which is scheduled for October 1, 2021.

Why Bitt Inc?

They’ve got more than a little bit of experience.

According to Osita Nwanisobi, CBN’s Director of Corporate Communications, the Barbados-based company was selected from a list of highly competitive bidders because of its “technological competence, efficiency, platform security, interoperability, and implementation experience.”

Bitt Inc. has experience creating digital currencies having worked with the Eastern Caribbean Central Bank (ECCB) to develop DCash, a digital currency being used in four countries across the Caribbean islands.

Could Nigerian tech companies develop it too?

They could.

Social conversations, which criticize CBN’s decision, are ongoing on how companies like Bantu, or SiBAN could also get the job done.

Not everyone believes this though. Technical expertise is paramount for the design. In this article, Chimezie Chuta who is the Founder, Chairman Blockchain User Group, shares that local technical partners might not be the best option considering that the Blockchain network — Hyperledger Fabric — CBN will run the eNaira on is created by a consortium of “big entities including IBM and a couple of other big organisations that are not local.”

Zoom out: CBN seems to be taking the development of its digital currency seriously but selecting foreign developers over their counterparts in Nigeria does call into question its mandate to foster local talent. What do you think?

FACEBOOK IS TUNING DOWN POLITICAL POSTS AND CONTENT

What’s happening: Facebook has resolved to reduce the number of political posts and content that appear on their users’ news feed.

Why? Earlier this year, in February, the social media platform began running tests. They had received the same type of feedback: people wanted less and less political content on their news feed. Facebook wanted to test out how their users felt about this type of content, and how they’d feel if it was reduced.

It’s understandable.

At that time, the US was still dealing with the aftermath of their national elections: think pieces on Trump and Biden were flying over the place, and the mob attack on the Capitol was still fresh.

In Brazil, there were conversations on President Jair Bolsonaro’s intent with the military. In Africa, Uganda too had just completed its national elections and social media was awry with President Yoweri Museveni’s internet shutdown decision. Nigeria itself was still struggling to deal with the aftereffects of its #EndSARS protests.

Everyone had something to say about politics, and no one was ready to listen.

So what did Facebook do? They started small.

They temporarily reduced the distribution of political content for a small percentage of people in Brazil, Indonesia, US, and Canada. They ran surveys on how those people felt about the reduction and ran more tests to explore how content could be ranked on News Feed.

While their tests revealed that political content makes up only 6% of what people see on Facebook in the US, they realized that that small percentage was enough to affect mood and overall app experience for the rest of the day.

While I think the stats would be higher in certain countries, I’d wager that the feeling is mutual. Political conversations are universally difficult.

Facebook is not deleting posts or anything, they’re just deemphasizing how much political news content appears on News Feed.

How will African countries fare?

As of now, it seems African countries are still exempt. Facebook is expanding its test to Costa Rica, Spain, Sweden, and Ireland but they plan to expand further later.

I think it’ll be intriguing to see how this will affect political conversations across the continent, considering how African governments have reacted to social media regulations over the past year i.e. The Ethiopian government planning to develop their own social media platform after Facebook deleted their posts, and the Nigerian government banning Twitter after the President’s tweet was deleted.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

FINTECH FOCUS: CAN OPEN BANKING AID FINANCIAL INCLUSION?

Earlier this year, we entered into a partnership with Flutterwave to explore fintech in Africa.

In this inaugural edition, we discuss the potential of open banking for driving financial inclusion in Nigeria, with insights from Ifeoluwa Orioke, Flutterwave’s Chief Commercial Officer.

So what’s open banking?

Open banking is an emerging trend of data sharing between banks and other stakeholders in the ecosystem; including third-party financial services providers (TPPs), fintechs, and other institutions.

What does open banking have to do with financial inclusion?

Nigerian banks boast an inventory of consumer data that fintech startups in the country can only dream of. But most legacy players are reluctant to use these rich data reserves to capture unserved populations – nearly 40 million adults were without bank accounts as of 2020 end.

In the banks’ place, fintech firms have been working to extend access to financial services to rural areas, through agent networks and mobile money wallets. But they need integrations with bank data to get the best locations for their agents.

Open banking is an effective way for banks and fintechs to work together, helping the latter’s efforts to reach the financially excluded or underserved.

Read more in Michael Ajifowoke’s Fintech Focus: The link between open banking and financial inclusion.

Time to take control of your investing journey.

Did you know that the US Stock markets have returned on average 10% annually for nearly a 100 years? Are you aware that Bitcoin has been the best returning asset-class in the past decade. Learn the basics, stay updated for free at 30%Club here.

EVENTS: NIGERIA STARTUP BILL REGIONAL TOWN HALL MEETINGS

Starting today, regional town hall meetings will begin for the Nigeria Startup Bill. This is an opportunity for everyone to join ongoing conversations on what goes into the bill.

What is the Nigeria Startup Bill?

The Nigeria Startup Bill project is a joint initiative by Nigeria’s tech startup ecosystem and the Presidency to harness the potential of Nigeria’s digital economy through co-created regulations.

