IN PARTNERSHIP WITH

Oh happy day 😬

Would you take a pay cut if it meant moving to another country for work?

Well, the subject of last week’s #DigitalNomads did, and it wasn’t a small pay cut either.

Gideon* took a €30,000 ($29,000) pay cut when he left his job as a software engineer in Nigeria to move to a new job in Germany—a job he later lost.

But Gideon isn’t deterred. He’s starting a new job that will bring him €84,000 ($81,000) per year. Here’s his #DigitalNomads story.

*Name has been changed to avoid stalking on LinkedIn. 🙏🏽

CRYPTO MARKET

|

|

|

|---|---|---|

|

Bitcoin

|

$19,302 |

+ 1.00% |

|

Ether

|

$1,306 |

+ 1.87% |

|

BNB

|

$272 |

+ 1.13% |

|

Solana

|

$30.30 |

+ 1.63% |

|

Cardano

|

$0.37 |

+ 0.94% |

|

|

Source: CoinMarketCap

|

|

* Data as of 21:30 PM WAT, October 16, 2022.

NALA LAUNCHES APPLE PAY INTEGRATION

Less than a week after launching a feature that allows Kenyans to pay their bills with M-PESA, Tanzania-based fintech NALA is making another splash.

According to the fintech, it has integrated Apple Pay for payments from the UK and the US to Africa.

In a statement sent to TechCabal, customers on the app will be able to send money to African countries from anywhere in the UK and the US. According to the fintech, it has partnered with over 300 banks on the continent and 20 mobile money players to make this happen.

CEO Benjamin Fernandes said, “NALA’s mission is to increase economic opportunities for Africans globally, enabling Apple Pay is a step towards connecting more global payment options with Africa. This reach allows us to build stronger financial infrastructure for Africans worldwide.”

Zoom out: This integration with Apple Pay is the latest in NALA’s product roadmap. The fintech has had it in the pipeline since May 2021.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

SNAPT SHUTS DOWN

Layoff season might be winding down, but it appears shutdown season might be upon the African tech ecosystem.

Recently, South African tech company Snapt announced to its users that it would be snapping its doors shut.

A quick snapshot

Founded in 2012, Snapt is a software company that “provides load balancing, acceleration, security and caching for websites, applications and services”. Simply put, Snapt helps make websites and apps faster and more responsive.

In 2015, it reported that 85% of its client base was in the US and proceeded to establish an independent sales and marketing arm there. At the time, CEO Dave Blakey told Disrupt Africa that the company was aiming at achieving a 1,000% annual growth rate.

By 2017, the company had reportedly acquired 10,000 customers across 50 countries, achieving year-on-year growth of 400% in both 2014 and 2015.

More recently—in May 2022—Snapt launched an AI-powered security package, Snapt Nova, that was set to help over 3.9 million Kubernetes users optimise production of applications.

So what’s up?

Snapt ran out of funding.

So far, the startup has disclosed over $4 million raised in funding: a $1 million seed round in 2016 led by Convergence Partners, and a $3 million Series A round in 2018.

Its Series A raise is Snapt’s last-known publicly disclosed raise. Crunchbase reports that the startup raised $3.4 million last year, but TechCabal cannot confirm this at the time of this article.

“Given recent unforeseen events, outside of our control, Snapt has been left with no option but to cease operations immediately, as we believe this is in the best interests of our staff and clients. We are extremely saddened by this, especially given the recent growth of the business, and grateful for all the amazing interactions we’ve had with our clients over the years,” the company said to Disrupt Africa.

Big picture: Snapt is the third-known startup to lock down its doors after Kenyan foodtech Kune, agritech WeFarm, and Notify Logistics. Sky.Garden, a Kenyan B2C marketplace, may also be closing down in October after CEO Martin Majlund announced to employees that the company was almost out of money.

APPLE FINED FOR NOT INCLUDING CHARGERS WITH IPHONES

Apple might be trying to save money by commodifying its accessories, but a few countries are making sure it pays back those monies in lawsuits.

Last week, Brazil fined Apple R$100 million ($19 million) for not including chargers in iPhones sold within the country.

What’s up?

Since 2020, Apple has been thinking outside the box, excluding chargers and earphones from all new iPhones.

Its official reason? It wants to be carbon-neutral by 2030, and removing chargers and earphones reduces two million metric tons of carbon emissions annually. A more truthful reason might be tied to news that the company has saved $6.5 billion by removing accessories, and this is making up for the billions it’s spending on 5G accessories for newer iPhone models.

The accessory removal has been met with scepticism and pushback from users across the globe. In France, for example, the tech giant was forced to include earphones with iPhones in compliance with French laws that seek to prevent RF radiation from direct contact from iPhones while receiving calls. This law was later revoked in 2022.

The European Parliament also recently approved a new law that mandates all devices sold within the European Union to have a USB-C charging port, a big change from Apple’s standard lightning port.

Earlier this year, the Brazilian government fined Apple $2.3 million for not including basic accessories, and suspended the sale of iPhones in the country. Apple appealed the court’s decision, and last week, a São Paulo court ruled against Apple again and fined the company $19 million.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront.

This is partner content.

RAIN DESCENDS ON TELKOM AND MTN MERGER DEAL

Rain has had a turbulent time in its rush to merge with South African telco Telkom, but its recent formal proposal to Telkom board might be causing a storm.

