In Africa, the most vital drivers across the natural resources value chain—critical small and medium-sized enterprises (CSMEs) in energy, agriculture, minerals, infrastructure, and mining—lack access to the capital they need to grow.

The urgency of this issue is undeniable: According to the African Development Bank (AfDB), SMEs account for over 90% of all businesses on the continent and provide nearly 80% of total employment, underscoring their critical importance. Yet, despite being the backbone of economic growth, these businesses face a persistent financing gap that the AfDB estimates to exceed $421 billion.

This massive shortfall is largely driven by commercial banks’ perception of SMEs as high-risk borrowers, leading to stringent lending requirements that effectively exclude a significant number of viable businesses from the formal financial channels that could otherwise sustain and transform them.

In 2015, Moneda Invest Africa was born from the conviction that this financial system had to change, especially after that year’s foreign exchange crisis. The company is a pan-African alternative fund provider offering bespoke capital and technical support to SMEs in critical natural resource value chains that are pivotal to Africa‘s economic growth.

Over the past decade, Moneda’s model has bridged global investors with African fund managers, combining international capital with local expertise, alternative credit solutions, and a strong emphasis on local content in Africa. Moneda has evolved from a disruptor to a definitive architect of African-led credit, pioneering a no-collateral, zero interest, profit-sharing model that has successfully bridged global diasporan capital with critical enterprises on the continent.

This is the story of Moneda’s first ten years: A journey of vision, resilience, and a singular focus on transforming Africa’s natural resources into wealth.

The vision: Turning a crisis into an opportunity

For Group CEO Ejike Egbuagu, the mission has always been about fixing the capital supply problem for critical SMEs—those micro and mid-level players whose existence and growth are essential for continental transformation.

“We are attracted to gaps in markets”, Egbuagu said. “We believe that these form fundamental opportunities for a player like Moneda to step in, create clarity, and value.”

By 2017-2018, the strategy paid off. After raising initial capital, Moneda facilitated strategic financing that supported its client in executing over 20,000 Metric Tons (MT) of Gasoil supplies to offshore oil production rigs for Chevron Nigeria. Scaling rapidly, Moneda expanded foreign lines to $25 million, enabling its client to become the largest single supplier of Gasoil to Total Upstream Nigeria. Moneda crossed 100,000MT in petroleum products delivered by its client, solidifying its reputation as a capable operator.

This early success led to a pivotal decision in 2019: Moneda ended all exclusive advisory contracts to work with a broader range of clients, securing regulatory approvals and officially moving from an advisor role to a Joint Venture (JV) investor status by 2020.

This strategic pivot has been key to attracting investors who share their mission. “For us, relationships, referrals, and track record in delivering our mandate has helped us win over the kind of capital that would help drive the continent forward,” Egbuagu says. “Some of our partners operate from outside the continent, and they believe our operational model has helped us deliver our promise to critical SMEs.”

Moneda’s biggest accomplishment, Egbuagu says, is the hope they have given to many critical SMEs who would otherwise have folded up if they relied solely on traditional financing models.

“Our hope for the next decade would be to bring in more wealth into the continent. More investments, more capital and more opportunities to drive the continent forward through our economic drivers – the critical SMEs,” Egbuagu says.

De-risking the future: An integrated African architecture

Traditional banks often rely on generic, global risk models that fail to grasp the nuances and actual value present in the African SME landscape, says Olajumoke Adekanmi, Chief Risk Officer at Moneda. Moneda’s success lies, instead, in equating collateral with risk management.

The firm operates through three core verticals: risk advisory, asset management, and commodities, which houses their five major ventures: Domena Commodities, Afrisand, DT Mining, Moneda Capital, and Musa.

1. Risk Management: In high-volatility sectors like oil, energy, and commodities, Moneda understands that intelligent risk management is the cornerstone of sustainable trade. The firm moves beyond traditional collateral-based lending to provide strategic advisory and advanced risk mitigation expertise directly to clients. This ensures every transaction is structured, not only for financial viability, but also for long-term value alignment, helping clients manage market volatility and navigate complex regulatory environments.

