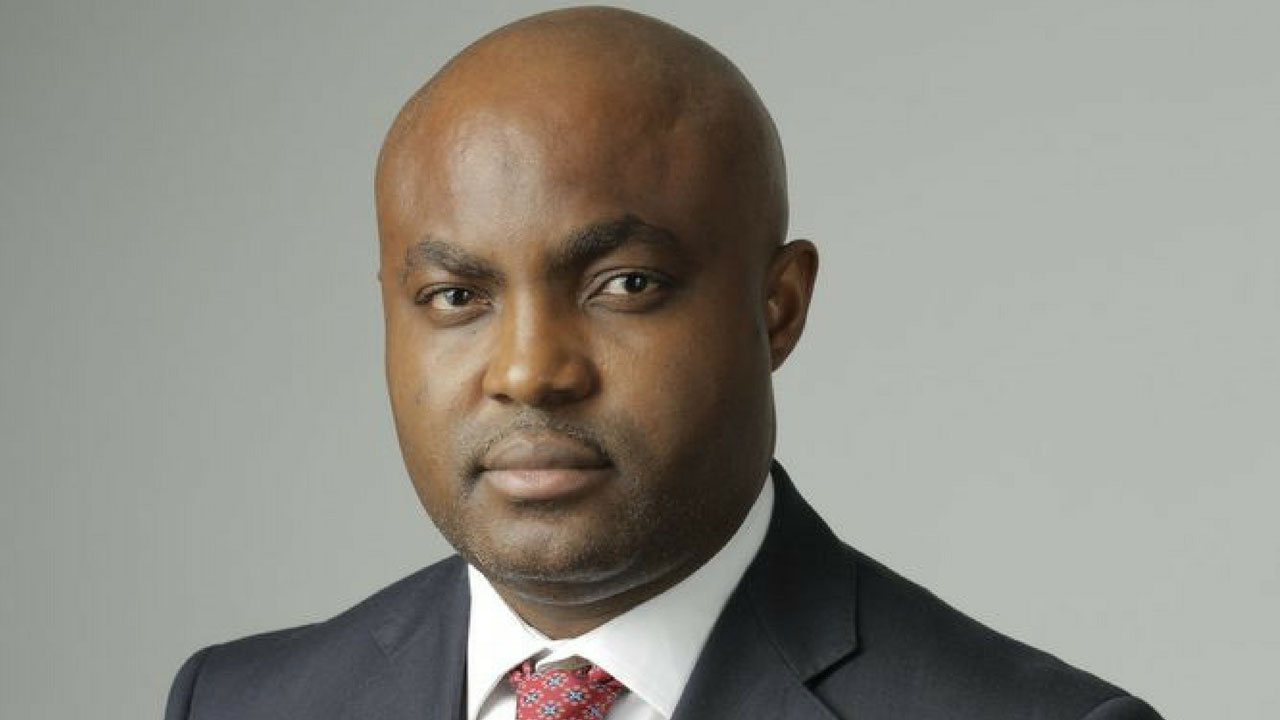

Less than eight years ago, the way people interacted with money was vastly different. But with the rapid growth of fintechs across the continent, money habits have changed and continue to. Josh Chibueze, co-founder and CMO at Piggyvest, in his keynote speech at Moonshot by TechCabal on October 12, shared some of the impact that fintechs have had and how they’re changing the habits of people who spend.

“Before fintechs, it was hard to save and manage money. People used to open several bank accounts just to have different savings accounts. Fintech has changed our interaction with money, and a lot of impact has been made.”

According to Chibueze, the advent of fintechs has hacked three key things: accessibility, control and flexibility with money. More people can now save in bits and access quick credit loans. Fintechs have revolutionised the banking industry in Nigeria and Africa, providing channels that reduce income inequality and poverty. Piggyvest, for instance, has paid back over $1.1 trillion since it launched in 2016. Fintechs have also done the work of helping to bank the unbanked and helped to improve social donations across the world.

However, the industry is not without challenges. Fintechs have to deal with regulatory issues from governmental bodies and authorities, fraud and also have to efficiently manage customer expectations and maintain their trust. Chibueze believes that collaboration is the future of fintech and one way to overcome these challenges.

“People often say that fintechs will overthrow traditional banks. I don’t think so. Collaboration is the way forward and will lead to exponential results. We all have a common problem, and we need to collaborate to solve these problems and create an inclusive financial future for everyone,” he said.

Another thing we can look forward to in the future of fintech is hyperfocusing. Chibueze believes that soon, we’ll see fintechs honing in on specific problems that the banking and financial industries face.