Read this email in French.

Editor’s Note

- Week 18, 2023

- Read time: 5 minutes

A lot of interesting things happened across the continent this week. In this edition, we bring you the most interesting news from Nigeria, Kenya, and South Africa.

Enjoy!

Pamela Tetteh Editor, TechCabal.

Editor’s Picks

|

SA firm to pay $3.4 billion for crypto fraudA federal US court in Texas has ordered the CEO of a South African firm to pay $3.4 billion for bitcoin fraud. This is now the biggest fraud case involving Bitcoin. Learn more. |

|

Kenya approves spyware for phonesKenya wants to curb the sale and distribution of fake phones and its solution is a spyware software on every mobile device in its territory. Learn more. |

|

Nigerian telcos reject NITDA billLast week, we reported the most recent fallout between Uber, Bolt and the Nigerian ride-hailing union, AUATWON. This week, we interviewed drivers of Bolt and Uber, and they spoke about their understanding of the situation. Learn more. |

|

Phone calls get more expensive for NigeriansPhone calls & data bundles are going to get more expensive for Nigerians as the government is imposing a 5% excise duty on the telecom industry. Learn more. |

|

Nigeria approves blockchain technologyThis week, the Nigerian Ministry for Communication and Digital Economy announced the approval and launch of a national blockchain policy, as a part of its 10-year digital economy plan. Learn more. |

|

Kenya gets state-backed QR codes for paymentsThe Central Bank of Kenya (CBK) has announced the Kenya Quick Response Code Standard 2023, also shortened as KE-QR Code Standard 2023. Learn more. |

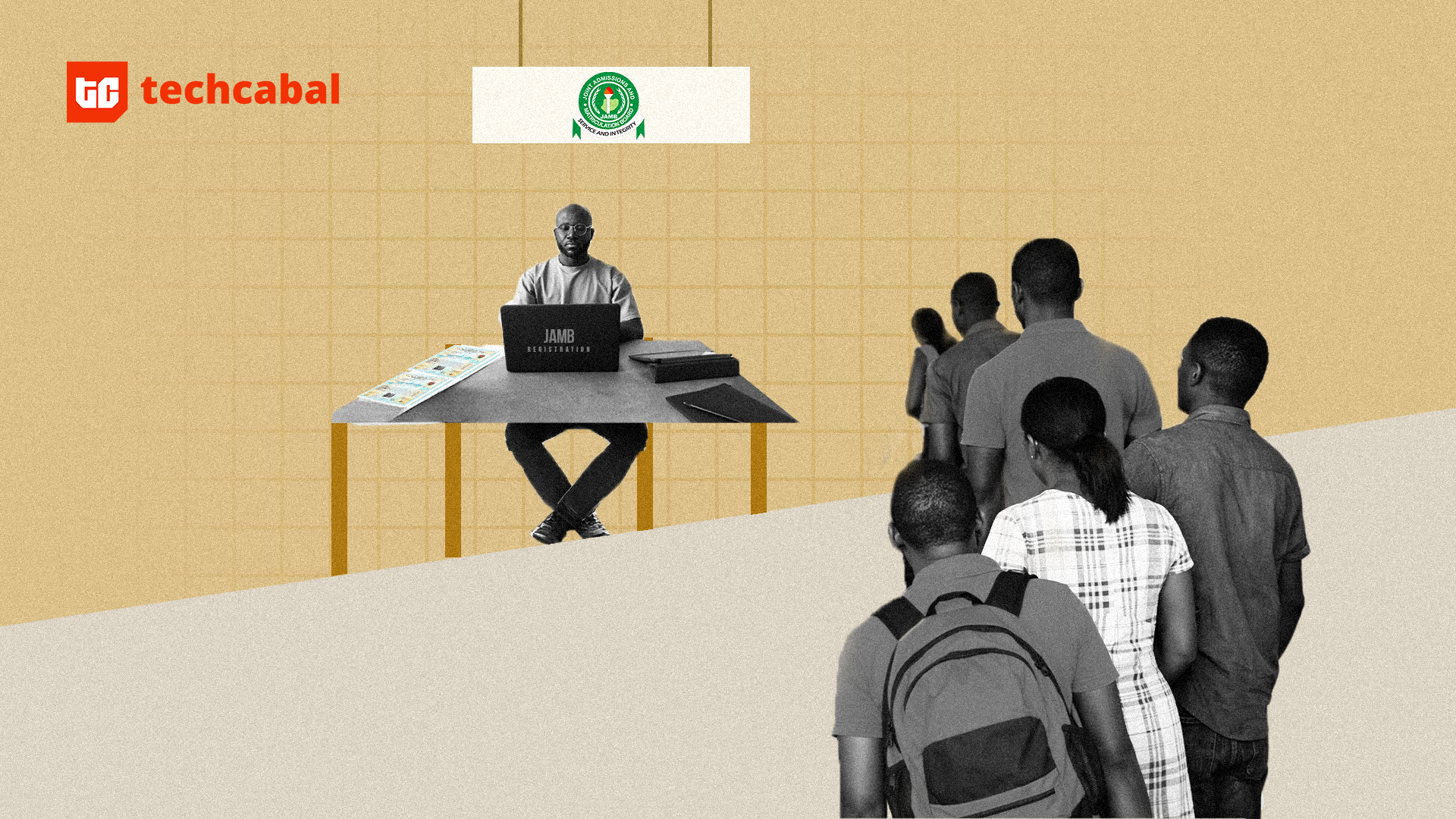

Lending in Nigeria

Are you curious about the dynamics of borrowing between family and friends, and how technology can play a role in solving the problem? Then this report by Sycamore, in partnership with TechCabal Insights, is for you.

It provides comprehensive analyses of the informal market and how technology can be leveraged to improve the family lending sector in Nigeria. Download here.

|

Meta loses again in KenyaMeta’s former content moderator, Sama, has once again failed to shake off the over 180 content moderators that it has been trying to lay off for months now. The court has granted the foreign petitioners the right to stay until the matter is resolved. Learn more. |

|

A fire incident at Zenith BankZenith Bank, Nigeria’s biggest bank by market capitalization, experienced total infrastructure downtime after a fire at the company’s primary data center. Learn more. |

|

Nomba raises $30 millionPayment service provider, Nomba, which started out as an AI chatbot, has raised #30 million at a $150 million valuation. Learn more. |

|

South Africa’s bRAND new currencyFor the first time since 2012, the South African Reserve Bank—the country’s apex bank—has unveiled new designs for rand notes and coins. Read more. |

Who brought the money this week?

- Nomba, a pan-African payment service provider, secured $30 million in Pre-Series B funding. The oversubscribed equity funding round was led by San Francisco-based Base10 Partners, with participation from Helios Digital Ventures, Shopify, Partech, and Khosla Ventures.

- Fedi, a Nigerian bitcoin-focused company, raised $17 million in a series A funding round led by Ego Death Capital. Other participating investors include Block, Kingsway, Trammell Venture Partners, and Timechain.

- Tunisian e-commerce company Drest.tn received $336,000 in an undisclosed funding round from 216 Capital Ventures.

- Nigerian Insight7, an AI company, secured undisclosed funding from Forum Ventures

What else to read this weekend?

Written by: Ngozi Chukwu

Edited by: Pamela Tetteh