The BackEnd explores the product development process in African tech. We take you into the minds of those who conceived, designed and built the product; highlighting product uniqueness, user behaviour assumptions and challenges during the product cycle.

—

Think back to the first time you opened a bank account. It was probably because you needed a reliable means of sending and receiving money.

Depending on when you got the account – my first is ten years old – your needs and the frequency of use have probably evolved significantly. But fund transfers and payments are still the most frequent activities any bank account holder performs.

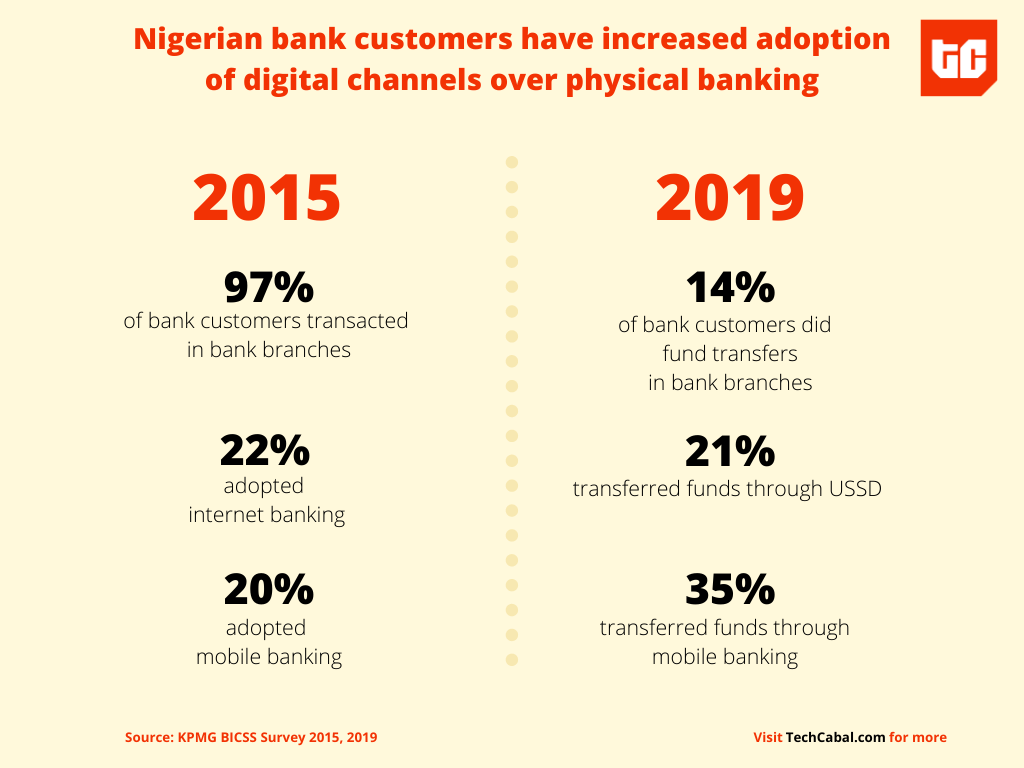

In 2019, 35% of Nigerian bank customers said they transferred funds through mobile banking. 21% relied on USSD and 14% said they went into bank branches.

45% of customers used their bank’s USSD code to buy airtime, more than twice the number that used banking apps.

These stats obtained from a KPMG customer experience survey paint an exciting picture of digital banking’s prospects in Nigeria, but hold off any celebration. According to the study, more than four in ten customers said they walked into bank branches to pay bills, compared to 26% who used bank apps.

Everybody agrees that in 2020, queuing in bank halls to send money or make a payment is a waste of time. No school fees or utility bill is so existential to warrant that stress. In this gilded age of Mark Zuckerberg’s internet, customers now fully expect to access banking without being compelled to be present at banks.

So how are Nigerian banks faring with fulfilling this digital demand for convenience? We turn to another useful survey.

Mobile apps and good old USSD

“Our Scorecard reveals that banks have developed strong capabilities in payments and transfers.”

