IN PARTNERSHIP WITH

Happy pre-salary day 🎊

If you’re in Nigeria, the name Moniepoint might ring some bells, but what about its parent company TeamApt?

Last year, the Nigerian fintech company—which owns Moniepoint—processed an annual total payments volume exceeding $170 billion.

With those numbers, the company should be in the same league as fintech giants, Flutterwave, OPay, and Interswitch. It’s not, though. Even though the fintech has been around since 2015, people have heard more about TeamApt’s products than they have about the company itself. Now, TeamApt has rebranded itself as Moniepoint—its most popular product—so more people can find out about it.

In this article, our reporter Muktar breaks down the essence of branding and how it may make or break TeamApt’s future.

CRYPTO MARKET

|

|

|

|---|---|---|

|

Bitcoin

|

$23,093 |

+ 1.70% |

|

Ether

|

$1,637 |

+ 0.34% |

|

BNB

|

$321 |

+ 5.52% |

|

Solana

|

$24.84 |

+ 1.01% |

|

|

Source: CoinMarketCap

|

|

* Data as of 05:40 AM WAT, Janaury 24, 2023.

NEW RULES FOR CRYPTO ADS IN SA

Last year, South Africa classified crypto assets as financial products. Now, the country’s Advertising Regulatory Board (ARB) has updated its Code of Advertising Practice with a clause specifically targeting the advertisement of crypto assets.

South Africans have fallen victim to some of the world’s largest cryptocurrency frauds. To protect them from falling into more due to misleading cryptocurrency advertisements, global cryptocurrency company Luno worked with the ARB to establish this clause.

What does the new clause say?

The new clause is 17 of Section III within the Code of Advertising Practice. Summarily, it says that:

- Advertisements must expressly and clearly state that investing in crypto assets may result in the loss of capital, and the overall message of the advertisement must not contradict the warning statements.

- An advertisement for a particular crypto asset service or product must explain the relevant product or service in an easily understandable way for the intended target audience. It must also give a balanced message about the benefits and risks associated with the product or service.

- Influencers or ambassadors must share only factual information and not offer advice on trading or crypto assets or promise benefits or returns. Advertised returns must be supported by an explanation of the calculated rate of return and what significant conditions apply.

- Information presented about past performance of the advertised asset must make it clear that past performance is not indicative of future performance.

- Advertisements by crypto asset service providers who are not registered credit providers should not encourage the purchase of crypto assets on credit.

Receive money from family and friends living abroad in minutes this holiday season with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

DELAYED CBK LICENCE THREATENS DIGITAL LENDERS

Digital lenders say that the Central Bank of Kenya (CBK) is taking too long to issue operational licences and that the delay is putting them in a precarious economic situation.

ICYMI: Last year, the CBK mandated that all digital lenders register for a new licence under a newly enacted regulation that seeks to rein in the predatory lending and consumer privacy violations that had permeated the space. By September last year, the CBK had cleared only 10 lenders for fresh licensing, as directed by the regulator. These licensed lenders include CeresTech Limited, Getcash Capital Limited, Jijenge Credit Limited, and seven others. Other 278 digital lenders that applied were allowed to continue with their business as they await CBK’s response to their application.

They are still operating, so what’s the problem?

Since December 15, 2022, Google has refused to host loan apps that don’t have said CBK licences, and the CBK has not licensed any other digital lender aside from the aforementioned 10 lenders.

This is costing the unlicensed digital lenders millions of customers—borrowers who are unable to download or get an update on their personal loan apps.

It’s not just interest on customers’ short-term loans that they are losing out on. Investors are also refusing to fund digital lenders who can’t prove their credibility with the CBK certification.

Digital lenders, unlike banks and microfinance firms, do not accept deposits that are then lent to borrowers. Unless and until they acquire the CBK licences, their sceptical investors will not pump money into them, and they will run out of money and finally go out of business.

