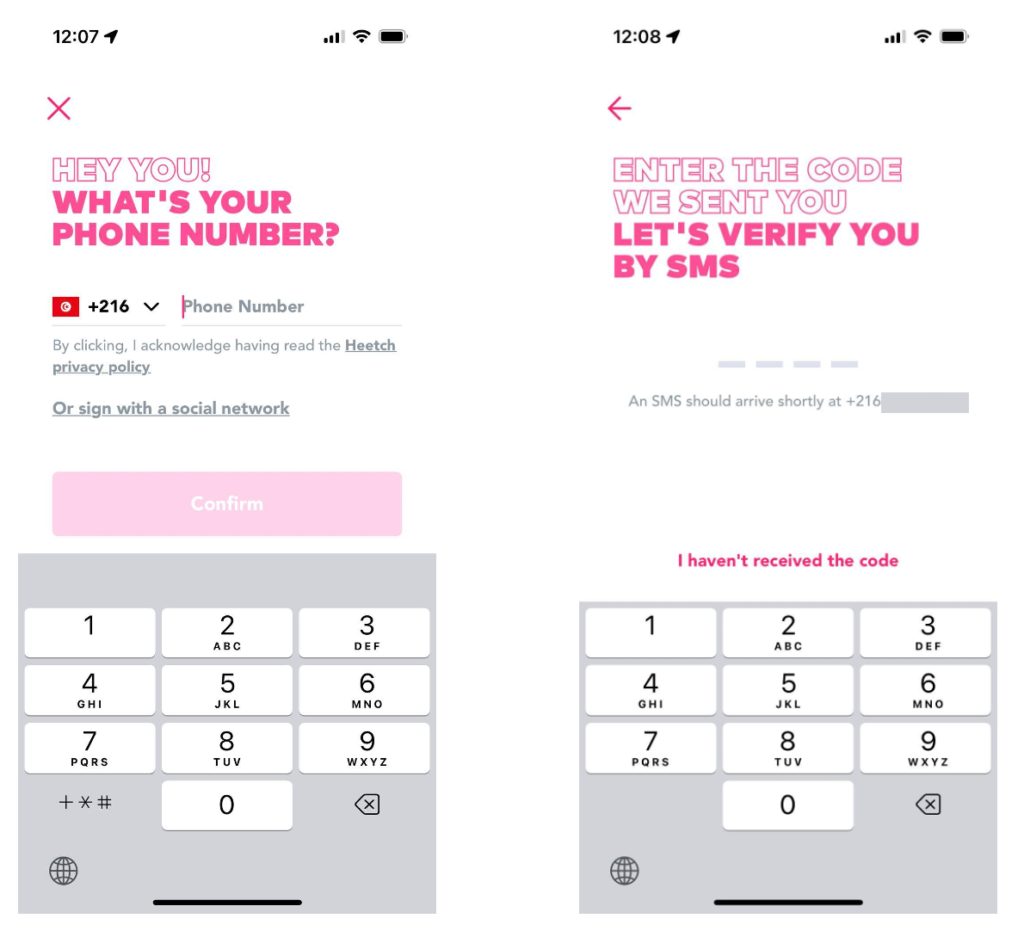

Did this ever happen to you?

You download an app and go through the registration process which requests your phone number to send you a one-time password (OTP). You have 30 sec or so to get the password and write it down otherwise you have to request a new one. Yet, you never receive the password.

CPaaS helping businesses stay ahead

In this case, the potential new user will probably never use the app again. When the communication channel between the user and the app is broken, users churn before even generating a single dollar of revenue for the business, and end up being acquired by a competitor. The company’s CAC increases while missing out on customer LTV.

Communication has undergone a significant transformation since the advent of the Internet and the evolution of mobile technology. In a world where speed and convenience are key, communication platform as a service (CPaaS) is helping businesses stay ahead of the game by providing them with real-time communication tools and services. From traditional phone calls to video conferencing, chatbots, and SMS, CPaaS has transformed the way businesses communicate with their customers. With this technological advancement, they can now provide efficient, reliable, and cost-effective communication services to their customers.