2. Asset Management: This vertical identifies, acquires, and optimises high-potential assets across energy, mining, and commodity logistics, prioritising long-term value and strengthening SMEs within critical value chains. It spans the full asset cycle—from opportunity identification and risk evaluation to performance optimisation and execution—deploying capital where it delivers measurable impact.

Moneda Capital, the Mauritius-licensed fund under this vertical, provides private credit to high-growth SMEs across agriculture, energy, minerals, and infrastructure. This work is strengthened by Musa, Moneda’s digital-first financing infrastructure that streamlines cross border and local payments, enhances transaction oversight, and ensures efficient capital deployment through automated risk management and transparent payment flows.

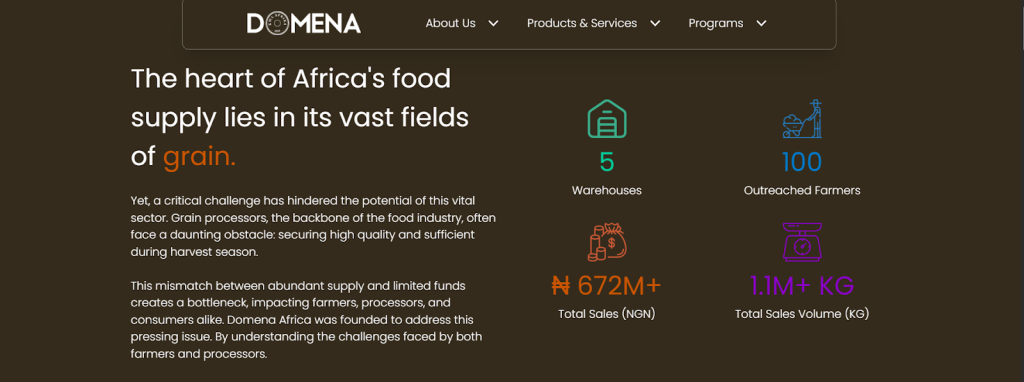

3. Commodities: At Moneda, its commodities vertical is a deliberate act of continent-building, built around efficient, transparent, and scalable trade in Africa’s key natural resource sectors. Through Domena Commodities, Afrisand, and DT Mining, the firm executes structured trading in natural resources products such as, agricultural products, oil and gas products, minerals and industrial inputs, strengthening supply chains, improving local content participation, and ensuring that value from Africa’s natural wealth circulates within the continent.

Moneda’s deep operational involvement is key to how it manages its core commitment to ‘local content’ and ‘inclusive prosperity’. “For us, a commitment to local content means ensuring that African businesses, African critical SMEs, and African professionals are the primary beneficiaries of major projects and contracts,” Adekanmi explains.

Instead of routinely turning to multinational corporations that repatriate profits, Moneda intentionally channels financing and capacity-building toward African-owned entities. This approach, she says, “keeps value—capital, jobs, and skills—circulating within the continent and creates a pathway for inclusive prosperity driven by African talent and African resources.”

The pan-African team and tech

This ethos is structurally supported by a vast, experienced team. Moneda now operates offices in Namibia, South Africa, Nigeria, and Mauritius, with a footprint across seven African countries, including Ghana, Botswana, and the Democratic Republic of Congo.

The team is intentionally built on a deep cultural understanding. “Everyone at Moneda is either African, grew up in Africa, or is deeply Africa-focused, meaning cultural understanding and local context are embedded into every decision we make,” Adekanmi says.

Quicker risk assessment with Musa

Originally launched in 2023 and rechristened in 2024, Musa began as a Moneda initiative to leverage technology to solve the inefficiencies, lack of speed and lack of risk oversight that impede traditional finance from extending credit to critical SMEs. The venture has grown rapidly to become a lending and transaction management software that not only enables African alternative financiers to seamlessly provide credit to CSMEs but also provides them with the payment processing capabilities to create value with that credit.

For Moneda, Musa reinforces the belief in the no-collateral model as effective risk assessment and monitoring backed by technology makes financing fast, transparent, and accessible as evidenced by Moneda’s track record over the last few years. With its capability to handle seamless cross-border and local payment processing for African enterprises, Musa also ensures swift and efficient deployment of capital.

Corporate Social Responsibility

Through their Corporate Social Responsibility (CSR) initiative, 1952 Africa, launched in 2021, Moneda is actively supporting Africa’s creative future.