Last week, Bloomberg announced that Rain’s merger offer to Telkom has caused another proponent, MTN, to pull back on its own offer. MTN’s talks to buy South Africa’s Telkom including negotiations on price have been halted.

ICYMI: Since August, Telkom—valued at $1.3 billion—has been in an acquisition dance with MTN, data-only telco Rain, and investment firm Toto Consortium. Rain’s initial proposal in August was stopped by South Africa’s Takeover Regulation Panel (TRP) who claimed the telco had not received the necessary approval to propose the merger. Rain retracted its proposal, and resubmitted it in September to Telkom’s board.

And now?

Telekom’s board has its finger in each pie, and is considering the perks of each of its suitors.

Its most attractive suitor is MTN—the telco who has now halted talks with Telkom. A merger between MTN and Telkom will see the duo overtake monopolist Vodacom which controls South Africa’s telco market.

TC INSIGHTS: DO AFRICANS LIKE CREDIT?

With an estimated $7.1 billion market size and rising investors’ interest, Africa’s buy-now-pay-later (BNPL) sector is growing. In the past, credit financing was tedious for private individuals to access. Most people relied on cooperative societies to access credit as interest rates from commercial banks meant credit was out of the reach of many. Yet, Africans are not entirely credit-averse, they mostly avoid taking loans for things they do not need.

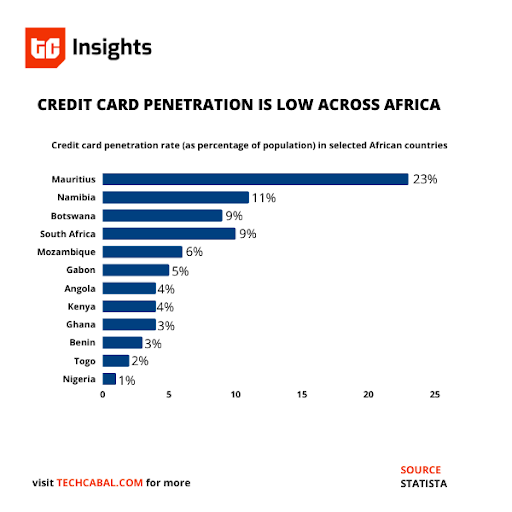

South Africa has one of the most advanced credit systems on the continent yet credit card penetration remains low at about 10%. Traditional credit operators focused on knowing their customers and covering the debt before disbursing loans. They managed default by leveraging community and collateral. Collaterals, on the other hand, grant credit operators access to the best loan recovery system.

Startups playing in the space have come up with interesting models to ensure default rates are low. For instance, M-KOPA does not run credit assessments on its customers. To keep their customers in check and ensure repayment, they use an IoT (internet of things) technology to lock and unlock functionalities on the product. For CredPal, the company runs creditworthiness checks by leveraging data from credit bureaus in Nigeria. CD Care, on the other hand, does not run credit checks beyond the initial KYC checks. The company requires that customers pay 50% of the purchase price of a product before taking ownership.

Leveraging data enables credit operators to manage default risk on payments. This is particularly important for tech startups as it helps them use alternative data points to determine creditworthiness and as such, are not legally obligated to report credit history to the credit bureaus.

Building creditworthiness using robust credit score analytics is only the starting point. Sensitising more Africans on the importance of credit facilities will require concerted efforts from both startups playing in the space and credit bureaus.

You can download all our reports here and watch videos from our events. Send your custom research requests here.

Protect your hard-earned money from inflation by saving in dollars on Pillow Fund.

Pillow is Nigeria’s #1 savings app that lets you save in dollars and earn 14% interest on it. Download the app, use TCPILLOW signup code to get ₦700 bonus on first deposit.

This is partner content.

EVENT: AFRICA TECH FESTIVAL

Africa Tech Festival returns to the CTICC in Cape Town, bringing you more content and surprises than ever.

The five-day in-person event will cover the topics shaping Africa’s present and future, including our awards ceremony and famous Afest, “Africa’s best party.”

IN OTHER NEWS FROM TECHCABAL

Nigeria’s oil city, Port Harcourt, wants ride-hailing drivers to pay ₦12,000 ($27) to register their vehicles, and ₦200 ($0.45) per month renewal fees.

Last year, Herconomy raised $600,000 within 24 hours. This year, it’s becoming a fintech startup with new offerings for African women.

QoreID offers a new way to carry out verifications using digital identity solutions customised to meet your KYC and compliance needs. The company offers a robust digital identity infrastructure that includes last-mile verifications, consumer insights, fraud prevention engine/tools, financial data analytics, instant identity verification, and much more. Learn more at QoreID.com

This is partner content.

JOB OPPORTUNITIES

- Big Cabal Media – Community Manager, Zikoko Memes – Lagos, Nigeria (Hybrid)

- Big Cabal Media – Content Creator, Zikoko Memes – Lagos, Nigeria (Hybrid)

- Big Cabal Media – Learning & Development Executive – Lagos, Nigeria (Hybrid)

- TechCabal – News Editor – Africa

There are more jobs on TechCabal’s job board. If you have job opportunities to share, submit them at bit.ly/tcxjobs.

What else is happening in tech?

- Apathetic customer service, passive KYC and hundreds of complaints: here’s everything going on at Wallets Africa.

- Amazon’s Cape Town fight turns personal as High Court disputes who can speak for First Nations tribe.

- In Zambia, Airtel Africa has acquired 60 MHz of additional spectrum for $29 million.

- Big Tech employees are TikToking on the job—and their bosses don’t always like it.