IN PARTNERSHIP WITH

Happy pre-Friday 🌄

“Keep my name out of your mouth” has become a Twitter feature.

The bird app has implemented an unmention feature that allows you to untag your Twitter handle from a thread. In addition to your assured exit from the conversation, anyone else replying to the thread will be unable to mention you or reply to you in it. This gives a fresh angle to “I said what I said”, but the main purpose of the feature is to prevent harassment that comes from unwanted attention.

Too bad Elon Musk cannot apply this feature to real life. We bet he’d have liked to unmention himself from this Twitter deal discussion that is dragging him to court.

In today’s edition

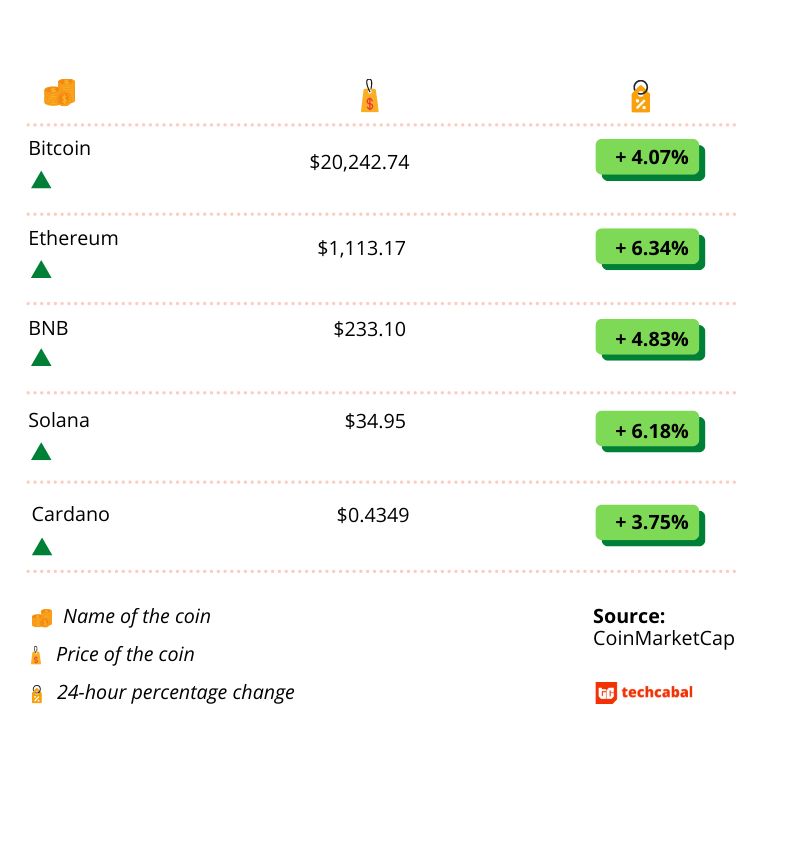

- Crypto market

- Egypt-born Swvl acquires Mexico’s Urbvan

- Sendsprint to power Africa’s diaspora remittances

- Voice notes are coming to Whatsapp status

- South Africa’s plan to regulate cryptocurrencies

- Opportunities

EGYPT-BORN SWVL ACQUIRES MEXICO’S URBVAN

After laying off about 400 employees last month, Egypt-born mobility tech Swvl announced plans to acquire Mexico-based shared mobility platform Urbvan Mobility. The acquisition, which is for an undisclosed amount, will be concluded by the end of the third quarter of the year.

About Urbvan

Founded in 2016, Urbvan provides urban and intercity transportation as well as on-demand ride services to organisations and individuals. It has footprint in 18 cities across Mexico,

Urbvan cofounder Renato Picard says: “Swvl and Urbvan both want the same thing—to make mass transit safer for everyone without discrimination. This acquisition extends Swvl to Mexico and advances its goal to expand across the world.

Swvl’s other acquisitions

This is Swvl’s 6th acquisition. Other acquisitions include smart bus platform Zeelo, Volt Lines, European mobility platform Door2Door, Viapool, and mass transit platform, Shotl.

Acquiring companies and firing employees

Weeks after acquiring Turkish Volt Lines, Swvl announced that it was laying off one-third of its employees—400 staff most of whom were from its Dubai and Pakistan offices. Swvl’s initial valuation deflated to $581 million from $1.5 billion so the cut was part of its efforts to turn cash flow positive by next year.

Lay-offs have become characteristic of startups in recent times due to the global economic downturn. Big tech companies like Netflix , Microsoft, Twitter, and Tesla have laid off a significant number of staff in the last few months. Other African startups that have announced lay-offs include healthtech startup Veezeta and, more recently, francophone Africa’s first unicorn Wave.

The economic downturn also presents an opportunity for bigger companies to buy up smaller ones and expand into new markets. That seems to be what Swvl is doing—pruning its businesses and also expanding.

Don’t just send money, send money fast. Send and receive money directly to mobile wallets, bank accounts, Barter or through cash pickup with $end.

Visit send.flutterwave.com and do it now!

This is partner content.

SENDSPRINT TO POWER AFRICA’S DIASPORA REMITTANCES

Over the past decade, migration has taken millions of people away from Africa. While this contributes to the existing brain drain narrative, the silver lining lies in the remittances being made into the continent by Africans in the diaspora.

Regrettably, sending money to Africa from abroad has been far from seamless. But Sendsprint is trying to change that, starting with a launch in the UK.

How is Sendsprint helping?