Why you should be concerned

The Bill aims to ensure that Nigeria’s laws and regulations are friendly, clear, planned, and work for the tech ecosystem. Its primary goal is to create an enabling environment for growth, attraction, and protection of investment in tech startups.

Where will the first session hold?

The first session for the North-West region is scheduled to hold today, the 2nd of September at 11 am (WAT). The venue is Colab 4, Barnawa Close. Barnawa, Kaduna.

Interested participants can also join virtually using this link.

This session will be followed by the North-Central regional town hall meeting on Saturday, September 4th at 3 pm (WAT) and the North-East regional town hall meeting also on Saturday, September 4th at 10 am (WAT).

Interested in attending these sessions physically or in person? Click here for more details.

For more information, visit the website and follow the NSB on Instagram, Facebook, LinkedIn, to stay updated on the project’s progress.

For partnership and other inquiries, send an email to hello@startupbill.ng.

KB4-CON EMEA is a free, highly engaging, cybersecurity-focused virtual event designed for CISOs, security awareness and cybersecurity professionals in Europe, the Middle East and Africa.

The event will be on Thursday, September 23rd and features keynotes from two of the most well-known figures in cybersecurity. Mikko Hyppönen will cover how our global networks are being threatened by surveillance and crime, and how we can fix our technical, and human, problems. Kevin Mitnick will reveal social engineering tradecraft and insights and wow you with a live hacking demonstration. You can register here.

What else we’re reading

- Last month, Twitter shut down Fleets, its stories feature. LinkedIn is following suit in September. (TechWeez)

- Impaq has just launched a fully-catered online school in South Africa. (Ventureburn)

- If you think you write premium tweets, you may soon be able to monetize them as Twitter rolls out its new monetization feature, Super Follows. (TechWeez)

How cool would it be to spend your cryptocurrencies anywhere you want to? In dollars?! With a debit card?! Without limits?! Sign me up!

Juice has all the answers. The American company has a working relationship with crypto exchanges worldwide, making it possible for you to readily spend your digital assets.

You can earn for life when you refer a crypto exchange too. Find out more here.

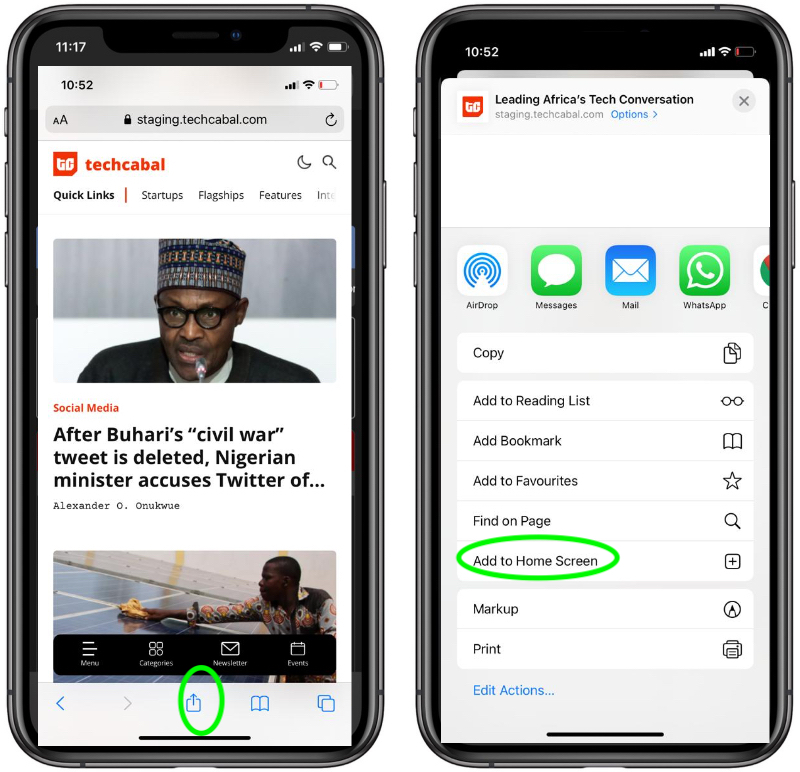

ADD TECHCABAL TO YOUR HOME SCREEN

TechCabal is the new app-ening thing in town.

We’ve got a PWA now, a Progressive Web App and you can now add us to your home screen on your phone and get updates when we publish new articles.

For Android users:

- Open Google chrome.

- Go to techcabal.com

- Select the Install button at the top left corner of your screen.

For our iOs users, there’s limited support but here’s how to add us to your home screen:

- Launch Safari on your iPhone or iPad.

- Navigate to https://techcabal.com.

- Tap the Share icon (the square with an arrow pointing out of it) at the bottom of the screen.

- Scroll down to the list of actions and tap Add to Home Screen. (If you don’t see the action, scroll to the bottom and tap Edit Actions, then tap Add next to the Add to Home Screen action. After that, you’ll be able to select it from the Share Sheet.)

- Type a name for your site link. This will be the title that appears beneath its icon on your Home screen. We suggest “TechCabal” or “The Best Thing Since Sliced Bread.”

- Tap Add in the top-right corner of the screen.