Good morning ☀️

To celebrate Nigeria’s 63rd Independence Day, we’re having a flash sale on Moonshot tickets!!

Save 25% on all Moonshot Tickets, only for the next 5 days!! Offer valid from October 1 – 6, 2023. Buy your tickets here.

Patricia calls for patience

Nigerian crypto startup Patricia is asking its customers for some patience.

Last Friday, the company held a virtual town hall to give updates about its progress and appeal to infuriated customers.

Why? Patricia has had a troubling year. Earlier in May, the startup revealed that it suffered a hack in January 2022 which cost it nearly $2 million. It partially froze withdrawals after the 2022 breach, allowing customers to deposit funds but not move them from wallet to wallet. Instead, Patricia offered to buy those coins from customers and pay them cash to manage the situation. This workaround continued until March 2023.

By April 2023, the company launched Patricia Plus, its new app which had no withdrawal restrictions, which triggered a bank run and led to a deficit of 75 bitcoins. The company was then forced to reinstate the freeze in May 2023.

Since then, customers have been unable to access their assets. In August, in what it termed a move to protect customer assets, it converted all user assets into its newly minted Patricia Token (PTK) backed by the US dollar. Unfortunately, users were not informed about the conversion beforehand, and still couldn’t access their funds even after the conversion.

A repayment plan: Now, the company is effecting a new repayment plan through fundraising. At the town hall, CEO Hamu Fejiro announced that the company had secured some funding and plans to reopen its app soon. While the investors or investment is undisclosed, TradeFada CEO Segun Dania announced, in July, that he had invested an undisclosed sum in Patricia.

As the startup revealed its plan to relaunch its app and repay funds, its customers were bothered with the timeline of repayment which still isn’t clear at the moment. Others are considering taking legal action or filing with the appropriate authorities.

Get a working card from Moniepoint

With the Moniepoint personal banking app, you get reliable payments every time and a card that always works. Enjoy seamless payments powered by the infrastructure that 1.5 million businesses trust. Download the app.

Kenya joins PAPSS

Kenya has officially joined the Pan African Payments and Settlement System (PAPSS).

Hold up, what’s that? PAPSS is a new way to make instant cross-border payments in local currencies across Africa. Basically, it’s a payment system that allows you to send money to another African country, in your local currency.

The service was launched in January 2022, and is currently used by commercial banks and payment service providers in nine African countries: Nigeria, Ghana, Liberia, Guinea, Sierra Leone, The Gambia, Djibouti, Zimbabwe, and Zambia.

Kenya becomes the tenth country to join the service. Last Friday, trade secretary Moses Kuria made the announcement noting that the Central Bank of Kenya (CBK) had signed the agreement and completed all the necessary formalities. “This means that Kenyan companies can trade with their peers from other African member states using our local currencies, a major boost for the African Continental Free Trade Area (AfCFTA),” said Kuria.

Zoom out: Since launch, PAPSS has reportedly saved African companies over $5 billion in transaction charges they would have incurred using alternative payment methods. With its growing success, PAPSS is expected to be spooned out to all 54 African countries in the near future.

P1 Ventures announces $25m first close of second fund

P1 Ventures, a VC firm, has completed its first $25 million of its second fund of $50 million. Mikael Hajjar, founder and general partner of P1 Ventures told TechCrunch that the VC firm will complete the second fund early next year.

P1 says it will use the funds to build African businesses across fintech, e-commerce, healthtech, SaaS and AI verticals.

Since its launch in 2020, the firm has invested in 29 early-stage companies across 10 countries, including Money Fellows in Egypt, and Reliance Health in Nigeria. It also recently led a seed round for Gameball, a software company gamifying loyalty and customer retention.

An AI focus? P1 Ventures is betting on AI-powered startups with this fund. The firm believes that AI can break down traditional infrastructure barriers faced in agriculture and FMCG retail. The firm has also invested in Nkloso, a startup that gathers data and keeps track of agricultural land using satellite imagery and AI. P1 Ventures The VC firm also uses AI to source deals and support its investing team.

Zoom out: In what seems to be a funding winter, the latest development by P1 Ventures raises hope for African startups looking to raise funds, especially for startups who leverage AI solutions.

