TGIF 🎉

More territories are banning TikTok on state-owned devices.

Unlike Kenya—which is still considering a TikTok ban—it’s not for moral reasons. Yesterday, New York joined other US states, Canada, Australia, Taiwan, Denmark, and many others in banning TikTok on state-owned devices. All these countries are worried that the Chinese-owned platform might be misusing the data it has and poses a security threat.

We neither support nor oppose any of it, but if you’re considering a TikTok ban, a cybersecurity threat might be more a rational reason than moral grandstanding.🤷🏾♂️

Nigeria disburses $6.5 million to each of its 36 states

Nigeria is sharing palliatives.

Yesterday, the country’s federal government approved the disbursement of ₦5 billion ($6.5 million) to each of the 36 states to cushion against the effect of fuel subsidy removal.

Why? Well, with the prices of food and petroleum skyrocketing due to the removal of fuel subsidy, things have gotten pretty tough. The plan here is for the states to use this money to buy essential grains like rice, beans, and maize. States should also use the money to buy fertilisers for local farmers. In addition to the money, the federal government also released five trucks of rice each to all its 36 states.

There are strings attached. Per Channels TV, 52% of the funds were grants while the remaining 48% are loans that the state governments will eventually need to repay.

Some concerns: Currently, only ₦2 billion ($2.6 million) has been distributed to each state, but the governor of Anambra state reported that the influx of refugees from Niger Republic is posing a challenge to the distribution of much-needed palliatives. The National Emergency Management Agency is in charge of delivering essential food supplies to states that share borders with the Niger Republic. Meanwhile, the governors are rolling up their sleeves to review the nation’s social register to ensure that every citizen gets their fair slice of the support.

Secure payments with Monnify

Monnify has simplified how businesses accept payments to enable growth. We are trusted by Piggyvest, Buypower, Wakanow, Fairmoney, Cowrywise, and over 10,000 Nigerian businesses.

Get your Monnify account today here.

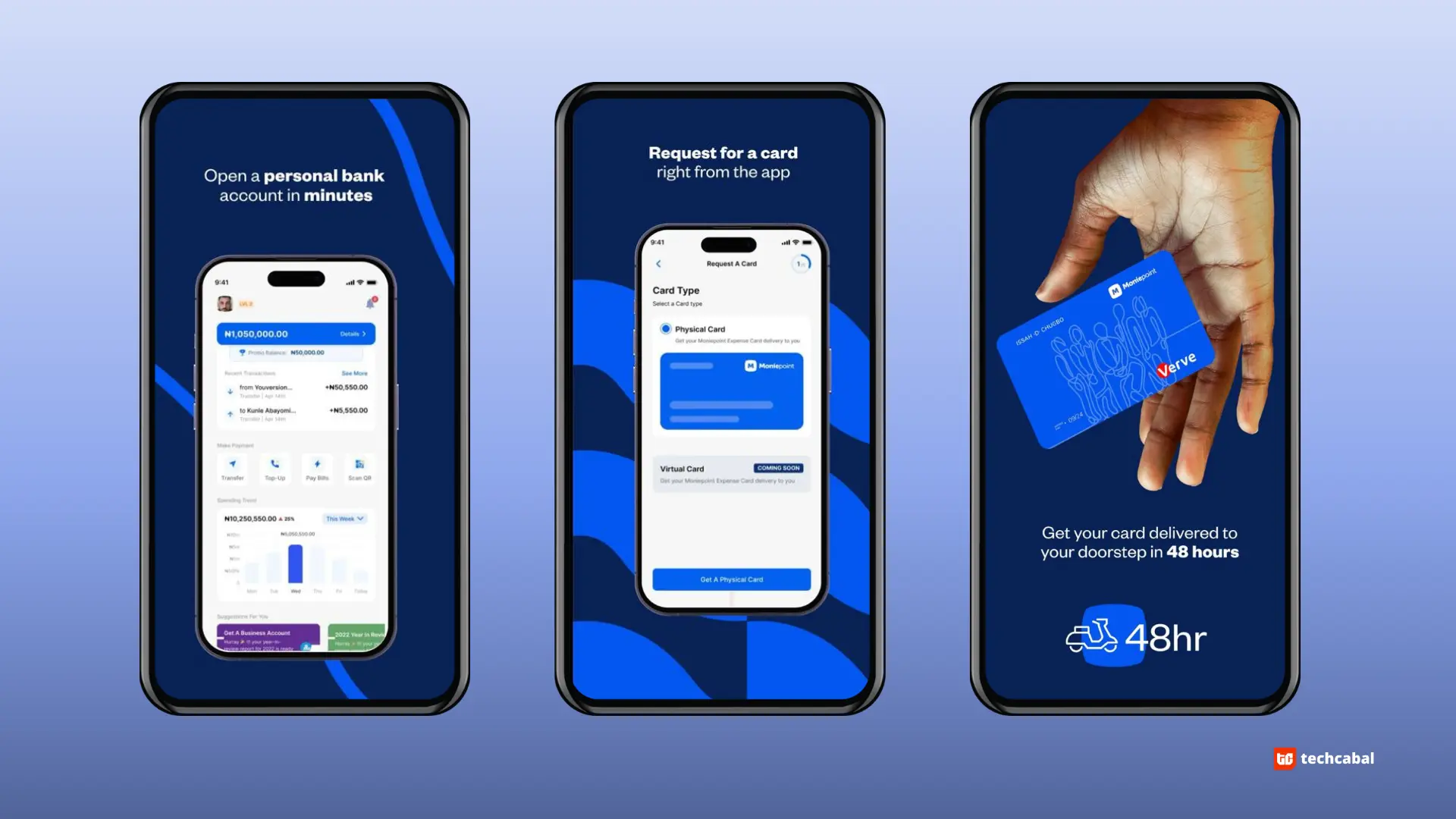

Moniepoint moves into retail banking

Moniepoint, the Nigerian fintech, is venturing into personal banking through the launch of its consumer app and debit app.

