Today, we hear that MTN has acquired one-third of Africa Internet Holding, the holding company created by Rocket Internet & Millicom in 2012. In case you didn’t know, Millicom is a telecommunications group that has interests in developing economies including South America and Africa.

The investment brings the full weight the behemoth that is MTN into e-commerce. Between MTN and Millicom, there are 220 million mobile subscribers across Africa up for grabs and Rocket’s companies will have near-unfettered access to them. Ladies and gentlemen, the big boys have come out to play.

MTN has been toying at the edges of the internet business for a while now. They acquired Afrinolly, did a partnership with DoBox and launched a cloud offering for businesses. None of these things have moved the needle significantly but MTN’s head is definitely in the internet.

This sort of move was almost inevitable. E-commerce continues to attract a ton of investment and there is no doubt that the turnover figures are attractive to many larger corporations. The opportunity to leapfrog many traditional systems of commerce – retail, food delivery, hotel bookings makes this a particularly inviting opportunity for Africa, especially since internet use on the continent is mostly driven by mobile.

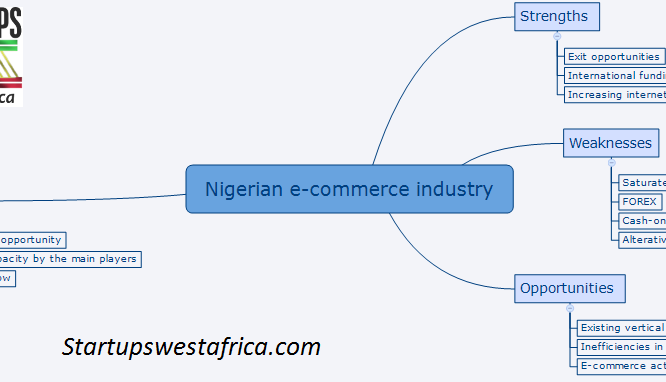

Jumia and Konga have definitely increased the price of entry for e-commerce, and a deal like this only makes the price steeper. Startups may then wonder if e-commerce is now “locked-up”. I don’t think so; I believe there are still opportunities for startups pursuing specific verticals (as opposed to general e-commerce). Companies also providing e-commerce support services (bundled e-commerce sites, logistics etc) can also prosper. Other players in e-commerce (and related fields) may start panicking about competition. The key would be to take a nuanced view to this. Yes, MTN’s cash injection plus access to their vast network is nothing to scoff at, but the go-to only brands for Nollywood are IrokoTV and their YouTube competitors, not Afrinolly.

More broadly, this deal does signal that the internet is getting a lot more attention from players with deeper pockets. This is great for the entire space – there could be more exit opportunities for startups that know what they’re doing. One thing startups are going to have to be more deliberate about is fund raising. The days of staying small or slow growth may be coming to an end. It’s not because bootstrapping is wrong, it’s simply that in the midst of rocket ships, an aeroplane is flying too low.

That being said, the news is generally encouraging. Some may view MTN’s entry into the space as a pseudo-exit for the Rocket team. In that light, this is definitely good news. While African tech startups may not generally IPO, the possibility of acquisition by larger corporate groups with interests in media, technology and finance should encourage more qualified players take a deeper interest in the internet. In my view, that sort of deepening can only be good.

As the deal concludes in Q2 of 2014, I wouldn’t be surprised if some of the early Jumia team start planning to launch new ventures. If they do, the space would definitely benefit from their experience. Their replacements may be more corporate, which begs the question, would Jumia et al gradually lose their entrepreneurial bent in the long run? Only time can tell.