IN PARTNERSHIP WITH

Good morning ☀️ ️

Twitter may be giving us an edit button soon, but it’s not for Tweets!

The social media platform is considering adding privacy-related features to let users edit their follower lists, and archive old posts.

In today’s edition:

- Why Netflix’s growth is stunted in Africa

- The colors on Africa’s plates

- Awabah’s digital pension solution

- TC Insights: A Mobile-powered Africa

- Tech Probe

- Events: FOC

WHY NETFLIX’S GROWTH IS STUNTED IN AFRICA

Netflix might closeout 2021 with 2.6 million subscribers in Africa. Considering that the streaming service aims to have at least 5.6 million subscribers by 2026 and that it had 1.4 million subscribers at the end of 2020, Netflix appears to be growing at a steady pace and will likely hit its growth target.

However, if you consider the fact that Netflix has over 209 million subscribers worldwide, with 27 million in Asia, and 38 million in Latin America, you may wonder why Netflix’s growth is stunted in Africa.

Netflix launched in Latin America in 2011, and 2015 in Asia, starting with Japan. Even though the launch timelines for Asia and Africa are similar, the growth is incomparable. Asia has at least ten times the number of subscribers when compared to Africa. Of course, there’s the argument that Asia’s huge subscriber base is due to their population which stands at 4.6 billion – three times the size of Africa’s population.

But there’s another reason why Netflix’s growth in Africa is (and may remain) stunted compared to other continents. As always, it’s a numbers game.

Even at $3.99, Netflix is still expensive

In June, Netflix announced a mobile plan across Sub-saharan Africa to help boost subscriptions. At $3.99, the cheapest is the mobile plan while the Premium plan was slated for $11.99.

Similar plans were launched in Argentina and Turkey, where the cheapest mobile plans are $3.28 and $3.68 respectively. Both plans have helped increase the subscriber counts in countries with Argentina recording 5.07 million subscribers as of Q2 2021, and Turkey recording 3.09 million in the same quarter.

In Africa though, the story is different. While subscription costs may be relatively affordable, streaming is not.

According to Netflix, one hour of streaming movies or series costs 1GB of data at standard definition, and 3GB at high definition.

1GB of data on the continent can be as high as $35 while the average price for 1GB, on the continent, is $5.

Let’s do some quick math: In the US, the average time spent on Netflix is 8 hours per week. In Africa, spending that much time on Netflix could cost anywhere from $40 per week, or $160 a month.

At these prices, very few African viewers can afford to spend a lot of hours streaming video content considering the average income per capita is $315.

Zoom out: Pay TV services on the continent, however, are growing rapidly. There are presently 34 million subscribers on the continent and the number is projected to grow to 51 million by 2026. Unlike streaming services, users of PayTV services do not have to spend extra on data services.

AWABAH’S DIGITAL PENSION SOLUTION

Awabah Nigeria is a digital platform that automates micro-pensions and target-savings for self-employed Nigerians and workers in the informal economy.

Launched in 2021 by co-founders Tunji Andrews, Tina Ajishebiyawo and Gboyega Olatunde, Awabah aims to drive financial inclusion by giving self-employed Nigerians and low-income earners access to benefits offered in the formal employment market.

Why is this important?

Nigeria’s workforce is predominantly informal with an estimated 65% earning outside state regulations. Most informal sector jobs include agriculture, small-scale construction or petty trading. At least 88% of people in the informal work sector don’t have pension accounts.

Young people aged 24-35 make up the majority of Nigeria’s workforce and no pension coverage means that they’re susceptible to living below the poverty line in their old age. The result? A large group of citizens becomes financially vulnerable as they get older.

What Awabah is doing

The strength of Awabah’s solution is in the flexibility it offers to users.

With a little as, ₦500 ($1.1), contributors can open a micro-pensions account and subsequently contribute to their accounts based on their own pockets. Pension contribution in Nigeria is made up of an 18% minimum of wages: 10% from the employers and 8% from the employees. With Awabah, contributors can decide how much of their wages they can afford to save.

Awabah also lets users withdraw up to 40% of their savings after the first three months of contributing.