“We see culture as a cornerstone of identity, social cohesion, and community resilience,” the company states. 1952 Africa supports emerging African artists through residencies, mentorship programs, and global engagement, anchoring the economic mission in the continent’s rich cultural legacy.

Just as Moneda channels African financial wealth back into local enterprises, 1952 Africa channels the continent’s cultural and intellectual wealth into global visibility. Through the elevation of African voices and artistic narratives, Moneda is anchoring its economic mission in the continent’s rich cultural legacy, affirming that African resources, whether financial or creative, must first work for Africa and define its future. This dedication ensures Moneda’s ethos of inclusive prosperity is lived daily, building a legacy that supports both the physical infrastructure (SMEs) and the social infrastructure (culture) of the continent.

The transformative impact

The most compelling proof of Moneda’s model is in the stories of the businesses they empower. For many critical SMEs, Moneda is not just a lender; they are the stability that allows for true, sustainable growth, demonstrating that risk can be managed without prohibitive collateral.

- Draise Energy Nigeria Limited

For Adegboyega Ige, COO of Draise Energy Nigeria Limited, the problem was simple: collateral and speed.

“Before partnering with Moneda, we relied heavily on banks for financial support, but we reached a point where they simply could not meet our needs,” Ige says.

The lack of collateral and lengthy processing times, even when support was possible, forced them into the highly volatile world of loan sharks with crippling monthly interest rates (sometimes as high as 15%).

Moneda’s intervention was transformative. “They removed the collateral requirement completely and offered a much faster disbursement process. The fact that Moneda does not charge interest was the first major relief, and their speed was the second. Those two things alone solved problems that banks never could,” Ige says.

Moneda’s profit-sharing model meant Draise Energy could dramatically reduce its mark-ups, and significantly improve patronage and competitiveness. “Working with Moneda has had a direct and transformative impact on our growth,” Ige concludes. “That assurance changed everything for us… Moneda has enabled us to operate with better pricing, better speed, and far less stress—all of which have contributed directly to our growth.”

“Another major benefit is the flexibility. If a project experiences delays, Moneda doesn’t exert the kind of pressure we faced with banks or loan sharks. That breathing room has given us stability, improved client relationships, and allowed us to take on and deliver more work confidently,” Ige says.

- Neptune Services

Operating in the complex environment of the Democratic Republic of Congo (DRC), Mike Luboya, CEO of Neptune Services, highlights Moneda’s understanding of operational realities.

“Traditional financing in many African markets, especially in places like the DRC, is extremely difficult for SMEs to access,” Luboya says, noting how slow, unpredictable approval processes derail critical project execution.

Luboya views Moneda as “a new generation of African capital that enables businesses, rather than blocking them.” Moneda offered a model that “actually understands how SMEs in critical sectors operate. Their financing is fast, flexible, and does not hinge on impossible collateral demands,” Luboya says.

For Neptune Services, Moneda provided financing and real project support, making it possible to “turn opportunities into real projects” by eliminating the delays that plagued traditional capital systems.

The next decade: Wealth, culture, and legacy

As Moneda enters its second decade, the firm is focused on scaling its impact and deepening its commitment to the continent’s wealth creation. While the economic mission remains paramount, Moneda understands that true prosperity is holistic.

Moneda Invest Africa’s 10-year journey is a powerful demonstration of how strategic vision, local knowledge, and an unwavering belief in African capacity can reshape the continent’s economic landscape. Bypassing outdated risk models and building an integrated ecosystem that champions local content, set Moneda as a builder of the modern architecture of African-led prosperity.

The firm acts as the crucial architecture that channels this African wealth back into African enterprises through its integration of capital, assets, and execution.

Looking forward, Moneda is preparing to mark this milestone by celebrating the continent’s true economic transformers, the critical SMEs they fund, and reinforcing its commitment to financing their growth. This celebration points to the fact that the future of African economic self-determination will be written not by foreign aid or debt, but by Africa’s own capital, driven by Moneda’s model of intelligent risk, inclusive investment, and an unwavering belief in local capacity.

The past decade built the platform, and the next will unleash its full transformative potential.