That’s the question, but first of all;

What is Rocket internet?

(Editor’s note: This is for the uninitiated, in fact, this whole article is for the uninitiated, so OGs can simply call it a read right here).

“We are builders of companies, we are not innovators,” Oliver Samwer told Wired in 2012. “Someone else is the architect and we are the builders.”

Oliver Samwer, one of the three Samwer brothers who own the e-commerce building beast that is Rocket Internet isn’t interested in being part of a league of innovators. The brothers founded Rocket Internet in 2007 to do two things; find proven internet business models and replicate them aggressively in pre-emerging markets.

The company had its first IPO in 2014 and was worth EUR 8 billion in April 2015. Its mission is to “become the world’s largest internet platform outside of the United States and China.”

Why stay out of China and US?

Yeah. Like, those are two biggest economies in the world yo.

But the US is also the most saturated market for Internet business models and where Rocket copies most of its models from. The over saturation of the US market is practically why the company was developed! There isn’t a single Rocket company in the US.

In China, Rocket launched an Airbnb spinoff, Airizu in early 2011 that shut down in 2013. Although, Rocket currently operates in China via Wimdu (another airbnb spinoff) and Glossybox, the protectionist nature of the Chinese government make it difficult for a foreign company- especially a foreign internet company to thrive. Even industry giant, Google had its own share of the flack before abandoning China’s search market.

What is Rocket Internet really?

We bloggers like to throw around labels; venture capital firm, incubator, accelerator, investment firm, grant making organization, angel investors — and some more.

For Rocket Internet, we haven’t found a label just yet. In its lifetime, the company has been an investment company, a venture capital firm and an incubator, all at the same time. There isn’t just one box to fit all these into, so, no one really knows. Some people call it a “clone factory” and the company constantly refers to itself as the “world’s largest technology incubator”.

Rocket takes proven models in different verticals, tests them, replicates them in different markets, drives the business growth aggressively and dominates everything — or tries to dominate everything.

What businesses are we talking about?

We are talking about businesses majorly in eCommerce, on-demand services and a few other verticals including logistics, classifieds, hotel booking, jobs listing and P2P lending.

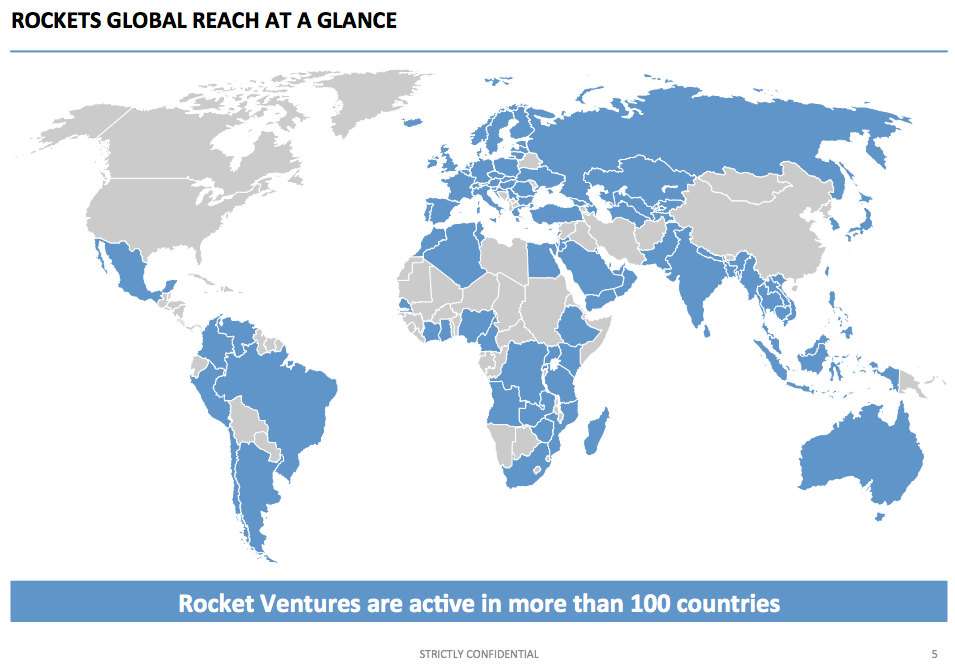

According to this Bloomberg report, Rocket Internet has about 75 online startups and internet companies in 110 countries. In Africa, Rocket internet has exactly 11 companies;

- Jumia, general merchandize e-commerce platform

- Zando, niche ecommerce for shoes

- HelloFood, online food ordering and delivery startup

- Lamudi, classifieds network for houses

- Carmudi, classifieds for cars

- Easy Taxi, ehailing taxi service

- Lendico, P2P lending network

- Kaymu, C2C marketplace

- Vendito, P2P online flea market for everything

- EverJobs, jobs listing

- Jovago.com, Rocket’s hotel booking network

Rocket has more companies shooting out of its pipeline. So many, I like to think, after getting their companies to break even, their next big problem will be naming all their new companies.