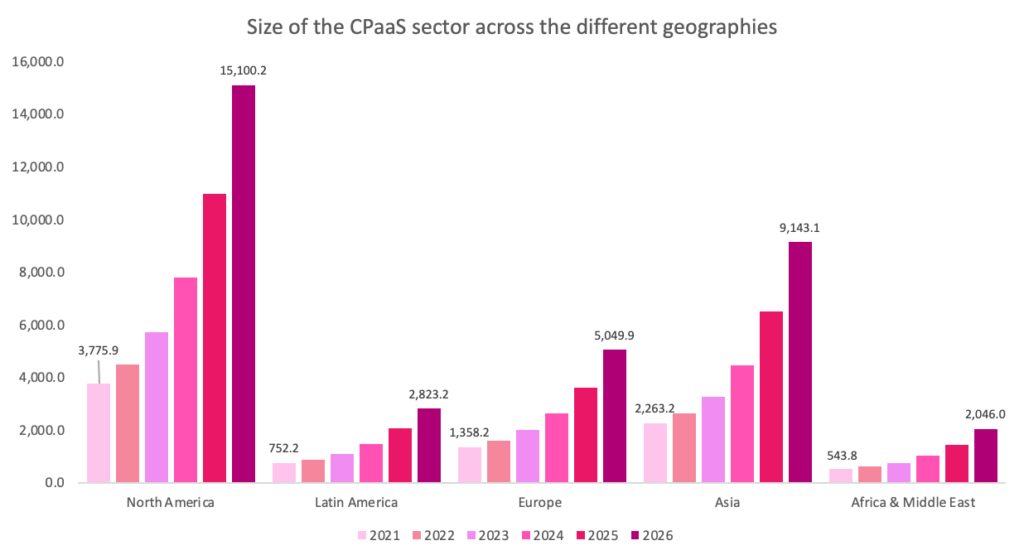

The global CPaaS market revenue was estimated at $4.75 billion in 2020 and is projected to reach $34.75 billion by 2026, growing at a CAGR of 38%.

North America is leading the CPaaS market, holding a consistent share of ~45% throughout the projected period. Meanwhile, Asia is the fastest-growing CPaaS market, with a projected CAGR of 40.7% from 2023 to 2026. In comparison, the CAGR for Africa and the Middle East during the same period is approximately 28%.