Since its inception, the startup has succeeded in raising $200,000, and partnered with three pension administrators including Leadway Pensure.

Awabah has faced some obstacles along the way – manpower, smartphone penetration and logistics are some of the largest.

Michael Ajifowoke’s shares more in With Awabah, Tunji Andrews wants to make pensions as popular as banking.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

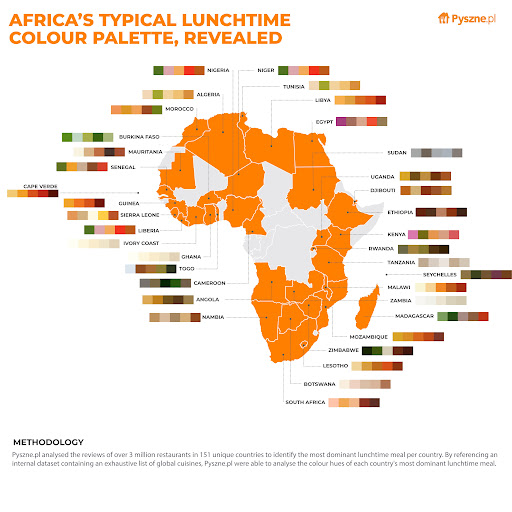

THE COLORS ON AFRICA’S PLATES

Can we guess what you’re having for lunch today? Or at least the color?

The color and appearance of food influence how we interpret flavour. The more balanced the color palette of a dish is, the more appealing it becomes to us.

Aesthetics play a large role in dining. That’s why we spend so much time bingeing short food videos online; we may not be able to taste it but the colors help us build a sketch of what it could taste like.

Psyzne.pl, a Polish food and lifestyle firm, was inspired by this and they’ve created color palettes that illustrate lunch options in different countries.

Here’s what lunchtime in Africa looks like:

Nigeria’s palette is characterized by red, yellow, green, and beige tones. Per the report, the most popular lunchtime options in the country are jollof rice and efo-riro, a vegetable dish made with spinach, locust beans, and assorted meats.

East Africa’s Ethiopia palette has beige and brown tones, highlighting the country’s love for spice, meat, and injera.

Down south, in South Africa, the colour palette ranges from dark browns to peaches and beige tones while Tanzania’s, where maize, rice and stews are loved, is made up completely of beige tones.

How accurate is this picture?

Psyzne.pl reports that the palettes are built from data obtained from analyzing online reviews from over 3 million restaurants in 151+ countries all over the world. It doesn’t, however, give info on how many restaurants were analyzed in each of the countries, and from what regions.

This brings to mind how accurate the palettes are.

If the methodology involves getting online reviews, then there’s definitely a lot of colors missing in Africa’s food palette. The percentage of restaurants that have web pages, or are registered on Google Maps in Nigeria, is lower when compared with other continents. Reviews, even more so.

Add the low percentage of internet penetration (28.2%) and smartphone penetration (40%) to the mix, it becomes clearer why online reviews of restaurants may not tell the full stories of what Africa is eating.

Zoom out: The food sector in Africa, anywhere really, is forever growing and tech companies are taking advantage of it too. Reports like this can help restaurants and services like Jumia Food, Bolt Food, or EdenLife hack growth by understanding the market.

TC INSIGHTS: A Mobile-powered Africa

In Accra, Asare can get most things she needs by swiping her phone. Mobile applications have bridged the gap between the physical and virtual world. This wouldn’t have been possible fifteen years ago. Today, more than 80% of Africa’s population has a mobile subscription. In many African countries, the digital economy is becoming a huge driver of growth, with the potential of contributing more than 5% to the continent’s GDP by 2025.

Across the region, mobile-enabled platforms have disrupted different sectors of the economy. An example is the growth of mobile money and the improved financial inclusion rate.

However, the journey is far from over. Compared to other regions, Africa remains the least connected region with about 28.2% internet coverage and 34% mobile broadband connection.

Few citizens have digital IDs, businesses adopting digital technologies remain the exception rather than the norm, and few governments are investing in developing digital infrastructure and services.

Digitalisation, especially for those who do not live in major cities, is a way to ignite and sustain economic growth. Over 60% of men and 75% of women are engaged in informal economic activity in Africa and digitalisation can help to ensure that development reaches everyone and that no one is left behind.

