Streams of cool jazz seep from the ceiling speakers, massaging Travelstart’s reception room like a healing balm.

In the open office area split by glass panes into a conference room, a call centre for recovery, and a corner for finance and marketing, some staff don masks and appear to be socially-distanced. They are all peacefully busy, shielded from the noisy traffic surrounding this office building in Lagos, Nigeria.

It is noticeable that this cosy space originally hosted more than the 20 or so people currently in it.

“We were a few more at the beginning of the year,” says Philip Aakesson, the CEO. They had to “say goodbye to a few friends, unfortunately.”

Those layoffs reflected the toll of the COVID-19 pandemic on the travel industry. Africa’s travel and tourism sector lost nearly $55 billion between April and June, according to the Africa Union.

In February, Travelstart initiated a company-wide re-evaluation of operations across its 9 African markets, on the assumption that it could lose half its volumes. But like most companies in the travel business, volumes sank to nearly zero as the strain of border closures wore on.

Things are beginning to look up in August.

Local flights resumed in Nigeria on July 8 and international flights will resume on the 29th of August, 159 days after restrictions were imposed at the end of March. As planes take off and humans reach for the skies once again, the global community is gradually moving on from the unfortunate mortal and mental toll of H1 2020.

But this pandemic has challenged assumptions underlying the online travel booking industry. Business will simply not go back to normal.

The size of African travel

Africa’s tourism industry is seen as one of the fastest-growing in the world. The growth has been helped by countries like Ethiopia that have eased visa restrictions.

8.48 million passengers passed through Nigerian airports between January and June 2019. That was a 5.4% increase from the volumes recorded for the same period in 2018.

But these growth figures should not create an illusion of strength. Africa accounts for just 2% of global air traffic, and the average African carrier loses $1.09 per passenger.

Because most economies in sub saharan Africa are classified as low or lower-middle income, there are simply not enough paying travellers able to give the continent a travel market as vibrant as North America, Europe or the Asia Pacific regions.

The unemployment rate in Nigeria has tripled over a five-year period. According to a 2019 discretionary income survey by SBM Intelligence, a consultancy, only 37% of Nigerians can afford to spend significantly on items beyond food and other essentials.

Consumer confidence in South Africa crashed to a 35-year low in the second quarter of the year.

All of this is a headache for travel agencies like Travelstart whose business model already accounts for the fact that Africans broadly travel more for necessities than leisure. The “bleisure” customer who has been hit adversely by COVID may have as many trips to China or Dubai as before.

What then is an online travel agency’s value proposition for this traveller?

The post-COVID model

Travelstart was founded in Sweden 21 years ago by Stephan Ekbergh, a former DJ. After a few years operating in Europe, the company shifted focus to Africa and is now headquartered in Cape Town, South Africa.