Apply for the MEST Africa Challenge

It’s time to unlock the next stage of your startup’s growth. Do this with access to funding, networks, and growth opportunities at this year’s MEST Africa Challenge startup pitch competition. Apply by 9th October 2023. Apply today!

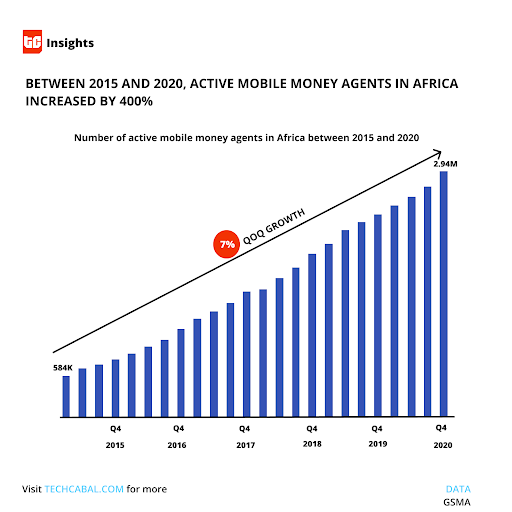

Beyond agency banking

As of 2019, the global density of the agent network reached an average of 228 active mobile money agents per 100,000 adults, seven times more than ATMs and 20 times more than bank branches. In Africa, there are about 460 agents per 100,000 people compared to the 6 ATMs and 5 bank branches for every 100,000 adults. The number of agents increased by an average of 7% quarter-on-quarter (QoQ) in five years, making digital financial services accessible to millions across the continent.

As a result, more people now use agent networks for deposits than withdrawals. For every $3 cashed in, only $2 is cashed out. This is due to the increase in mobile phone usage on the continent. Most people log in cash via agent networks and then continue transactions via mobile money rails. While agents have doubled down on their primary aim of providing access to financial services to the underbanked, especially in rural areas, they must begin to provide more value for the last-mile users by creating robust customer profiles.

Currently, there are no data pipelines that carry nuanced operations data upstream. Usually, when users perform transactions at agent touchpoints, there is zero data collected on the users. It would be effective to pull these data from the transaction database but a lot of transactions are done by third-party account owners.

In the coming years, agency banking will be led by operators who have access to last-mile data and are able to provide customised financial services with it. Currently, most agents run other businesses on the side while providing last-mile financial services to people in their community. It is possible for them to deliver diverse digital services to the last mile. Non-fintech companies like Copia, Jumia, and IrokoTV use agents for offline distribution. Rwanda’s Irembo uses an agent network to bring government services closer to the people. Bundling these services into a network for last-mile delivery will unlock more value for agent networks.

The future of agent networks goes beyond banking. Operators who are able to pivot while keeping an eye on the initial goal of financial inclusion will win.

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| $28,080 |

+ 3.42% |

+ 8.53% |

|

| $1,718 |

+ 2.30% |

+ 5.26% |

|

|

$7.89 |

– 3.04% |

+ 32.26% |

|

| $0.50 |

+ 1.05% |

+ 5.26% |

* Data as of 06:50 AM WAT, October 2, 2023.

Elevate your business with One Liquidity’s seamless integration. Choose from 10+ services to craft a custom solution. Join Obiex, Wewire, and others in providing trading, liquidity and compliance services. Start now with zero fees. One Integration. One Solution. One Liquidity.

- Parvana – Project Manager– Cape Town, South Africa (Hybrid)

- Wasoko – Senior Product Manager – Nairobi, Kenya (unspecified)

- iOCO– Senior Andriod Developer– Cape Town, South Africa (unspecified)

- uLesson – Digital Marketing Manager – Abuja, Nigeria (Unspecified)

- Tushop – Senior Backend Engineer – Nairobi, Kenya (On-site)

- SUMMIT Africa Recruitment –Product Manager – Cape Town, South Africa (Hybrid)

There are more jobs on TechCabal’s job board. If you have job opportunities to share, please submit them at bit.ly/tcxjobs.

What else is happening in tech?

Want more of TechCabal? Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Entering Tech: tech career insights and opportunities in your inbox every Wednesday at 3 PM WAT.

- In a Giffy: business decisions powered by data-driven insights and analysis you can trust.

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.