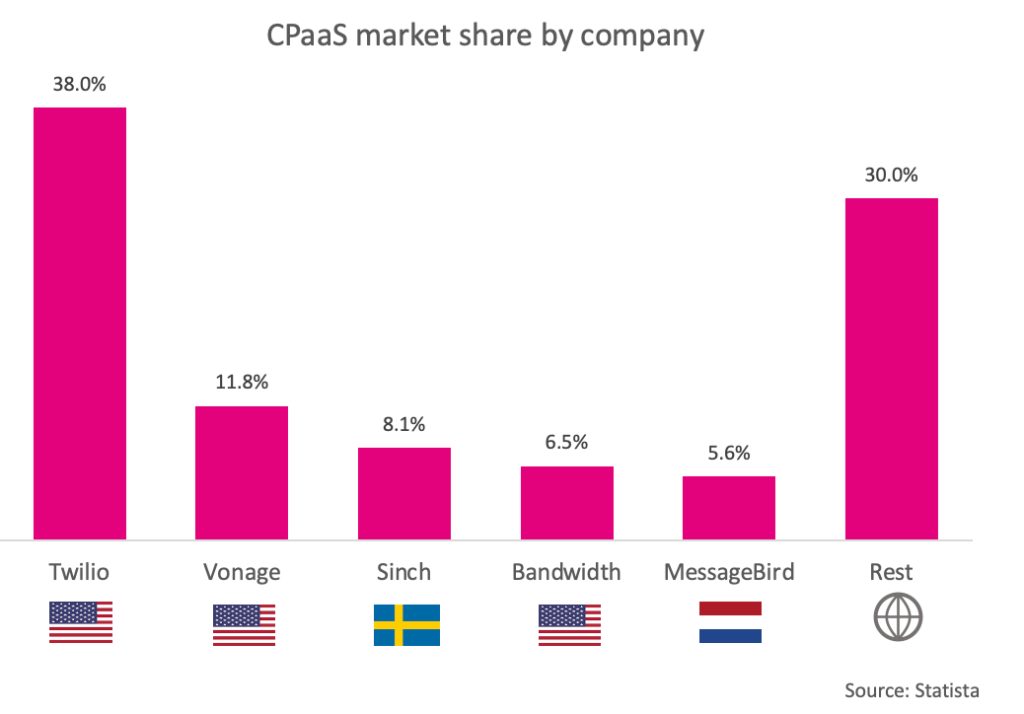

As of Q2 2021, five players control 70% of the market share with Twilio owning 38% of the global market.

Amid the maturation of the US and European CPaaS markets, businesses are engaging in strategic mergers and acquisitions to gain a competitive edge. Twilio’s acquisition of SendGrid in 2018 for $3 billion was the largest horizontal M&A deal in the CPaaS space, bringing together two US-based CPaaS platforms.

In 2022, Ericsson acquires Vonage for a whopping $6.2 billion making it the largest acquisition that the networking and telco company has made.

The CPaaS market is highly consolidated in most developed regions, with five major players controlling over two-thirds of the market. However, the sector is still relatively new in Africa, presenting significant growth opportunities for businesses in the region.

Despite the massive growth of the global CPaaS market, the African CPaaS space is still in its early days with immense potential for growth. In recent years, there has been a surge in demand for real-time communication services in the region leading to the rise of local players tapping into the opportunity.

In Africa, CPaaS providers like Termii, Africa’s Talking, Beem, SendChamp, Pindo, and others offer a wide range of communication tools and features, enabling businesses to deliver richer, more engaging user experiences.

How does CPaaS work in Africa and who are the stakeholders involved along the way in the process? And what are some key elements to consider when evaluating a CPaaS business?

Note: It’s worth highlighting that Nigeria has emerged as a trailblazer in CPaaS implementation across Africa and boasts a highly advanced and sophisticated regulatory framework, serving as a reference point for other countries in the region. As such, this piece will exclusively focus on Nigeria.

How CPaaS works

What are some of the use cases for CPaaS adoption?

CPaaS is rapidly becoming a go-to solution for businesses in Africa looking to enhance customer experience and streamline operations. From mobile payments to healthcare, the technology is being leveraged across various sectors to improve communication and reduce costs. Here are some use cases and examples below.

1. Mobile payments: CPaaS platforms are being used to facilitate mobile payments across the continent. By integrating it into their mobile payment systems, businesses can send SMS notifications to customers about transactions, send and receive payments via messaging, and provide customer support via messaging or voice calls. Paystack, a Nigerian payment infrastructure acquired by Stripe for $200M, uses a third-party CPaaS platform to send payment notifications via SMS to customers.

2. Customer service: CPaaS is also being used to enhance customer service in Africa. For example, businesses can use it to provide real-time customer support via messaging or voice calls and improve their response time while reducing the cost of customer support. For example, Nomba, a Nigerian fintech startup, uses CPaaS to provide real-time customer support via messaging and voice calls.

3. Marketing campaigns: Businesses can use CPaaS to send targeted text messages to customers as part of marketing campaigns with promotional offers, discounts, or other marketing messages. It allows businesses to reach a large audience quickly and at a lower cost than traditional marketing methods. For instance, Cowrywise, a Nigerian investment app, uses CPaaS to send targeted SMS messages to customers as part of their marketing campaigns.

4. Education: Businesses can use CPaaS to send SMS notifications to students about upcoming exams, schedule reminders, and other important information. It can also be used to provide interactive educational content, such as quizzes and games, via messaging. For instance, uLesson, a Nigerian edtech startup, uses CPaaS to provide students with important information via SMS notifications.