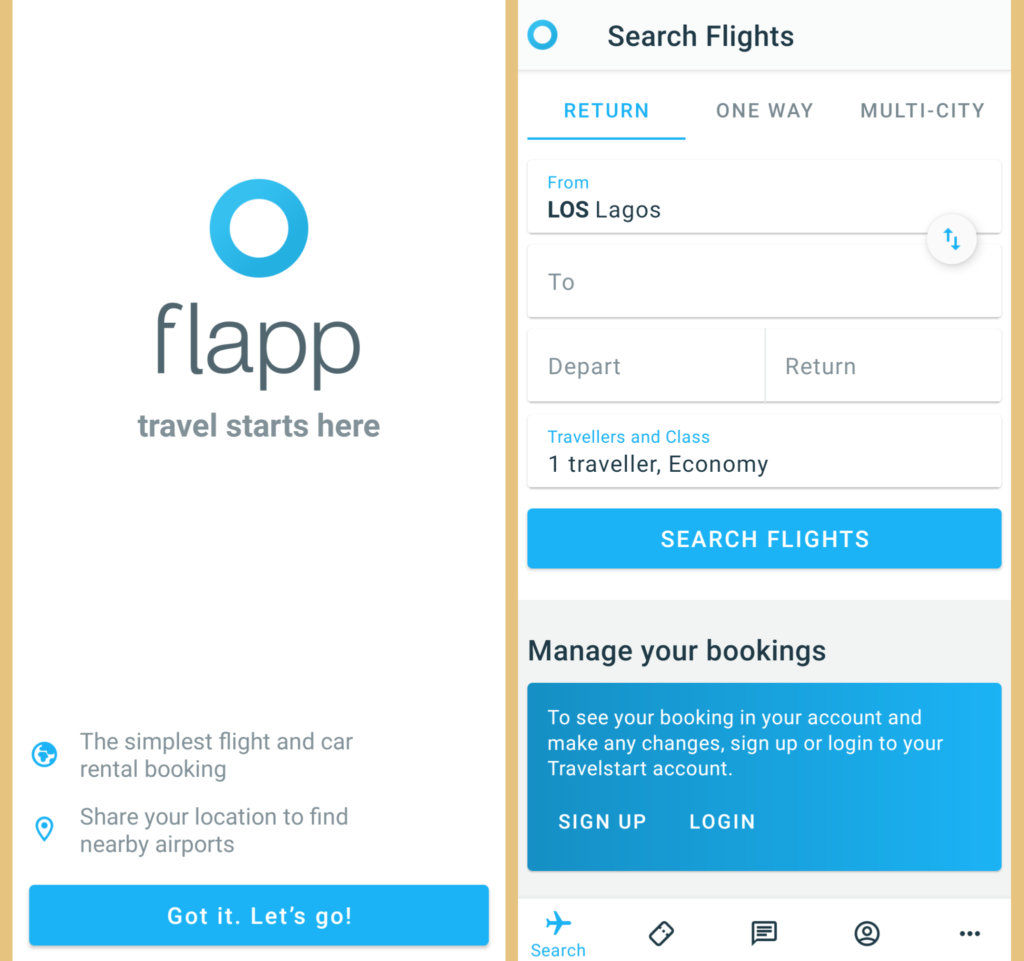

Its main service offerings are online travel booking, hotel reservation and car hire booking. But in Nigeria where the company has been in operations since 2012, the focus is strictly on helping customers find and book flights online from a mobile app or website.

Customers who prefer to interface directly with humans have the option of visiting their stores to shop for travel. To fulfill those customers’ preferences, the company had planned to add two stores to its sole retail outlet in Lagos and its first in Abuja in 2020.

The pandemic has forced those plans into hibernation. In place of physical interaction, customers now want to more easily initiate and conclude travel inquiries and bookings online.

As a result, Travelstart has accelerated the automation of their processes, condensing two-year plans into six months and leading to human resources changes.

“Before we go and hire all over again, what can we fix so that new hires will start on a much better platform than before COVID,” Bukky Akomolafe, Travelstart’s new country manager for Nigeria, says.

Online travel booking is a low-margin business. Travelstart is in competition with hundreds of outlets across Nigeria. Each company’s model is predicated on receiving a few dollars off each ticket sale, and travel consumers are price sensitive.

In the US, Expedia has 70% share of the online travel agency industry. Priceline, its main global competitor, has larger global revenues (they own Booking.com). Both companies have an extensive network of smaller travel agencies who rely on their infrastructure to extend sales to buyers.

Aakesson believes the pandemic has been an opportunity to reposition Travelstart for the inevitable evolution of travel booking in Nigeria.

“This industry will look much more like how you buy tickets in the US or in Europe. It’s just a matter of time,” he says.

He anticipates the arrival of big players like Expedia in Africa sooner than later. Having the necessary operational backbone for the coming competition is not an option but a prerequisite for continued relevance in the business.

One product at a time

This backbone hinges on how technology is deployed into ensuring seamless customer experiences.

In that regard, Travelstart is preparing for a scenario where 100% of prospective customers rely exclusively on Flapp, their mobile app for flight booking, or their website.

Either medium gives the traveller access to 5,000 airlines traversing over 11,000 destinations, finding suitable flight combinations for trips requiring more than one connection.

For the Nigeria business, Travelstart has chosen to focus on mastering one product: online flight booking. They don’t handle visa enquiries, hotels or car hire services.

Offering ancillary services requires dependence on other players, which ties a travel agency’s rating to multiple players whose performances are not within the agency’s control. Nigeria’s unpredictable regulatory environment, exemplified by the ride-hailing tax in Lagos, poses a risk for bundling too many verticals into one.

That said, travel can be an exciting industry. It remains a necessity of human life. Potential for innovating around customer experience exist especially when conditions favour the integration of air, land, water and rail modes. Indeed, Travelstart is able to sell bus tickets in South Africa.

When each mode of transport is developed around technology with reliable data collation, operators could rely on a core of technology APIs to produce an interconnected transportation network.

Learning from Nigeria to service Africa

The prospect of selling multi-modal transport bundles in Nigeria appeals to Aakesson. But they will start any rollout when the process can be automated, rather than rely on manual connections.

He’s been in Nigeria long enough to understand ecommerce, having moved from DealDey in 2012 to help run the early days of Konga leading operations and business development.

While serving as Travelstart’s country manager for Nigeria, his job was to increase reach and inbound requests. In December 2019, the company began handling all traffic from Jumia Travel, one of Travelstart’s main competitors at the time.

Though some Jumia staff were absorbed, Aakesson says the deal was not an acquisition. Both companies continue to share income on every lead generated and converted on Travelstart from the Jumia website.

In the short-term, Aakesson expects COVID-19 will shrink the overall travel pie, meaning that those leads will be fewer.

But he is confident that Nigeria is the market where Travelstart will find solutions that can be applied to similar problems in its operations in Egypt, South Africa and 7 other African countries.

How does Akomolafe think about the future of Nigeria’s travel market, considering current dire macroeconomic trends?

“Because Nigeria is such a heavy import market, somebody has to fly from point A to B. Constantly having that at the back of my mind helps me know there are customers,” she says.

Her anchor is that the economy, no matter how bad, will continue to produce the bleisure and trade categories of customers who require air travel. Other target users include students who continue to leave Nigeria in droves annually either at post-secondary or post-tertiary stages.

With that in mind, her focus is to find the best ways to position Flapp and Travelstart’s 6,000 affiliate agencies to reach those customers.

While she’s concerned that COVID-19 may upend the stable correlation between summer holidays and large travel volumes in the future, managing the present is about perfecting in-house features that can be controlled, namely: can a customer book a flight and travel without hassle?