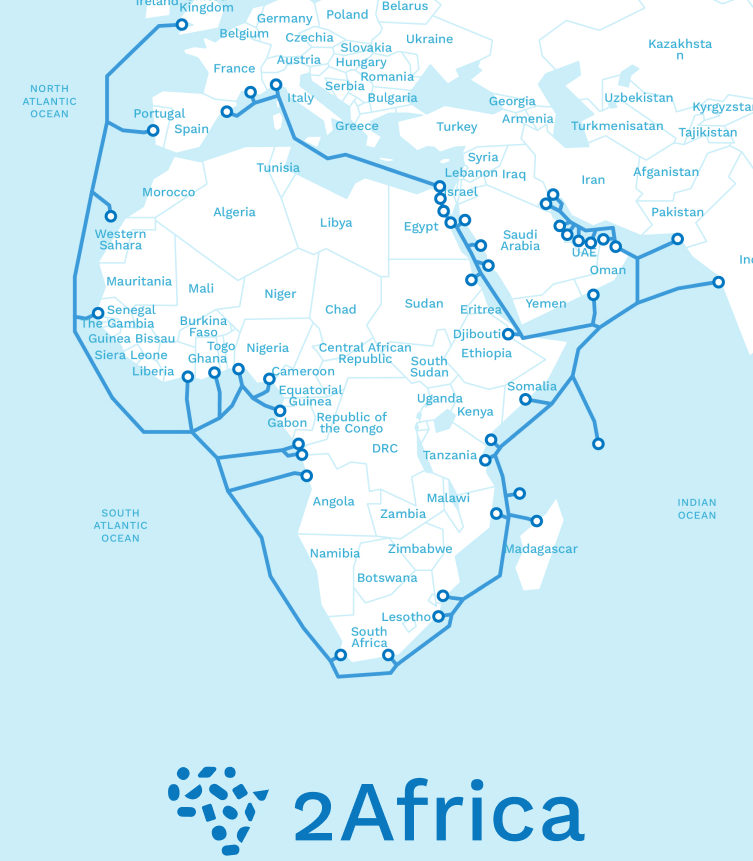

2AFRICA SUBMARINE CABLE LANDS IN SOUTH AFRICA

Another submarine cable is set to touch down Africa in key areas.

2Africa’s submarine cable has landed in South Africa, from where it will travel to other landing points in Africa and power advanced internet infrastructure on the continent. The cable, which landed in a Vodacom facility in Gqeberha, is the first of its kind in the Eastern Cape and is scheduled to begin full operations in 2024.

Sidebar: A submarine cable is a fibre optic cable that connects countries across the world, usually laid on the floor of oceans. They help to carry telecommunications signals across stretches of water bodies and connect to land-based stations.

The landing of the 2Africa cable comes with a promise for South Africans: quality and cheaper internet services, rural connectivity, and reduced latency. It will also create more local jobs and grow the South African economy—from $26.2 billion to $36.9 billion in three years, according to Vodacom’s press release.

The project was executed by the 2Africa consortium, a collaboration of eight industry stakeholders including China Mobile International, Meta, MTN GlobalConnect, Orange, center3 (stc), Telecom Egypt, Vodafone/Vodacom, and the West Indian Ocean Cable Company (WIOCC).

Zoom Out: Internet experience in Africa is generally poor. The average data cost of 1GB in sub-Saharan Africa is around $6.4 dollars, owing to a lack of optimised internet infrastructure. Google’s Equiano cable is an earlier intervention to this problem. Running from Portugal to South Africa, the cable is touted to increase internet speed by a factor of six, create millions of jobs, and boost the GDPs of the African countries it lands in.

Build programmable, in-person payment experiences with Paystack Terminal.

This is partner content.

EVENT: STATE OF TECH IN AFRICA Q4 2022

Join us on January 27, on a special edition of TechCabal Live. We’ll be launching “The State of Tech report”. The State of Tech Report is our flagship report that analyses quarterly data on acquisitions, expansions, product launches, and funding in Africa’s tech ecosystem.

This edition looks at 2022 in retrospect and contains interesting patterns and trends to look out for this year. At the event, we will discuss actionable insights and findings from the report with you and share our perspectives on the outlook of Africa’s tech landscape.

IN OTHER NEWS FROM TECHCABAL

The Next Wave: Africa needs to tell its own tech stories…just not the bad ones.

OPPORTUNITIES

- The GROW Impact Accelerator is now accepting applications from agritech startups offering solutions to the problems facing the processing, packaging and transportation of food. Apply by January 30.

- The 100x Impact Accelerator is open to applications from impact-driven social enterprises that work across eight sectors including health, climate and education. Selected enterprises selected will receive £150,000 grants and access to LSE’s world-class expertise, plus a 12-week programme of bespoke support from experts and social unicorn founders. Register by March 10.

- Do you have what it takes to become the next supplier to leading South African enterprises in the furniture sector? Apply for the 2023 eThekwini Furniture Cluster Acceleration Programme. Apply by February 28, 2023.

- The Jasiri Talent Investor Programme is looking for highly driven individuals with a history of achievement and/or entrepreneurial action who aspire to launch a high-growth venture. Apply by April 23, 2023.

- Application for the first cohort of the SME Growth Lab Africa’s accelerator programme 2023 is now open. The digital accelerator programme is designed to empower business owners with digital skills, knowledge, mentorship and community events with the aim of transforming their businesses and driving economic growth. Apply by January 30, 2023.

- The GSMA AgriTech Accelerator is now accepting applications from innovative, revenue-generating digital agriculture solutions that support the shared vision of improving smallholder farmers. Cohort members will benefit from targeted consulting from the GSMA team, user experience and product design/management support, farmer feedback surveys, access to GSMA events and insights and capacity building for investor readiness. Apply by February 10, 2023.

- Are you an ambitious and innovative leader who wants to learn how to bridge the gap between desire and action on sustainability? Then apply to join the Swedish Institute Management Programme 2023. Apply by February 13, 2023.