Withdrawals, debit cards, and more: Moniepoint is bringing the heat to competitors Opay and Palmpay through its retail banking focus. With its new app, users will be able to make transfers, pay bills, and buy airtime, while its debit cards, issued through Mastercard and Verve, can be used at ATMs, POS terminals, and online.

The company also says it will introduce a first-of-its-kind automated dispute resolution system that will enable users to log disputes for failed card transactions and track them until they get a full reversal within 48 hours. This is in line with the CBN’s guidelines on chargebacks, which mandate a 48-hour reversal period.

The right time: For an 8-year-old payments company, Moniepoint could have launched a personal banking product earlier, but Ope Adeyemi, Moniepoint’s senior vice president for channels and sales tools, told TechCabal that the company chose now because “[Moniepoint] are positioned to do it right.”

He added that the company has designed its personal banking app to be as reliable as possible and added features such as salary advances. The app will store sensitive customer debit card information, rather than keeping it on the physical card.

Adeyemi also added that a play at remittances would come later for both its business customers and its personal bank customers.

Learn with Unicaf

Unicaf isinviting you to the Lagos Oriental Hotel on the 31st of August, 2023, at 11:00 AM WAT for a panel titled “The Role and Impact of AI on the Job Market: The Future is Here”.

Attendees will be awarded up to in 75% Unicaf Scholarships to pursue internationally recognised degrees from one of Unicaf’s respected partner universities in the UK and Africa. Register here.

Bolt records milstone in Kenya and Nigeria

Bolt is wheeling Africans across their nations.

The ride-hailing service announced that it has facilitated over 100 million rides in Kenya since entering the market.

Over the past decade, Bolt says it has grown from a groundbreaking startup to a global leader in the mobility sector. The company says it remains focused on providing an innovative technology platform that enhances safety, affordability, and sustainability.

ICYMI: In July, the company reportedly surpassed 150 million customers in over 45 countries and 500 cities. These customers are spread across its suite of mobility products which include ride-hailing, micro-mobility (scooter and e-bike rental), food delivery, grocery delivery, Bolt Drive which is a free-floating car-sharing service, and Bolt Business, a corporate mobility service.

250 million rides: In Nigeria, the company announced that it completed over 250 million rides since its launch in 2016. In the announcement shared yesterday, the ride-hailing company noted that it had recorded over 3 billion kilometres in distance travelled by its users.

Bolt said it had recorded over 7 times growth in the rides business since it was launched in 2016. “As we reach these remarkable milestones in the ride-hailing market, we remain steadfast in our commitment to ensuring safety, affordability, and reliability for all users on our platform,” said Yahaya Mohammed, its country manager for Nigeria.

Funding Tracker

This week, Kenya-based ed-tech company Ed Partners secured $1.5 million in debt funding from a social impact investor Oikocredit.

Here are the other deals this week:

- Ghanaian agricultural company Oyster Agribusiness raised $310,000 in grant and debt funding from Root Capital.

That’s it for this week!

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. You can also visit DealFlow, our real-time funding tracker.

Save costs with QoreID

Seamless customer onboarding made easy! Onboard users instantly and save costs with CBN compliant regulations. To learn more, visit www.qoreid.com or book an instant demo at sales@qoreid.com

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $26,266 |

– 8.31% |

– 12.84% |

|

| $1,666 |

– 7.31% |

– 12.77% |

|

|

$4.13 |

– 3.97% |

+ 128.84% |

|

| $1.24 |

– 12.33% |

– 19.69% |

* Data as of 06:00 AM WAT, August 18, 2023.

TC Live

Join us tomorrow at 11 AM (WAT), as we bring experts in the payment and trade sector to share perspectives and insights on how to enable seamless and affordable cross-border banking for African businesses.

Speakers include; Elizabeth Rossiello- CEO at AZA Finance, Dare Fadeji – International trade expert, Lucia Okafor – Senior Manager, Payments & Financial Services Strategy at Deloitte, Nana Yaw Owusu Banahene – Regional Head of Africa Partnerships at AZA Finance, and Fatimah Gana – Mahmoud – Head of Sales, West and Central Africa at AZA Finance.

- Visa is open to applications for its Africa Fintech Accelerator Program. Startups up to the Series A stage are encouraged to apply for a chance to gain unparalleled expertise, valuable industry connections, cutting-edge technology, and potential investment funding. Apply by August 25.

- If you are an aspiring economist entering your first year of undergraduate studies in the 2024 academic year, the South African Reserve Bank’s (SARB) Economic Research Department in collaboration with the SARB Academy, invites you to apply for competitive SARB bursaries in the field of economics, economics and econometrics, economics and mathematical statistics and economic science. Apply by September 30.

- Applications are open for the Cambridge Africa ALBORADA Research Fund 2023 for sub-Saharan African Researchers ($20,000 in Grants). The Cambridge Africa ALBORADA Research Fund competitively awards grants between £1,000 and £20,000 for research costs, research-related travel between Cambridge and Africa, and conducting research training activities in Africa. Apply by September 4.

- The SaaS Accelerator Programme: Africa 2023 has opened applications for its accelerator programme to enable early startups in Africa to receive funding. Selected startups will receive up to $70,000 in funding. Apply by September 7.

What else is happening in tech?

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.