TGIF!☀️

We have come to the end of TC Daily for 2024!🎉

Thank you so much to all our readers who have stuck with us through all the ban puns and insightful articles. We’ll be taking the next two weeks to strategise. TC Daily will be back in your inboxes on January 6, but TechCabal will be publishing some insightful pieces to keep you going.

To close out the year, we’ve got you a gift. Ecosystem thought-leaders Osarumen Osamuyi, publisher of The Subtext, and Derin Adebayo, publisher of Unevenly Distributed, have co-authored today’s edition.

Let’s get started!

Next Wave

When will the exits cross the road?

by Osarumen Osamuyi and Derin Adebayo

Four days ago, Tyme Bank announced its $250 million Series D round which valued the company at $1.5 billion. This comes just under two months after Moniepoint’s Series C, which also took the company to unicorn status.

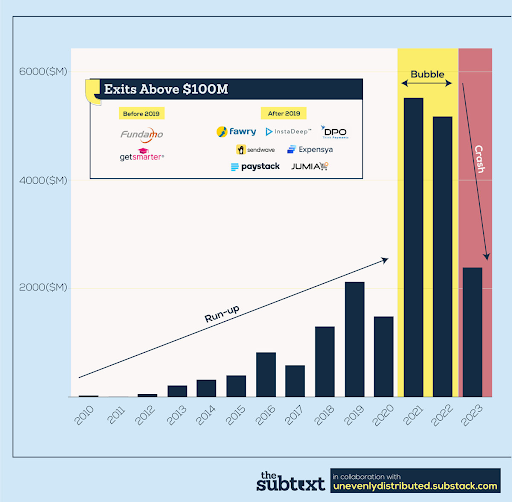

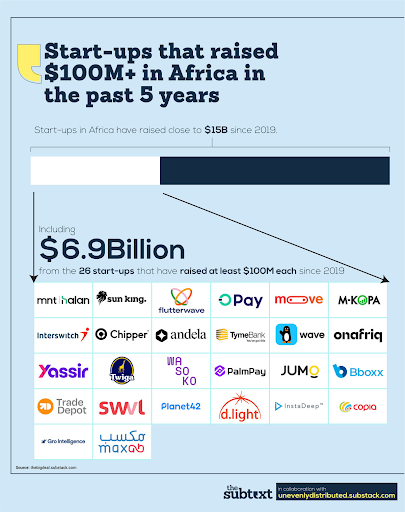

In November 2019, Interswitch became Africa’s first unicorn. This was six months after Jumia listed on the New York Stock Exchange. Since 2019, eight other African startups have hit a billion dollar valuation (add one or two more companies depending on how you feel about the provenance of companies like Go1 and Zipline). The exits have also accelerated, with companies such as Paystack, Sendwave, DPO, & Instadeep all getting acquired since 2019.

However, while the continent has seen many billion dollar valuations and has seen some companies exit, it has not seen a single company hit a billion dollar valuation and then exit. African unicorns account for a combined $14.7 billion in valuation. In comparison, since 2010, all major exits (>$100 million) for African startups sum up to just $4 billion.

We first addressed the lack of African exits in an essay titled The Chicken or The Exit? (2021). In the 11 years before that article (2010-2020), the ecosystem raised $7B in venture capital. At the time we argued that it was too early for a conversation about exits. In the three years since (2021-2023), the ecosystem raised more than $12 billion. A significant portion of that capital went to a handful of growth stage companies.

Given the level of capital that has come into the continent, and the number of growth-stage companies that have emerged, it is difficult to argue that the ecosystem is still too early to face real questions about the lack of exits. With this in mind, we’ve revisited the question in a new essay titled “When Will The Exits Cross The Road?”

The piece explores the journey of the African ecosystem since 2010. We place Africa within the context of other emerging markets while chronicling the continent’s first real venture cycle. We also explore the core tension that this cohort of African growth-stage companies must navigate if they are to achieve significant exits. Finally, the piece tries to explore how the past few years have set up the foundation for the next stage of the ecosystem’s growth.

You can read it on The Subtext, and Unevenly Distributed.

Osarumen Osamuyi is the founder of The Subtext, an Africa-focused tech analysis firm. Previously, he has studied/supported the ecosystem via roles at Meta, DFS Lab, and Ventures Platform.

