IN PARTNERSHIP WITH

Good morning ☀️ ️

Do you remember that pesky contact that always sends you annoying texts on Whatsapp even after you’ve blocked them? Yes, the one using the “GB” version of Whatsapp?

Well, let’s just say your worries are about to be over. Whatsapp has threatened to permanently ban users who have an account with the clone app.

In today’s edition:

- Ghana Chronicles

- Quick Fire 🔥

- My Life In Tech

- MultiChoice accused of ₦1.8 trillion tax fraud

- TC Insights: Funding Tracker

Ghana Chronicles

Yesterday, I left Accra for Berekuso (an hour away) to visit Ashesi University. The tour around one of the finest universities in Africa was delightful. Glad to see that Ashesi is making great effort to build and equip entrepreneurs.

Food

I easily could have called this rice, beans and stew but in Ghana, it’s Waakye (cooked rice and beans) and Shitto. I love it!

Zeepay is one of the most successful Ghanaian startups. I had a good chat with Zeepay’s CEO Andrew Takyi-Appiah, who had a lot to say about why Ghana’s tech ecosystem is the way it is.

Ended the day at the networking session by the Tony Blair Institute for Global Change where I met more people in the Ghanaian tech community and policy makers.

See you on Monday!

Quick Fire 🔥 with Jesse Gyau Kusi

This week’s edition of Quick Fire had to be with someone from Ghana 😉

Jesse is a tech and digital management enthusiast with an interest in sales, growth and project management. He is the Sales Manager at Bolt Food Ghana and a local TEDx organizer.

Explain your job to a five-year-old

I ensure that people can get their favourite meals delivered to them fast at an affordable price.

What’s something you wish you knew earlier in your career/life?

Gaining mastery in using spreadsheets.

What has been the most important business decision you’ve taken?

Deciding not to over promise and under deliver.

What are you currently watching/listening to?

Watching All or Nothing (Prime Video), Coaches PlayBook and Fatherhood (Netflix). Listening to Omar Sterling’s Album (Same Earth different Worlds) and waiting for Sarkodie’s Album (No pressure).

Tell us about something you love doing that you’re terrible at. And tell us about something you really do not like doing that you’re great at.

I love to play FIFA but I think I’m overrated. I don’t like cooking but I’m a great cook.

What’s a trend in Ghana that we should be paying attention to?

Ghanaian Tiktokers are gradually growing their influence and the Fintech space in Ghana is on Steroids.

We’re looking for an experienced Product Marketing Leader to help Paystack acquire, engage, and retain Africa’s most ambitious businesses. Does this sound like you? Apply here →

My Life In Tech: Peter Njonjo

Peter Njonjo started his first business in high school. He noticed a problem; the school canteen was too far from the dormitories.

Every day, he and his classmates made the tiresome journey from their beds to the canteen to buy bread. Peter’s solution was simple – buy all of the bread in the canteen, bring it to the dormitories, sell to customers from the comfort of their beds and charge a small fee for this convenience.

“I built a very successful franchise because there were many dormitories so I couldn’t do it alone.”

Today, he is solving a similar problem on a much larger scale. He is the CEO and co-founder of Twiga Foods, a company that is taking fresh and processed foods from over 4,000 farmers and manufacturers who are often far away and delivering to more than 35,000 vendors across Kenya – while charging a small fee for this convenience.

From having an incomplete MBA to heading Coca-Cola’s operations across 33 African countries, his story is one of a man who is passionate about making the lives of people just a little easier.

Edwin speaks to Peter Njonjo for this week’s My Life in Tech.

Applications are now being accepted for Inclusive Fintech 50! IF50 provides key exposure for the most promising early-stage inclusive fintechs that have the potential to drive financial inclusion.

Learn more: https://bit.ly/IF50-2021

MULTICHOICE BANK ACCOUNTS FROZEN IN NIGERIAN TAX SCANDAL

A few years after the Nigerian unit of the MTN Group overcame a tax scandal, another South African giant has seen its bank accounts blocked in Nigeria over an alleged tax misconduct.

