Over the past decade, the push for financial inclusion has united governments, companies, technology entrepreneurs, and nonprofit organizations in dozens of countries on every continent — and with remarkable success. In 2011, only 51 percent of the world’s adults had a formal bank account. By 2017, as the World Bank recently reported in its new Global Findex data, we’ve reached 69 percent — that is 1.2 billion more people who are now connected to the modern economy.

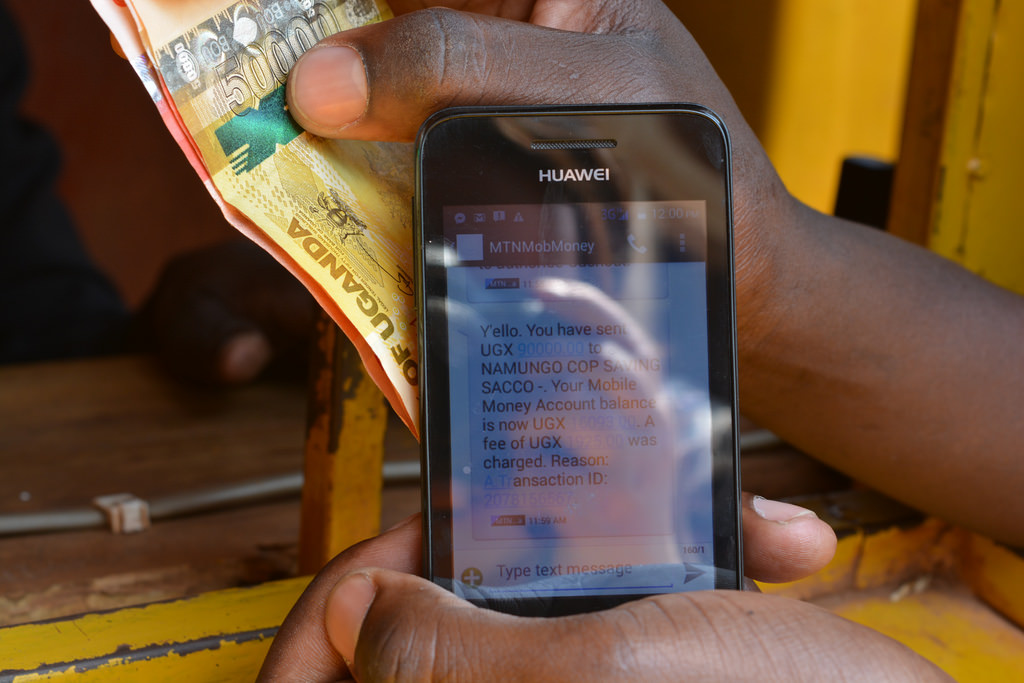

As more people in emerging markets gain access to the formal financial system — fueled by the increased penetration of the mobile phone and associated digital financial services — the pace of financial inclusion is accelerating. At this rate, we’re on track to reach universal financial access by 2020, a goal set by the World Bank, which is an important success milestone. Access to basic financial services, such as a bank account, credit, and insurance, is a crucial step in improving people’s social and economic outlook.

As we move forward, however, we must concentrate on what comes next: Shifting our focus from creating access to improving financial outcomes for the hundreds of millions who have been excluded until now; making sure that people can use financial instruments to better weather economic shocks and invest in health, education, or in a business.

Even in the developed world, where access is nearly universal, a large cohort of people are not well served by the existing financial system. Many people who have transaction accounts but whose incomes are low or irregular, rely on expensive solutions, such as payday lending, check-cashing services, or informal moneylenders, to lead their financial lives.

Globally, account inactivity remains stubbornly high. About one in five accounts around the world are sitting idle. The reality is that access alone does not truly solve people’s financial struggles and set them up for long-term success.

There is a difference between financial access and financial health. The Global Findex has provided a valuable metric and a goal for us to strive toward: Ensuring everyone has access to financial mechanisms that many of us take for granted. But using these services must be affordable, and most importantly, fit people’s financial contexts.

Promoting financial health means designing products and services that are relevant and address the real challenges that people face. Across ages, genders, income levels, and backgrounds, consumers have very different attitudes toward technology, levels of financial literacy, and appetites for risk. What works for a single mother in India, may not work for a cocoa farmer in Brazil or a micro-entrepreneur in Nigeria.

The obstacles are real. Increasing adoption among under-served consumers demands new approaches. Companies will need to employ cutting-edge human-centered design, the latest insights in behavioral science, and culturally-specific distribution — while pioneering new business models.

While no easy feat, several entrepreneurs around the world are already showing promising results leveraging these new approaches. The rise of neobanks is a good example. The digital-only, mobile-first banking experiences give consumers more personalization and smarter tools, often at dramatically lower costs. Neobanks can overcome many of the legacy and infrastructure costs of brick-and-mortar banking. They can take advantage of digital channels for distribution and marketing, while riding on the rails of smartphone proliferation and digital payments. They also offer the opportunity to “re-skin” a traditional bank for new languages, cultural contexts, and market segments.

As companies bring these and other new models to market, their success will depend on a policy environment that fosters innovation as well as consumer protection. Success will also rest on listening to consumers to understand their unique financial needs, values, and behaviors.

The world has made incredible progress by uniting across public and private sectors toward universal financial access — a feat we will achieve sooner than could have been imagined just a decade ago. Let’s pursue the next challenge — widespread financial health — with the same unity of purpose, consumer-centric innovation, and focus.

This article was originally published here.

Tilman Ehrbeck is a partner at Omidyar Network, where he co-manages the Financial Inclusion initiative, leading global venture investments in visionary entrepreneurs and their ideas to create opportunities for people to improve their lives.