Abstract

Africa’s fintech ecosystem has scaled rapidly, but the question now is whether that growth can deliver long-term impact. Can fintech adoption keep pace with the infrastructure needed to support it? The answer will decide if Africa’s rapid growth translates into resilience and sustainable scale. For fintech startups, banks, and e-commerce platforms, the stakes are clear: the future of digital finance in Africa will be built on robust rails, regulatory clarity, and user-centric innovation. Early examples from infrastructure providers such as Unipesa show how operators are beginning to link these foundations to sustainable scale.

Africa’s fintech story is often viewed as a success, with hundreds of millions of people using mobile money and digital payments as part of their daily lives. Yet underlying challenges remain. Growth has outpaced the systems designed to support it, driving up costs, straining networks, and testing trust.

On the ground, the picture is more complex. Transaction costs remain high. Regulations shift with every border. Infrastructure buckles under volume, creating user churn and operational risk. For fintech startups in Africa, these aren’t small inefficiencies but systemic challenges that drag on margins and stall growth.

The next phase isn’t about adding wallets but building foundations. Payments need to move smoothly across markets. The future of fintech in Africa depends on rails that interconnect markets, regulatory frameworks that align, and infrastructure that holds steady at scale.

Multinational operators recognize that the friction is structural rather than incidental. Fragmented systems yield fragmented outcomes, rendering the regional scale nearly impossible to achieve without foundational fixes.

The next five years will hinge on resilient fintech infrastructure, regulatory clarity, operator-grade tools, and whether stakeholders are ready to invest in long-term, scalable solutions. For banks, e-commerce platforms, and fintechs pursuing regional expansion, the choices made now will determine whether growth leads to stability in Africa’s digital finance sector, says Vasily Raku, Chief Commercial Officer at Unipesa.

Fintech Opportunities in Africa: Regional Behavior, Inclusion, and Embedded Payments

Opportunities exist across the region, but they are distributed unevenly and require localized strategies. Digital finance is embedded in daily life across much of Africa, but regional variations demand a localized strategy for sustainable growth.

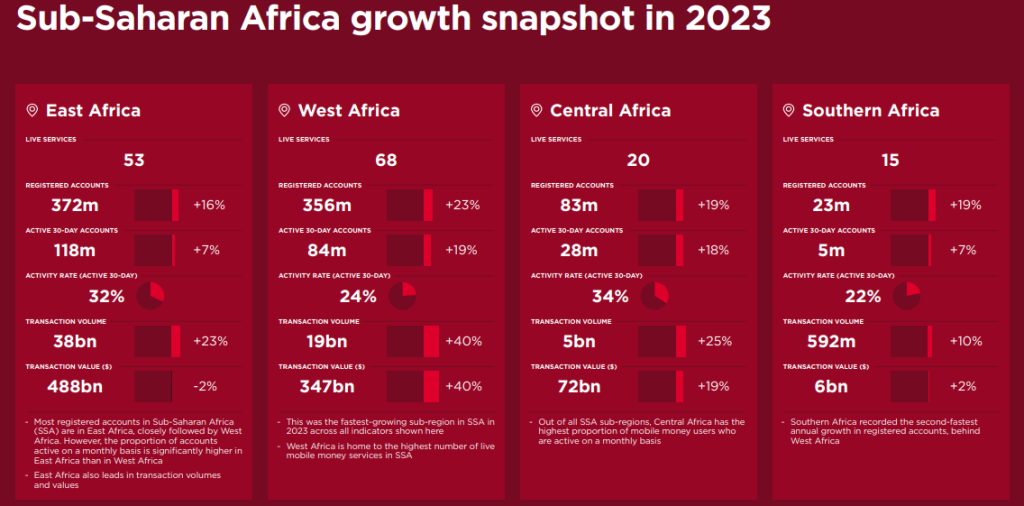

Mobile money growth looks very different across Africa: East Africa leads in daily use, West Africa is onboarding fastest, and Central Africa keeps users most engaged.

African fintech growth takes different paths. In East Africa, success means rails strong enough to handle daily payments. In West Africa, the focus is on onboarding systems that can scale quickly. In Central Africa, tools that keep monthly users engaged are most important. For fintechs, banks, and e-commerce platforms, the message is clear: design around local behavior, not one-size-fits-all models.

Financial inclusion in Africa is rising but unevenly. Women, rural households, and low-income adults still trail 7 to 20 percentage points in account ownership, World Bank data shows. Closing the gap requires more than just access; it also needs tailored credit, savings, and insurance. Further research on mobile fintech adoption in Sub-Saharan Africa shows that uptake grows when users perceive tangible value, encounter intuitive interfaces, and can trust the system.

At the same time, mobile payments in Africa remain the default entry point for millions. Multi-rail integration across USSD, QR, NFC, and SMS is crucial for extending access to all user segments. Without it, many users will remain excluded from formal financial systems. This model can be seen in providers such as Unipesa, which integrate these channels through hosted payment and API layers.

Providers operating across 20 or more African markets confirm the same pattern. Merchants in Nairobi prefer QR, while rural households in Malawi still rely on USSD. A layered approach to banking technology in Africa is essential to ensure no user segment is left behind.