5. Healthcare: Healthcare providers can use CPaaS to send SMS notifications to patients about appointments, medication reminders, and other important health information. It can also be used to provide telemedicine services, such as remote consultations and diagnosis via messaging or video calls. RelianceHMO, a Nigerian health insurance startup, uses CPaaS to send SMS notifications to patients about appointments, medication reminders, and other important health information. They also use it for telemedicine services, such as remote consultations and diagnosis via messaging or video calls.

These are just a few examples of the many CPaaS use cases. As the technology continues to evolve, we can expect to see even more innovative use cases emerge across the continent.

Who are the main stakeholders involved in the CPaaS value chain?

The value chain in Nigeria

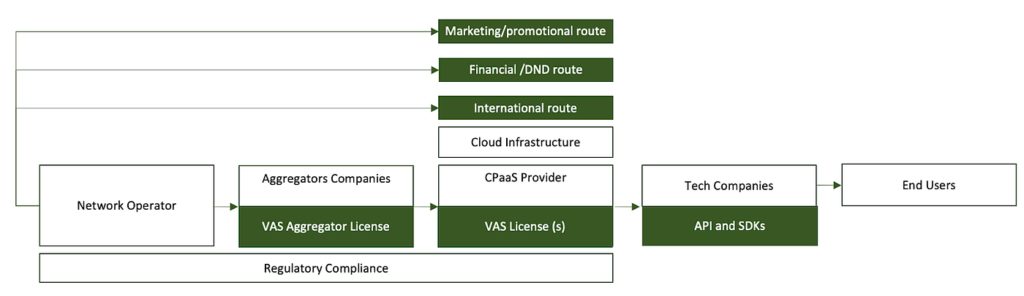

The CPaaS value chain mainly involves 6 stakeholders:

Regulator

Network operators

Aggregators

CPaaS providers

Clients (mainly tech companies)

End users

The regulator provides the licenses and guidelines to aggregator companies and CPaaS providers. Aggregators are the middlemen between the network operators and the CPaaS providers, they provide CPaaS companies with a simplified, direct, and secure connection to all Network Operators. Finally, tech companies use CPaaS providers to deliver messages to their customer base.

How do Network providers route the messages?

Network providers such as MTN or Airtel have three distinct routes within their systems for all communication channels:

1. Marketing or promotional route: this route only allows for the transmission of marketing messages.

2. Financial or do-not-disturb route: this route is reserved for priority messages such as one-time passwords (OTPs) and user-based notifications.

3. International route: anything can be pushed through this route, however, it is a more expensive option.

The category in which a message falls is determined by the Network operator. An instance is when a CPaaS company sends a marketing message through the marketing route, it goes through an aggregator and then reaches the network operator. If the message meets the requirements for the marketing route, it is accepted, and a confirmation message is sent back. However, if it does not meet the requirements, the message is blocked, and the transmission fails.

Reasons messages fail

Messages can fail for various reasons, including sender ID (filtering), fake numbers, interoperability, do not disturb (DND) mode, and network operators’ routes being down. Sender ID filtering involves network operators blocking messages based on keywords or content using a firewall. Fake numbers can also lead to message failure, as messages sent to non-existent or invalid phone numbers will not be delivered.

For example, around 10–15% of active sim cards in Nigeria are under the DND mode as of 2020, preventing them from receiving messages. However, they will still receive messages channelled via the financial route. Only companies with an operating license like the CBN Payment License, CBN MFB License, Insurance License, Money Lender License, or other forms of approved operational licenses can send messages through the DND phone mode.

There are still potential issues to consider like customers porting from one mobile network to another which leads to message delivery failures. Additionally, when network operators’ routes are down, messages that don’t match any available route will automatically fail without being sent.

These result in high failure rates and increased costs for CPaaS businesses.

CPaaS in Nigeria

Developers and businesses using CPaaS in Nigeria must ensure that they comply with the Nigerian Communications Commission (NCC) regulations regarding the use of communication services. This may include obtaining certain licenses or certifications, ensuring that their communication services are secure, and protecting the privacy of their users.

