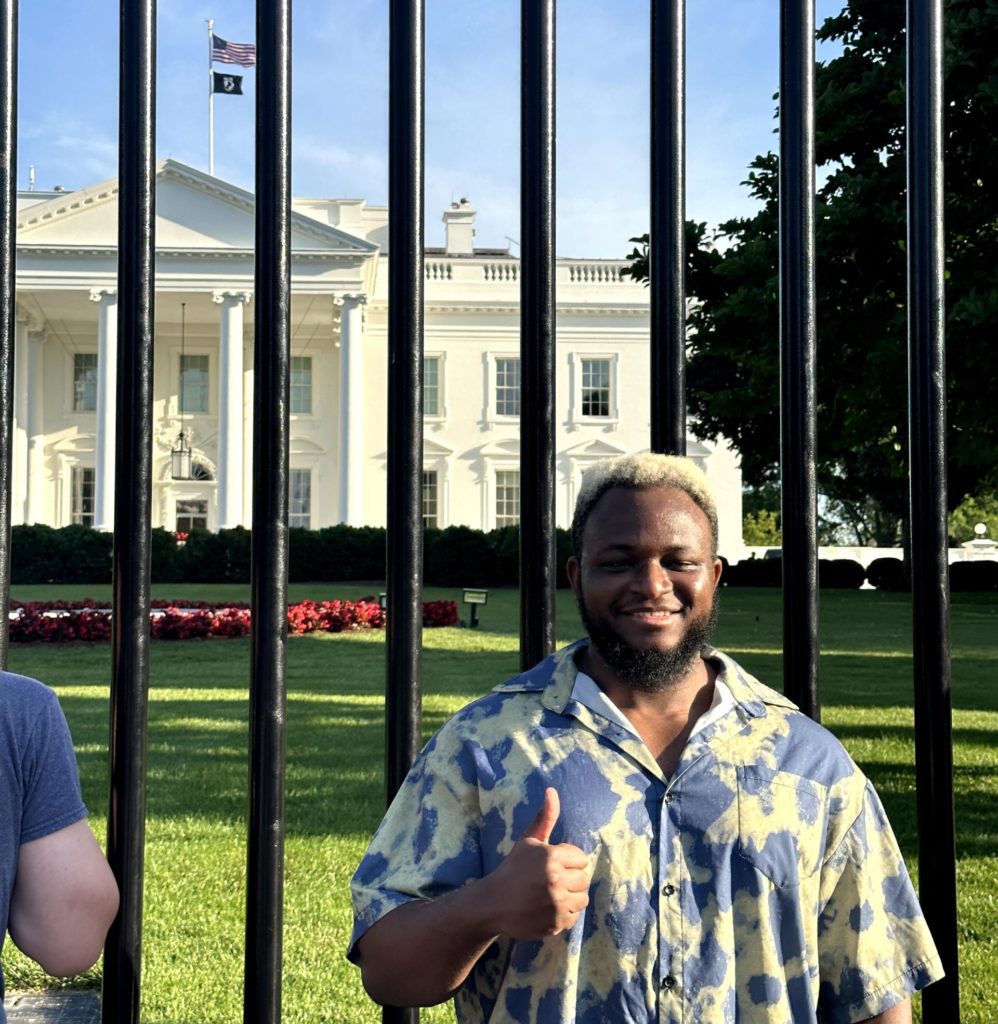

Oluwaleke Fakorede’s story begins on a grim note. On a random weekend in July 2022, after visiting friends in Osogbo, southwest Nigeria, he rode home on his superbike, the sun warming his skin.

Fakorede loved his superbike. For the Nigerian-born software engineer, the bike presented a regular rush of adrenaline break from sedentary work. But on this day in July, zooming through the asphalt tracks of the Osogbo highway, a car appeared out of nowhere and suddenly swerved in front of him. He skidded off the path, his body lurching forward, and in a blur, came crashing down helmet-first onto the hard floor.

“I saw my life flash before my eyes,” recalled Fakorede. “I wasn’t going too fast, so I could still control where I dived to. Thankfully, I was wearing complete gear when [the accident] happened, but I still sustained bruises and sprained my ankle badly.”

The accident occured right in front of a police station. The driver of the rogue car that hit him turned out to be a police officer who claimed his tyre had burst. Instead of holding the officer accountable, other officers turned on Fakorede and threatened to lock him up.

