1. Funding: Q3 brings in the lowest funding of the year

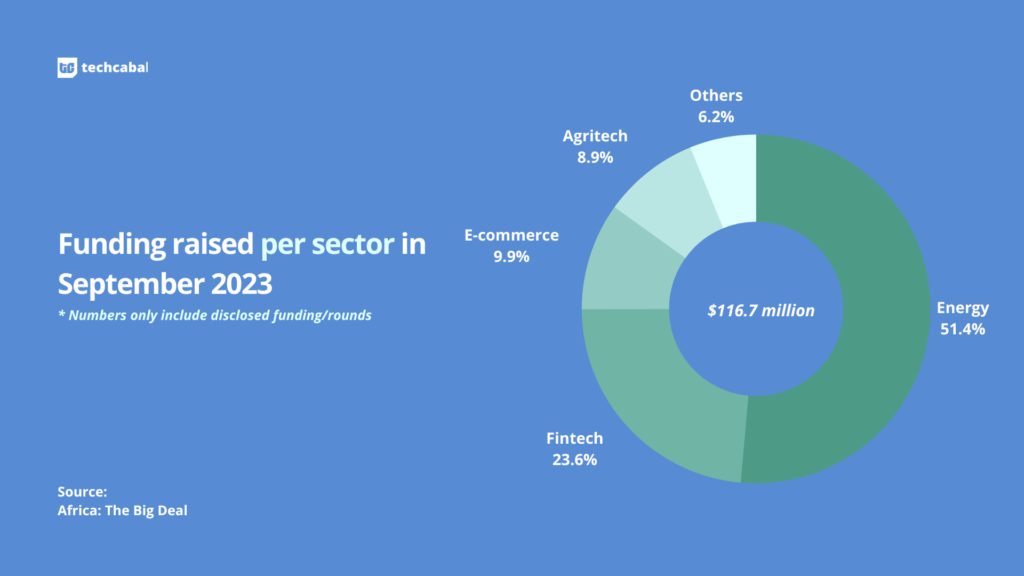

In September 2023, 22 African tech startups raised $116.7 million across 22 fully disclosed* raises. Compared to August 2023’s $243.7 million total raise, this represents a 52.11% decrease.

This also represents a significant YoY decrease—about 69.6%—from September 2022 when African startups raised $383.4 million. With this, September marks the month with the second-lowest funding following March’s $66 million raise.

In total, Q3 saw African startups raise $492.6 million across 67 fully disclosed deals. It’s a decline from Q2’s $877 million total raise, and an even sharper drop from Q1’s $1.3 billion. So far, African startups have raised $2.57 billion.

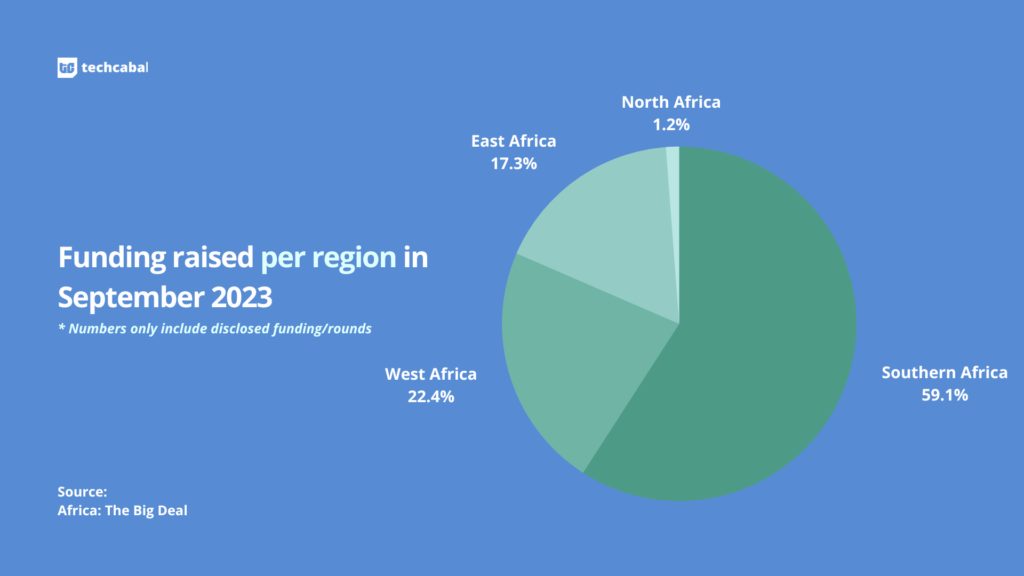

Per region, Southern African startups made a surprising appearance in first place with $69 million in raises, about 59.1% of the total funding. This is mostly led by energy startup Wetility’s $48 million raise. West Africa comes second with $26.1 million, East Africa with $20.2 million, and North Africa with $1.4 million.

