Online payments in Nigeria has been begging to be disrupted since Nigeria first went online, and it looks like Konga.com might be the one doing the disrupting, albeit quietly. The two-year old online marketplace has created it’s own secure payment method that will allow its customers bypass debit cards when they make purchases on the site.

KongaPay is the result of a partnership with leading banks in Nigeria, which will make it possible for their customers to link their Konga accounts directly to their bank accounts. What is more, the integration is so tight that KongaPay will work regardless of whether or not said customers have internet banking enabled on their accounts or not.

It is not clear how long this has been in the offing, but this move to disintermediate card payments, with the help of banks has clearly been in the making since 2014, when Konga first announced a payment feature that would let GTBank customers pay for their purchases via a bank transfer that would be initiated from right inside the Konga.com checkout cart. If a user elects to pay via GTBank, they are redirected to the bank’s internet banking portal, which on the user’s login populates the forms with the amounts due. Once the transfer is made, the customer is sent back to Konga.com, completing the purchase.

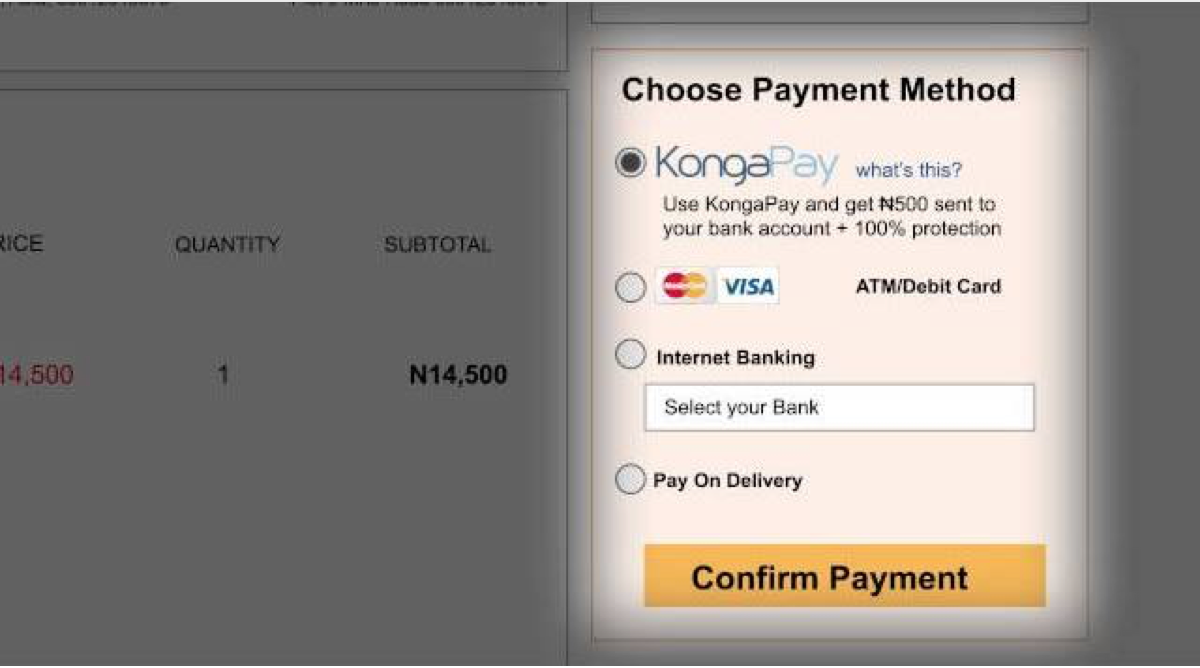

KongaPay however changes the game entirely in that asides from doing away with cards entirely, the user will never even see an internet banking portal. After a one time integration, all a customer with a linked bank account need do is click the checkout button, enter a one-time password, and boom.

KongaPay also has an escrow-like feature which allows them offer a guarantee to refund the total purchase sum for any unsatisfactory products. Because the transfers will be happening between Konga’s bank account and the buyer’s bank account in the same bank, these reversals can be effected near-instantaneously. In many ways, KongaPay is like Alipay, a subsidiary of Alibaba.com, which Konga’s founder studiously follows in order to see if he can replicate the Chinese ecommerce giant’s success. Alipay is said to control almost half of China’s online payment market.

KongaPay is not just a game changer in terms of how Konga is positioned to serve its customers. Seamless bank-enabled payments could give Konga a significant boost in its running battle for Nigerian ecommerce domination with Jumia, its fiercest and better funded competitor. Jumia has raised close to $300 million in comparison to Konga’s < $90 million, and clearly spends more on marketing, but both seem evenly matched on execution, and tend to ape each other on most market innovations and strategies. The two companies are massively invested in proprietary logistics, are aligned with mobile OEMs for exclusive device distribution pushes and even more stuff that is not apparent. It will be interesting to see if and how the Rocket-backed startup will zig to Konga’s latest zig. Or maybe they’ll zag and offer airtime-enabled one-click checkout to MTN customers (this would have made for a good April fool’s joke).

Beyond one-upping its ecommece nemesis, KongaPay could have bigger effects on the Nigerian electronic payments space itself. Interswitch has said itself that Konga and Jumia are the biggest drivers of ecommerce transactions through their gateway, and the adoption of cardless payments by any one of them would take away some of those revenues. Ecommerce might not be the biggest part of Interswitch’s business at the moment, but it’s perhaps the portion where the biggest future opportunity exists. This development will cause some brows to furrow at the very least. Interswitch has been making positive noises about overhauling its payment gateway and investing in ecommerce-aligned startups — they just invested $850,000 in African Courier Express, a logistics startup — but it seems the ecosystem won’t wait for them to figure things out.

KongaPay will likely launch in May 2015.