Despite impressive growth in data services, MTN Nigeria’s revenue is under threat as crucial voice revenue declines.

The Nigerian subsidiary of the MTN Group has announced its financial report for the first quarter of 2020 and the numbers were quite rosy. The telecom company added 4.2 million new subscribers in the first quarter. Its total number of subscribers now stands at 68.5 million, the largest in the country.

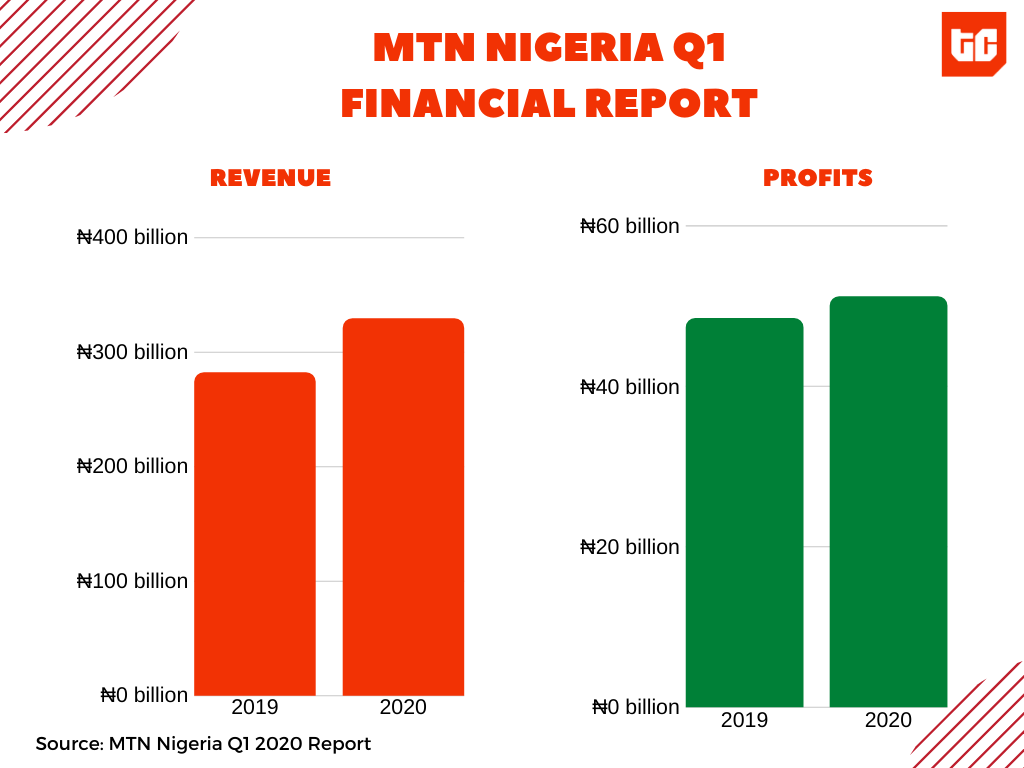

Its revenue also witnessed impressive growth as it raked in ₦329.2 billion ($845.4 million) during this period, a 16.7% growth from the same period a year ago. Profits after tax increased by 5.3% to ₦51.02 billion ($131.1 million).

However, while these numbers seem rosy, they mask a serious challenge; MTN’s voice traffic and voice revenue are facing serious challenges. The company disclosed that it is witnessing a drop in voice traffic, especially in the mass market.

“Voice revenue has experienced an immediate impact from the current macro disruptions,” MTN wrote.

The slump started in late March as the coronavirus and the drop in oil prices began to affect the Nigerian economy. Both developments have caused “a slowdown in economic activity and a reduction in people’s earning capacity,” the telco said.

While voice revenue took a beat down, data traffic is rising fast. MTN said traffic patterns changed following the presidential lockdown of Lagos, Abuja and Ogun States as part of initial responses to tackle the COVID-19 pandemic.

“[W]e started experiencing a change in traffic patterns with a drop in voice traffic which was partially offset by an increase in data traffic on the network,” the company wrote in its report.

Data traffic spiked as subscribers “began to adopt digital channels for most of their activities and routines including telecommuting, entertainment and social media engagements.”

Following the outbreak of the pandemic, people have switched to WhatsApp, Telegram, Zoom and Google Meets for text and group calls. In less than two months, Zoom grew from 10 million to 300 million users globally. Telegram recently hit 400 million daily active users.