Sendsprint wants to connect Africans in the diaspora to their loved ones on the continent by enabling international transfers that are fast, simple, and hassle-free. They’re also capping the transfer charge at a flat $5, making it cheaper to send big sums to family and friends at home.

That’s not all…

The startup is partnering with over 3,000 retailers operating in Africa—including big names like Shoprite, FilmHouse Cinemas, Jumia, and Healthplus—to make it possible for users to send gift cards to recipients in Africa. This allows recipients to use the remittances directly for things that matter to them, such as groceries, healthcare, and fashion and beauty products.

Sendsprint is currently targeting the 1.7 million Africans living in the UK. At launch, it’s offering 3 destination countries for senders including Nigeria, Kenya, and South Africa, but the list will expand as they grow.

Bigger Picture: Africans are increasingly leaving the continent, but they don’t mind sending money to their people back home. Indeed, these monies can contribute to better socio-economic standings, but it does not compensate for the brain drain.

VOICE NOTES ARE COMING TO WHATSAPP STATUS

I don’t know if Zuckerberg intended for it to be so, but a lot of people have chosen their WhatsApp status to be that place where they rant freely or share personal opinions and experiences. This feature is loved by many. However, a snag many complain about is the 700-character limit that stares you in the face when you have so much to say on your status.

Looks like WhatsApp has been listening

Per Mybroadband, users of the app will soon be able to post voice recordings to their WhatsApp status for their permitted contacts to listen and engage.

Zoom Out: In recent years, audio messaging and conversations around it have been on the rise. Despite not being a new concept, innovative ways to explore audio messaging has sprung up since the pandemic era in 2020. From Clubhouse and Facebook’s Hotline to Twitter Spaces and LinkedIn’s Audio Room, the social media world is proving to be bullish on audio.

According to research, humans love the sound of their own voice. There is a chance that our psychological preferences are driving interests in these new tech products and features. But then, what do we care? Telling and listening to stories is core to our being, and WhatsApp is now giving us a chance to express that.

Increase your online sales with a Paystack Storefront – a free, beautiful seller page that helps you bring creative ideas to life.

👉🏾 Learn more at paystack.com/storefront

This is partner content.

SOUTH AFRICA WANTS TO REGULATE CRYPTOCURRENCIES

Once bitten twice shy. Twice bitten, then what?

South Africa was rocked twice in 2021 by record-breaking crypto scams. Scams such as South Africa-based crypto investment firm Africrypt scamming investors of about $3.6 billion of bitcoin. Later on, South African Mirror Trading International (MTI) defrauded hundreds of thousands of people of about $589 million.

Now the country is speeding up its efforts to regulate crypto and protect the vulnerable from further exploitation.

In April 2020, South African Reserve Bank (SARB) and other top financial regulators put their heads together and came up with 30 recommendations for crypto regulation. Among several things, the recommendations emphasised that cryptocurrencies are not legal tender. That same year, in October, the Financial Sector Conduct Authority (FSCA) proposed declaring crypto assets a financial product. Due to new developments in crypto-asset and crypto-related activities, that declaration was paused.

What is happening now?

It’s been over 2 years and South African regulators are still trying to implement some recommendations. However, the crypto-related crimes in South Africa are nudging the government to take immediate steps to reduce the risk of cryptocurrencies being used as instruments of fraud.

What are these steps?

The first is to bring crypto assets under the authority of the FSCA. The second is to implement a regulatory framework that governs exchanges and crypto platforms. This framework includes exchanges and crypto platforms that includes Know Your Customer (KYC) protocols, exchange controls, and applicable taxation laws.

These measures are a short-term fix before other long-term measures are implemented.

Zooming out: South Africa is not the only African country that is warily trying to regulate cryptocurrencies. Nigeria, Kenya, Zimbabwe and others are eyeing it cautiously too. Only the Central African Republic has welcomed it hopefully. The African country made bitcoin its legal tender and introduced a national cryptocurrency—Sango Coin— to create a crypto-based economy driven by private investment.

Fincra provides easy-to-integrate APIs developed and designed to launch seamless and reliable global payment solutions.

With Fincra’s customisable APIs, developers can build quick financial applications.

Build the best payment solutions on Fincra.

This is partner content.

IN OTHER NEWS FROM TECHCABAL

Nomanini and Baobab Global partner to expand StockNow app.

Jumia teams up with bicycle delivery company Errand360.

Zazuu raises $2 million to build a remittance marketplace.

Angola’s telecommunications service provider ITA is now Paratus Angola.

Edge computing company inq. acquires Syrex.

OPPORTUNITIES

- The Last Mile Money Startup Accelerator is now open to ventures working at the intersection of last-mile users and financial empowerment. Selected startups will receive design support, access to Last Mile Money’s network, and up to $50,000 in equity-free grants. Apply here. (July 15)

- Applications are now open for the Decentralised Umoja Algorand Bounty Hack II, by Algorand and Reach. The hackathon is a great opportunity for African developers to learn and build blockchain projects and win up to $3,000 in prizes. Apply by July 15.

- Apply Now! The 2022 #InclusiveFintech50 application period is now open! Seeking cutting-edge fintechs serving the underserved. Learn more and apply at inclusivefintech50.com.

What else we’re reading

- A detailed explanation of why Kuda Bank is now charging users.

- Safaricom will employ debt collectors to obtain unpaid M-PESA loans.

- Persistent Energy raises $10 million to fund ckeantech startups.

- Tablets meant for digital literacy of Ugandan students are being sold on Facebook.

It’s time for you to judge us! How have we done this year? Take this survey and share your experience reading TC Daily with us. Help us bring you the content that you love.