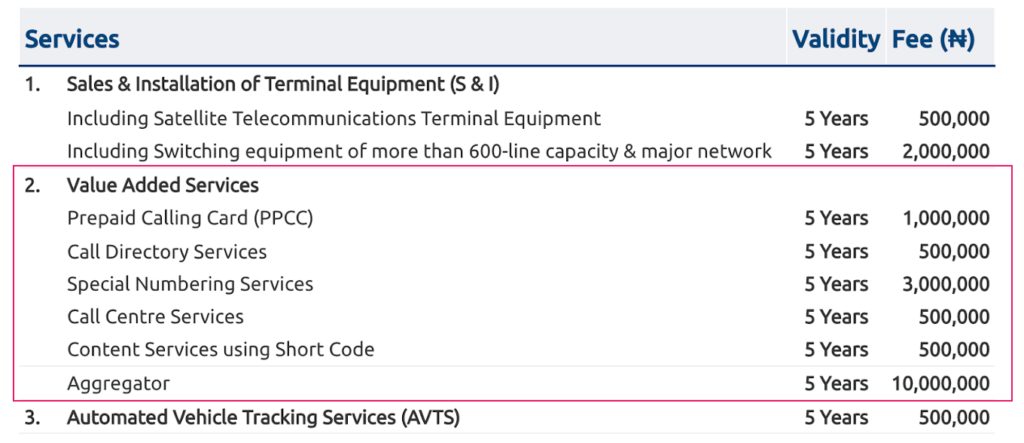

In Nigeria, there are two types of licenses:

- The Value-Added Services Aggregator license (Aggregator license)

- Use case-specific Value-Added Services (VAS) license(s)

Companies that hold the VAS Aggregator license are known as aggregators. They serve as a link between network operators and companies holding the other VAS licenses. The aggregator license is the most cost prohibitive of all the VAS licenses—₦10 million, circa $21,500, for a 5-year validity period. As of July 2021, only 28 companies hold this type of license in Nigeria.

ALSO READ: Funding or not, Wimbart’s Jessica believes tech PR is here to stay

On the other hand, the other VAS licenses allow companies to offer messaging, voice, call centres, prepaid calling cards, and other services to retail consumers. Companies with the VAS license are required to connect to aggregators and cannot connect directly with the network operators.

What’s worth noting is that it is illegal to hold both licenses in Nigeria and also illegal for network operators to provide value-added services directly to the end user.

In Nigeria, CPaaS companies that provide SMS services hold the “Content Services Using Short Code” license and the ones that provide voice services hold the “Call Center Services” license. Companies that offer both services must have both licenses.

Factors to keep in mind while evaluating a CPaaS business

Lastly, having researched most CPaaS companies in Africa and interviewed 3 of their CEOs, several criteria came to mind while evaluating the investability of such businesses.

- The cultural context of the team is essential in navigating regulatory hurdles. Having a team present in the markets they operate in is crucial, as the interface differs from one country to another.

- Reacting quickly to market requirements and adapting products to meet regulatory and compliance demands. The team’s technological abilities and speed in implementing changes are key. As an example, in 2016, the NCC mandated telcos in Nigeria to enforce the DND code across their networks which impacted CPaaS businesses.

- Expansion plans must be developer-first and well-strategized.

- Delivery of messages and response times are crucial, so evaluating a business’s plan B for ensuring that at least 90–95% of messages are not failing is vital.

- The speed of receiving (pull and push) messages is a critical consideration.

- Customer support must be reliable and responsive.

- Ensuring that the platform remains stable, and the operator’s connection is reliable is key.

- Cost is an important factor, and commercial agreements with network operators should be negotiated to ensure pricing is competitive.

- Evaluating the number of integrations with network operators is vital in assessing a business’s ability to expand its reach and connect with customers.

- The customer experience should be a top priority for the business.

Cyrine Ben Fadhel is a Venture Capital Investor at Global Ventures, a mission-driven early and growth stage fund investing in foundational technologies across the continent.

If you enjoyed this read, or have any further questions, feel free to reach out on Linkedin or Twitter.