Derin Adebayo is a Manager at Endeavor. Through his newsletter, Unevenly Distributed, he explores the diffusion of technology, entrepreneurship, and venture capital in emerging markets.

Read About Moniepoint’s Impact on Pharmacies

Do you remember what you bought the last time you visited a pharmacy? Data from Moniepoint’s pharmacy case study reveals it was likely a painkiller. Click here to discover how Moniepoint is enabling access to healthcare through payments and funding for community pharmacies.

Companies

Eskom records $3 billion in losses in 2024

Eskom is having a rough time.

The South African power company which was last profitable in 2017 recorded a R55 billion ($3 billion) loss in its 2024 fiscal year. The loss was 2x its 2023 loss of R26.1 billion ($1.4 billion).

The steep loss was expected following widespread power outages stemming from failures at inadequately maintained generating facilities. The power facility recorded 329 days of scheduled power outages or load-shedding during the fiscal year. Those power outages caused the company to lose R22 billion ($1.14 billion) in revenue.

The company has now improved power supply, with no scheduled load shedding scheduled since Q2. The company has also lowered its diesel spend by R11.9 billion ($643 billion) according to a presentation on the company’s website.

A significant portion of Eskom’s 2024 losses also stemmed from a R36.6 billion ($1.9 billion) impact after the unbundling of its transmission business.

Eskom chief executive officer Dan Marokane believes that the power company can return to profitability in the 2025 financial year due to a reduction in diesel usage and a drop in power cuts. The company projected an after-tax profit of more than R10 billion ($548 million) for its 2025 fiscal year.

Lower debt and debt service costs will also contribute to the improved profit outlook, in addition to a 12.7% tariff hike. The company’s liquidity has significantly improved, primarily due to a government bailout of R76 billion, which covered much of its debt servicing obligations.

Get Fincra’s Embedded Finance and BaaS Report 2024 for FREE

Fincra in collaboration with The Paypers have released the Embedded Finance and Banking-as-a-Service Report 2024. This report examines the key challenges and innovative solutions defining the future of seamless cross-border payments and remittances across the continent, among other topics, with key experts.

Investment

Proparco invests $5 million in Equator Africa Fund

This year venture capital firms have been expending a lot of effort into saving the planet by investing in climate solutions. A recent report by The Big Deal on Africa’s funding revealed that climate tech startups raised 35% of all funding in 2024.

The investment in Africa’s climate tech scene highlights the continent’s emerging entrepreneurial talent and vast renewable energy resources.

Now, Proparco, the private sector financing arm of the French Development Agency (AFD) has made a $5 million investment in Equator Africa Fund, a climate-focused VC firm.

Proparco’s first fund is aimed at supporting the growth of impactful climate startups in Nigeria. Priority will be given to some areas, such as clean energy, sustainable farming, and environmentally friendly mobility solutions. The fund also aims to leverage Africa’s entrepreneurial strength and renewable resources.

“Through this investment, we aim to support ventures addressing the urgent climate challenges in sub-Saharan Africa”, Fabrice Perez, head of the Venture Capital Division at Proparco said.

Equator Africa’s presence in Nairobi, Kenya, and Lagos, Nigeria, will enable the company to combine local knowledge with global expertise to back and scale effective climate solutions.

Equator Africa Fund focuses on three sectors; energy, agriculture, and mobility. Its portfolio includes companies like Sun Culture, Roam and Apollo Agriculture. The investment will be made through FIESA+ Facility.

Introducing Paystack transfers in Kenya 🇰🇪

Paystack merchants in Kenya can now send single and bulk transfers to any Kenyan bank or MPESA account (including customer wallets, Paybills, and Tills) Learn more →