What happened?

The agency in charge of revenue generation in Nigeria on Thursday said it had instructed banks to freeze the accounts of media entertainment firm MultiChoice Africa and its Nigerian subsidiary for breaching agreements and denying access to their records for auditing.

Both companies are part of South African-headquartered MultiChoice Group, which owns DStv and GOtv services, and provides several entertainment services across Africa.

Why the embargo?

The Federal Inland Revenue Service (FIRS) says it wants the banks to help it recover ₦1.8 trillion in outstanding tax obligations from MultiChoice Africa and MultiChoice Nigeria.

“The companies would not promptly respond to correspondences, they lacked data integrity and are not transparent as they continually deny FIRS access to their records,” the executive chair of FIRS, Muhammad Nami said.

No cause for alarm

In a statement responding to the allegations, the MultiChoice Group said they have “been and are currently in discussion with FIRS regarding their concerns and believe that we will be able to resolve the matter amicably.”

What happens now?

Being one of DStv’s biggest markets, the tax dispute in Nigeria could potentially disrupt the operations of MultiChoice. As it said, the company will be hoping the issue can be resolved amicably, and quickly too.

Read more: MultiChoice’s bank accounts blocked in Nigeria over alleged ₦1.8 trillion tax fraud

Small business budget? Access affordable service and more on the FCMB Business Zone; a robust one-stop online platform that provides a wide range of services such as advisory, escrow, certified online learning, etc. to small and medium enterprises.

Access it for free here.

TC LIVE: Lessons from Rwanda

Today at 11 am (WAT), TechCabal will be hosting Faith Keza – CEO of Irembo and Oswald Guobadia – Senior Special Assistant (Digital Transformation) to The President, Federal Republic of Nigeria.

Faith and Oswald will speak about how African countries can drive rapid economic growth through digital transformation.

They’ll also discuss what lessons can be learned from Rwanda, putting Irembo into context. Irembo is a one-stop online platform where over 6M Rwandans can easily access 120+ public services.

It will be moderated by Edwin Madu, Senior Editor at TechCabal.

Register now to attend: http://bit.ly/tclivejuly9

Note: By clicking on the registration link for this event, you’ve indicated interest in the event and will get an invite to attend. To opt out, please ignore the invite.