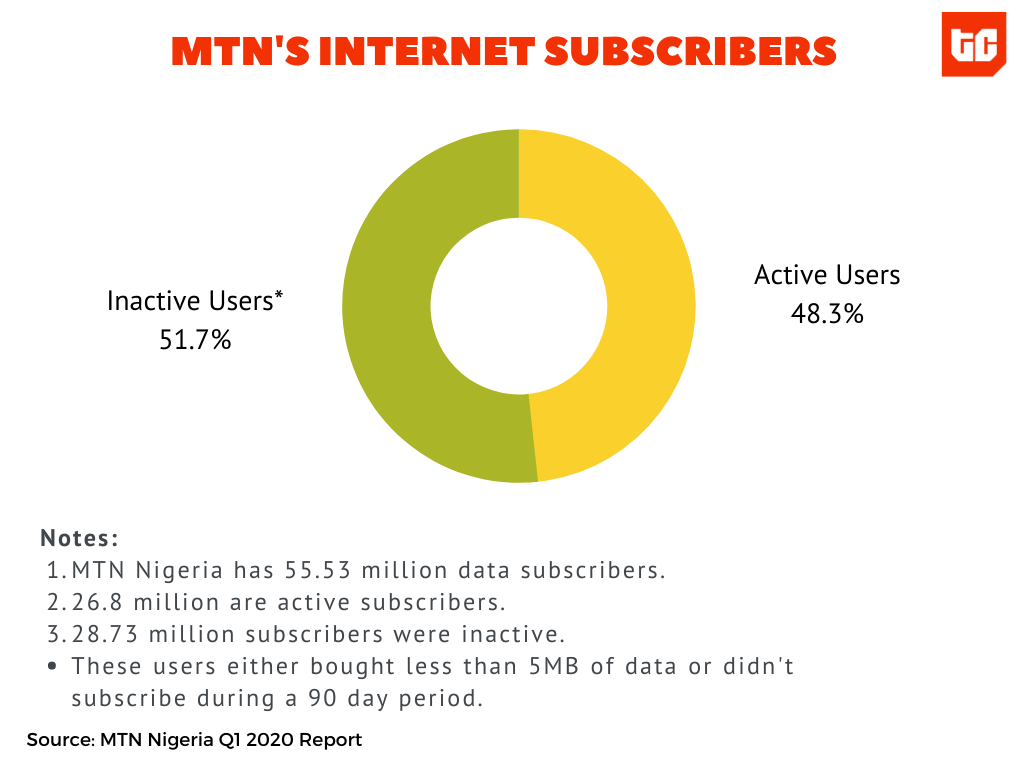

This trend could have a positive impact on MTN’s data services. Between January and March, the company’s total number of active data subscribers jumped by 1.7 million to 26.8 million. Data revenue equally witnessed growth as it increased 59.2% during the first quarter.

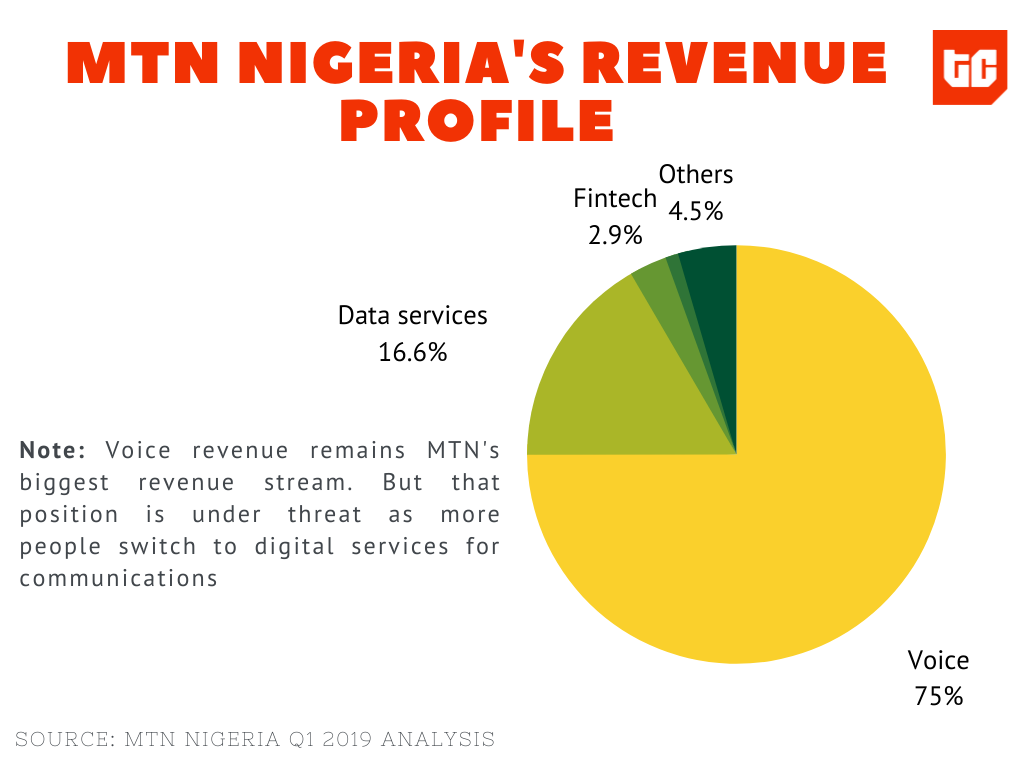

However, despite the growth in data services, MTN will face revenue challenges in subsequent quarters. Data revenue is still a relatively small part of MTN’s revenue. In Q1 2019, it represented just 16.6% of the company’s earnings. Even with its 59.2% growth in the first three months of 2020, it only accounts for only 22% of the telco’s ₦329.2 billion 2020 earnings.