Unequal access to connectivity and digital tools is dividing cities and towns across the continent. Digital infrastructure should be accessible to all. A study by the International Telecommunications Union (ITU) found that increasing mobile broadband penetration by just 10% in Africa would equate to an increase of 2.5% in GDP per capita.

For this to happen, there needs to be increased spending in digital infrastructure and a more conducive environment for private sector investments in the sector. It is only then that mobile subscribers will increase and add to the growth of the digital economy in Africa.

TECH PROBE

Last week, we asked our readers, “What sector of the African economy needs urgent rescue?”

Here are some of the most interesting responses:

- “It will be the public education sector. The public education sector in Africa has always been on life support for many years but with the pandemic, things have gotten worse. Public education in Africa was hit badly because there is no infrastructure in place to cushion the impact of the lockdown and there will be crises if something is not done urgently.” – Lekan Odukoya

- “Healthcare: there is a huge resource and infrastructure gap that needs solving and I’m happy we are doing this.” – Ayodele Adeyemo O. (@iyoaye)

- “Education. Biggest source of fx bleeding and poor productivity but we close our eyes to it.” – Iyin Aboyeji (@iaboyeji)

- “My personal economy needs urgent rescue, biko.” – King Wavy 👑 (@JackFleet)

- “What sector doesn’t?” – OSNON (@lifemathecian)

- “Health, finance, communication, energy …… the whole country [sic] sef.” – Bunny Mack (@MaziNwagu)

KB4-CON EMEA is a free, highly engaging, cybersecurity-focused virtual event designed for CISOs, security awareness and cybersecurity professionals in Europe, the Middle East and Africa.

The event will be on Thursday, September 23rd and features keynotes from two of the most well-known figures in cybersecurity. Mikko Hyppönen will cover how our global networks are being threatened by surveillance and crime, and how we can fix our technical, and human, problems. Kevin Mitnick will reveal social engineering tradecraft and insights and wow you with a live hacking demonstration. You can register here.

EVENTS: Will you be at #FOC2021?

It’s less than three weeks from now!

On the 24th of September, TechCabal will host some of the most influential players in tech and commerce in and out of Africa at the Future of Commerce.

Speakers include Nkebet Mesele – Senior Director (Solutions Management), Visa Sub-Saharan Africa, Ray Youssef – CEO at Paxful, Isaac Kamuta – Group Head: Cash Management & Client Access at Ecobank; Juliet Anammah – Chairwoman at Jumia Nigeria and Group Chief Sustainability Officer, Khadijah Abu, Head of Product Expansion at Paystack and many more.

Join #FOC2021 to hear speakers share fresh and insightful perspectives on all the major changes coming to the world of commerce.

JOB OPPORTUNITIES

Every week, TechCabal shares job opportunities in the African ecosystem.

- No Filter PR – Mid-level Account Manager – Lagos, Nigeria (Remote) – September 17

- PayHippo – DevOps Engineer – Remote

- Mastercard Foundation – Program Partner, Innovation – Accra, Ghana – Deadline: September 20

- Brink – Community Manager, East Africa, Innovation Manager, East Africa – Kenya/Rwanda – Deadline: September 15

- Sokowatch – Credit Administration Associate – Kampala, Uganda

- PiggyVest – Social Media Associate – Lagos, Nigeria

There are more opportunities here. If you’d like to share a job opening or an opportunity, please fill this form.

What else we’re reading

- Apple is delaying plans to roll out its child sexual abuse detection tech after negative feedback from its users. (TechCrunch)

- In May 2020, Vodacom became the first ISP to launch 5G in South Africa, covering Johannesburg, Pretoria and Cape Town. The Northern Cape city of Kimberly just joined the number. (MyBroadBand)

- Sexual assault isn’t something to joke about and this Ivorian TV show is earning serious backlash after broadcasting a “rape demonstration” from a self-confessed repentant rapist. (Quartz Africa)

- Notify Logistics has just raised Ksh45m ($400,000), and it plans to use that to support 20,000 Kenyan entrepreneurs. (EIN Presswire)