TC Insights

Funding Tracker

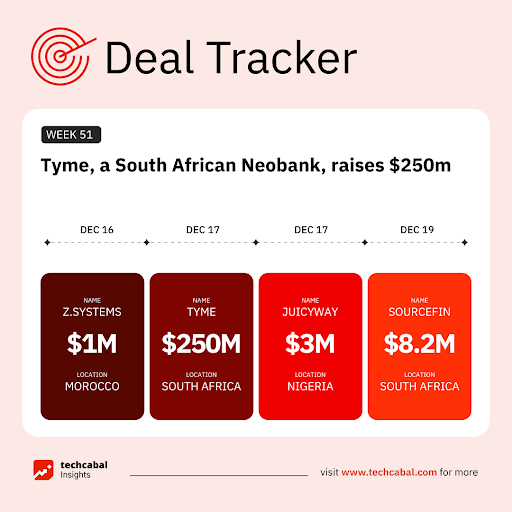

This week, z.systems, a Morocco-based retail tech startup, raised $1 million in a funding round led by MNF Ventures, with participation from Witamax, CASHPLUS Ventures, and Kalys Ventures (December 16)

Here are the other deals for the week:

- Tymebank, South Africa’s digital banking platform, raised $250 million in a Series D funding round led by Nu Holdings Ltd. (Nu) with an investment of US$150 million, while the M&G Catalyst Fund and other existing shareholders contributed US$50 million each. This funding valuation of US$1.5 billion and achieving unicorn status (December 17)

- Juicyway, a Nigerian fintech startup, raised $3 million in a pre-seed funding round led by P1 Ventures, with participation from Ventures Platform Fund, Future Africa, MAGIC Fund, Andrew Alli, Microtraction, and notable investors including Gbenga Oyebode and Tunde Folawiyo. (December 17)

- Sourcefin, a South African fintech and alternative funding provider, secured $8.2 million in funding from Futuregrowth Asset Management (December 19)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go, our Future of Commerce: Outlook for 2025 Report is out. Click this link to download it.

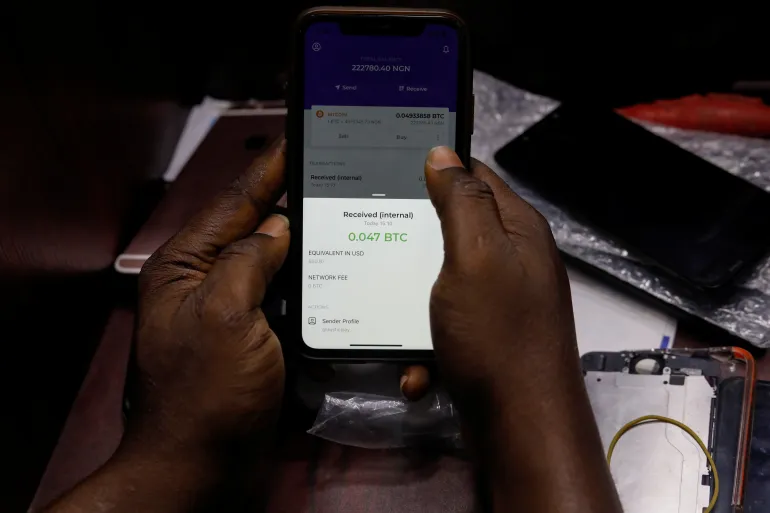

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $97,138 |

– 4.70% |

+ 5.05% |

|

| $3,392 |

– 7.39% |

+ 8.88% |

|

| $0.32 |

– 11.44% |

– 16.87% |

|

| $197.34 |

– 6.36% |

– 16.60% |

* Data as of 06:30 AM WAT, December 20, 2024.

Jobs

- PressOne Africa – Growth and Sales Operations Manager – Lagos, Nigeria

- Condia – Sales and Partnership Associate – Remote (Nigeria)

- Moniepoint – Growth Product Partner – Lagos, Nigeria

- 54 Collective (Radease) – Growth Manager – Hybrid (Lagos, Nigeria)

- Renmoney – Chief of Staff – Lagos, Nigeria

- Interswitch Group – Data Engineer, Mobile App Developer – Hybrid (Lagos, Nigeria)

- Fairmoney – Data Engineer – Remote (Lagos, Nigeria)

- Duplo – Senior Product Manager, SaaS, Risk & Compliance Manager – Hybrid (Lagos, Nigeria)

- Reliance Health – Content Strategist – Remote (Lagos, Nigeria)

- Darey.io – Quality Assurance Specialist – Lagos, Nigeria

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

Written by: Osarumen Osamuyi, Derin Adebayo, Towobola Bamgbose, Oluwaseun Joseph, and Faith Omoniyi

Edited by:Timi Odueso

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 10 AM WAT.

- TC Scoops: breaking news from TechCabal

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.