“This is an insane country,” he remembers thinking after leaving the station in disbelief. The following day, still bandaged from the accident and walking cautiously with a limp, Fakorede headed out to drop his damaged bike parts at the mechanic’s. There, another unmarked police car pulled up, and officers jumped out with their guns drawn, demanded his papers, and tried to extort him. They detained him for nearly two hours until he called his father to intervene.

Fakorede would spend weeks recovering physically, and several more years healing from the emotional scar. Until then, he had never seriously considered leaving Nigeria. But it was the accident, and the events that followed, that ignited a strong desire to move abroad and build his career in an environment where, as he puts it, “freedom of movement meant safety.”

The man, his bike, and his dreams abroad

Fakorede is the founder of Proton Tech Lab, but is best known as the Chief Technology Officer (CTO) of GoWagr, a Nigerian ‘prediction market’ startup where over 400,000 users can win money from predicting real-life events. He co-founded the startup with longtime friends, Daniel Oladepo and Michael Okoko, in 2021. But they built their conviction two years later, during the country’s 2023 general elections, when they saw an opportunity to help Nigerians make money.

They tested the idea by building a small spreadsheet to track people’s predictions on election outcomes and awarding winners a share of pooled contributions; a low-tech experiment that validated demand before they shipped the product.

Before GoWagr, Fakorede had built his career across several high-profile Nigerian and foreign startups. An Andela-trained talent, he cut his teeth at Terragon as a data engineer before stints at Denmark’s Sports Compass, Nestcoin, Binance, and Yellow Card. But it was a remote job at Insomnia Labs, a US-based venture studio he joined in 2022, that gave him a real foretaste of life outside Nigeria.

In his two-room apartment in Ife, Osun State, Fakorede built and scaled a tech team to deliver products for companies like Coca-Cola, ICC, Ava Labs, and Coinbase. Steadily, his importance to the team grew. He rose to VP of Engineering, then became CTO. The company decided it was time to meet the man in person.

After his bike incident in July 2022, Fakorede travelled out of Nigeria to the UK for the first time to meet the top brass executives at Insomnia Labs. It left an impression on his employers, and soon, the company wanted him to move permanently.

“I thought, if I were physically closer to the team, we could get so much more done,” he said.

Though he romanticised what life in the UK would look like, Fakorede also thought about Scandinavian countries to settle in. Yet his dream to build GoWagr, the desire that nudged him all along, drew him to the United States, where Insomnia Labs is headquartered.

Moving to the US on an H-1B

In April 2023, Insomnia Labs filed a petition for Fakorede’s H-1B visa, America’s tightly regulated work permit for specialty occupations. The application process was a gamble because the visa is awarded through a lottery. Every year, American companies file petitions for skilled foreign workers, but the demand is far higher than the supply. Hundreds of thousands apply, yet only about a minimum of 85,000 names are selected.

Fakorede’s name did not make the cut at first. He waited with uncertainty, unsure if the door to his American dream had closed. Then, in August that same year, while still at home in Nigeria, he received the call that changed everything. His petition had been picked after all. It took four months.

Bubbling with joy, he moved into the next phase of the journey, starting with the filing of the I-129 petition with the US Citizenship and Immigration Services (USCIS), the official request that allows an employer to sponsor a foreign worker for an H-1B visa. After that came legal filings, credential checks, and preparations for the embassy interview. Fakorede quickly realised that getting his petition picked was only the first hurdle. Insomnia Labs, as his sponsor, handled the paperwork and lawyer fees, but it required patience despite the fast-tracked process.

“We opted for premium processing to expedite the full H-1B visa approval; this usually takes about two weeks,” said Fakorede, adding that his petition got approved, inching him another step closer to the American dream. “But I was outside the United States at the time, so I needed a visa to enter the country. I went back to the embassy to do that.”

When he went for his visa interview at the US embassy in Nigeria, officials said the administrative processing would take two weeks and held on to his passport. What was meant to be a short wait stretched into nearly two months. He couldn’t travel. Every day, he refreshed the portal, checking anxiously as the status remained pending. Finally, after another two months, he saw that his visa had been issued.

By December 2023, everything was finally in place. He sold his bike, said goodbye to friends and family, and boarded a plane to the United States on February 1, 2024. The day marked a personal rebirth and the start of a new chapter he anticipated would be radically different from what he was used to in Nigeria, Fakorede reminisced.

Embracing life at Insomnia Labs in the US, he thrived, quickly integrating into the team and making significant contributions at the highest levels. But even as he found stability, he was already thinking ahead.