Per sector, the top three sectors for September 2023 are energy with $60 million (51.41%)—led by the Wetility raise and Kenya’s SunCulture’s $12 million raise, fintech with $27.5 million (23.56%), and retail/e-commerce with $11.6 million (9.94%).

The top five disclosed deals of the month are:

- South African energy startup Wetility’s $48 million debt and equity round.

- Kenyan energy startup SunCulture’s $12 million syndicated debt facility.

- Ghanaian agritech Complete Farmer’s 10.4 million pre-Series A round.

- Zambian fintech Lupiya’s $8.25 million Series A funding.

- South African retail startup Rentoza’s $6 million raise.

*Note: This data is inclusive only of funding deals announced in September 2023. Raises are often announced later than when the deals are actually made. This data also excludes estimated grants from accelerators.

2. Investments: Enza Capital launches a $58 million fund

In September, Kenyan-based venture firm, Enza Capital, raised $58 million to support startups on the continent.

The VC company, which invests from first cheque, is also kickstarting a new shared ownership model that allows startup founders the ability to own part of the firm. Enza capital has allocated 10% of its carry pool to founders.

Another VC firm, P1 Ventures, also closed a $25 million fund which it plans to invest in African businesses across fintech, SaaS, AI and healthtech ventures.

3. M&As: Risevest acquires Chaka, WhoGoHost acquires SendChamp

Q3 also ended with a few acquisitions.

First, earlier in the month, Nigerian cloud infrastructure company WhoGoHost acquired SendChamp, a cloud communications startup, for an undisclosed amount.

Much later, Nigerian trading startup Risevest announced its acquisition of digital trading startup Chaka for an undisclosed sum.

4. Shutdowns: 54gene shuts down

Last month, TechCabal also confirmed that Nigerian genomics startup 54gene is shutting down. The news was confirmed by ex-CEO Ron Chiarello.

The startup, which raised $54 million since its founding in 2019, struggles through several leadership changes and impulsive spending habits.

Meanwhile, founder and ex-CEO Dr. Abasi Ene-Onong launched a new genomics startup, Syndicate Bio, in the same month.

5. Sendy goes into administration, PayDay searches for a buyer

September saw Kenyan logistics startup Sendy enter into administration—an independent person, Peter Kahi, will take control of the company until it can resolve its financial crisis.

This comes after the company, which was reportedly burning $1 million per month in operating costs, failed to find a buyer.

Meanwhile, Nigerian fintech startup PayDay also confirmed its search for a buyer in September. The company, which raised $3 million in March 2023, faced a series of challenges including contentious salary increases, impulsive management choices and faulty infrastructure.

6. Economy: Kenya joins PAPSS

In September, Kenya became the tenth African country to join the Pan-African Payments and Settlement System (PAPSS).

Trade secretary Moses Kuria made the announcement noting that the Central Bank of Kenya (CBK) had signed the agreement and completed all the necessary formalities.

So far, the service—which is used by nine central banks—has reportedly saved African companies $5 billion in transaction charges.

7. Layoffs: mPharma lays off 150 staff

One year on, and layoffs are still occurring in the tech space.

In September, Ghanaian healthtech mPharma announced that it had laid off 150 employees—including 40 from its Nigerian team. Per CEO Gregory Rockson, the layoff are—unsurprisingly—due “macroeconomic conditions driven by the devaluation of the naira”.

This comes 19 months after the startup raised $35 million in a Series D round.

8. Economy: Sama to provide 2,100 Kenyans with AI jobs

Months after Meta cut ties with it, Kenyan content moderation firm Sama is taking a new turn.

In September, the company announced a pivot from content moderation into artificial intelligence (AI). Per Kenya’s cabinet trade secretary Moses Kuria, the company was set to hire 2,100 Kenyans to work in several AI-focused teams including machine learning, and business process outsourcing (BPO).

9. Social Media: Kenya is still going after TikTok

While Sama might not be interested in moderating content anymore, several other Kenyan players are.

September saw Kenyan officials with a renewed drive to ban TikTok…or at least parts of it. The Kenyan Film Classification Board (KFCB) reportedly requested that TikTok disable its Live feature in the country in a meeting with TikTok CEO Shou Zi Chew. The meeting was held with the Kenyan president to discuss a petition to ban TikTok earlier received by the Kenyan Parliament.

Meanwhile, similar petitions to ban TikTok have surfaced in Uganda and Egypt.

10. Global News: TikTok fined $370 million in the EU

Looks like the social media company is fighting fires everywhere.

In the European Union, TikTok was fined €345 million ($370 million) for violating privacy laws relating to the processing of children’s personal data. Per Ireland’s Data Protection Commissioner, TikTok committed a number of breaches between July and December 2020 including non-verification of age for underage users, and setting visibility for under-16 accounts to “public” by default.

Have you got your tickets to TechCabal’s Moonshot Conference? Click here to do so now!