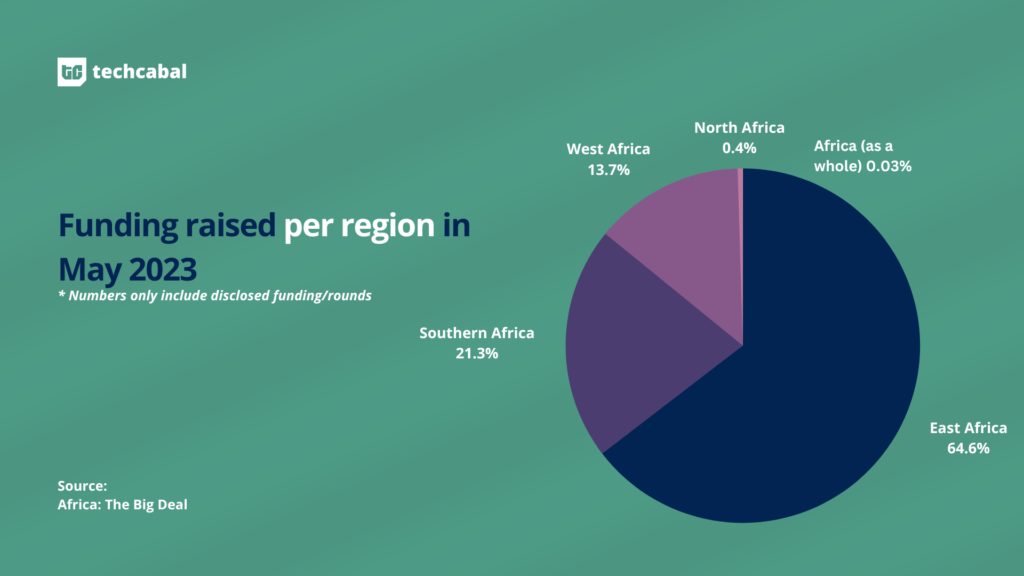

1. Funding: East Africa leads the way

In May 2023, African startups raised $621.8 million from 34 fully disclosed* raises.

Compared to May 2022 where African startups raised $437.1 million, this shows a 42% year-on-year increase. The number is also a significant increase from April 2023 where the total amount raised was $129.8 million, a whopping 379% increase!

Per region, East African startups led the way with the majority of the funding—about $414.7 million representing 64.6% of the total funding. These figures are led by fintech M-Kopa’s $255 million raise, and Sun King’s recent $130 million raise.

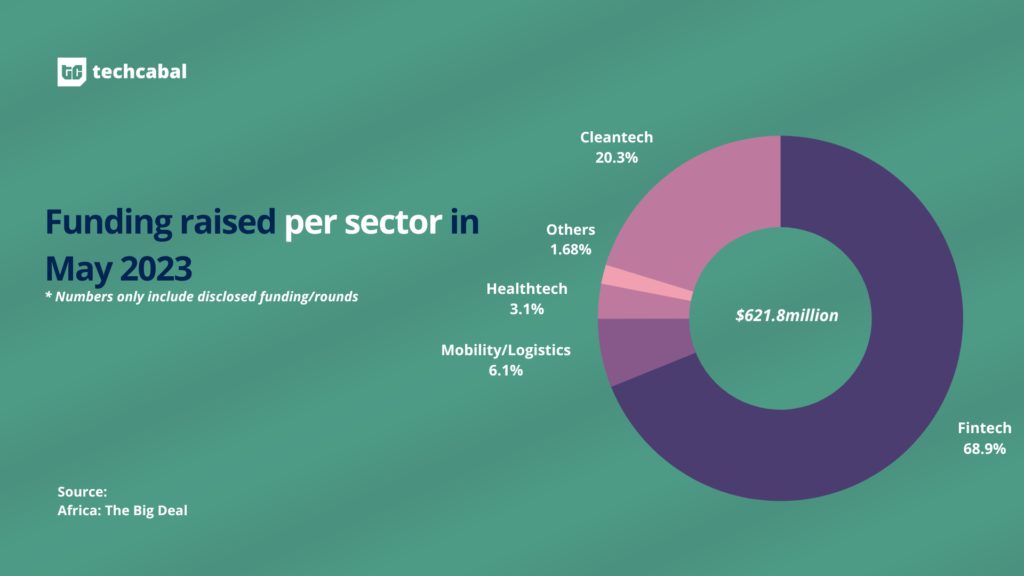

Per sector, the top from May 2023 are fintech, cleantech and mobility/logistics. Fintech leads with $442 million (68.9%), cleantech with $130 million (20.3%), and mobility/logistics with $39 million (6.1%).

The top 5 disclosed deals of the month are:

- Kenyan asset financing startup M-Kopa’s combined $255 million debt-and-equity financing round.

- Kenyan cleantech SunKing’s $130 million securisation deal.

- South African digital bank TymeBank’s $77.8 million pre-Series C round.