That’s the first sentence in the concluding paragraph of a Digital Channels Scorecard published by KPMG in August. The consulting firm conducted a qualitative study of 17 Nigerian commercial banks to evaluate the customer experience across four digital banking mediums: mobile banking, internet banking, USSD and chatbots.

For each bank, the four mediums were assessed for a range of qualities, from functionality and minimalism (given a combined 80% weight), to aesthetics (2%).

Internet banking as a medium for transactions is on the decline. With stable connectivity, smartphone apps perform practically every transaction you can rely on a web page to do, and USSD was made for feature phones.

But “there is a need for banks to ensure that their internet banking channel is functional as it still remains the channel of choice for certain users such as small enterprises,” the study’s authors advice.

With that clarification, let’s get into what differentiates the banks on the quality of their digital payments offerings.

Understanding time and effort

KPMG’s user experience assessment on the delivery of digital payments services tests each bank’s mobile app, internet banking, USSD and chatbot for three functionalities:

- Sending money to beneficiaries within the same bank and other Nigerian banks.

- Paying utility, entertainment, and toll bills

- Cardless withdrawal.

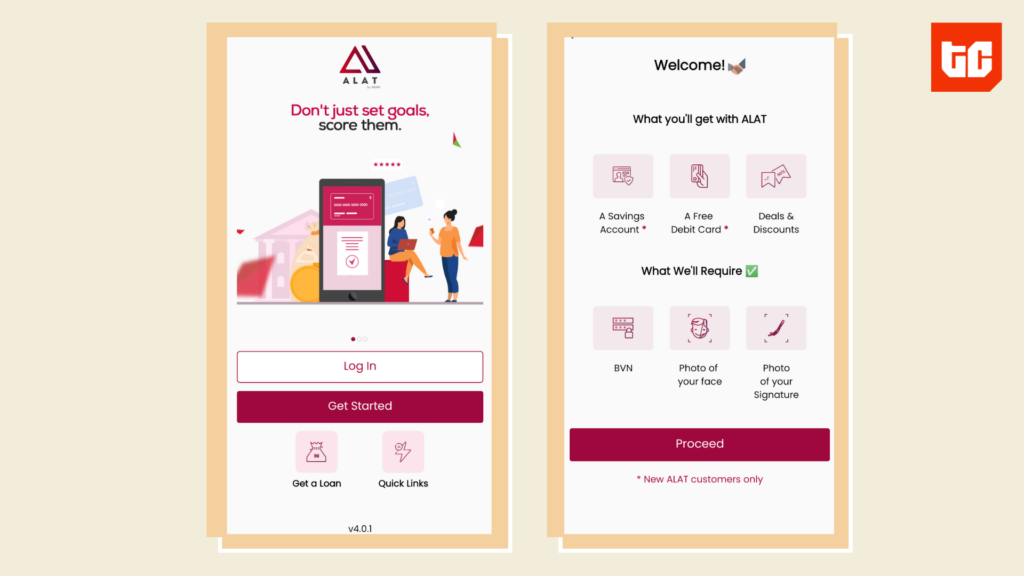

From the assessment, Wema Bank’s ALAT and GT Bank’s mobile app are rated as the best of the bunch.

According to the study, Wema’s ALAT app stands out because “the user interface is simple, and only relevant information is visible on the screen, thus keeping design minimal, user friendly, and removing the possibilities for user errors or confusion.”

Digital payments on Wema’s internet banking is rated better than others, while GT Bank’s *737# leads on USSD for payments. The report does not identify a clear leader in the delivery of payments through chatbots, but acknowledges Fidelity Bank as having an ambition that is still short on execution.

Wema and GT Bank get the overall good credits on digital payments because they “understand that time and effort are of vital importance to user experience on the digital channels,” the report says.

On their apps and USSD, both banks have designed the payment journey to “enable customers to achieve their objectives rapidly.”

What other banks are doing wrong

A user-friendly digital funds transfer and payments app or USSD service should save users time and effort without compromising security and the desired outcomes.

Wema and GT Bank have integrated this in seemingly simple ways like ensuring users easily see their past payments and can save time re-inputting data afresh when repeating similar transactions.

Users like it when their apps have a feature for scheduling transfers or payments. They also want to easily search and find things like the destination bank for a payment without scrolling.