A year later, in mid-2025, Fakorede upgraded his stay in the US to the O-1 nonimmigrant work visa, reserved for individuals of “extraordinary ability.” This gives him a clearer path to permanent residency in the US, and finally, the freedom to leave employment and focus fully on GoWagr.

In July 2025, he resigned from his role at Insomnia Labs.

Life on the East Coast

No stranger to travelling before his migration to the US, Fakorede admitted there were the usual culture shocks. But living costs probably rank high up that list. In Manhattan, New York, where he briefly lived when he was visiting the US in 2023, he paid $2,800 for a studio apartment monthly. He was also mostly ordering food and eating out, stretching those costs.

“I even made a little app just to calculate what I’d actually spend,” he said, laughing. “But cooking is definitely cheaper than weeks of spending $500 on Uber Eats and DoorDash; I’ve done the math multiple times.”

To cut costs, Fakorede moved to a one-bedroom house in downtown Newark, New Jersey, where he pays $2,200. There, he began cooking his own meals, saving a fraction of the costs. When it came to work, Fakorede settled into a routine of late-night work calls with his GoWagr Nigerian teammates.

“We joke that our startup runs 24/7,” he said. By day, he leads the engineering team to ship features; at other times, he anchors partnerships, strategy, and investor meetings abroad.

Communities have helped him adjust in the US. In New York, he inserted himself into founder meetups and immigrant-focused groups where dinners and casual introductions opened doors to people he once only read about.

“Three months ago, I was in Goldman Sachs HQ in New York, speaking with a couple of VPs and some very big shots,” said Fakorede. “No way I’d be doing that in Nigeria.”

Build for home, but don’t lose touch with home

If Nigeria gave Fakorede grit, the United States gave him perspective. In America, prediction markets like Polymarket are edging towards unicorn status, riding on the back of stronger regulatory clarity and investor appetite. Africa, by contrast, has no defined regulatory category. Prediction often risks getting lumped together with gambling, almost comically, and this stifles innovation.

“What I saw here was different,” Fakorede noted. “In the US, it’s not just luck. It’s skill-based, community-driven. That was refreshing, and that’s what we wanted to bring back home.”

GoWagr officially launched in 2023, just after Nigeria’s elections. By re-framing prediction markets as skill and participation rather than gambling, the startup found a foothold among young Nigerians.

Yet African investors remain cautious. Many struggle to differentiate prediction markets from betting, and few understand the model deeply.

“Some local investors in Nigeria don’t understand the model until you mention Polymarket,” he explained. “Others just wait to see numbers. But with or without them, we’ll get there. The only question is how fast.”

With some good numbers now rolling in across users and revenue, Fakorede doesn’t think it is harder to convince sceptical investors.

Yet his fundraising game of chess is two-pronged: he uses his location advantage to speak with high-value foreign investors who understand the model, scale potential, early-to-market appeal, and Africa’s massive exposure to eSports. Locally, the numbers, culture tap-in, and a gateway to buying into a global business become the sell.

For the ex-Insomnia Labs chief, being global is not just a strategy—it’s survival. Okoko, his equally technical co-founder, covers the Nigerian time zone; Fakorede anchors the American side. Between them, the product never sleeps.

The Osogbo accident on that fateful afternoon taught Fakorede about uncertainty—no, the fickleness of existence, yet the grace to lead a life of urgency. Throughout his career, he has earned high praise, but he considers GoWagr his life’s work, and there’s an unreal work ethic he has committed to building the company of his dream.

He’s chasing scale. The United States, its savoir faire that rubs off on just about anyone who spends a week there, and Silicon Valley’s somewhat performative élan for business-dealing have become all too familiar to Fakorede. GoWagr will be a global affair, he tells me, quite possibly the biggest startup of its kind from Africa. And there in America, he has the precedents he badly lacks in his home continent to learn from.

As we wrapped up our call, Fakorede didn’t punt. He delivers his point like a rugby wing diving for the try line, making it clear that you cannot build for an African market you are losing touch with as a nomadic or location-independent founder. His hack is to have co-pilots—comrades-in-arms if you like—on the ground building GoWagr for an African market where consumer behaviour is often erratic.

Mark your calendars! Moonshot by TechCabal is back in Lagos on October 15–16! Join Africa’s top founders, creatives & tech leaders for 2 days of keynotes, mixers & future-forward ideas. Early bird tickets now 20% off—don’t snooze! moonshot.techcabal.com

Image: TechCabal

Image: TechCabal