Trade and commerce are the major drivers of economic growth and also constitute a critical part of human existence. In Africa, the absence of a generally accepted local currency and the volatile nature of individual currencies make commerce difficult, thus hindering economic growth. Due to this challenge, cross-border payment within Africa is done majorly in dollars. But dollars are usually in the firm grip of big corporations and the government such that SMEs—the backbone of every economy—have little or no access to it for business.

In recent times, with greater efficiency, greater financial inclusion, and more innovation, digital currencies and payment systems have tremendously benefited consumers and society as a whole. Stablecoins, especially, are gradually gaining ground as the most acceptable means of payment due to its fast, secure, affordable and easily transferable nature, with more than $185 billion worth of stablecoins circulating in the global market.

In 2021, Chainanalysis, a blockchain data platform, reported that cryptocurrency adoption exploded across Africa with a 1,200% increase from 2020. This adoption was driven by the use of stablecoins for savings, remittances and commercial transactions, with cross-region transfers reportedly constituting a bigger share of Africa’s cryptocurrency market (96%) than all other regions combined (78%).

But despite this recent progress in the adoption and use of crypto, particularly stablecoins, for commerce, savings (to hedge against inflation), and cross-border remittances in Africa, businesses on the continent still struggle to integrate crypto offerings into their platforms. This ultimately reduces their ability to scale and plug into the opportunities in the global market.

This is where Lazerpay comes in, to help African businesses plug into this future of commerce driven by stablecoins.

Lazerpay, popularly known as the Stripe for crypto, is a Nigerian crypto payment gateway startup which helps businesses accept crypto payments quickly and securely from anywhere in the world. In October 2021, Njoku Emmanuel, a 19-year-old highly sought-after Nigerian blockchain engineer, founded Lazerpay alongside Abdulfatai Suleiman and Prosper Ubi as it launched in beta testing providing access to over 1000 businesses in Africa.

Prior to Lazerpay, accepting crypto payments was such a complex and risky venture as businesses have to set up a wallet address on a crypto exchange, accept payments from limited crypto assets, and then manoeuvre P2P hurdles to convert their crypto to fiat. Alternatively, they have to get someone to provide a wallet address and pay the person for converting the crypto asset received on their behalf to fiat.

But with the launch of the beta version of the crypto payment startup, all businesses have to do is integrate a collections widget in their apps or collect payments through a link. Both options support payment with every crypto asset such that any business or company using either solution can receive crypto payments from anywhere in the world within seconds. Once the crypto asset is received, it is immediately converted into stable coins in the user’s Lazerpay wallet. This is to protect users from the highly volatile nature of most crypto assets. Clients/users can then decide to withdraw the stablecoins into their crypto wallets or a bank account of their choosing.

“The first version of Lazerpay was simple in that all businesses could do was accept and pay out in stablecoins. It currently serves over 2,000 businesses spread across five continents. However, we quickly realised that an additional layer of converting stablecoins to fiat was needed. To improve our users’ experience, we decided to build the second version of our payment gateway to allow merchants to withdraw their crypto payments in fiat, directly from their dashboards,” Njoku Emmanuel, Lazerpay CEO said in a statement about the new updates.

In February 2022, the startup came out of private beta and is set to introduce a new set of features based on feedback from the previous version to further improve customer experience on the platform. The new solutions which have been tested in the last few weeks and will be launched for the benefit of customers include:

Payouts by Lazerpay—move your money on your terms

“Commerce has evolved to the point where many merchants can now offer products to a global audience and receive payments from anywhere in the world. Despite this evolution, some businesses, particularly those in Africa and the Middle East, are still locked out from this global expansion drive. With the addition of payouts, we are equipping businesses to drive growth by receiving and making global payments without exchange barriers,” Amara Uyanna, head of MEA partnerships, said in a statement about the new updates.