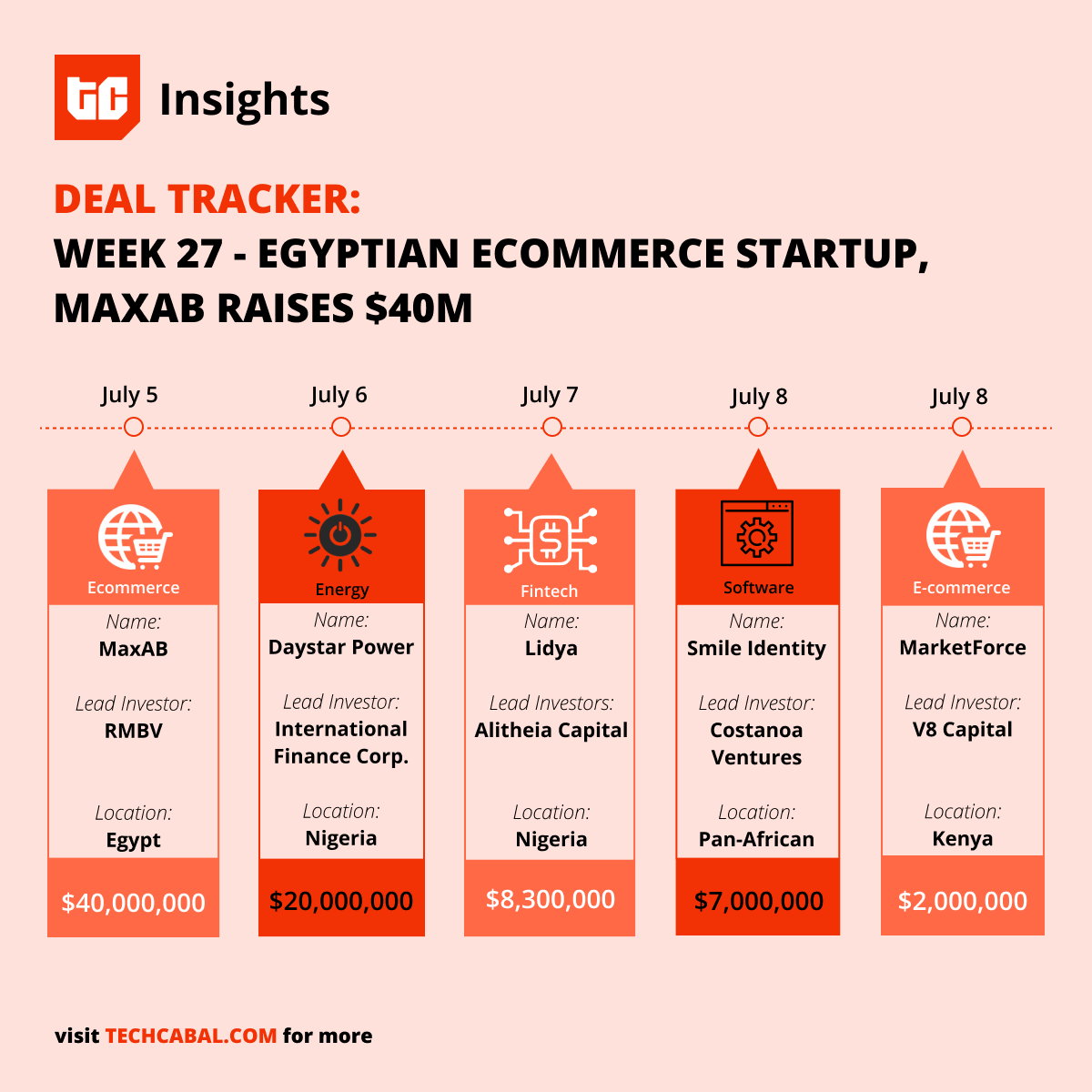

TC Insights: Funding Tracker

This week, Nigerian solar power provider Daystar Power closed its second funding round in 2021. After a series B round in January, the energy startup secured $20million from the International Finance Corporation.

The other deals for the week are:

- Egyptian inventory delivery platform MaxAB closed a $40million Series A funding round from RMBV, International Finance Corporation (IFC), Flourish Ventures, Crystal Stream Capital, Rise Capital, Endeavour Catalyst, Beco Capital and 4DX Ventures.

- Omnisient, a South African data collaboration platform, raised $1.4million from Compass Venture Capital, Investec, Nedbank CIB, Technova, Grand Bay Ventures, Tahseen Consulting, and Kepple Africa Ventures.

- Lidya, a Nigerian fintech startup, raised $8.3million from Alitheia Capital, Bamboo Capital Partners, Flourish Ventures and Accion Venture Lab.

- Smile Identity, a Pan-African identity verification startup secured a $7million deal with Costanoa Ventures and CRE Venture Capital, LocalGlobe, Intercept Ventures, Future Africa, Khosla Impact and other investors.

- Kenyan B2B retail platform, MarketForce, raised $2million from V8 Capital, Future Africa, GreenHouse Capital, Launch Africa, Rebel Fund, Remapped Ventures, Y Combinator and P1 Ventures.

- Nigerian ticketing platform tix.africa secured six-figure pre-seed funding round from Hoaq and other private equity investors.

- ShipBlu, an e-commerce delivery startup raised an undisclosed pre-seed round from Nama Ventures, Y Combinator and other investors.

- Damanesign, a Moroccan digital trust solutions startup, raised a $450,000 seed round from the Maroc Numeric Fund.

- MAGIC Fund, a global collective of founders, raised $30million to continue backing early-stage startups around the world.

That’s all we’ve got this week!

Follow TC Insights on Twitter and LinkedIn for more updates on funding deals.