What’s Holding African Fintech Back: Infrastructure, Regulation, and Cost Pressures

Momentum is undeniable, but growth is hitting limits that can’t be ignored. The most significant risks are not about user adoption but about what happens behind the scenes. Below are three barriers that will determine whether Africa’s fintech sector can scale sustainably.

Cross-Border Payments Remain Too Expensive

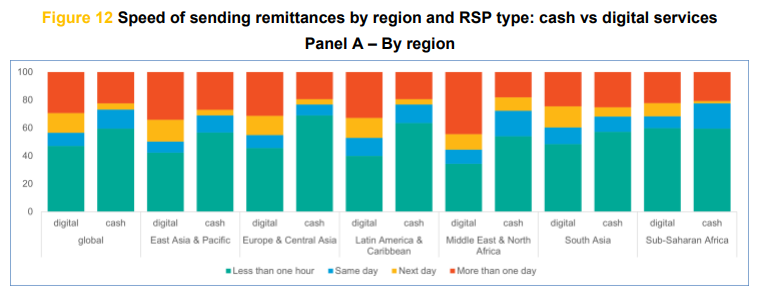

For every $100 sent to Sub-Saharan Africa, $8.45 disappears in fees, making it the costliest remittance destination, per World Bank figures.

Persistently high costs erode the viability of cross-border fintech solutions. For e-commerce platforms, making supplier payments is a more complex process.

Unipesa provides an example of how infrastructure partners connect payment networks with multi-currency settlement and compliance-ready onboarding to reduce costs and improve visibility. With operations across more than 20 African markets, it illustrates how regional players are navigating fragmented settlement systems while keeping expansion viable. SMB banks face increased FX exposure, and fintech startups in Africa are already operating on tight margins.

As a specialist in African fintech infrastructure, Unipesa also illustrates how infrastructure partners support scale with developer-focused tools such as bulk operations, hosted checkout, and reconciliation systems, helping fintechs expand without rebuilding in each market.

Regulatory Fragmentation and Policy Gaps

The African Continental Free Trade Area (AfCFTA) Protocol on Digital Trade provides a framework for harmonized rules governing data, payments, and electronic signatures. It is designed to reduce friction for providers scaling across markets, but execution remains uneven.

A study on mobile money and financial inclusion revealed that policy fragmentation increases compliance costs and limits access, making regulatory harmonization essential for fintech regulation in Africa to drive growth.

For businesses, fragmented regulation often results in:

- Repeating KYC requirements across different jurisdictions

- Navigating inconsistent transaction limits

- Managing ongoing compliance uncertainty

Leveraging its expertise in African compliance, Unipesa, for instance, illustrates how providers operationalize compliance by using regionally aligned templates and real-time KYC alerts to ease regulatory friction across multiple jurisdictions.

Infrastructure and Network Constraints

A study about telecom network coverage and financial inclusion found that weak connectivity directly reduces fintech adoption, leading to higher churn and slower repayment.

This is why financial services transformation hinges on resilient infrastructure. Unipesa, for example, has emphasized retry-friendly APIs and offline agent support, illustrating how providers adapt infrastructure to uneven connectivity.

Fraud monitoring, tokenization, and PCI DSS-aligned controls are essential for operating effectively at scale. Providers also need tools that reconcile transactions and manage failed payments. From e-commerce checkouts to bank disbursements, performance depends on this layer of banking technology in Africa.

Africa’s Emerging Fintech Markets: Revenue Potential and Next-Gen Payment System

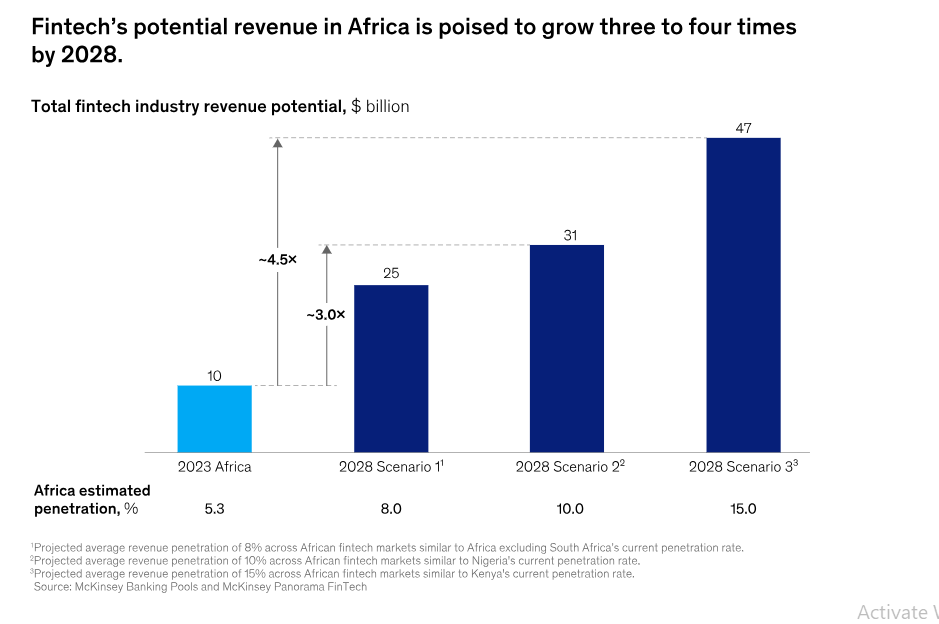

The growth outlook is ambitious but remains tied to realistic conditions. By 2028, African fintech revenues could grow 3 to 4.5 times, up to $47 billion. That scale of growth depends on two key factors: deeper adoption of digital accounts and stronger infrastructure to support the increased load. The opportunity is enormous, but only if the rails mature.