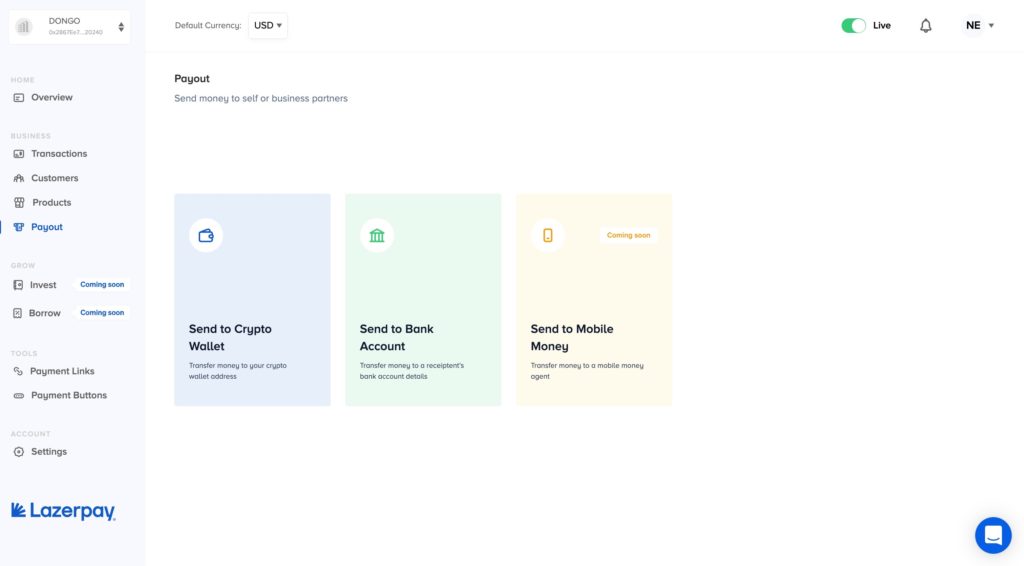

A major upgrade coming to the Lazerpay platform is how it processes payouts. Previously, the platform pays out earnings to its customers or business owners in whatever stablecoin they earned irrespective of whether they needed to transact using another stablecoin. But in the new version (2.0), users are able to swap their stablecoins between USDT, USDC, BUSD, and DAI, which are all supported stablecoins for earning on the platform.

Additionally, Lazerpay has also added fiat payout options for its users. While users could only receive payouts in stablecoins before, they can now pay out to multiple currencies in countries such as Nigeria, Ghana, the US, the UK, India, China, and the UAE. Lazerpay merchants can now pay out in USD anywhere in the world, and in Nigerian naira and Ghana cedis in Africa. They can also send money to other businesses in their desired currencies, thereby providing more freedom and flexibility to move their money how they want to.

Products by Lazerpay—helping merchants sell faster

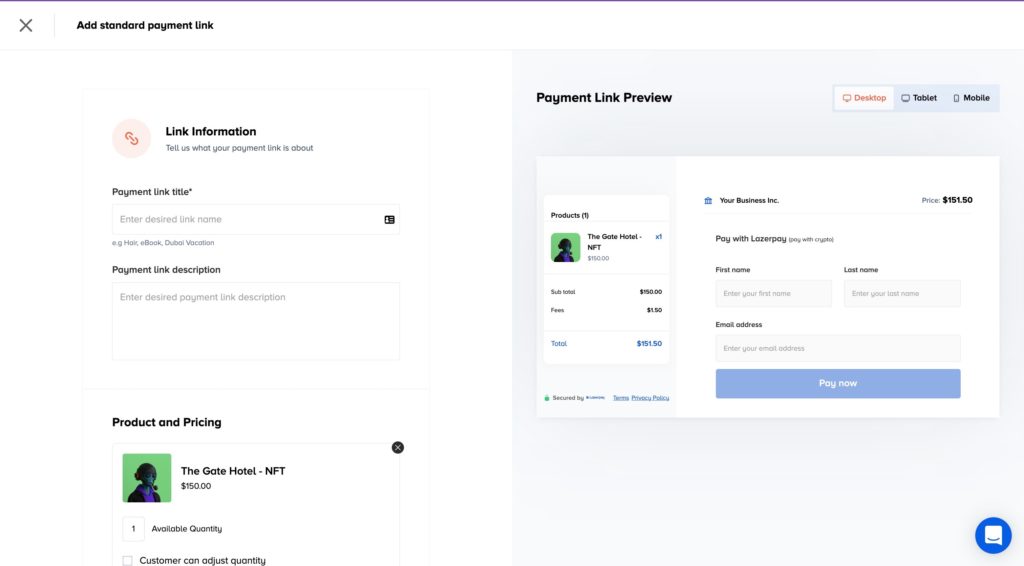

Products is Lazerpay’s solution for an adaptable yet powerful online store for business owners and digital creators. With this offering, users can upload and make several product listings using products, letting customers know how many of each item they have in stock.

The game changer in this particular feature is that previously, business owners used to create a payment link for every product they wanted to sell. But with the new Lazerpay version, merchants can build orders for their customers using any combination of their product listings and generate a single payment link that customers can use to pay for all of their purchases. They can also customize the descriptions that appear with their orders and preview it to get an inkling of what customers see after clicking the link.

An additional feature to the products by Lazerpay is the option of a “thank you” message when payment is received and the ability to collect delivery details and other standard transaction details for record or analysis purposes.