- South African fintech E4’s $52 million acquisition led by Infinite Partners.

- Nigerian Logistics startup Sabi’s $38 million Series B funding.

*Note: This data is inclusive only of funding deals announced in May 2023. Raises are often announced later than when the deals are actually made. This data also excludes estimated grants from accelerators like Techstars or Y Combinator.

2. Big deals: Ghana secures $3 billion from IMF, MTN gets $320 million

Topping the big non-startup deals of May 2023, Ghana secured a $3 billion bailout from the International Monetary Fund (IMF).

The approved funding will serve to replenish Ghana’s foreign-exchange reserves, which have seen a significant decline of nearly 50% since their peak in August 2021.

Meanwhile, MTN is sticking to its “everywhere you go” mantra with a $320 million deal. The deal, which comes as part of a partnership with development fund Africa50, will see the creation of a fibre optic network between 10 African countries by 2025.

3. Regulations: Nigeria’s new ICT bill resurfaces amidst pushback

Amendments to the regulatory act of Nigeria’s ICT agency, NITDA, made a stir in May.

Last month, the Senate Committee on ICT and Cybersecurity also recommended that the Senate pass the new National Information Technology Development Agency (NITDA) Act.

The recommendation comes as the bill faces intense opposition from ICT leaders who have labelled the bill a “bundle of chaos”. Nigerian telecoms also wrote to the National Assembly, requesting exclusion from the bill that could bring double taxation and regulation to their doorsteps.

4. Fintech: Kenyan government launches unified QR code system

In East Africa, May saw the Kenyan government implanting financial interoperability with the launch of a unified QR code system.

The Kenya Quick Response Code Standard 2023, or the “KE-QR Code Standard 2023”, will offer all payment service providers regulated by the Central Bank of Kenya (CBK) the ability to process payments using QR codes.

5. Crypto: Zimbabwe launches digital currency, sells $39 million worth

Zimbabwe kicked off its digital currency early in May.

Post-launch, the country faced criticism from the International Monetary Fund (IMF) who cautioned that the gold-backed currency would not solve its fiat currency devaluation problems, and could deplete the country’s gold reserves.

Despite this, the Reserve Bank of Zimbabwe (RSV) reportedly sold 14 billion Zimbabwean dollars’ worth of gold-backed digital tokens—worth around $39 million.

6. Acquisitions: Safaricom buys M-Pesa Holdings for $1

In the deal of the month, Vodafone sold the trust company M-Pesa Holding Company Limited (MPHCL) to Safaricom for $1.

The holding company presently has €1.2 billion ($1.3 billion) in customer funds which Safaricom could invest in short-term securities.

Safaricom will need the money after acquiring a $150 million licence to operate mobile money services in Ethiopia.

7. Regulations: Nigeria suspends licences of 179 microfinance banks

While April may have seen Nigeria approving licences for loan apps to operate in the country, May meets the country revoking licences in other sectors.

Last month, the Central Bank of Nigeria (CBN) revoked the licences of 179 microfinance banks (MFBs), four primary mortgage banks, and three finance companies. The licences were revoked because the institutions didn’t comply with regulatory requirements or carried out unauthorised businesses.

Part of the affected MFBs included Eyowo, a Nigerian digital bank whose customers are finding creative ways to withdraw money after the bank suspended all withdrawals pending its licence re-approval.

8. Africa + Big Tech: Kenya rules against Sama again, Bolt opens engagement centre in Nairobi

Continuing the trend from previous months where Kenyan courts have ruled that they have the jurisdiction to hear cases against big tech companies like Meta, Kenya once again—in May—held the tech behemoth accountable.

Last month, Kenya’s Employment and Labour Relations Court ordered the content moderation service Sama to pay its employees. This comes after Sama, Meta’s outsourcing partner, refused to pay its content moderators their salaries due to the moderators’ court case against them.

Meanwhile, in contrast, could Bolt be finally taking its Kenyan drivers’ complaints seriously with the launch of its Nairobi engagement centre?

9. Telecom: Mozambique joins the 5G gang

In May, East Africa’s Mozambique became the newest African country to launch 5G.

Early in the month, telecom Vodacom announced the launch at selected sites in Maputo, Matola; the central area of Nampula; downtown Nacala, Munhava, Maquinino, and Chipanga neighbourhoods; Beira; and Tete.

So far, at least a dozen African countries have launched 5G commercially while many more are reportedly running trials across their respective countries.

10. Economy: IMF says Nigeria’s e-naira is failing

Contrary to claims by the Central Bank of Nigeria’s (CBN) governor, Nigeria’s digital currency might be a bust.

In May, the International Monetary Fund (IMF) revealed that 98.5% of e-naira 14 million wallets have not been used even once, two years after its launch.

According to the IMF, the total number of retail e-naira wallets amounted to about 860,000, which is equivalent to just 0.8% of Nigeria’s active bank accounts.