For e-commerce platforms, this means embedding payments at checkout and routing them based on cost and risk. For SMB banks, pairing working capital with automated KYC and reliable repayment rails. For fintech startups, this means utilizing shared onboarding, payout, and reconciliation infrastructure that reduces costs and accelerates time to market.

Adoption improves when the value is clear and the regulatory expectations are predictable. Policy support and next-gen payment systems will drive this. Further fintech innovation in Africa is expected as providers extend basic wallets with credit scoring, insurance, and cross-border tools.

Governments are also beginning to integrate fintech rails into national payment switches. Providers such as Unipesa are contributing to this frontier, linking compliance-ready systems with public infrastructure. Unipesa also illustrates how operator-grade security from tokenization to 3-D Secure is being embedded into interoperable rails that underpin the next wave of African fintech growth.

The Road Ahead: Building Resilient, Scalable, and Inclusive Fintech in Africa

Africa has already proven the power of mobile money. However, sustaining progress will require more than just adoption. Transaction costs must fall. Regulation must align across borders. And fintech infrastructure in Africa must support scale, security, and inclusion.

The next five years will determine whether digital finance in Africa matures into a genuine transformation of financial services. Operators that invest early in resilient rails, compliance-ready systems, and inclusive design will shape the future. For e-commerce platforms, banks, and fintech startups, growth depends on working with infrastructure partners who bring regional expertise and operator-grade tools.

In Africa’s digital economy, resilience is what ensures that growth at scale becomes sustainable and delivers long-term impact. Providers such as Unipesa, which work across banks, governments, fintechs, and e-commerce platforms, illustrate how regional expertise and multi-stakeholder infrastructure are being applied in practice to bridge these gaps.

About the Author

Written by the Strategy Team at Unipesa, a financial services infrastructure provider operating in 20+ African markets. Unipesa supports banks, governments, fintechs, and e-commerce platforms with secure, scalable digital finance solutions.

Media Contact:

Vasily Raku

Chief Commercial Officer, Unipesa

Chief Product Officer, Unipesa

info@unipesa.com

+971 58 683 2480

References:

- African Union. (2024, February 18). Protocol to the African Continental Free Trade Area (AfCFTA) on Digital Trade. African Union. Available at: https://au.int/sites/default/files/treaties/45079-treaty-EN_AfCFTA_Protocol_on_Digital_Trade.pdf

- GSMA. (2024, October). State of the Industry Report on Mobile Money 2024. GSMA. Available at: https://www.gsma.com/solutions-and-impact/connectivity-for-good/mobile-for-development/wp-content/uploads/2024/10/SOTIR-2024-regional-cuts.pdf

- Hornuf, L., Safari, K. & Voshaar, J. (2024, August 17). Mobile fintech adoption in Sub-Saharan Africa: A systematic literature review and meta-analysis. Research in International Business and Finance, 73(3): Article 102529. Available at: https://www.researchgate.net/publication/383210130_Mobile_Fintech_Adoption_in_Sub-Saharan_Africa_A_Systematic_Literature_Review_and_Meta-Analysis

- McKinsey & Company. (2024, December 10). Redefining success: A new playbook for African fintech leaders. McKinsey & Company. Available at: https://www.mckinsey.com/industries/financial-services/our-insights/redefining-success-a-new-playbook-for-african-fintech-leaders

- Mothobi, O. & Kebotsamang, K. (2024, January 19). Determinants of mobile money adoption: A meta-analysis of Sub-Saharan Africa. Journal of Economic Structures, 13(1): Article 26. Available at: https://journalofeconomicstructures.springeropen.com/articles/10.1186/s40008-023-00326-7

- Osabutey, E.L.C. & Jackson, T. (2024, March 22). Identification of innovation drivers based on technology-related news articles. Technological Forecasting & Social Change, 213: pp. 1–17. Available at: https://researchportal.northumbria.ac.uk/ws/portalfiles/portal/135140195/1_s2.0_S0040162524001355_main.pdf

- World Bank. (2025, January 8). Data From the Global Findex 2021: Progress and Obstacles. World Bank. Available at: https://www.worldbank.org/en/publication/globalfindex/brief/data-from-the-global-findex-2021-progress-and-obstacles

- World Bank. (2024, September). Remittance Prices Worldwide: Issue 49, Q3 2024. World Bank. Available at: https://remittanceprices.worldbank.org/sites/default/files/rpw_main_report_and_annex_q324.pdf