A data-informed dashboard for better decision-making

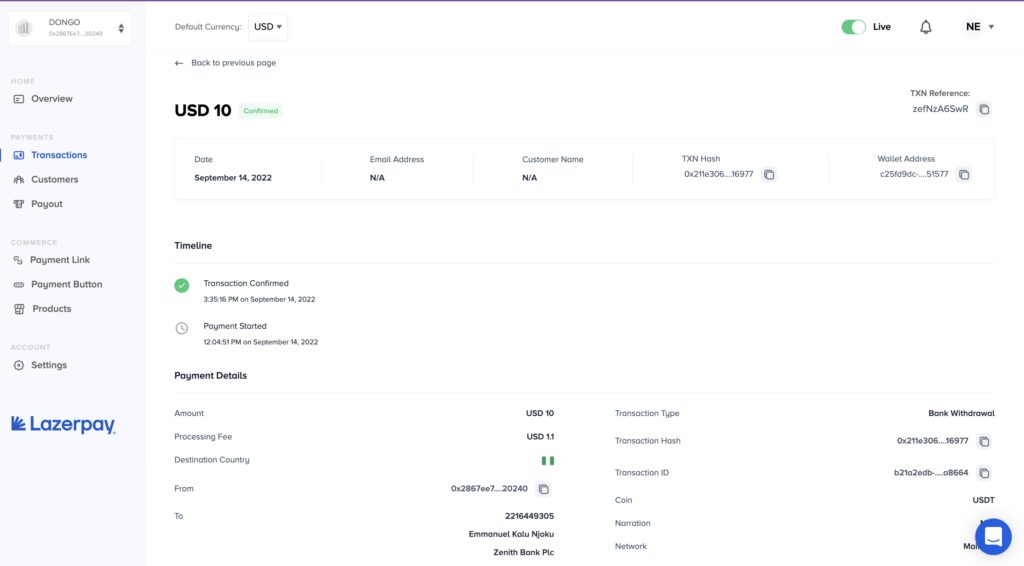

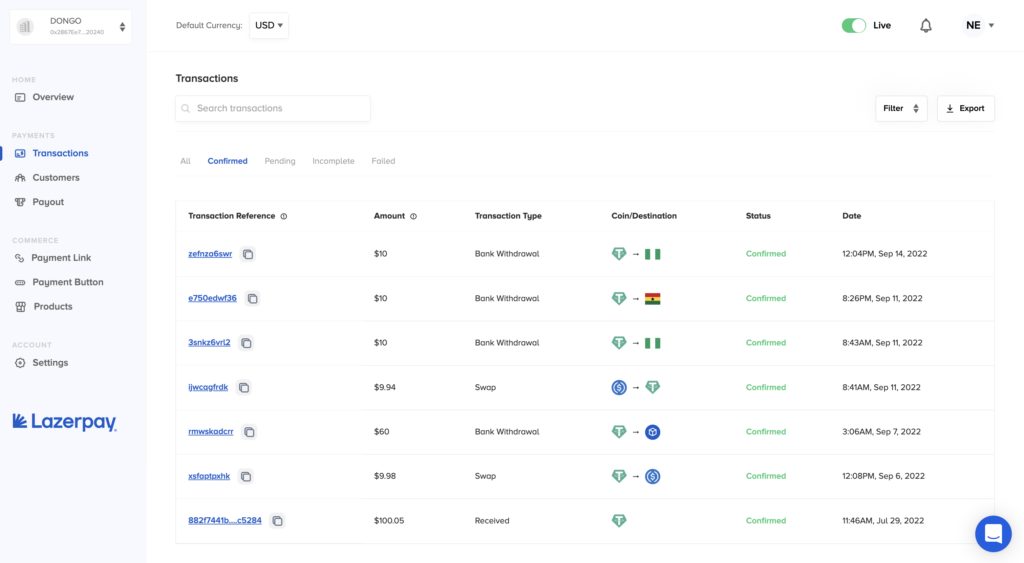

Considering the importance of data in decision-making for businesses, Lazerpay has introduced a data segment on the dashboard of every business signed up to the platform to provide more data on their wallet balance, financial performance in the past few months, and a summary of recently concluded transactions.

The transaction dashboard gives users access to all their transactions which they can export if need be to conduct further analysis on their financials. While on the customer dashboard, merchants can access customer details that have been collected and filter them to learn more about their customers to make better data-driven business decisions.

In addition to solving payment problems for businesses, Lazerpay understands that businesses need to grow their funds and increase their market share to scale. For this reason, the platform provides business owners with investment options, and a token system to reward their customers.

With no special knowledge of crypto required, Lazerpay enables users to grow their revenue through a secure algorithm that aggregates the best crypto investments. They can earn up to 10% per annum in interest and also borrow for an urgent need without collateral. For the tokens, it provides liquidity and functions as a loyalty bonus that businesses can use to reward their customers.

In all, the new updates on Lazerpay ensure that no one, including non-technical customers, is left behind as the startup continues to lead the way in improving commerce across the continent by building simple, easy to use, customer-centric crypto payment solutions. In future, the platform will also work on adding more analytics to the data dashboard to help business owners make the best decisions for their businesses.