Bamboo, an investment platform that allows Nigerians buy and trade US stocks in real-time from their mobile phones or computers, has raised $15 million in a Series A funding round led by American venture capital firms Greycroft and Tiger Global. Motley Fool Ventures, Saison Capital, Chrysalis Capital, and Y-Combinator’s Michael Seibel also participated in the round, the company said.

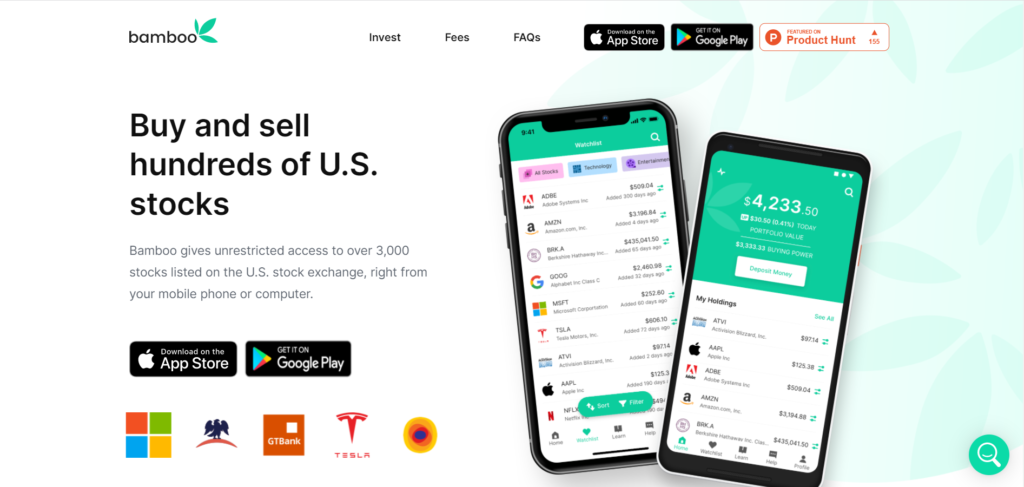

Launched in January 2020 by CEO Richmond Bassey and COO Yanmo Omorogbe, Bamboo has rapidly grown in popularity with retail investors, claiming over 300,000 accounts in Nigeria. Its users can access all equities available on the US stock exchanges, that is, the stocks of roughly 6,000 companies.

“Our goal is simple: we want to give Africans and their asset managers easy, fast and secure access to global investment options that will allow them to earn real returns,” Bassey said in a statement released Monday.

With the new funding, Bamboo plans to further accelerate its growth, doubling down on unlocking new markets and launching more products, it said while Bassey told TechCabal in an emailed response that Bamboo will be providing more asset classes and investment opportunities for its users.

“Bamboo is enabling Africans to build wealth by creating an investing platform that is helpful to both experienced investors and to those new to the stock market. We are thrilled to support the innovative, user-first approach the Bamboo team is bringing to market,” Greycroft Partner Alison Lange Engel said on the investment.

Last year, the company launched Powered by Bamboo, its API solution that allows asset managers, fintech companies, and other financial institutions to plug into Bamboo’s API to provide their customers access to global securities. The company has been testing the product with a small group of companies and expects to onboard more this year.

“Everyone building for African investors is welcome. We plan to add other products and tools that offer greater access and make global investing simpler from Africa,” Bassey said. “We’re building the technology infrastructure powering financial services in Africa.”

In April 2021, Bamboo announced plans to launch in Ghana and has since seen more than 50,000 Ghanaians join the waitlist, according to the company. In the near future, Bamboo plans to expand into more markets such as Kenya and South Africa, Bassey said.

Compared to developed markets such as the United States, investing in stocks is relatively new in Nigeria, and Africa at large. For instance, nearly 75% of Bamboo users have never traded stocks before.

Thus, the company has had to put significant effort into educating its users on how to invest and become better investors, using a mix of regular educational content published on its social media, a stock market course, an investment bootcamp, newsletters with investing tips and exclusive value-added services from top investment advisors like The Motley Fool and MyWallSt.

These efforts appear to pay off, going by Bamboo’s figures. In 2021, repeat depositors made up 85% of deposits on the platform, an indication that Bamboo users are rapidly gaining confidence in trading US stocks.

But with the US equities market experiencing its worst January in well over a decade—since 2009—how are Bamboo users reacting to the downturn?

“Even though they are new to stock investing, Bamboo users tend to handle their emotions like more seasoned investors,” Bassey said. “We saw this during the 2020 Covid-19 pandemic crash and we’re seeing it again now.”

Africa’s wealth management market remains largely underdeveloped but holds high potential. According to data cited by Bamboo, Africans account for over 16% of the world’s population, yet they own less than 1% of global wealth.

But that is expected to change over the next decade, with private wealth in the continent expected to increase by 30% to reach $2.6 trillion by 2030, according to AfrAsia Bank.

Bassey is upbeat platforms like Bamboo will play a major role in realising the projected growth, by helping to develop an investing culture among Africans.

“We think investing in stocks has a bright future in Nigeria. Nigerians are hungry to earn a return on their investments and build wealth,” he said. “We are bullish on platforms such as ours in bringing more Nigerians into the world of investing.”

Without revealing many details, Bamboo says in the statement it plans to make it seamless for African investors in the diaspora to discover the best investment opportunities on the continent.

In August, Nigeria’s central bank received court approval to freeze the bank accounts of Bamboo and other similar Nigerian fintech platforms for a six-month period. However, Bassey confirmed the company received a court order unfreezing its accounts. “All have been unfrozen now,” he said.

If you enjoyed reading this article, please share it in your WhatsApp groups and Telegram channels.