Voice traffic remains MTN’s biggest revenue base. In Q1 2019 it represented 75.9% of all its earnings. And in 2020, phone calls brought in over ₦227 billion during the first three months of the year, representing over 68% of the company’s total revenue.

The adoption of digital services for voice and video calls is showing, once again, how vulnerable telecom companies are to internet platforms. “Although we have witnessed growth in data revenue,” MTN said in its latest report, “it does not fully offset the decline in voice revenue.”

This explains why telcos considered the option of blocking internet services a few years ago. In Nigeria, the first sign of trouble was in 2013 when telcos saw a 30% decline in revenue from international calls between October 2013 and December 2013.

Since then, telcos have lost the SMS market to instant messaging apps like Telegram, WhatsApp and even Twitter. They were slow to predict and develop social media platforms to rival Facebook or other platforms for video calls, voice calls or content streaming.

Only few telcos have developed rival products. MTN Group, parent company of MTN Nigeria, developed Ayoba, a social media platform, in 2018. It also acquired Simfy Africa, a music streaming platform in 2018, and relaunching it as MusicTime! In late 2019. Other diversification plans include the development of fintech services like mobile money solutions.

However, the dilemma for MTN and other telcos is that they have to spend more on critical infrastructure to improve internet access or risk losing data subscribers to competitors. In Nigeria, their operating costs are rising due to the foreign exchange regime. Meanwhile, alternative internet service providers like Smile, Spectranet, Tizeti, Swift and NTEL are becoming interesting rivals.

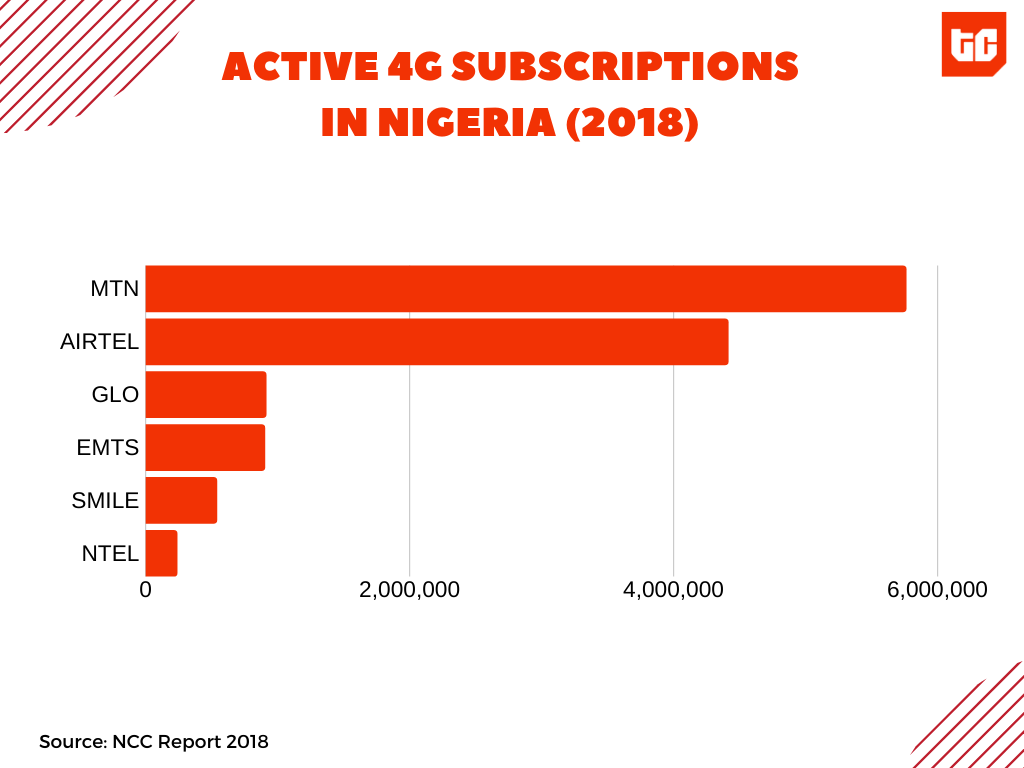

MTN has the largest 4G coverage in the country. It was 24% in early 2019 but has since risen to 44%. However, in 2018, the company had 5.76 million 4G subscribers, the highest in the country according to the NCC [PDF]. Meanwhile smaller companies like NTEL and Smile had 538,308 and 237,066 4G subscriptions respectively.

These look like small figures, but they are really not. Globacom and 9Mobile had 911,701 and 901,771 4G subscribers in 2018. In perspective, these two companies had over 60 million mobile users that year compared to Smile and NTEL that had less than 1 million users combined.

So MTN has a few things to worry about during this pandemic: rising operating costs, declining voice revenue and, possibly, new competition from alternative internet service providers. Other telcos may be feeling the same pressures.