On the other hand, payments features on the bank apps immediately below Wema and GT Bank’s performance level (described as “challengers”) often have

“Too many fields to be populated by the user which are often unnecessary such as beneficiary country for a local transfer, phone number for utility payment, etc,” the report says.

Some banks still rely on a system of generating one-time passwords that require customers to visit a bank branch, mandating a ‘narration’ for transfers and lacking receipt sharing features.

Only five Nigerian banks have the cardless withdrawal functionality on their mobile apps, creating an unnecessary dependency on debit cards in an age where smartphones are perfectly capable of doing the job.

How to catch up and scale digital payments

To be sure, Wema and GT Bank are not perfect models of the mobile banking and USSD experience.

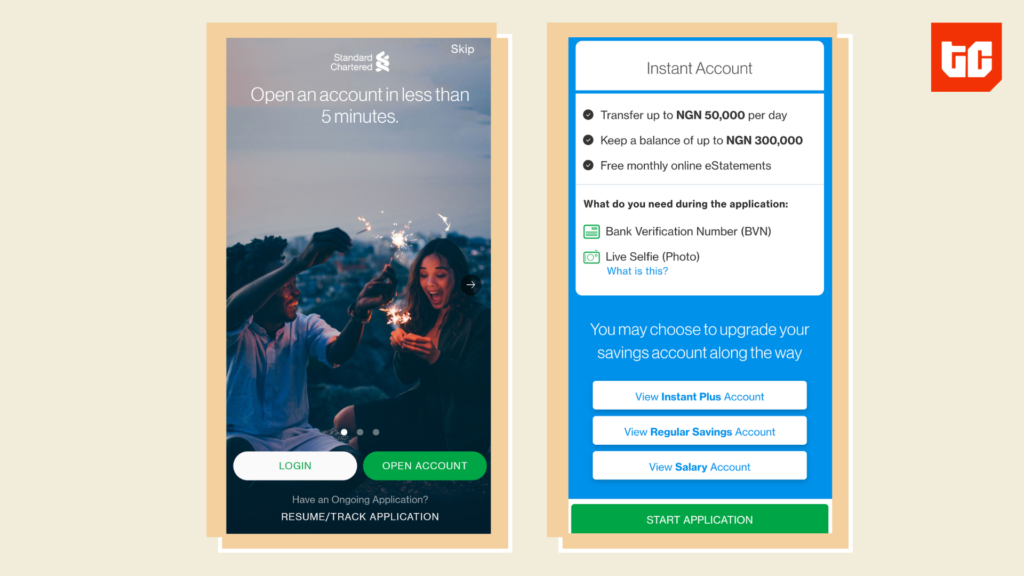

Standard Chartered is the clear industry leader in terms of onboarding new users on a mobile banking app, thanks to their very detailed information on the various account tiers and a gorgeous user interface.

Also, it’s easier to create a brand new Zenith Bank or Stanbic IBTC account via USSD than on any other bank.

But as good as a bank might be at onboarding, it has to efficiently deliver payments and fund transfer to capture users loyalty. That entails helping customers with simplified processes that are both smart (“Know me as well the data you have about me,” KPMG advises) and secure.

Wema, GT Bank and the other banks aspiring to be innovators in payments should explore the use of machine learning tools to deepen their understanding of customer behaviour. They should be looking to get more interaction out of their chatbots, beyond the basic money transfer, airtime purchase and account enquiries that currently prevail.

Once in a while, I would like Leo (UBA’s chatbot) to chat me up for real talk about how I am always sending money to a certain Zenith bank account. It would be nice if it notices that I always subscribe for a “monthly” 15GB data plan that runs out in four days. Leo, please offer me some alternative or at least consolation.

Zooming out from payments, KPMG’s report highlights gaps particularly in the delivery of lending, self service, and customer care across the board. The underdeveloped nature of digital self service (debit card requests, statement requests, etc) is a big reason why many people still visit bank branches.

To distinguish themselves as digitally savvy, it’s no longer an option that can be ignored: each bank has to design its in-branch processes around the profile of a mobile-first user.