Where are they?

Rocket is pretty much everywhere. Though the mothership is resident in Germany, they are in every continent asides North America.

Africa Internet Group is Rocket Internet’s proxy in Africa. AIG does everything Rocket Internet does, only it zones in on Africa. Rocket has similar regional proxies in Latin America, Middle East and Asia Pacific.

Is Rocket kicking ass?

You bet. Although, Rocket Internet is currently valued at EUR 8 billion, its companies have not begun turning profits in the strictest sense of the word. Rocket listed 12 of its companies as proven winners in 2014, but these companies haven’t made any net profit.

Rocket is focused on scaling fast. They spend a ton of money scaling, drive traction and focus on breaking even after. Their typical exit MO is to either flip a company outright or to take cash off the table by selling substantial shares in whatever venture, to institutional funds or companies. The brothers sold their eBay spinoff , Alando, to eBay for USD 43 million in ‘99, setting up a blueprint that has seen it sell, Groupon clone, CityDeal to Groupon for USD 170 million in 2010, and at least 11 other similar exits that we know of.

Who is investing in Rocket?

Rocket is currently listed on Frankfurt Stock Exchange. Its investors are the brothers themselves through their investment firm, Global Founders Fund and Swiss investment firm, Kinnevik, United Internet, Philippine Long Distance Telephone Company, Len Blavatnik’s Access Industries and Holtzbrinck Ventures.

Aside from the brother themselves with collective 38.1% equity in the business, Kinnevik is Rocket’s biggest investor with 13.2% equity.

So really, why is Rocket internet so unpopular?

Because, (not my opinion), they are copycats, run an insensitive ship, and the method in their madness is itself, madness.

A clone factory label is not flattering, but the Samwer brothers wear it like a neon vest. Right along their business description as the world’s largest internet startup incubator, is another description that basically says, we are not innovators, we just build companies that other people have already built and drive their growth like crazed japanese warriors in a kamikaze drive.

In 2011, a leaked confidential email/memo from Oliver Samwer described an online furniture strategy as a ‘Blitzkrieg’.

Blitzkrieg; also called “lightning war” is a military tactic deployed by the Germans during WWII, designed to create disorganization among enemy forces. Such vocabulary of course would be innocuous if the rest of the memo written in halting English had not clearly hinted at a tight ship run by an over-achieving micro-managing warlord who wouldn’t take “no” for an answer. A TechCrunch report on the incident, said that such language “indicates an aggressive and potentially insensitive management style.”

This has been testified to numerous times. Rocket, in multiple threads on Quora has been said to be insensitive in its operations. The brothers are all about KPIs. Hiring and firing in Rocket companies are as mercurial as the Zimbabwean dollar.

Not at all the least, is the blatant rehashing that goes on at Rocket Internet. There are at least 15 companies including Groupon, Zappos and eBay that Rocket Internet has cloned in other markets.

And what could be even more riling is that, Rocket’s goal for its companies is ultimately not profitability, but a buy out. Usually by the companies whose propositions have been cloned.

In spite of all these things, it’s hard to believe anyone actually hates Rocket Internet.

“What people have to realize is the idea is the easy part, and that execution is the hard part” Andrew Mason, CEO of Groupon, one of the many companies Rocket cloned said In 2012. “Marc and Oli are the best operators I’ve ever seen in my life—they’re just inhuman.”

The Samwers know this too and they agree that they may be the Tesla of startups; underappreciated geniuses.

Oliver Samwer said to Bloomberg in 2012: “I think the most admirable entrepreneurs are those with original ideas, ja? It’s a unique gift that you either have or you don’t. Just as we might have a very good gift of execution, others have a unique gift for the purest form of innovation.”

The next obvious question would be, should Rocket Internet be hated. Should their properties in Nigeria for instance be appropriated and their companies regulated to death? We already know Rocket Internet cares very little who likes and dislikes it. Guys are too busy making money.

We’re discussing this post on this Radar thread. Join in.

Photo Credits: Nic Taylor Photography via Compfight cc, Daniel Haskett via nytimes